The Rare Earth Reckoning: Which US Companies Surged After China’s October Restrictions

What Happened: China’s Escalating Rare Earth Weapon

On October 9, 2025, China’s Ministry of Commerce unveiled “Announcement No. 61 of 2025,” implementing the most aggressive rare earth export restrictions to date. The announcement added five critical elements—holmium, erbium, thulium, europium, and ytterbium—to existing controls, bringing the total to 12 of the world’s 17 rare earth elements now under Chinese export licensing.

More significantly, Beijing deployed the foreign direct product rule (FDPR) for the first time in the rare earths sector. This extraterritorial mechanism requires licenses for any product globally that contains more than 0.1% Chinese-sourced rare earths or was manufactured using Chinese extraction technologies. This fundamentally disrupts global supply chains and extends China’s control far beyond its borders.

The strategic timing was unmistakable: announced just weeks before President Trump’s planned meeting with President Xi Jinping at the Asia-Pacific Economic Cooperation summit in South Korea, the restrictions serve as both leverage in trade negotiations and a calculated response to US semiconductor export controls.

| Date | Event | Impact |

|---|---|---|

| Dec 21, 2023 | China bans rare earth extraction and separation technology exports | First signal of weaponizing rare earth dominance |

| April 4, 2025 | Export restrictions on 7 rare earth elements (Announcement No. 18) | Retaliation for Trump’s tariffs on Chinese goods |

| May 11, 2025 | 90-day tariff truce agreed in Switzerland talks | Temporary reprieve, US companies removed from blacklist |

| July 2025 | DOD invests $400M equity + $150M loan in MP Materials | Landmark government investment in rare earth supply chain |

| Oct 9, 2025 | Expanded restrictions adding 5 elements (Announcement No. 61) | Now covers 12 of 17 rare earth elements + FDPR implementation |

| Dec 1, 2025 | Full implementation of October restrictions (upcoming) | Foreign military entities denied licenses, export approvals required |

|

Powered by

|

||

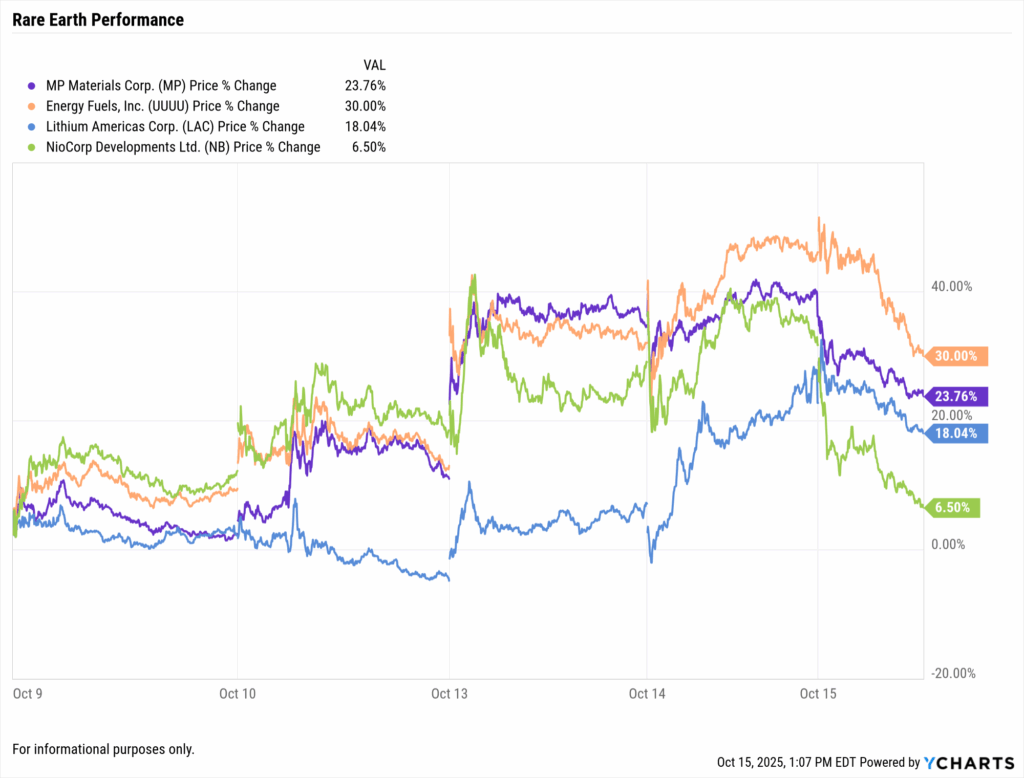

Market Reaction: Five-Day Performance Analysis

The market’s response to China’s announcement was immediate and differentiated based on each company’s rare earth exposure and strategic positioning. Rare earth stocks saw the strongest gains, while diversified miners with tangential exposure experienced modest moves or declines.

