New on YCharts: SPAC Units Data

Special Purpose Acquisition Company (SPAC) Units are the latest addition to YCharts’ already expansive data universe.

In addition to SPAC shares, which are already available on the platform, units and their related metrics can be leveraged to evaluate SPAC investment opportunities and communicate insights to your clients.

So… what is a SPAC unit?

A SPAC unit is a security that consists of one common share in a SPAC and a fraction of a warrant. The latter component can be ½ of a warrant, ⅓, ¼, or any other fraction as determined by the SPAC’s prospectus. We dig into SPAC units, shares, and warrants below, but would also recommend this SEC bulletin and Corporate Finance Institute article for further reading as SPACs and SPAC units are nuanced financial instruments.

For further insights about SPAC share performance pre- and post-merger, check out our free research guide.

Explaining SPAC Units with Visuals

SPAC units trade under tickers that add a “U” or “.U”, for Nasdaq and NYSE exchanges, respectively, to their shares’ ticker symbol.

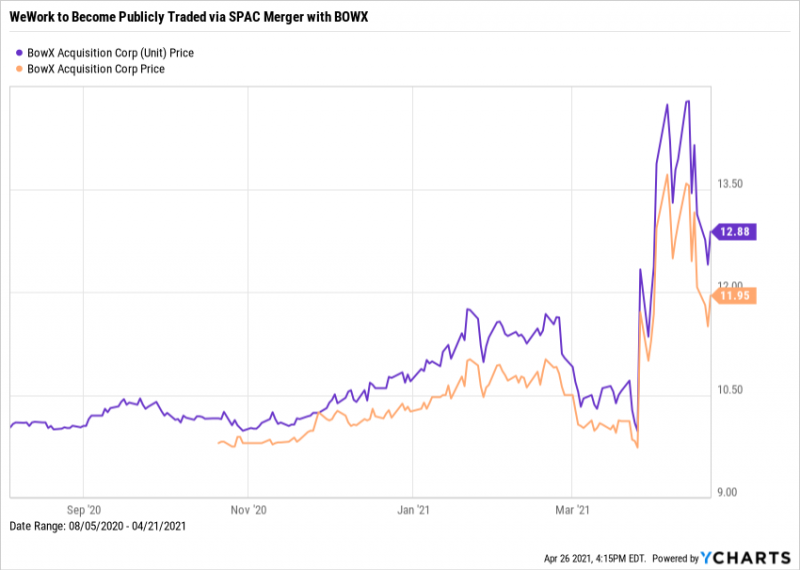

For example, BowX Acquisition Corp (BOWX) is a SPAC that is set to acquire WeWork, the highly publicized, short-term office leasing giant. Its units, trading under the ticker BOWXU, change hands at slightly higher prices than BOWX shares due to the value of its additional, fractional warrant.

Download Visual | Modify in YCharts

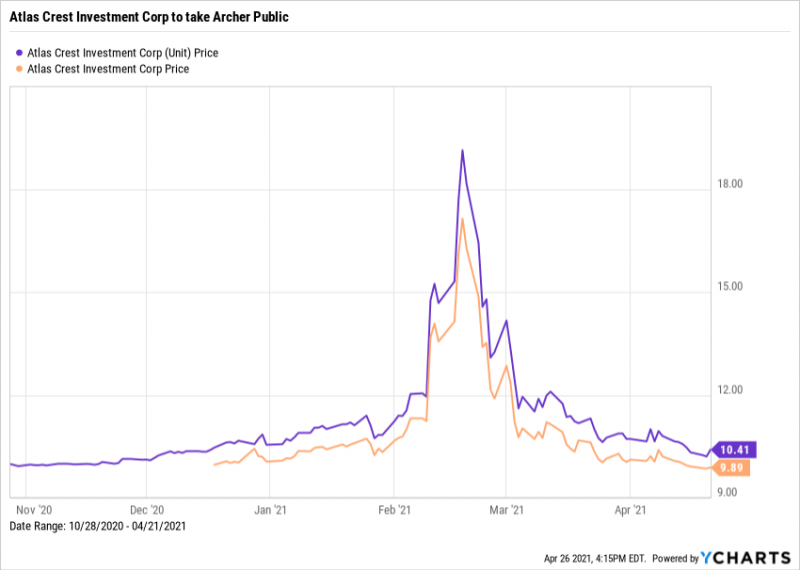

Shares of Atlas Crest Investment Corp (ACIC) and its units, ACIC.U, trade with a similar price gap due to the value of attached fractional warrants.

This chart also demonstrates the speculative nature of investing in pre-merger SPACs. ACIC.U traded as high as $20.91 per unit after announcing it would acquire electric jet-maker Archer, but its price has since more than halved.

The decline could be due to a number of factors, but a likely contributor is the expectation that a large number of warrants will be converted post-merger, introducing additional shares to the market and diluting ACIC’s per-share value.

Download Visual | Modify in YCharts

SPAC Units, Shares, and Warrants

When a SPAC goes public, it first begins trading in the form of units. It’s not until about two months later that its shares (which will ultimately be converted to de-SPAC company shares) start trading.

Herein lies the first benefit of SPAC units: they enable investors to get a foot in the door sooner.

Another key benefit of SPAC units is the fractional warrant they carry. SPAC warrants are coveted by their pre-IPO investors as “sweeteners” because they can be cashed in for more shares if or when the SPAC makes an attractive acquisition.

However, SPAC warrants are not redeemable as fractions—only whole warrants. So in practice, investors need to buy multiple SPAC units (likely in a quantity that agrees with the fraction size) to take advantage of the sweetener. Furthermore, your broker may charge fees to separate SPAC units into shares and warrants, and to convert whole warrants into shares. These are just a couple mechanical nuances that lead only certain investors to be interested in SPACs and SPAC units.

Take a Closer Look at SPAC Units

Use the YCharts Stock Screener to sort and filter 560 SPAC units by your choice of performance, risk, or price metrics. It’s especially interesting to see the wide price ranges in which a given unit trades—this can be seen in the 52-week high and low price metrics included in the screen.

SPAC units are fairly complicated, so it’s important to read through the SPAC’s prospectus for information about warrant fractions, separating units, and other restrictions that change on a SPAC-by-SPAC basis.

There’s also an expectation that SPACs will face a regulatory headwind in the near future. The SEC released a statement changing the accounting and reporting standards around SPAC warrants.

That said, units can be an attractive investment if you understand their mechanics and want exposure to a SPAC as soon as possible—but they aren’t for everyone.

Connect with YCharts

To get in touch, contact YCharts via email at hello@ycharts.com or by phone at (866) 965-7552

Interested in adding YCharts to your technology stack? Sign up for a 7-Day Free Trial.

Disclaimer

©2021 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure