Q1 2025 Utilities Sector Earnings: Key Highlights & Market Reactions

Introduction: Utilities Navigate Rising Costs and Infrastructure Demands

The Q1 2025 Utilities Sector Earnings season highlights how the sector balances major capital investments, customer growth, and cost pressures. Utilities are demonstrating steady revenue streams while investing aggressively in grid modernization, clean energy expansion, and resilience initiatives. As inflationary impacts persist and extreme weather events become more common, financial professionals are tracking which companies are best positioned to deliver stable returns.

This live-updating blog summarizes major earnings results, management commentary, and YCharts visualizations to help advisors and investors stay informed during earnings season.

Latest Earnings Reports

YCharts users can view a full breakdown of all current and upcoming earnings calls and reports live here.

Not a YCharts user? Try a 7-Day Free Trial.

April 24, 2025 Earnings

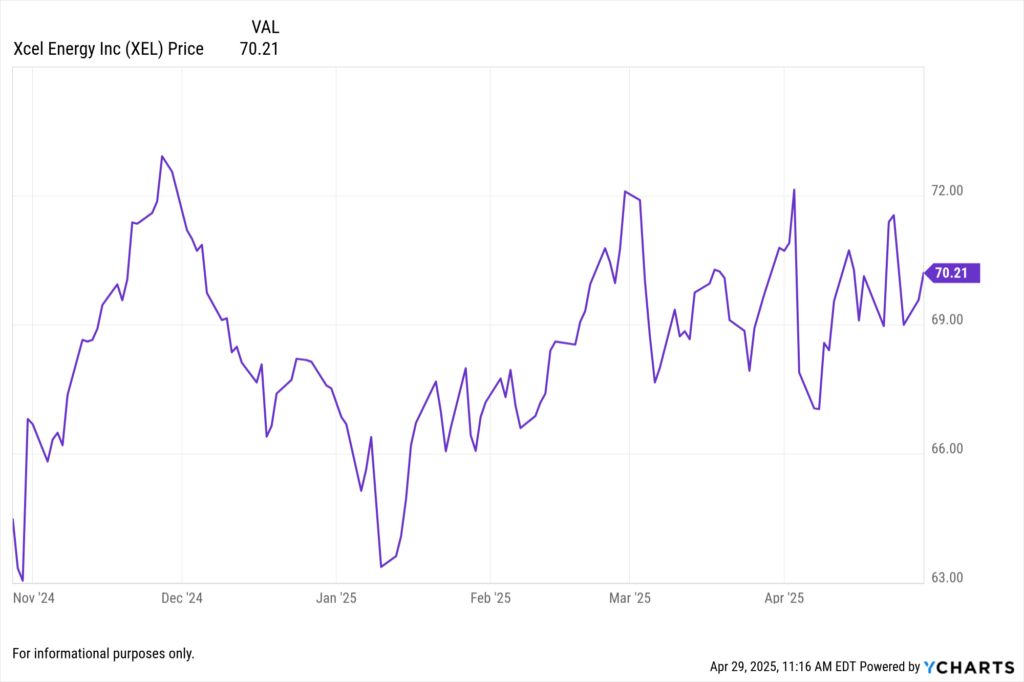

Xcel Energy Inc. (XEL) Maintains Guidance Amid Higher Operating Costs

Xcel Energy reported Q1 2025 GAAP and ongoing EPS of $0.84, slightly down from $0.88 in Q1 2024. Revenue was $3.48 billion, a 1.2% decline year-over-year. Management cited higher operating and maintenance expenses as drivers of the slight earnings dip but reaffirmed 2025 EPS guidance of $3.75 to $3.85. Xcel also confirmed its $45 billion investment plan over the next five years to support clean energy growth and grid modernization.

