Largest Crypto ETFs: September 2025

Updated as of: October 9, 2025

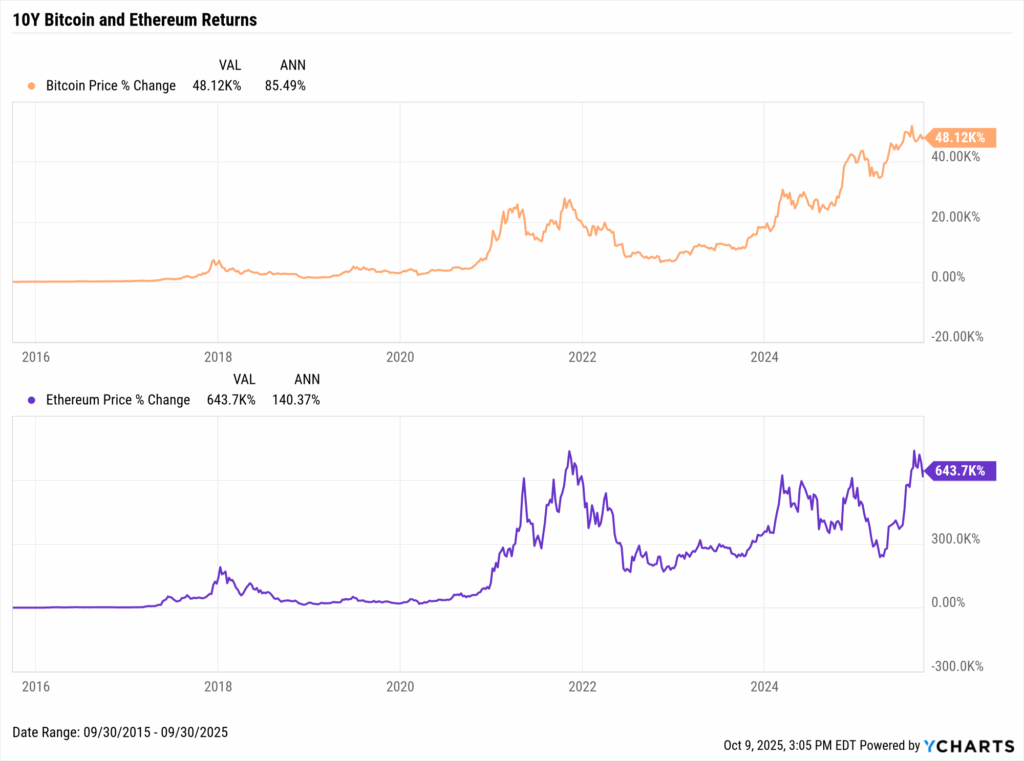

Despite being considered a high-risk, speculative asset, the adoption of cryptocurrency continues to skyrocket. The last 10 years has been a period of parabolic and volatile growth for Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization:

Download Visual | Modify in YCharts

For advisors with clients who want to leverage cryptocurrency as an investment vehicle but don’t have easy access to direct crypto trading through a wallet or exchange, crypto ETFs provide advisors a convenient way to build an allocation to crypto within a client’s existing portfolio.

Crypto ETFs have grown in both popularity and adoption in recent months. In January 2024, the SEC approved the first U.S.-listed spot Bitcoin ETFs, and proceeded to approve spot Ethereum ETFs six months later. Most recently, the SEC approved generic listing standards for spot crypto ETFs in September, opening the door for a wider range of ETFs to be represented and traded by investors and institutions alike.

To provide advisors with crypto-focused investment ideas for consideration in client portfolios, we compiled a list of the largest crypto ETFs based on share class assets under management (AUM) using the YCharts Fund Screener, which helps advisors navigate across a universe of over 85,000 funds.

The following data includes crypto ETF flows over the last month, three months, and one year, along with net expense ratio and one-year price returns.

Table of Contents

Largest Bitcoin ETFs

These are the largest Bitcoin ETFs as of September 30, 2025.

