Which Companies Will Lose from New U.S. Tariffs? Market Risks & Portfolio Considerations

Introduction: How Tariffs Can Hurt Certain Companies & Industries

The Trump administration’s latest tariff policies are reshaping global trade dynamics, putting pressure on industries heavily reliant on imported raw materials, foreign manufacturing, and international supply chains.

While some sectors stand to benefit, others face rising input costs, shrinking margins, and supply chain disruptions that could erode profitability.

For financial advisors and asset managers, understanding how tariffs impact specific industries is critical to adjusting sector allocation, stock selection, and risk management strategies.

This analysis will explore:

- Which industries face the greatest risks from tariff increases

- Key companies that could struggle under higher import costs

- ETFs and funds that may see volatility from trade restrictions

- Investment strategies to hedge tariff-related risks

Sectors & Companies Most at Risk from Tariffs

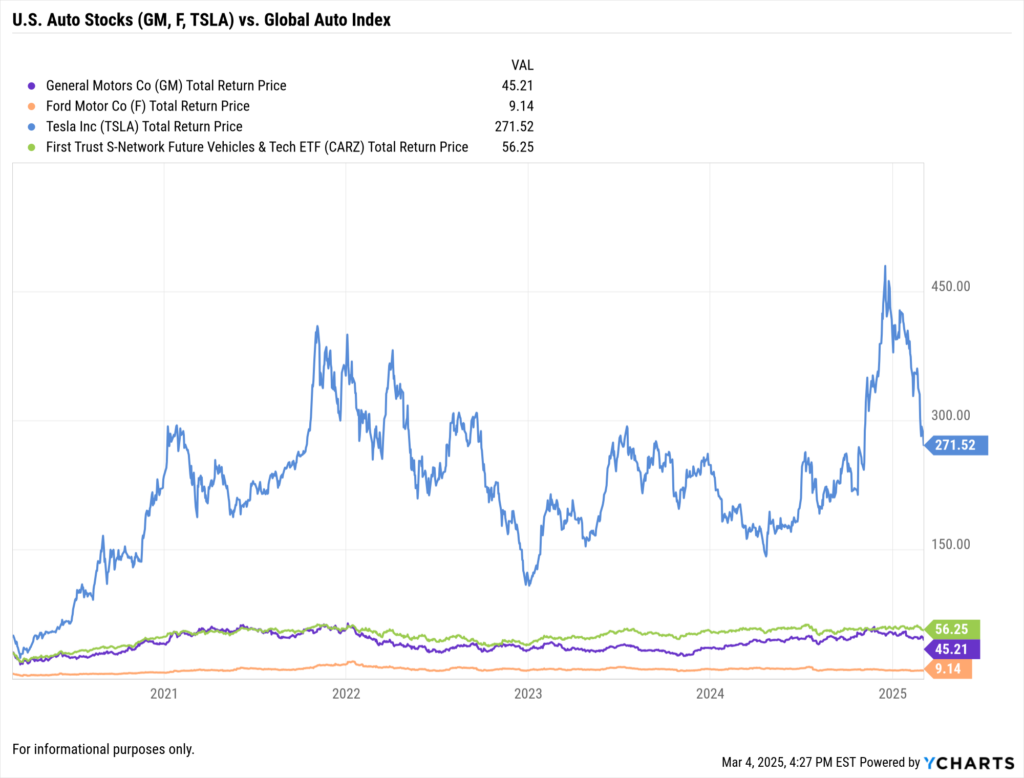

1. Automakers & Auto Parts Suppliers

Why They’re at Risk:

- Heavy reliance on imported materials such as aluminum, steel, and semiconductors.

- Potential price increases on vehicles due to rising manufacturing costs.

- Declining consumer demand if higher prices make vehicles less affordable.

Companies Impacted:

- General Motors (GM) & Ford (F): Significant exposure to foreign auto parts and raw materials.

- Tesla (TSLA): Imports lithium-ion batteries and AI chips from overseas, increasing potential costs.

- BorgWarner (BWA) & Aptiv (APTV): Auto part manufacturers that rely on global semiconductor supply chains.