View Xcel Energy Inc.’s Earnings Report Here >

PG&E Corp. (PCG) Focuses on Infrastructure Speed and Wildfire Risk Management

PG&E reported Q1 2025 GAAP EPS of $0.28 and Core EPS of $0.33, compared to $0.34 and $0.37, respectively, in Q1 2024. Revenue rose to $5.98 billion, a 4.6% increase year-over-year. While wildfire mitigation costs continued to rise, PG&E reaffirmed its 2025 Core EPS guidance of $1.48–$1.52 and introduced its new “Flex Connect” service aimed at accelerating EV charger and battery storage interconnections.

View PG&E Corp.’s Earnings Report Here >

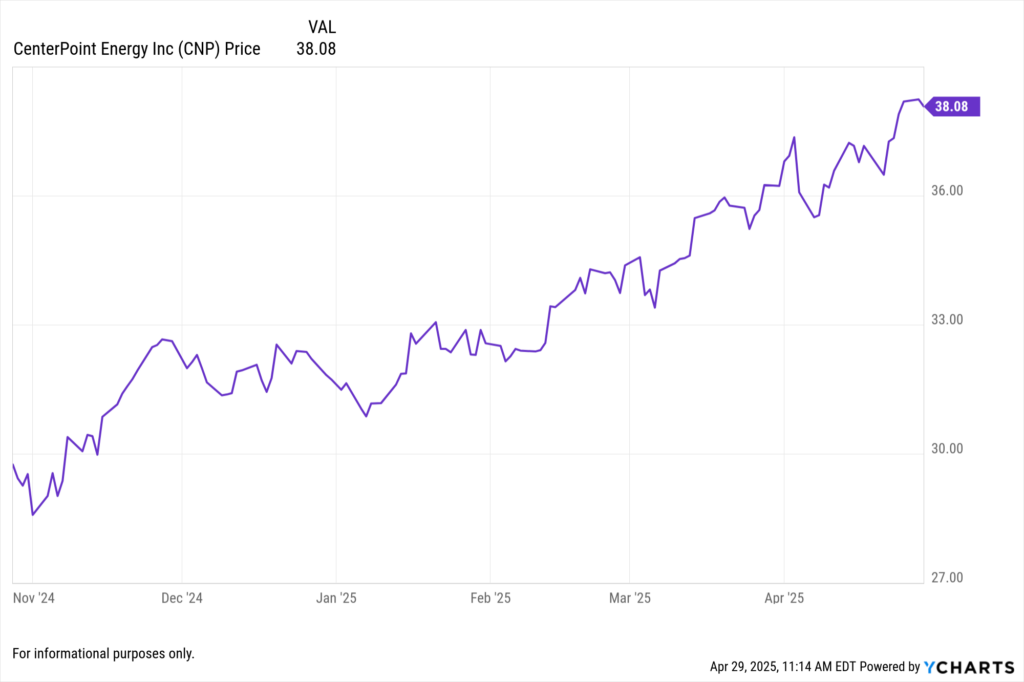

CenterPoint Energy Inc. (CNP) Expands Capital Investment to Meet Rising Demand

CenterPoint Energy posted Q1 2025 GAAP EPS of $0.45, down from $0.55 in Q1 2024, with net income falling 15% year-over-year to $297 million. Despite the earnings dip, CenterPoint announced an increase in its 10-year capital plan to $48.5 billion, citing robust demand from AI data centers and industrial growth in Texas. The company reiterated its confidence in meeting its 2025 earnings targets.

View CenterPoint Energy Inc.’s Earnings Report Here >

April 23, 2025 Earnings

NextEra Energy Inc. (NEE) Accelerates Renewable Energy Backlog

NextEra Energy reported Q1 2025 adjusted EPS of $0.99, exceeding analyst expectations, on $6.25 billion in revenue, a 9% year-over-year increase. Net income for the quarter was $1.68 billion. The company added 3.2 GW of new renewable and storage projects to its development pipeline, bringing its backlog to 28 GW. Florida Power & Light delivered 12.3% year-over-year net income growth, underscoring NextEra’s position as a sector leader in clean energy transition.