Start a Free Trial to See Full Rankings | View & Modify in Stock Screener

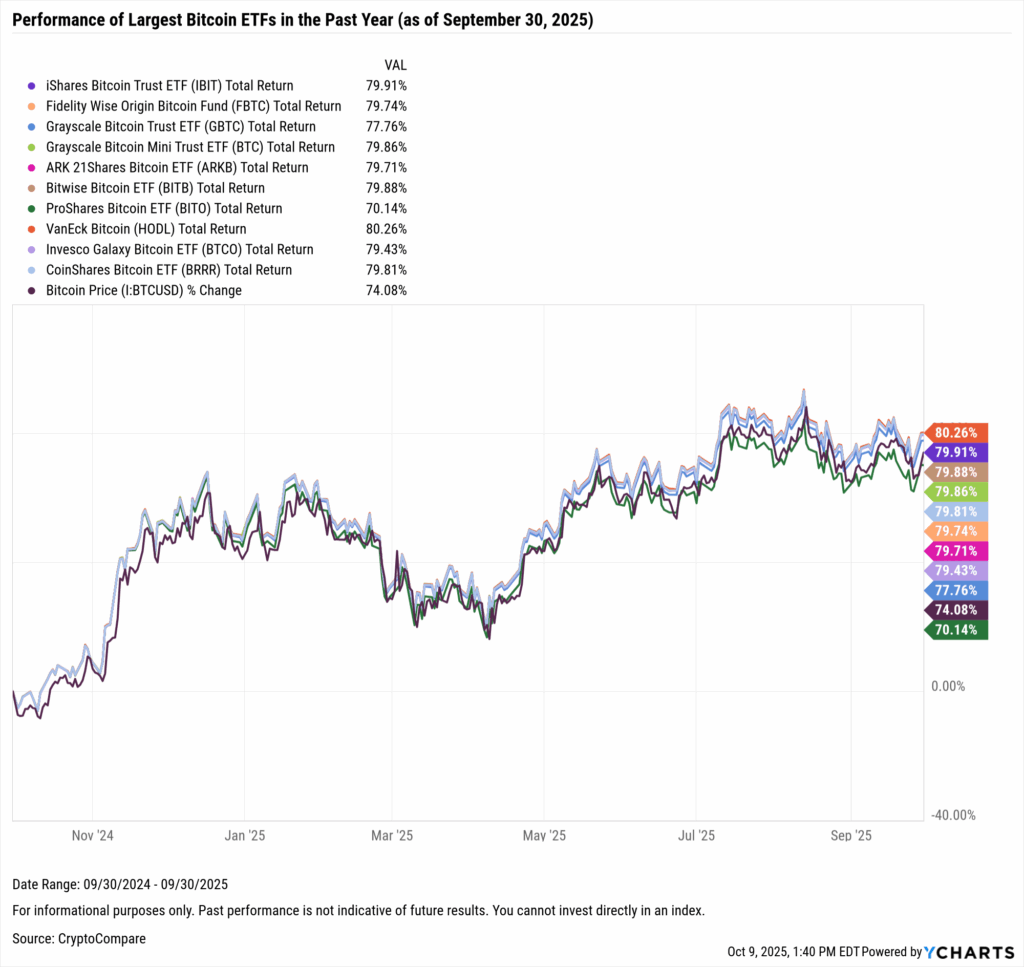

Bitcoin ETF Performance

Download Visual | Modify in YCharts

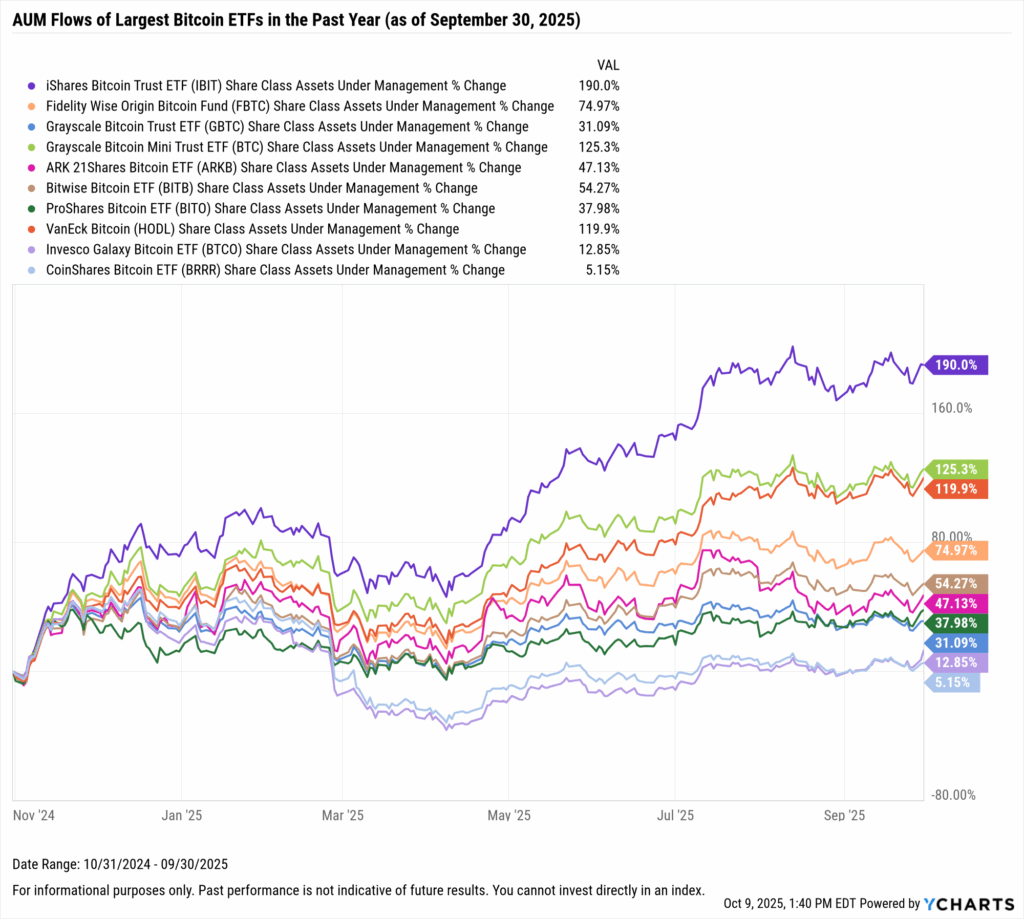

Bitcoin ETF Share Class Flows

Download Visual | Modify in YCharts

Largest Ethereum ETFs

These are the largest Ethereum ETFs as of September 30, 2025.