ETFs to Watch:

- iShares U.S. Auto ETF (IDRV)

- First Trust Nasdaq Global Auto ETF (CARZ)

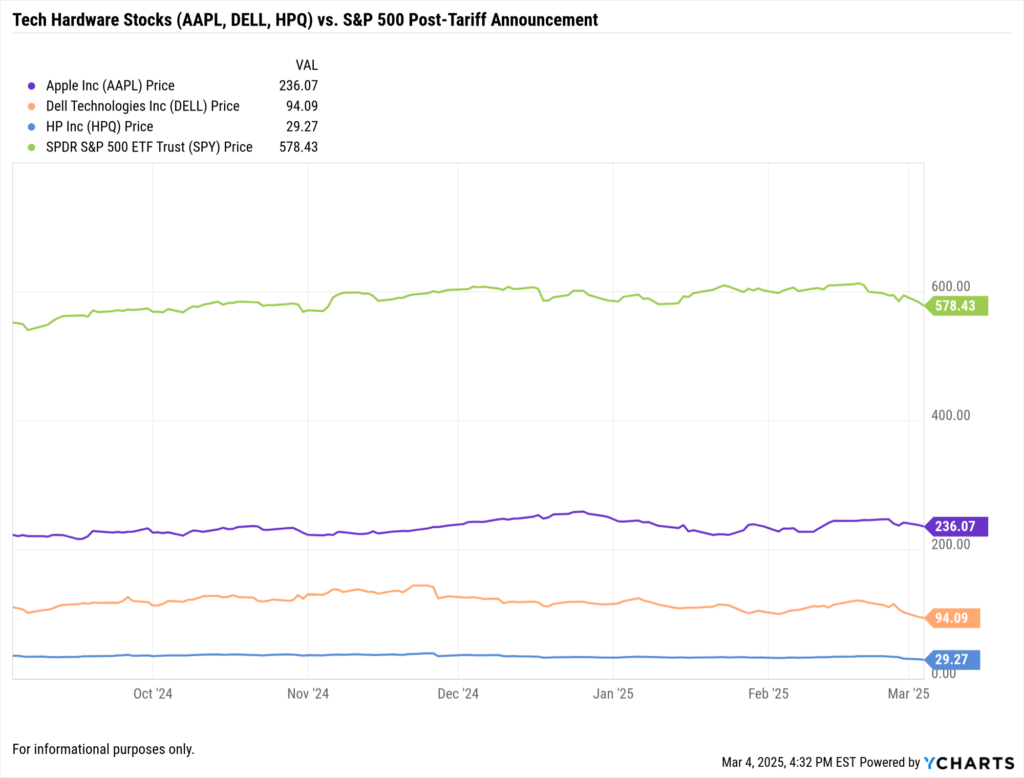

2. Consumer Electronics & Tech Hardware

Why They’re at Risk:

- Semiconductors and electronic components are mostly produced in Taiwan, China, and South Korea.

- Rising costs for consumer devices like smartphones, laptops, and networking equipment.

- Potential supply chain bottlenecks if trade tensions escalate.

Companies Impacted:

- Apple (AAPL): Relies on Chinese manufacturing and Taiwanese semiconductor suppliers.

- Dell (DELL) & HP (HPQ): Depend on global laptop and server production hubs.

- Cisco (CSCO): Increased costs on networking equipment and enterprise hardware solutions.

ETFs to Watch:

- Technology Select Sector SPDR ETF (XLK)

- iShares Global Tech ETF (IXN)