View NextEra Energy Inc.’s Earnings Report Here >

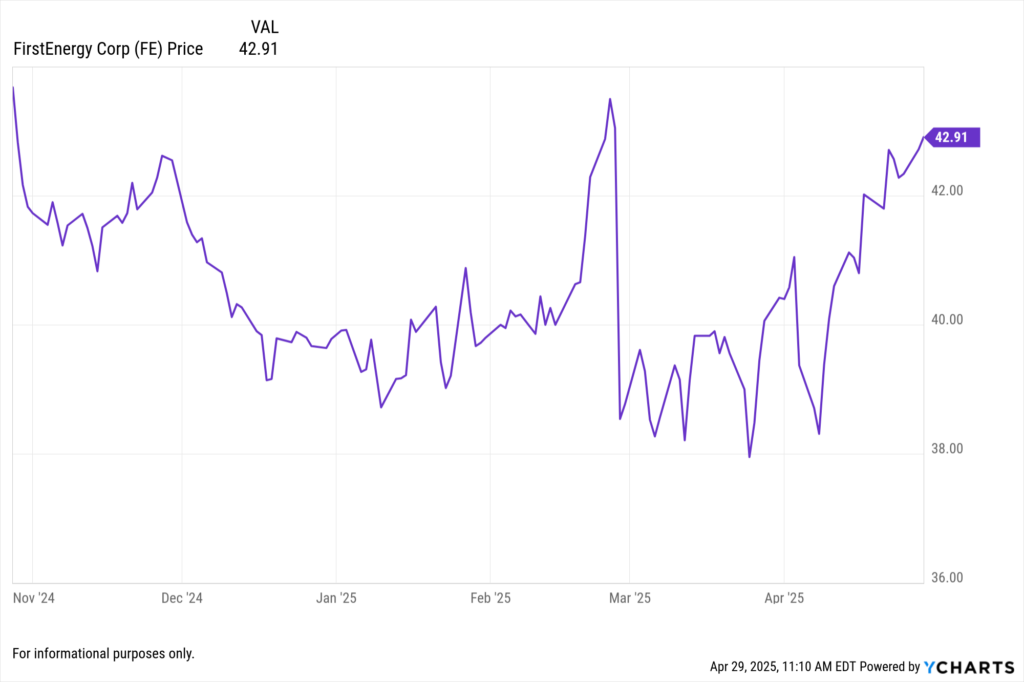

FirstEnergy Corp. (FE) Posts Strong Core Earnings Growth

FirstEnergy reported Q1 2025 revenue of $3.8 billion, compared to $3.3 billion in the prior year. Core (Non-GAAP) EPS rose 37% to $0.67 from $0.49 a year ago. The company invested more than $1 billion in capital projects during the quarter, aligned with its $5 billion 2025 investment plan. Management reaffirmed full-year 2025 core EPS guidance between $2.40 and $2.60 per share.

View FirstEnergy Corp.’s Earnings Report Here >

How YCharts Can Help

Whether you’re tracking renewable project additions, rate base expansion, or infrastructure modernization across the Utilities sector, YCharts provides data-driven tools to help financial professionals stay ahead this earnings season.

Event Calendar: Monitor upcoming utility earnings reports and announcements

Fundamental Charts: Analyze revenue, net income, and capital investment trends over time

Stock Screeners: Identify Utilities stocks based on EPS beats, dividend growth, and rate base trends

Custom Reports: Build shareable Utilities earnings decks for clients and internal teams

Conclusion: Infrastructure Investment and Energy Transition Dominate Utilities Earnings

The Q1 2025 Utilities Sector Earnings season shows utilities navigating operating cost pressures while aggressively investing for the future. NextEra and FirstEnergy lead on renewables and transmission expansion, while Xcel and CenterPoint focus on maintaining earnings stability through infrastructure growth. PG&E’s efforts to streamline grid access for clean energy deployments could be a critical differentiator moving forward.

Bookmark this blog — we’ll continue to update with new Utilities sector earnings results and strategic insights as they are released.

Whenever you’re ready, here’s how YCharts can help you:

1. Looking to Move On From Your Investment Research and Analytics Platform?

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Q1 2025 Communication Services Sector Earnings: Key Highlights & Market ReactionsRead More →