Monthly Canada Market Wrap: January 2022

Welcome back to the Canadian Monthly Market Wrap from YCharts! Here, we break down the most important market trends for Canada-based advisors and their clients every month. As always, feel free to download and share any visuals with clients and colleagues, or on social media.

Looking for the US Market Wrap? Click here.

Before we get into it: the Monthly Canada Wrap has a new look! Our goal is to give you more shareable insights in an easy-to-read format — let us know how we did or drop a suggestion here.

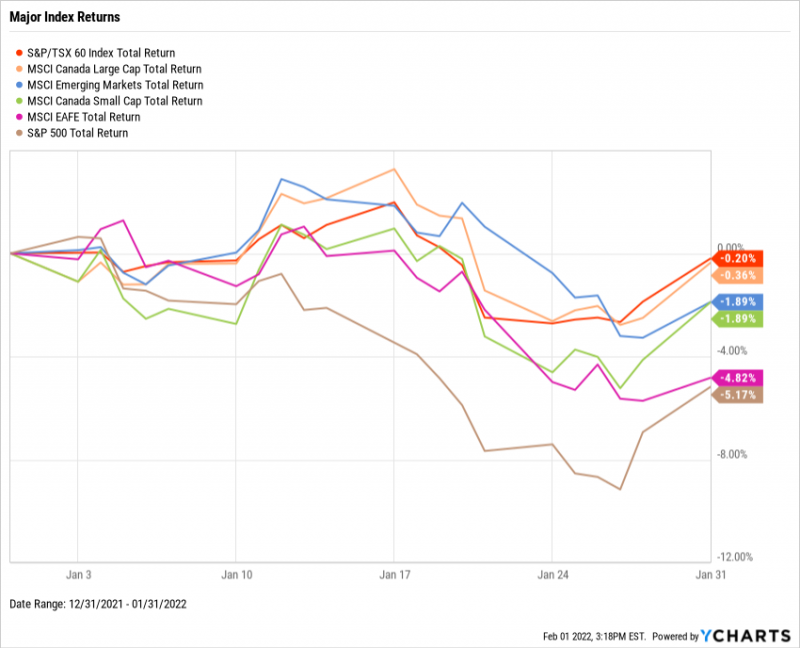

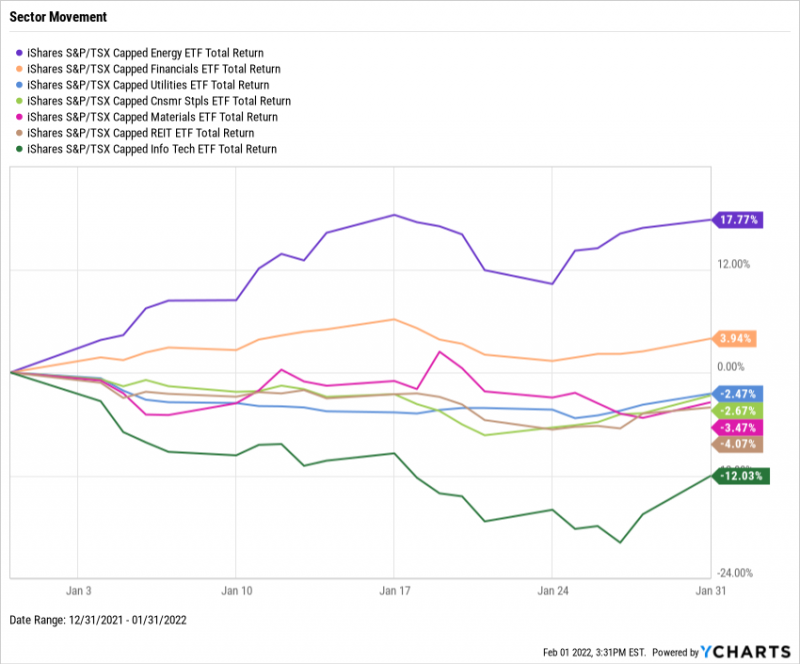

Canada was one of the best places to be in an ugly January for major global equity indices. The S&P/TSX 60 finished the month down just 0.2% for the month, compared to its US counterpart who dove 5.2%. Tensions between Russia and Ukraine fueled the possibility of reduced oil supply, sending the Energy sector up another 17.8% having already performed well in the current inflationary environment. The Canada 10 Year Benchmark Bond has moved mostly in tandem with the US 10 Year Treasury over the past year, ending January with a yield of 1.76%. Finally, unemployment dropped below 6% for the first time in nearly two years. However, one of Canada’s leading employment indexes fell sharply in January, and last month’s readings on the manufacturing sector signaled a contraction for the first time in a year.