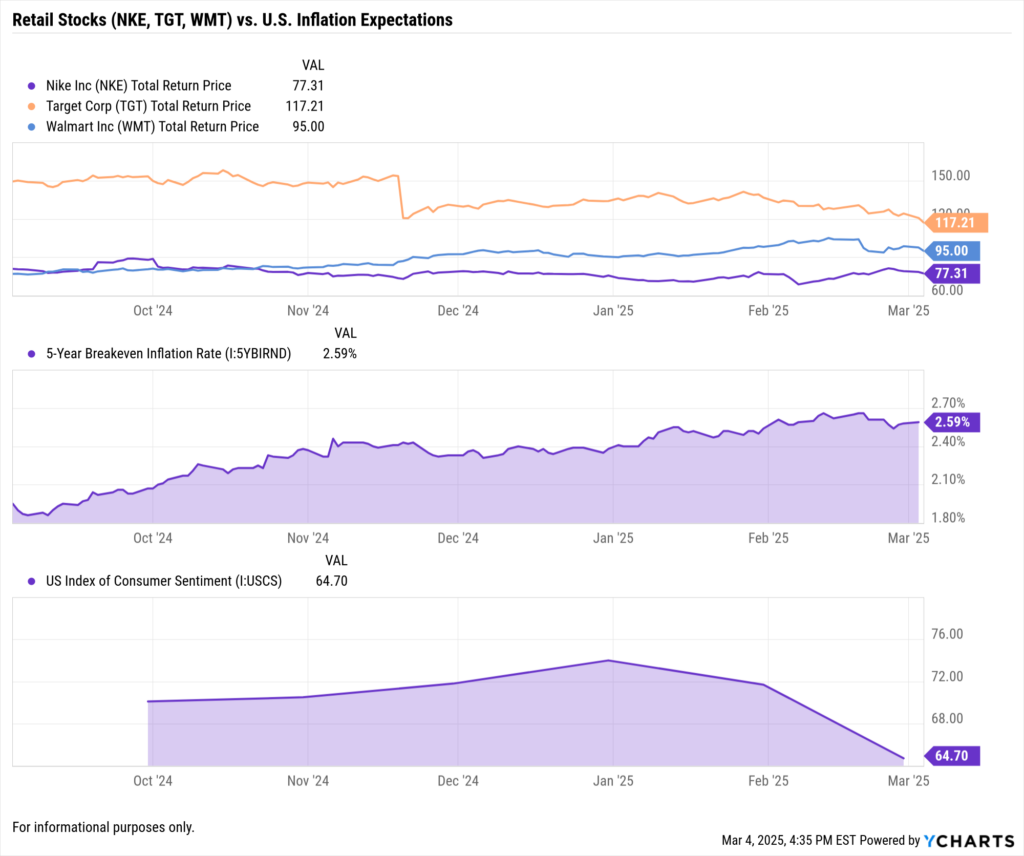

3. Retail & Apparel Companies with High Import Dependence

Why They’re at Risk:

- Over 40% of U.S. apparel and footwear is imported from Asia.

- Higher tariffs could reduce retailer profit margins or force companies to pass costs to consumers.

Companies Impacted:

- Nike (NKE): Major supplier factories are based in China and Vietnam.

- Adidas (ADDYY): Another global sportswear brand with significant Asian manufacturing exposure.

- Target (TGT) & Walmart (WMT): Large-scale importers of consumer goods from tariff-affected countries.

ETFs to Watch:

- SPDR S&P Retail ETF (XRT)

- VanEck Retail ETF (RTH)

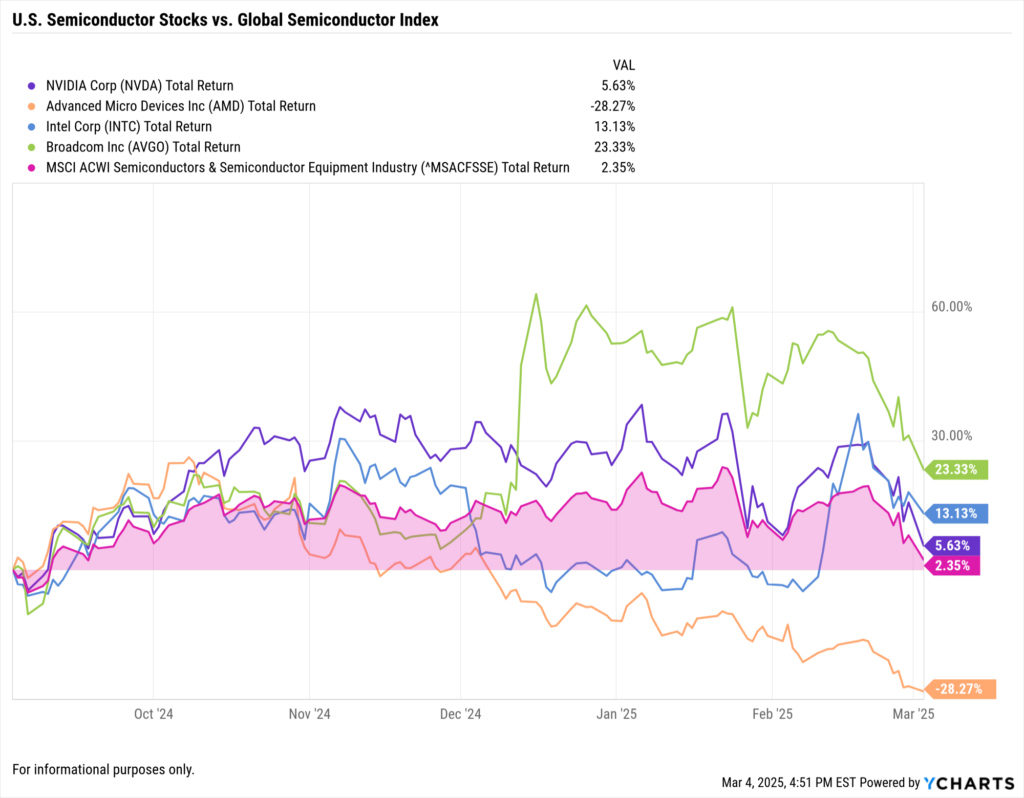

4. Semiconductor Companies with Global Supply Chain Exposure

Why They’re at Risk:

- U.S. chipmakers depend on Taiwanese foundries for production.

- Tariffs on semiconductors from Taiwan and South Korea could increase costs for major firms.

