US Retail Sales Monthly Update

The US Retail Sales report is a critical economic indicator that reflects the total receipts of retail stores in the country. Released monthly by the US Census Bureau, this report offers valuable insights into consumer spending trends, which account for a significant portion of the US economy. Understanding the fluctuations in retail sales can help predict economic health and guide both business strategies and investment decisions. For more details, you can visit the US Census Bureau Retail Sales page.

Latest Data Release

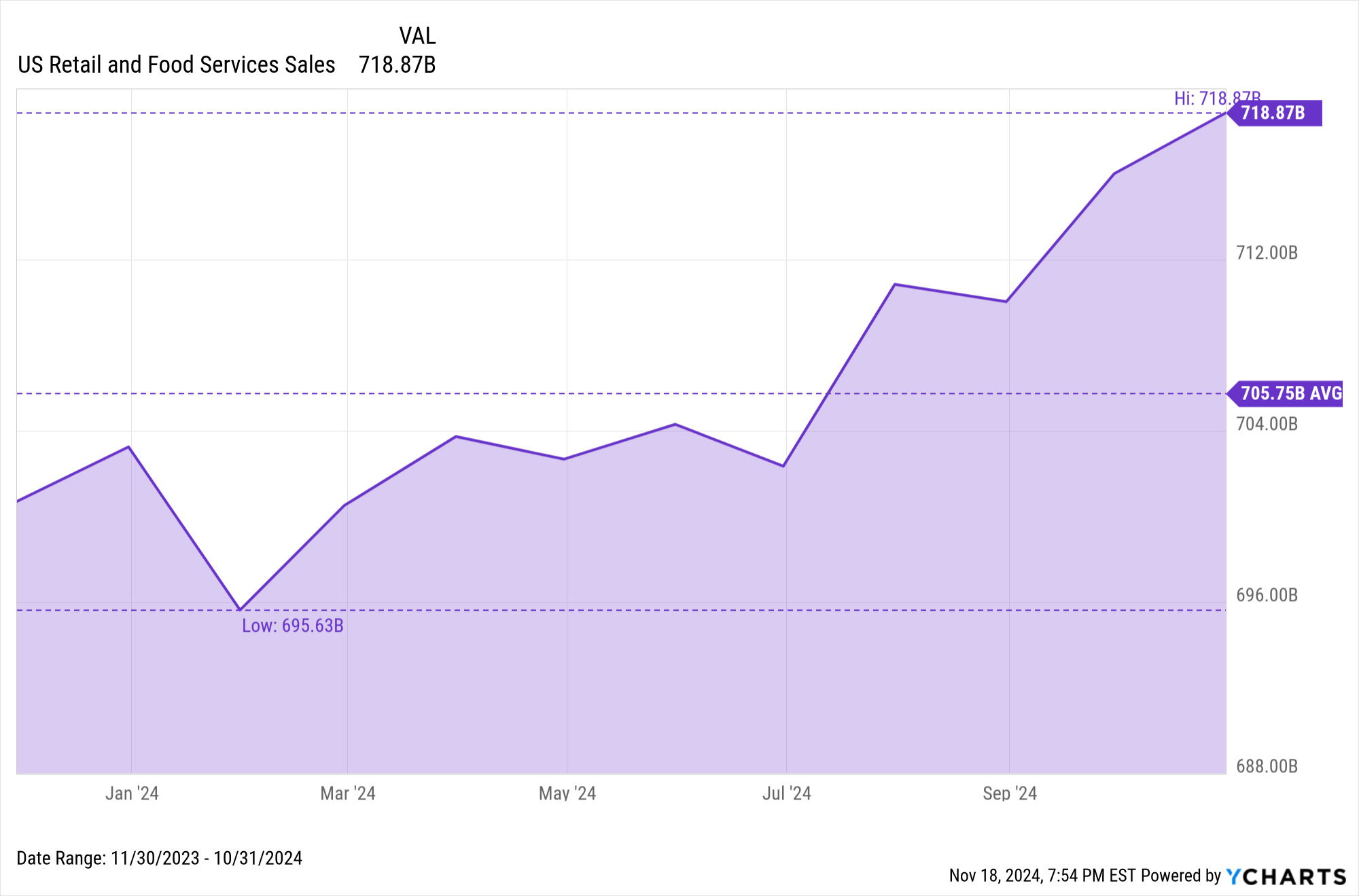

The latest US Retail and Food Services Sales report was released on November 15, 2024. The report revealed that retail food and services sales for October 2024 were approximately $718.87 billion, an increase from the previous month’s $716.03 billion.

Download Visual | Modify in YCharts

Analysis and Insights

US Retail and Food Services Sales for October are up 0.40% from the previous month and represent a 2.85% increase compared to October 2023. Retail sales for October 2024 came in at $621.59B, up 0.35% from last month and 2.63% higher year-over-year. Nonstore retailer sales grew by 7.0% year-over-year, while food services and drinking place sales increased 4.28% in the same time frame.