Equity Performance

Major Indexes

Download Visual | Modify in YCharts

Canadian Sector Movement

Download Visual | Modify in YCharts

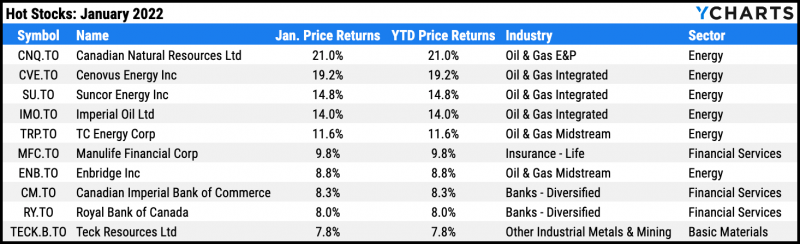

Hot Stocks: January’s Top 10 TSX 60 Performers

Download Visual | Modify in YCharts

Canadian Natural Resources (CNQ.TO): 21.0% gain in January 2022

Cenovus Energy (CVE.TO): 19.2%

Suncor Energy (SU.TO): 14.8%

Imperial Oil (IMO.TO): 14.0%

TC Energy (TRP.TO): 11.6%

Manulife Financial (MFC.TO): 9.8%

Enbridge (ENB.TO): 8.8%

Canadian Imperial Bank of Commerce (CM.TO): 8.3%

Royal Bank of Canada (RY.TO): 8.0%

Teck Resources (TECK.B.TO): 7.8%

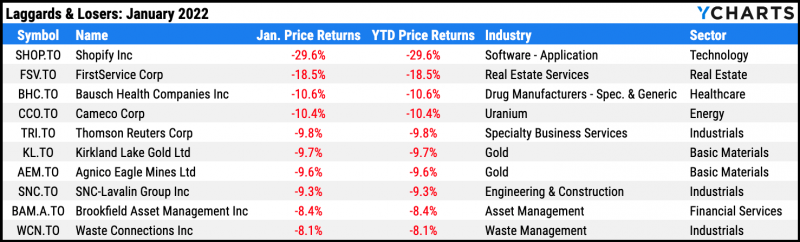

Laggards & Losers: January’s 10 Worst TSX 60 Performers

Download Visual | Modify in YCharts

Shopify (SHOP.TO): -29.6% decline in January 2022

FirstService (FSV.TO): -18.5%

Bausch Health Companies (BHC.TO): -10.6%

Cameco (CCO.TO): -10.4%

Thomson Reuters (TRI.TO): -9.8%

Kirkland Lake Gold (KL.TO): -9.7%

Agnico Eagle Mines (AEM.TO): -9.6%

SNC-Lavalin Group (SNC.TO): -9.3%

Brookfield Asset Management (BAM.A.TO): -8.4%

Waste Connections (WCN.TO): -8.1%

Fixed Income Performance

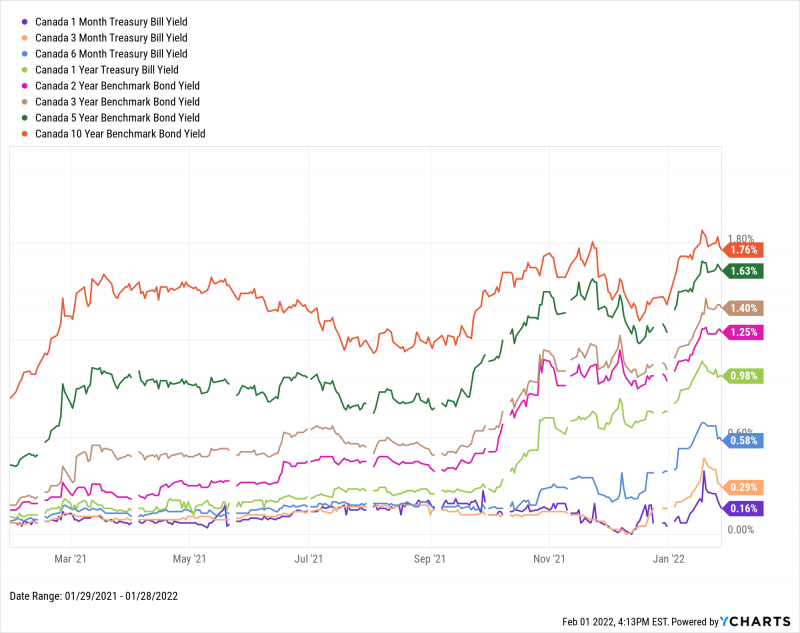

Canadian Treasury Yield Curve

Download Visual | Modify in YCharts

Canada 1 Month Treasury Bill Yield: 0.16%

Canada 3 Month Treasury Bill Yield: 0.29%

Canada 6 Month Treasury Bill Yield: 0.58%

Canada 1 Year Treasury Bill Yield: 0.98%

Canada 2 Year Benchmark Bond Yield: 1.25%

Canada 3 Year Benchmark Bond Yield: 1.40%

Canada 5 Year Benchmark Bond Yield: 1.63%

Canada 10 Year Benchmark Bond Yield: 1.76%

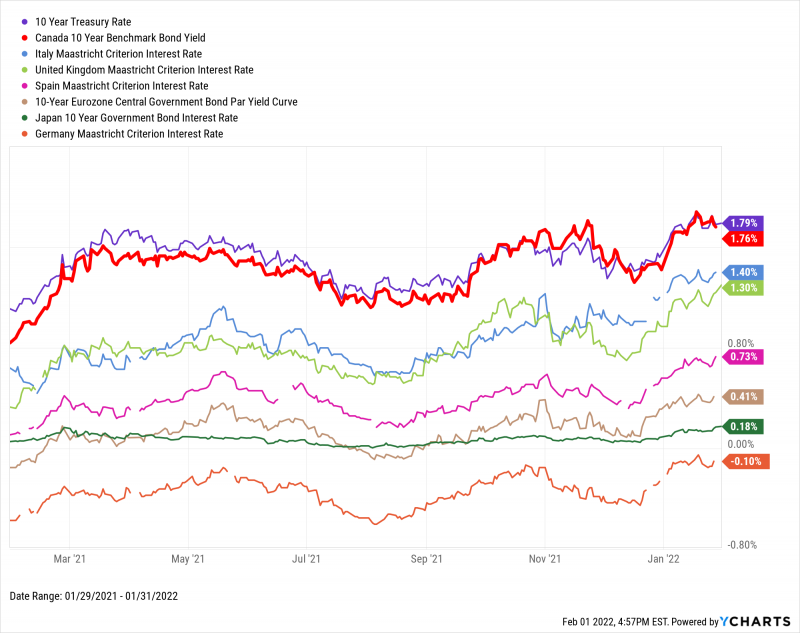

Global Bonds

Download Visual | Modify in YCharts

10 Year Treasury Rate: 1.79%

Canada 10 Year Benchmark Bond Yield: 1.76%

Italy Long Term Bond Interest Rate: 1.40%

United Kingdom Long Term Bond Interest Rate: 1.30%

Spain Long Term Bond Interest Rate: 0.78%

10-Year Eurozone Central Government Bond Par Yield: 0.41%

Japan 10 Year Government Bond Interest Rate: 0.18%

Germany Long Term Bond Interest Rate: -0.10%

