Monthly Market Wrap: October 2024

Welcome back to the Monthly Market Wrap from YCharts, where we dissect crucial market trends for advisors and their clients. This October, equities suffered declines in a month marked by volatility stemming from the run up to the presidential election while mortgage rates and treasury yields spiked higher despite a Fed rate cut in September and future cuts expected.

Want to use these visuals in your own presentations? Download our free Monthly Market Wrap slide deck, containing all charts featured in the Market Wrap and more in a shareable, presentation-ready format.

October 2024 Market Summary: Equities Stall, Job Numbers Disappoint, and Treasury Yields Rise

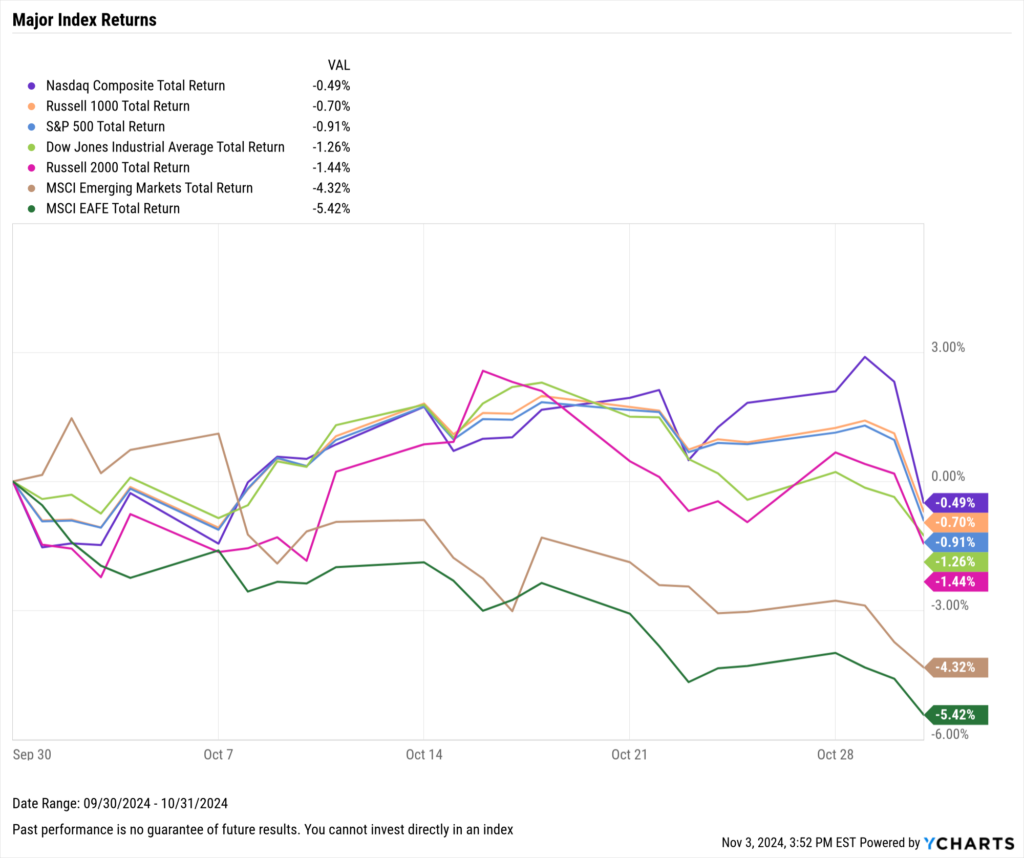

Equities slid in October as the 2024 presidential election drew near. The S&P 500 fell 0.9%, the Nasdaq Composite slipped 0.5%, and the Dow Jones Industrial Average lost 1.3% in October. Semiconductor stock underperformance particularly weighed on markets; four of the ten worst performing S&P 500 stocks were companies in the semiconductors & semiconductor equipment industry, along with Super Micro Computer (SMCI). Ex-US indices logged worse performances this month; Emerging Markets sank 4.3% and Developed Markets tumbled 5.4%.