Companies Impacted:

- Nvidia (NVDA): Relies on TSMC (Taiwan Semiconductor Manufacturing Co.) for advanced chip fabrication.

- AMD (AMD): Outsources semiconductor production to foreign chip foundries.

- Intel (INTC): Despite U.S. fab expansion, Intel still sources critical components globally.

ETFs to Watch:

- iShares Semiconductor ETF (SOXX)

- VanEck Vectors Semiconductor ETF (SMH)

Portfolio Strategies to Hedge Tariff Risks

1. May want to reduce Exposure to High-Tariff Sectors

- Can trim positions in companies heavily reliant on imported raw materials and components.

- May want to reallocate toward sectors that benefit from domestic production and reshoring trends.

2. May want to shift Towards U.S.-Based Producers

- May want to consider industrial, energy, and defense companies with minimal exposure to foreign trade risks.

- Alternative ETFs: May want to focus on U.S.-manufactured goods, infrastructure, and defense.

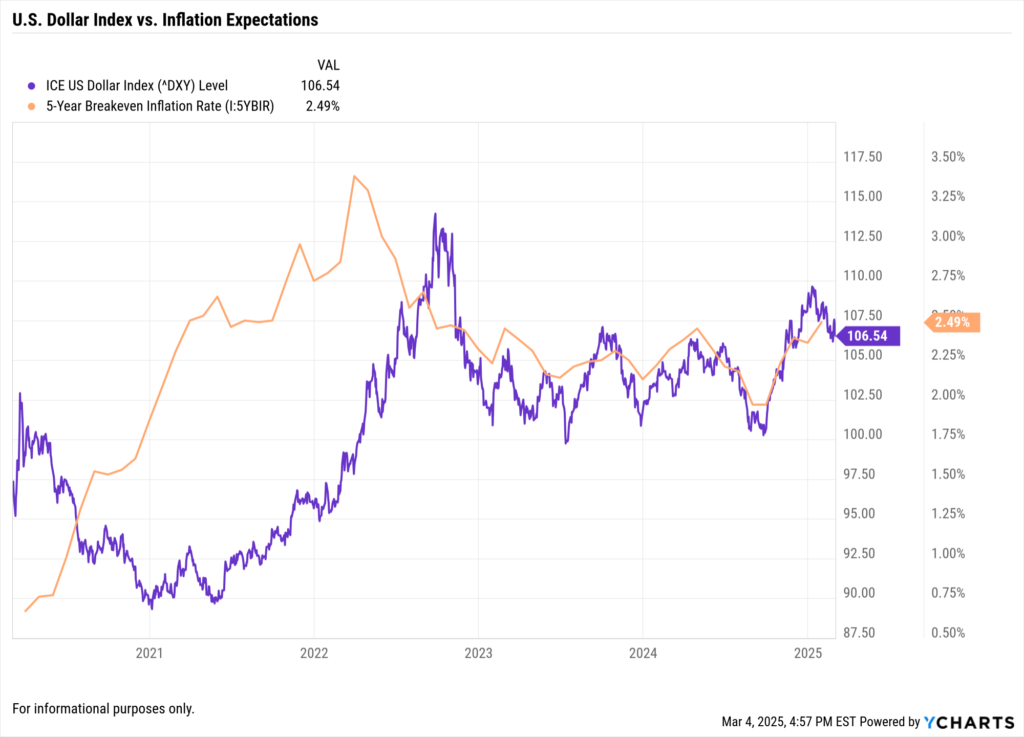

3. May want to hedge with Commodities & Inflation-Protected Assets

- If tariffs drive inflation, consider gold, agricultural commodities, and inflation-protected bonds.

- Monitor Treasury yields and the U.S. dollar’s reaction to trade policies.

How YCharts Helps Financial Professionals Analyze Tariff Impacts

YCharts provides real-time market data, sector analysis, and charting tools to help financial professionals:

Track sector-specific tariff impacts with custom performance comparisons.

Analyze historical trends to see how similar trade policies affected stocks in past trade wars.

Generate client-ready reports with clear visual insights on trade-related market risks.

Start tracking these insights today: Request a Free YCharts Trial

Conclusion: How Advisors Can Navigate Trade Policy Risks

New U.S. tariffs pose a significant challenge for companies with import-heavy supply chains, higher input costs, and exposure to global manufacturing hubs.For financial advisors and asset managers, it’s critical to assess how these trade shifts affect portfolio allocations. By leveraging YCharts, investors can track market reactions, evaluate sector trends, and adjust strategies to minimize tariff risks.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking for a best-in-class data & visualization tool?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Get your copy of The Top Metrics Advisors Used in Portfolio Reports: 2024

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Moving On From Your Investment Research and Analytics Platform?Read More →