Featured Market & Advisor News

Canada’s economy slows down to cap strong end to year (BNN)

Can You Hedge Inflation with an ETF? Or Bitcoin? (YCharts)

60/40 Portfolio Suffers Worst Loss Since March 2020 (InvestmentNews)

2021 Fund Flows: Fixed Income & Large Blend Win, Growth Loses (YCharts)

Scotiabank sees aggressive rate hikes by Bank of Canada, Fed this year (Financial Post)

Economic Update — Reviewing Q4 2021 (YCharts)

Economic Data

Employment

December marked the first month since February 2020 in which the Canadian unemployment rate was below 6%, falling for the seventh consecutive month to 5.9%. However, full-time employment was adversely affected. The Canada Ivey Employment index slipped 4.5 points to an even 50.0, and the Canada Part-time Employment figure recorded a decrease of 67,000 part-time workers in December.

Production and Sales

The Canada Ivey PMI plummeted 16.2 points in December to 45.0, which is the first contractionary reading for the index since January of 2021.

Housing

After setting an all-time record in November, Canada Housing Starts cooled down to 17,797 in December. As such, the Canada New Housing Price Index was up only a slight quarter of a percent.

Consumers and Inflation

The Canada Consumer Price Index rose 0.28% in December, while the Canada Inflation Rate increased for the sixth straight month to a 30-year high of 4.8%.

Gold

The price of gold in CAD was $2,283.90 per ounce at January’s end, while the iShares S&P/TSX Global Gold ETF (XGD.TO) was down 3.7% for the month.

Oil

Oil prices reached 7-year highs last month. The WTI Daily Spot Price was $89.16 per barrel as of January 31st, and the Brent Daily Spot Price sat at $92.35.

Cryptocurrencies

The price of Bitcoin was $37,983USD as of January 31st, down 19.5% in the month and off 43.0% from its all-time high. Ethereum stood at $2,610USD, representing a 44.2% retracement, and Cardano ended the month at $1.04USD.

Have a great February! 📈

Next Article

How Strong Are Your Diamond Hands? with RAMP CapitalRead More →