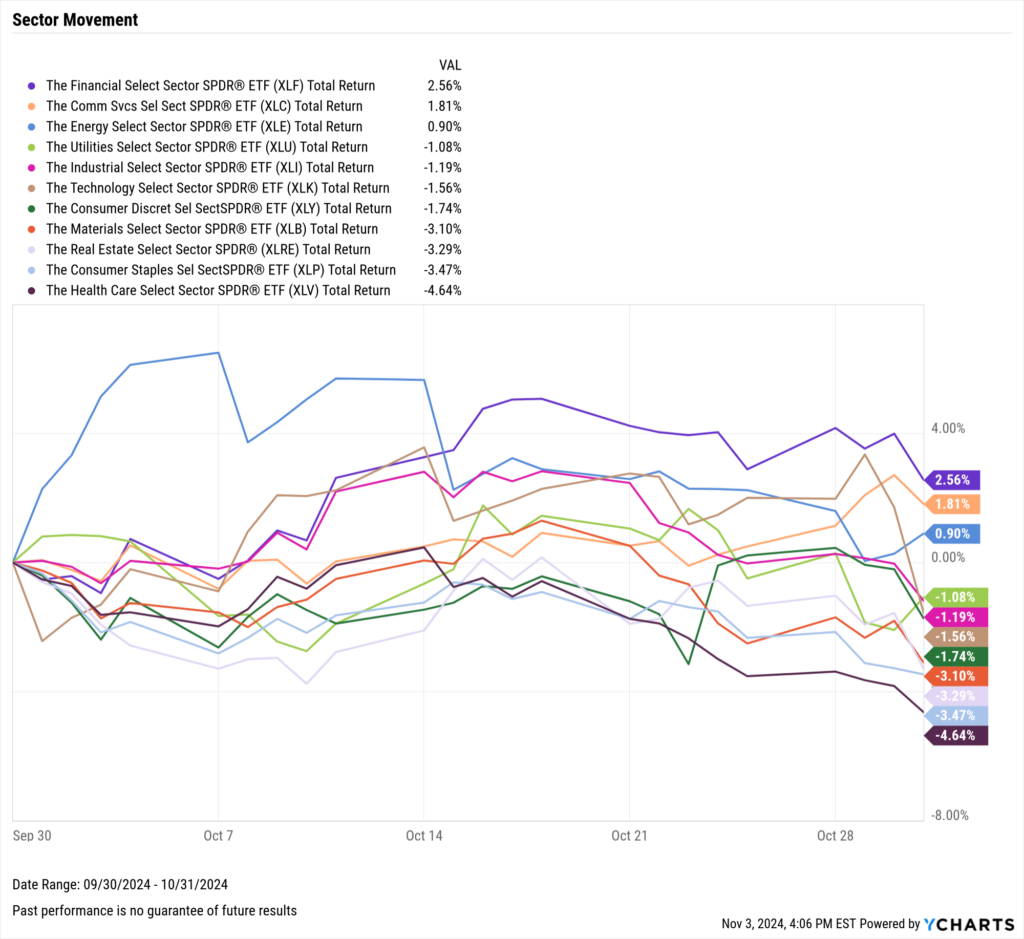

Eight of eleven sectors finished last month in the black; this month, it was the opposite. Only three sectors–Financials, Communication Services, and Energy–had a positive October. The worst-performing sector was Health Care, which lost 4.6% in October. Close behind was Consumer Staples (-3.5%) and Real Estate (-3.3%), the latter of which was affected by slowing home sales and prices along with spiking mortgage rates.

The Economy added just 12,000 jobs in October, the lowest monthly figure since December 2020. October saw several divergences among economic indicators: inflation fell while core inflation rose, the US ISM Manufacturing PMI declined as the Services PMI jumped higher, and mortgage rates spiked significantly even as Fed watchers expect the Fed Funds Rate to be cut by 25 basis points at the next FOMC meeting on November 7th, according to CME FedWatch.