Start a Free Trial to See Full Rankings | View & Modify in Stock Screener

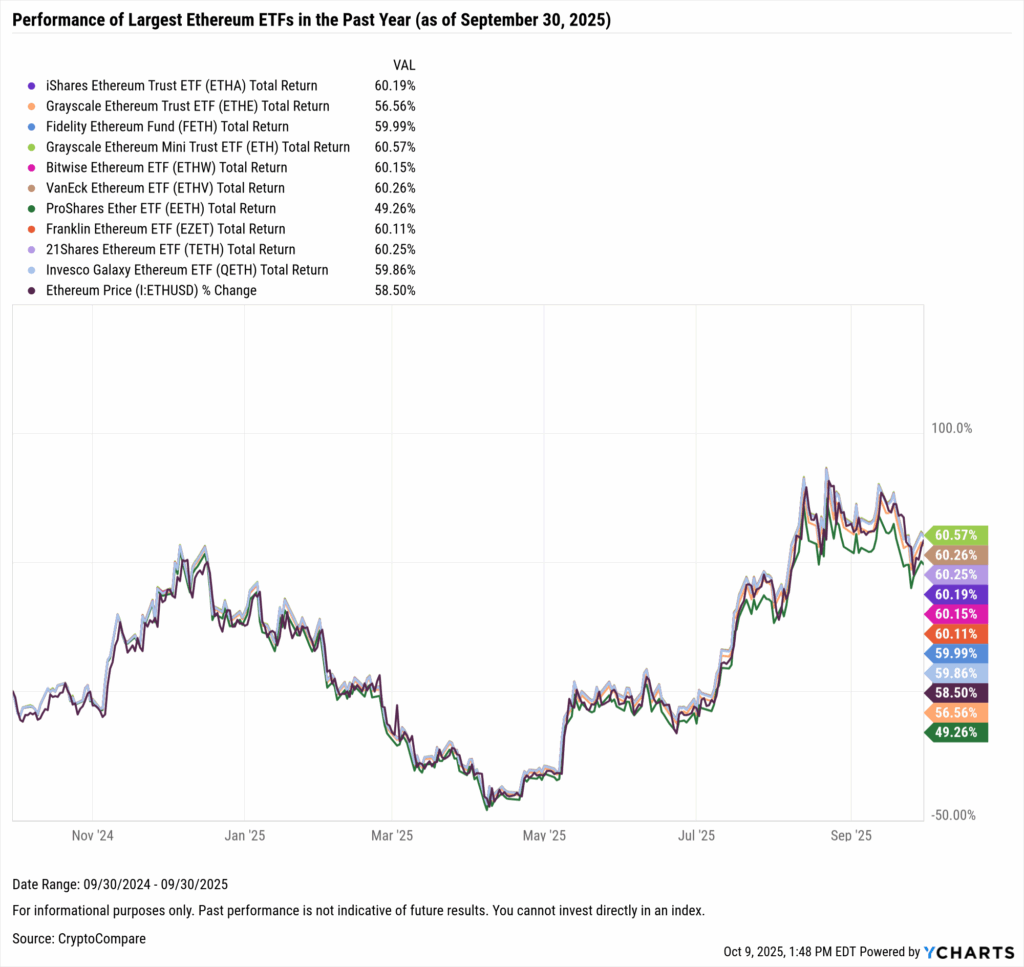

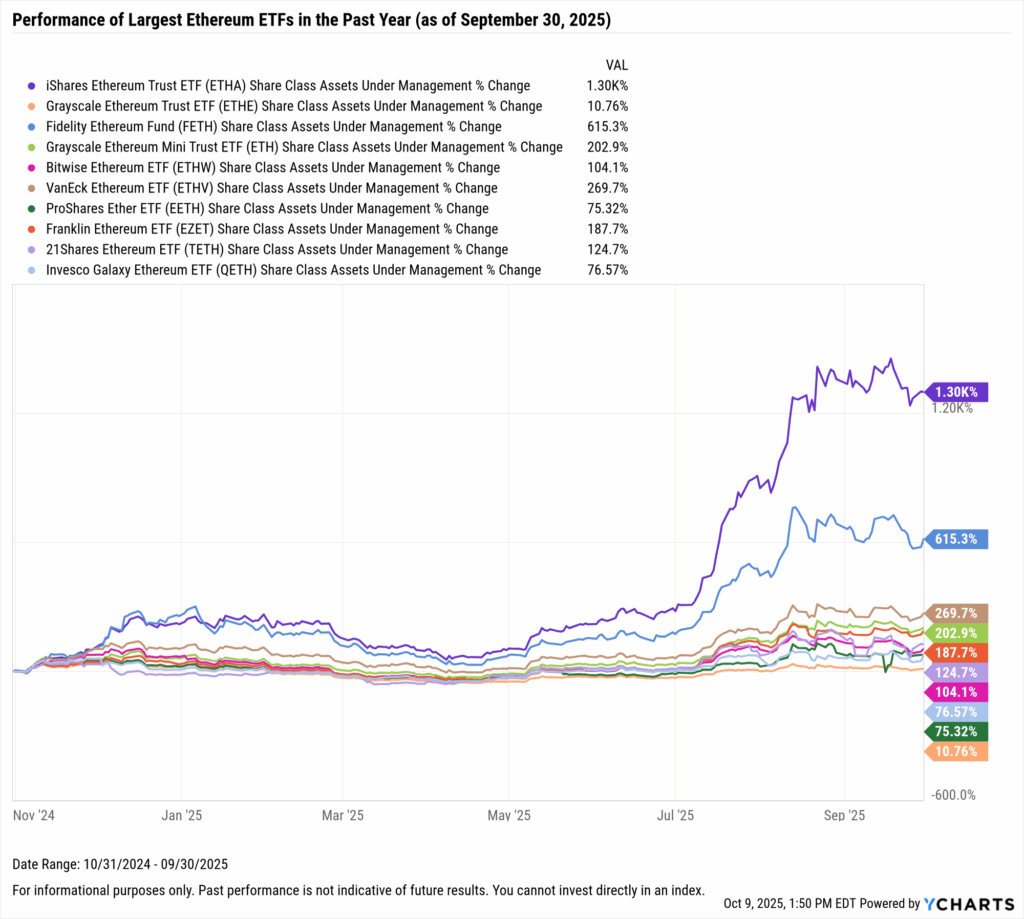

Ethereum ETF Performance

Download Visual | Modify in YCharts

Ethereum ETF Share Class Flows

Download Visual | Modify in YCharts

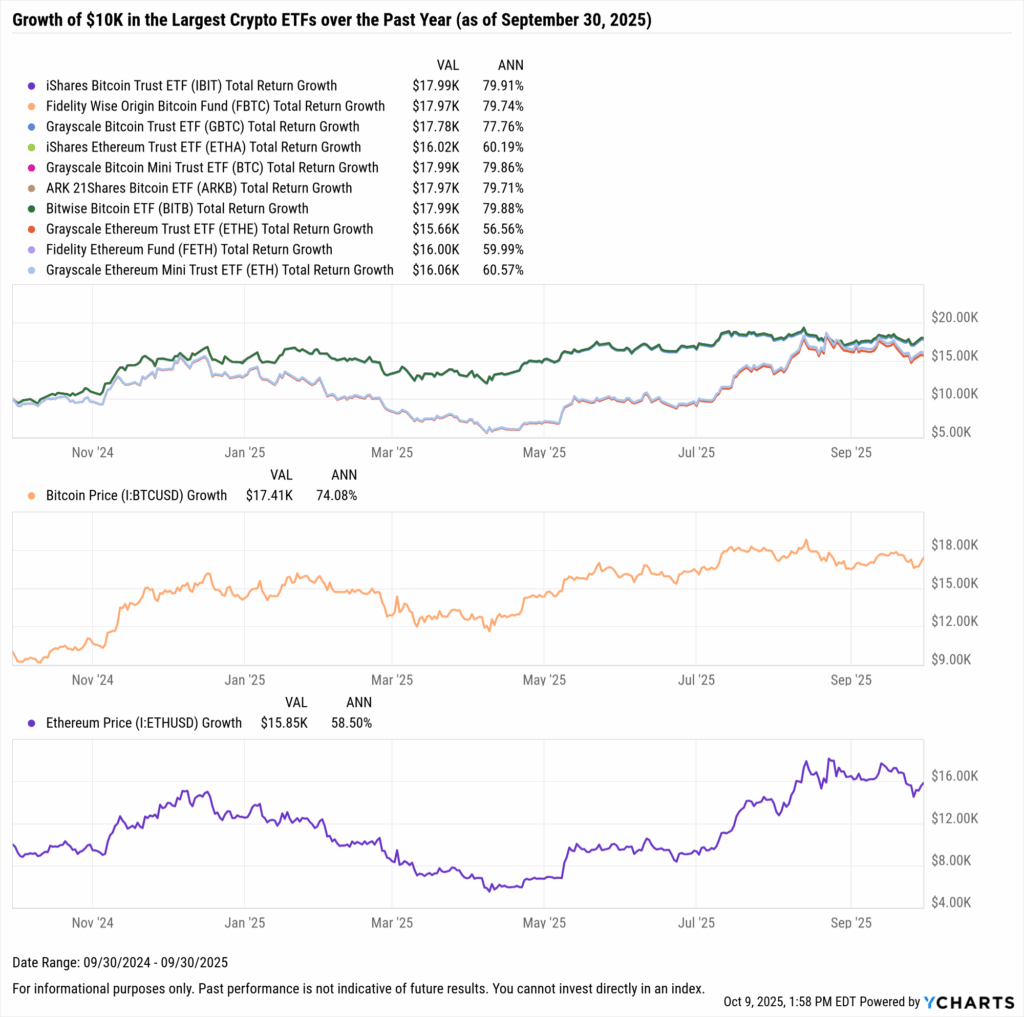

What Was the Growth of $10,000 in the Top Crypto ETFs Over the Last Year?

If you invested $10,000 one year ago into any of the ten largest Bitcoin or Ethereum ETFs, your total return one year later would be on par with or even slightly higher than the performance of the underlying crypto asset.

Data as of September 30th, 2025

- Bitcoin 1 Year Price Growth: 74.08%

- iShares Bitcoin Trust ETF (IBIT): 79.91%

- Fidelity Wise Origin Bitcoin Fund (FBTC): 79.74%

- Grayscale Bitcoin Trust ETF (GBTC): 77.76%

- Grayscale Bitcoin Mini Trust ETF (BTC): 79.86%

- ARK 21Shares Bitcoin ETF (ARKB): 79.71%

- Bitwise Bitcoin ETF (BITB): 79.88%

- Ethereum 1 Year Price Growth: 58.50%

- iShares Ethereum Trust ETF (ETHA): 60.19%

- Grayscale Ethereum Trust ETF (ETHE): 56.56%

- Fidelity Ethereum Fund (FETH): 59.99%

- Grayscale Ethereum Mini Trust ETF (ETH): 60.57%

Download Visual | Modify in YCharts

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking for a best-in-class data & visualization tool?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Download a copy of The Top 10 Visuals for Client and Prospect Meetings slide deck:

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Next Article

Has the Market Gone Too Far? Reading the Signals Behind the StrengthRead More →