The latest data indicates a resilient consumer sector despite various economic challenges. Comparing this month’s figures to previous periods shows a steady upward trend, suggesting that consumer confidence remains strong. This consistent growth is crucial for sectors like retail and manufacturing, which rely heavily on consumer spending.

Access long-term US Retail and Food Services Sales Data on YCharts by following these simple steps:

1. Log on to YCharts.com.

2. Type “US Retail and Food Services Sales” into the search bar from anywhere on the platform and click on the result.

3. Once on the indicator page, users can toggle the navigation bar to browse historical data on a month-by-month basis or view data in an interactive chart.

Clicking “View Full Chart” will open data in an interactive Fundamental Chart to compare against other economic indicators, such as the target Federal Funds Rate. Additionally, users can export historical data to a CSV file for offline analysis by clicking the “Export” button.

Related Financial Indicators

YCharts’ Advance Monthly Retail Trade Report contains several additional related indicators to the US Retail Sales. The U.S. Census Bureau conducts the Advance Monthly Retail Trade and Food Services Survey to provide an early estimate of monthly sales by kind of business for retail and food service firms located in the United States. Other indicators from this survey include:

- US Auto and Other Motor Vehicle Sales

- US Food and Beverage Store Sales

- US Gasoline Station Sales

- US Retail and Food Services Sales

- US Retail and Food Services Sales (Excluding Motor Vehicle and Part Dealers)

Implications for Businesses, Investors, and Other Stakeholders

Changes in Retail Sales can significantly impact various stakeholders, including businesses, investors, policymakers, and consumers.

Businesses

For businesses, strategic adjustments are crucial based on consumer spending trends. An increase in retail sales may prompt businesses to ramp up production and stock levels to meet higher demand. Additionally, businesses can streamline operations, optimize supply chains, and manage workforce requirements effectively. Different sectors react differently to retail sales changes; for example, a rise in nonstore retailing indicates a shift towards e-commerce, encouraging traditional retailers to enhance their online presence.

Investors

Investors use retail sales data to forecast market performance and identify potential investment opportunities. A surge in retail sales may signal a bullish market, prompting increased investments in retail stocks. Investors can also diversify their portfolios by including stocks from sectors showing positive retail sales trends. Conversely, a decline in retail sales might prompt investors to consider more defensive sectors like utilities or healthcare. Retail sales data serves as a barometer for the overall economic health, influencing investor sentiment and decisions.

Policymakers

Policymakers use retail sales data to formulate and adjust economic policies. An increase in retail sales might lead to measures that support continued consumer spending, while a decline could result in stimulus packages or interest rate adjustments. Accurate retail sales data aids in fiscal planning and budgeting, helping governments allocate resources efficiently and support economic stability.

Consumers

For consumers, retail sales trends reflect consumer confidence and purchasing power, influencing individual spending habits. Understanding these trends can help consumers make informed financial decisions. Changes in retail sales data can indicate shifts in pricing strategies, helping consumers anticipate potential price increases or discounts.

YCharts Feature Highlights

YCharts offers powerful tools that enhance financial analysis and decision-making. Here’s a look at how you can leverage YCharts features for monitoring and analyzing economic data, including the Advance Monthly Retail Trade Report.

Model Portfolios

YCharts’ Model Portfolios allow you to build, backtest, and compare investment strategies. This feature enables advisors to simulate different economic scenarios and automate comprehensive portfolio performance reports.

Fundamental Charts

Fundamental Charts in YCharts help visualize and analyze data. Create and customize charts to compare multiple metrics and identify trends and correlations.

Dashboards

YCharts Dashboards consolidate various charts and data points into one view. Monitor performance, track key indicators in real-time, and easily share insights with clients or colleagues.

By utilizing these YCharts features, financial advisors can make data-driven decisions, stay ahead of market trends, and provide greater value to their clients.

Custom Alerts

Stay updated with YCharts’ Custom Alerts. Set alerts for specific economic indicators or portfolio changes, and receive notifications to ensure you never miss critical updates.

Economic Indicators Library

This library provides access to a wide range of economic data. Users can track key indicators, create customizable dashboards, and analyze historical data to identify trends and make informed forecasts.

Conclusion

The latest US Retail Sales report highlights the importance of staying informed about consumer spending trends, as these are pivotal for understanding the broader economic landscape. Whether you’re a business owner strategizing for the future, an investor looking to optimize your portfolio, a policymaker shaping economic policy, or a consumer planning your finances, understanding retail sales trends is crucial.

YCharts empowers you with the data and tools necessary to navigate these trends effectively. Regularly checking updates and utilizing YCharts for in-depth analysis can provide a competitive edge in a dynamic economic environment. To arm yourself with YCharts’ extensive library of economic indicators, charting software, and analysis tools, get in touch for a personalized information session or start a free trial.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking to better communicate the importance of economic events to clients?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Download a copy of the Quarterly Economic Update slide deck:

Disclaimer

©2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation

Next Article

Best Investment Research Tools for Financial Advisors in 2025Read More →