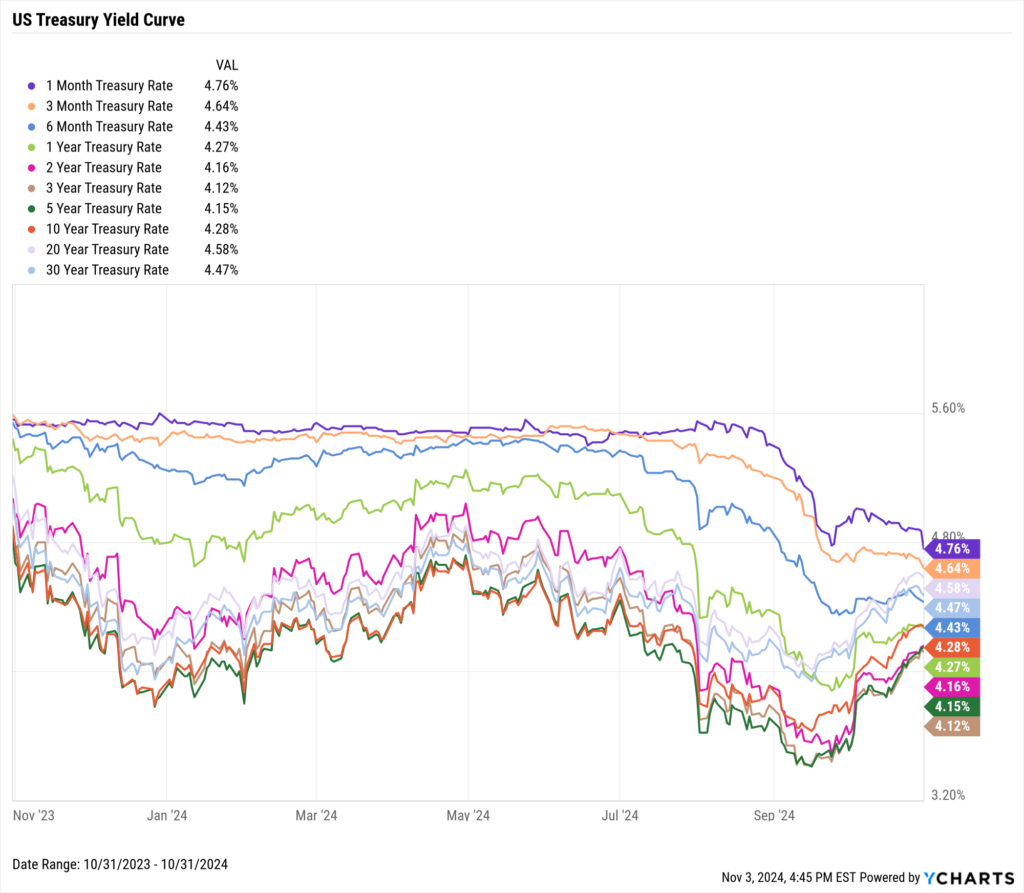

Treasury yields shot higher in the middle and longer portion of the curve even as future Fed rate cuts are expected as early as the November 7th FOMC meeting. The 3-year and 5-year Treasury Note yields rose the most of any durations on the curve, gaining 54 and 57 basis points, respectively. Yields on the 1-month and 3-month Treasury Bills declined in October.

