Resources

Access webinars, blogs, white papers, slide decks, how-to videos & other tailored financial advisor resources to elevate your game and share with clients.

Upcoming Webinars

You’ve prepared your pitch, gathered your data, and set up meetings with advisors.

Yet, despite your best efforts, you find your interactions falling flat. Advisors seem disengaged, and you struggle to make a lasting impact…

If this scenario feels all too familiar, YCharts is here to change that.

Join us for an exclusive webinar featuring Brian Margolis, Founder of PG Wholesaling, where you’ll gain:

- Insights into what today’s advisors are truly looking for in a wholesaler and how to position your value to boost engagement.

- Proven tactics top wholesalers use to drive success, with communication templates and real-world examples to build your strategies.

- Tips for leveraging YCharts’ powerful features to analyze trends, streamline operations, improve advisor communication, and maximize your impact.

YCharts University

Every week we review a handful of powerful workflows to help you get the most from YCharts!

Monthly Skill Sessions

Each month our team reviews top use cases & best practices for one tool on the YCharts platform.

Blog

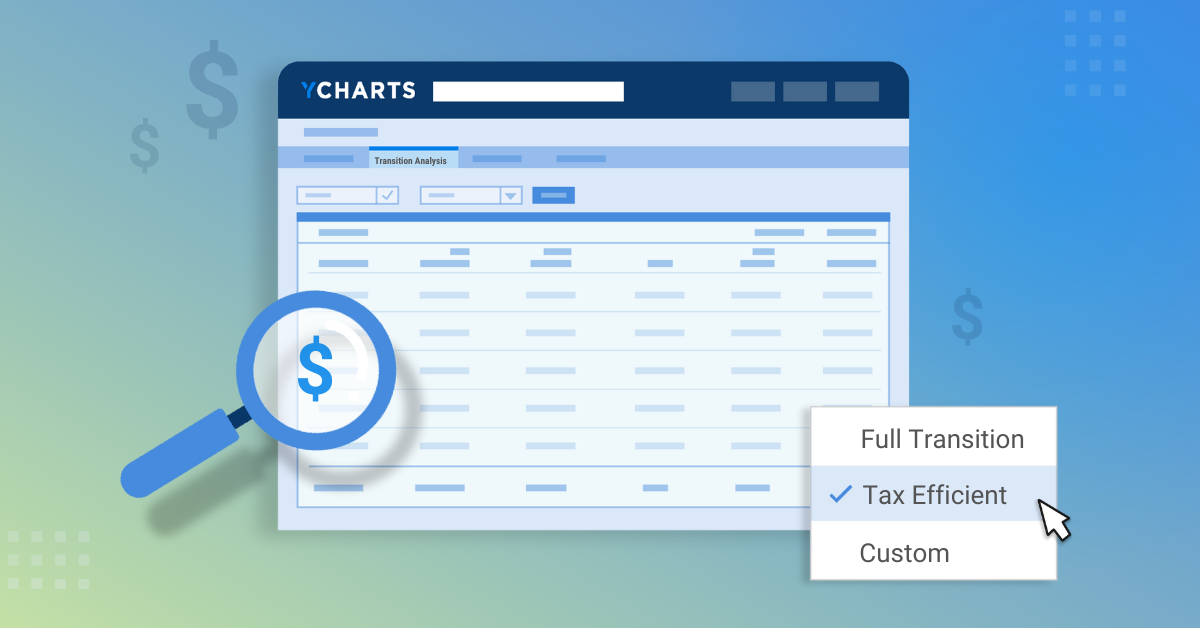

June 11, 2024

Simplifying Portfolio Transitions with YCharts’ New Transition Analysis Tool

Decks & White Papers

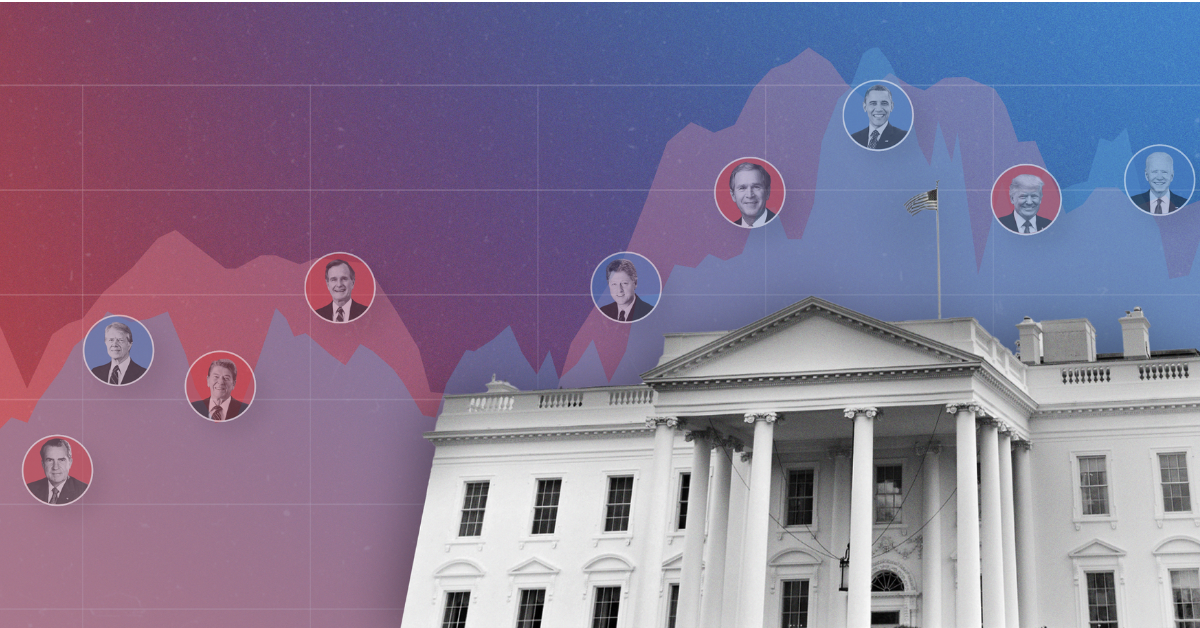

Sharable slide decks and in-depth research to help answer the questions your clients are askingHow Do Presidential Elections Impact the Market?

The Financial Advisor’s guide to answering election questions, with downloadable visuals.

2024 Advisor – Client Communication Survey

Involving nearly 800 clients of financial advisors, this survey uncovers what & how clients want to hear from their advisors and provides communication best practices that advisors can implement to achieve higher retention rates.

The Top 10 Visuals for Clients and Prospects

This free deck is filled with insightful visuals that illustrate key investing concepts for clients and prospects, arming advisors with another resource for AUM growth and retention.

View Past Webinars and Product Demos on our YouTube Channel

Talk to one of our experts.

Reach out for a personalized demo with a YCharts product specialist.