Simplifying Portfolio Transitions with YCharts’ New Transition Analysis Tool

Taxes are inevitable and unavoidable. Minimizing your clients’ tax burdens is part of your job as a financial advisor. Early on in any client relationship, one of the first hurdles you’ll have to clear is the complex and time-consuming process of transitioning a client’s portfolio from their current provider to your proposed strategy. This could involve manual calculations, spreadsheets, and even various pieces of software, making it one of the more cumbersome tasks as an advisor.

Prospective clients, especially high-net-worth individuals, will be concerned about the associated tax impact when switching advisors. Setting appropriate expectations regarding potential tax liabilities is crucial for not only establishing credibility but also the first step in building a solid foundation for a long-term advisory relationship.

YCharts’ new Transition Analysis tool streamlines the portfolio transition process to enhance your practice’s proposal workflow and ensures any transition plan is mindful of your client’s tax budget.

About YCharts’ Transition Analysis Tool

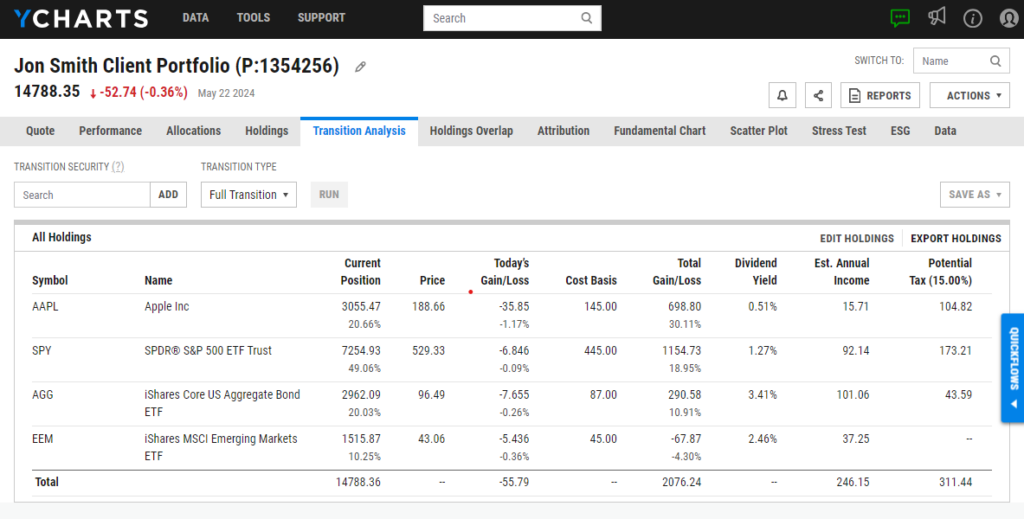

The new Transition Analysis tab, available exclusively in YCharts’ Client Portfolios, revolutionizes the portfolio transition process. Upon entering the Transition Analysis tab, advisors are greeted with a comprehensive overview of the selected client portfolio. This includes vital information such as each security’s current position, price, cost basis within the portfolio, calculated gain/loss, and potential tax implications.

From there, advisors will designate which security they are looking to transition to and select between three distinct transition strategies available:

– Full Transition: Seamlessly identifies and executes all necessary trades, streamlining the transition process from the current portfolio to the designated security.

– Tax Efficient: This strategic approach begins by selling losing positions based on their cost basis. Following this, winning positions are incrementally sold as needed, starting from the smallest positions. The goal? To ensure that the total amount of sales results in a projected tax liability of $0 for the client.

– Custom: For those seeking a tailored approach, this option allows advisors to manually input transaction details, offering complete control over the transition process.

By leveraging these strategies, advisors can significantly reduce the amount of manual work and mental energy typically associated with this part of the proposal process. Moreover, the flexibility extends to client interactions, enabling dynamic analysis during meetings. This feature is particularly beneficial for high-net-worth (HNW) individuals, empowering them with more control over decision-making regarding securities to buy or sell and the resulting tax impact.

For a visual walkthrough of this workflow, watch the short video below.

Automate the Transition Analysis Process

The Transition Analysis tool offers substantial time savings, a major advantage for advisors juggling multiple priorities. This tool streamlines manual processes, sparing advisors from starting from scratch and enabling them to craft comprehensive and informed transition recommendations efficiently. When choosing either the “Full Transition” or “Tax Efficient” options, the transition process becomes more or less automated, yet it presents clients with two distinct, yet thoughtful, approaches based on their tax liability tolerance, further enhancing the client experience.

Moreover, when combined with other time-saving features in YCharts—such as seamless portfolio importation via integrations and a suite of streamlined proposal solutions—the Transition Analysis adds to your ability to serve clients efficiently and effectively.

Empower Your Clients to Drive The Transition

The “Custom” option is tailor-made for seamless portfolio transition analysis on the fly. This feature not only facilitates more engaging client interactions but also empowers clients by involving them in the decision-making process. By allowing clients to steer the conversation and adjust portfolio allocations in real time, advisors create a highly interactive and personalized experience. This approach not only boosts client satisfaction but also strengthens the advisor-client relationship, fostering a deeper sense of trust and collaboration.

The customized transition approach enables advisors to explore various allocation scenarios tailored to a prospective client’s preferences in their portfolio, all while staying within their desired tax parameters. Despite being a more hands-on approach, clients appreciate the sense of control and involvement in shaping their portfolio’s final composition. This not only enhances client satisfaction but also maintains deal momentum, showcasing advisors’ commitment to delivering personalized solutions and driving positive outcomes.

Provide Context to Your Client’s Portfolio Transition

When it comes to meeting preparation, the YCharts’ Transition Analysis tool excels at generating concise yet comprehensive one-page reports with just a few clicks. These reports serve as valuable supplements to your presentations, allowing clients to follow along and enhancing the impact of your conversations.

These detailed reports illustrate key aspects such as the client’s current portfolio composition, the target allocation aligned with their risk profile, and the steps required to achieve this allocation, specifically buy and sell transactions. By combining the ability to craft personalized transition plans with immediate report-generation capabilities, you’ll always equipped to deliver high-quality, data-driven presentations regardless of the situation.

Elevating Your Proposal Workflow with YCharts’ Transition Analysis

By incorporating YCharts’ Transition Analysis into your toolkit, you’re not just enhancing your investment research and communication capabilities—you’re revolutionizing your entire proposal workflow. This tool showcases your dedication to your clients’ best interests right from the start, adding value to the advisor-client relationship from day one. With its ability to streamline complex processes, save time, and boost client satisfaction, this powerful feature sets the stage for long-term success in managing their portfolio. You’re not just managing investments; you’re shaping a seamless and fulfilling client experience.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Interested in creating your own election material for clients?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Join Michael Kitces Webinar on Tax-Efficient Withdrawals!

Learn to equalize tax brackets in retirement by integrating taxable, tax-deferred, and tax-free accounts. Discover strategies like partial Roth conversions and capital gains harvesting to reduce cumulative taxes. Save your spot here.

Disclaimers

©2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information reg

Next Article

How Asset Managers Can Showcase Unique Holdings with YCharts to Grow AUMRead More →