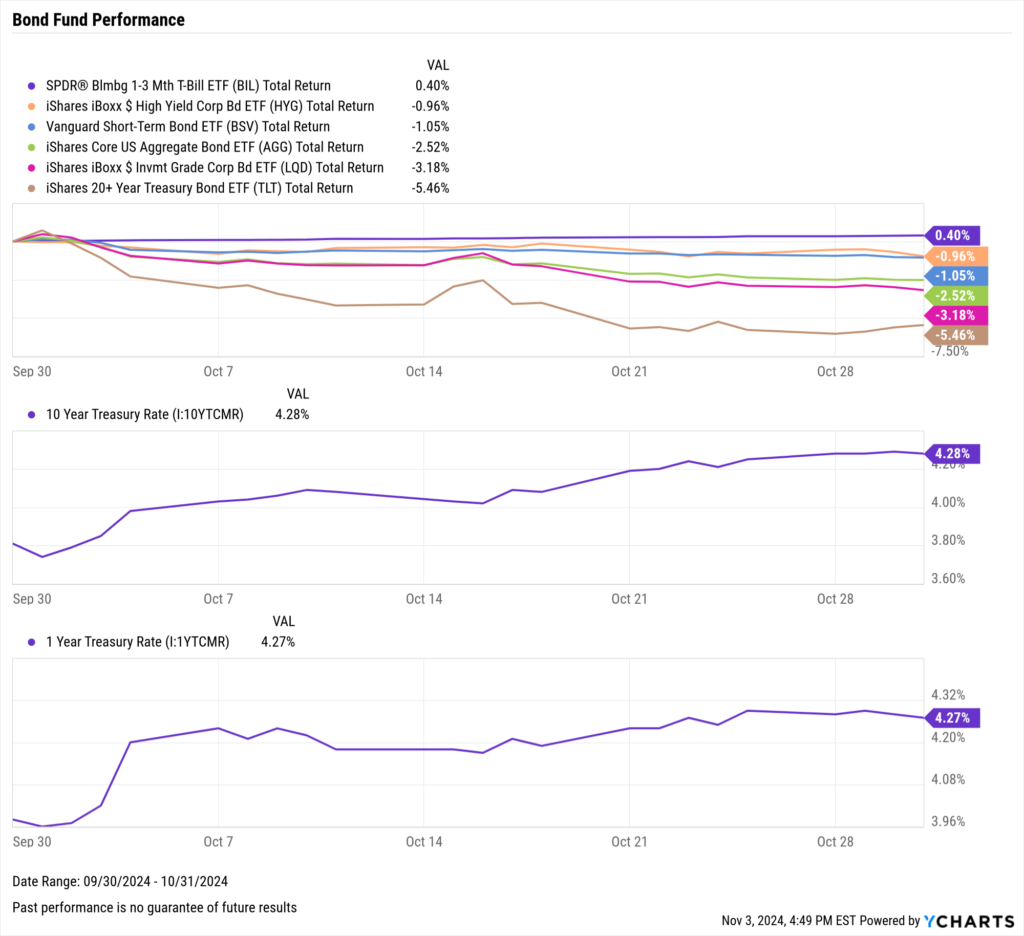

Several bond funds took a hit as a result of the increasing yields. The iShares 20+ Year Treasury Bond ETF (TLT) fell 5.5% in October, and the iShares iBoxx Investment Grade Corporate Bond ETF (LQD) lost 3.2%. Declines in the 1-month and 3-month T-Bill yields helped move the short-duration SPDR® Bloomberg 1-3 Month T-Bill ETF (BIL) higher by 0.4%.

Jump to Fixed Income Performance

Want to create your own monthly recap, complete with these charts in a presentation deck that contains your firm’s branding? Start a Free Trial →

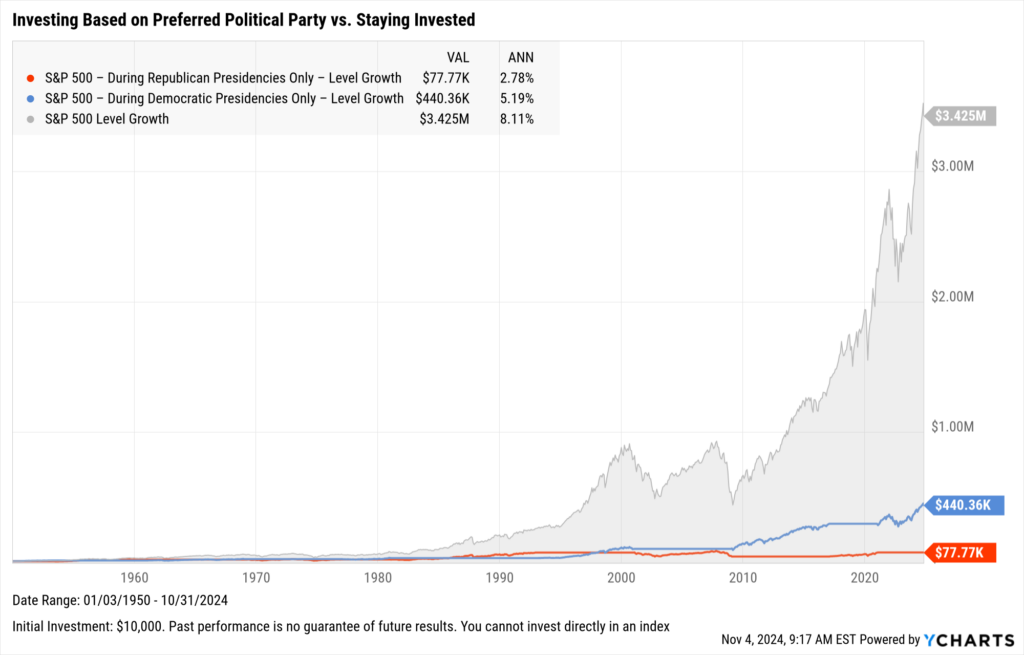

Off the YCharts! Should The Election Cause You to Change Investing Strategies?

The 2024 presidential election has arrived. Though elections often bring added volatility to markets, our 2024 Election Guide for Advisors found that making investing decisions based on election outcomes is not as beneficial in the long-run versus staying the course.

Historically, investing only during the presidencies of one’s preferred political party results in missing out on significant gains over time. For example, a fully-invested all-S&P 500 portfolio generated an 8.11% annualized return since 1950 through October 31st, 2024, much higher than that same portfolio invested only during Democratic or Republican presidencies, and cash otherwise.

Download Visual | Download How Do Presidential Elections Impact the Market?

Though the candidates, policies, and election results differ every four years, staying the course has produced the best long-term outcomes regardless of who wins or loses.

Equity Performance: U.S. Indices Take Breather, Semiconductor Companies Weigh on Tech Sector

Major Indexes

Download Visual | Modify in YCharts | View Below Table in YCharts

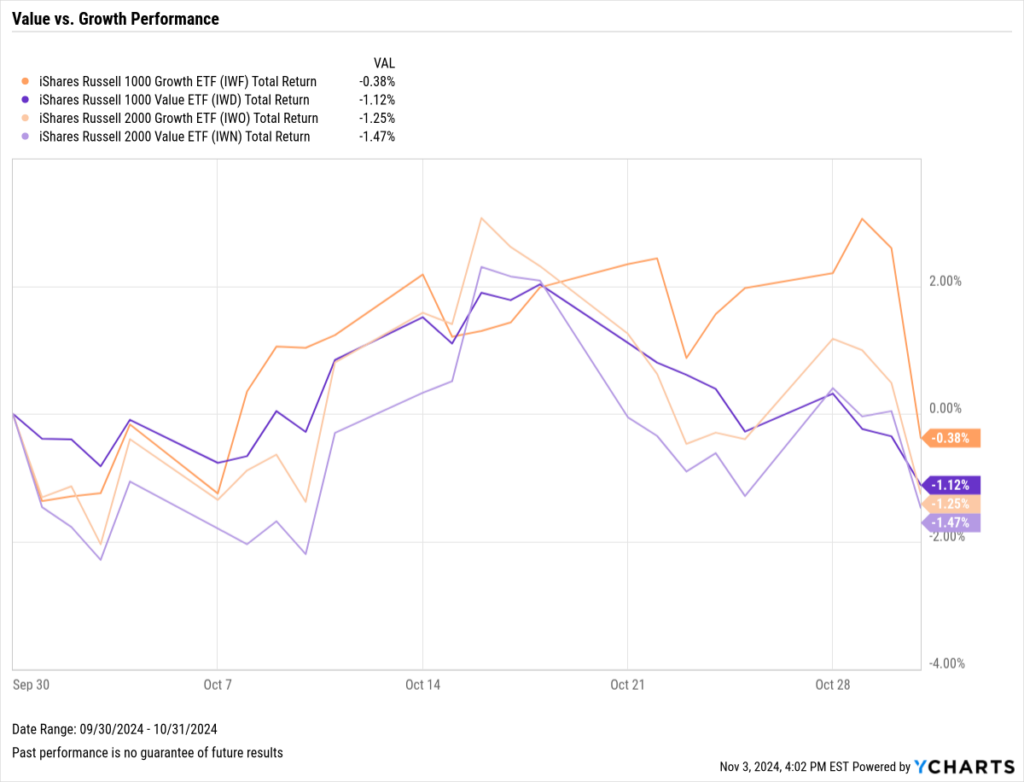

Value vs. Growth Performance

Download Visual | Modify in YCharts | View Below Table in YCharts

US Sector Movement

Download Visual | Modify in YCharts | View Below Table in YCharts

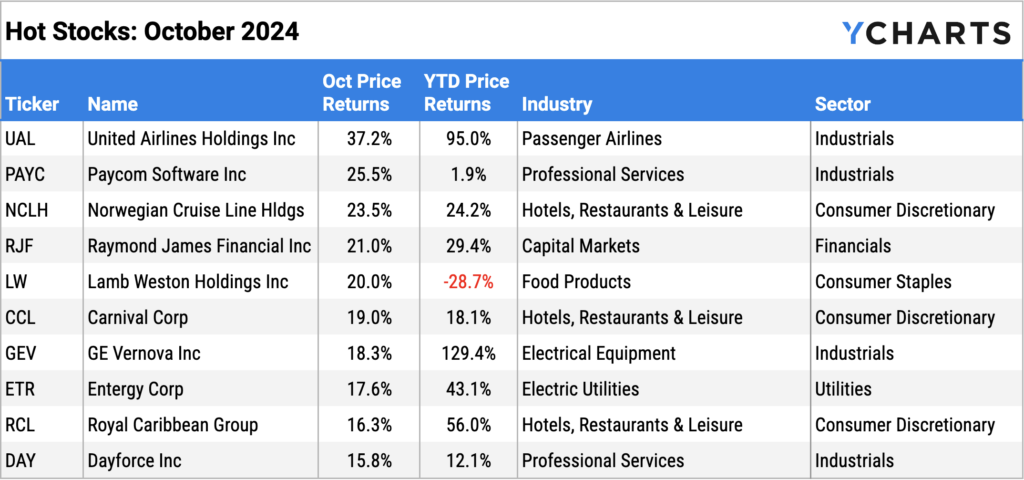

Hot Stocks: Top 10 S&P 500 Performers of October 2024

Download Visual | Modify in YCharts

Laggards & Losers: 10 Worst S&P 500 Performers of October 2024

Download Visual | Modify in YCharts

Featured Market News and YCharts Insights

Economists Boost U.S. Growth, Spending Forecasts Into Early 2025 (FA-Mag)

Economic Update: Reviewing Q3 2024 (YCharts)

Advisors sunny on the economy and active ETFs (InvestmentNews)

The 10 Best Performing Growth ETFs in the Last 10 Years (YCharts)

AI Usage Top Priority for SEC Examiners in 2025 (WealthManagement.com)

An Advisor’s Guide to Elections and the Markets (YCharts)

Economic Data Overview: Economy Adds Fewest Jobs since December 2020, Gold and Bitcoin Hit Highs

Employment

The unemployment rate remained unchanged at 4.1% between September and October, while the labor force participation rate fell 0.1 percentage points to 62.6%. October nonfarm payroll data showed that the U.S. economy added just 12,000 jobs this month, partially due to the recent hurricanes and dockworker strike. This was the lowest monthly jobs figure since December 2020 and well below the expected increase of 100,000.

Consumers and Inflation

The US inflation rate fell for the sixth straight month to 2.44% in September; on the other hand, core inflation went in the opposite direction for the second month in a row, coming in at 3.31%. The US Consumer Price Index rose 0.53% month over month, and US Personal Spending increased by 0.18%.

The Federal Reserve’s next FOMC meeting is just around the corner on November 7th, where the Fed is expected to cut its key Fed Funds Rate by 25 basis points, according to CME FedWatch. This would lower the Fed Funds Rate down to 4.50%-4.75% from 4.75%-5.00%, and mark the second rate cut since March 2020.

Production and Sales

After remaining unchanged at 47.20 between August and September, the US ISM Manufacturing PMI came in at 46.50 in October, slipping another 0.7 points further into contraction territory. However, the Services PMI surged 3.4 points higher to 54.90 in September, building further momentum off of a 2.6-point gain from July. The YoY US Producer Price Index fell to 1.76% in September, while US Retail and Food Services Sales increased 0.43% between August and September.

Housing

US New Single-Family Home Sales rebounded by 4.1% MoM in September following a contraction in August, but Existing Home Sales dipped by 1% MoM. The Median Sales Price of Existing Homes dipped for the third consecutive month to $404,500 as of September. This marks a 2.9% MoM decrease and a 5.2% decline from its all-time high set in June. Mortgage rates surged higher in October, forming a V-shaped recovery since August. The 15-year Mortgage Rate rebounded by 83 basis points to 5.99% while the 30-year rose by 64 bps to 6.72%, both as of October 31st.

Commodities

Gold continued its 2024 run, adding another 4% in October, bringing its price per ounce in US Dollars to $2,734.20 as of October 31st, marking a YTD gain of 31.6%. Crude oil prices dipped slightly in October; the price of WTI fell by 1.6% in October to $67.65 per barrel as of October 28th, while Brent sank by 0.7% to $71.87. Falling oil prices translated into lower gas prices, with the average price of gas shedding another 8 cents MoM to $3.22 per gallon.

Cryptocurrencies

The price of Bitcoin topped $70,000 for the first time since June, reaching $72,342.62 as of October 31st and gaining 10.2% in the month. Bitcoin and other digital assets have seen price appreciation in the runup to the 2024 presidential election, with some– including hedge fund billionaire Paul Tudor Jones–describing them as a hedge against inflation and policy uncertainty. Bitcoin is up 71.3% this year, and though the price of Ethereum was largely flat in the month of October, it is 15.8% higher in 2024.

Fixed Income Performance: Insights into Bond ETFs and Treasury Yields

US Treasury Yield Curve

1 Month Treasury Rate: 4.76%

3 Month Treasury Rate: 4.64%

6 Month Treasury Rate: 4.43%

1 Year Treasury Rate: 4.27%

2 Year Treasury Rate: 4.16%

3 Year Treasury Rate: 4.12%

5 Year Treasury Rate: 4.15%

10 Year Treasury Rate: 4.28%

20 Year Treasury Rate: 4.58%

30 Year Treasury Rate: 4.47%

Download Visual | Modify in YCharts

Bond Fund Performance

Download Visual | Modify in YCharts | View Below Table in YCharts

Stay updated with the latest market trends, economic data, and financial analysis with YCharts, your go-to source for financial insights and advisor tools. Download the visual aids directly from YCharts, and contact us for customized access to these charts.

Have a great November! 📈

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking for a tool to help you better communicate market events?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Download a copy of the Monthly Market Wrap slide deck:

Disclaimer

©2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

How Financial Advisors Use YCharts to Optimize Investment StrategiesRead More →