| Company (Ticker) | Oct 9 Close | Oct 14 Close | 5-Day Change | Category |

|---|---|---|---|---|

| MP Materials (MP) | $72.29 | $98.65 | +36.4% | Pure-Play Rare Earth |

| Energy Fuels (UUUU) | $19.70 | $26.23 | +33.1% | Pure-Play Rare Earth |

| Lithium Americas (LAC) | $8.04 | $10.05 | +25.0% | Critical Minerals |

| NioCorp Developments (NB) | $9.84 | $11.67 | +18.6% | Pure-Play Rare Earth |

| Century Aluminum (CENX) | $31.32 | $32.01 | +2.2% | Diversified Miner |

| Materion (MTRN) | $125.34 | $127.34 | +1.6% | Specialty Materials |

| Compass Minerals (CMP) | $19.59 | $19.91 | +1.6% | Diversified Miner |

| Albemarle (ALB) | $96.50 | $96.24 | -0.3% | Lithium Focus |

| Freeport-McMoRan (FCX) | $43.31 | $41.97 | -3.1% | Copper/Gold Major |

|

Powered by

|

||||

Note: Performance data reflects trading from October 9-14, 2025. Past performance is not indicative of future results.

Pure-Play Rare Earth Companies: Deep Dive

For advisors seeking concentrated exposure to the rare earth theme, four companies represent the purest plays in US-listed equities. However, “pure-play” comes with significant caveats around production capacity, development timelines, and geopolitical dependencies.

MP Materials (MP): $17.5B Market Cap | +36.4%

MP Materials operates the Mountain Pass mine in California, the only significant rare earth mining and processing site in the United States. The company benefited most from China’s announcement due to its strategic importance and substantial DOD backing.

DOD Investment: In July 2025, the Department of Defense (recently renamed the Department of War) made an unprecedented $400 million equity investment in MP Materials, making the US government the company’s largest shareholder. The deal includes a 10-year price floor commitment of $110 per kilogram for MP’s neodymium-praseodymium (NdPr) products, designed to protect commercial viability amid Chinese overproduction pressure. Additionally, the DOD’s Office of Strategic Capital extended a $150 million loan to expand the Mountain Pass facility, adding heavy rare earth processing capabilities.

Current Production: MP Materials produced 1,300 tons of NdPr oxide in 2024, a record for the company. The Fort Worth, Texas magnet manufacturing facility is expected to produce approximately 1,000 tons of neodymium-iron-boron (NdFeB) magnets by end of 2025. For context, China produced 138,000 tons of NdFeB magnets in 2018 alone.

Strategic Partnerships: In July 2025, MP Materials signed a $500 million supply agreement with Apple for rare earth magnets used in iPhone speakers, Taptic Engines, and MagSafe components. General Motors serves as the founding customer for the Fort Worth magnetics facility, a relationship established in 2022.

Energy Fuels (UUUU): $6.1B Market Cap | +33.1%

Energy Fuels represents a hybrid opportunity, with core business in uranium and vanadium production but expanding aggressively into rare earth processing. The company operates the White Mesa Mill in Utah, the only conventional uranium mill in the United States, which is being adapted for rare earth separation.

Rare Earth Development: Unlike MP Materials, Energy Fuels does not currently operate a rare earth mine. Instead, the company is positioning itself as a rare earth processor, separating concentrates sourced from third-party mining operations. This toll processing model could provide exposure to rare earth price appreciation without the capital intensity and permitting challenges of mine development.

Timeline Considerations: Energy Fuels’ rare earth operations remain in pilot/demonstration phases. The company has indicated it is in close contact with the Trump administration regarding potential DOD contracts but has not yet secured the scale of support provided to MP Materials. Advisors should view this as a higher-risk, earlier-stage opportunity within the rare earth space.

NioCorp Developments (NB): $1.2B Market Cap | +18.6%

NioCorp is developing the Elk Creek project in Nebraska, targeting production of niobium, scandium, and titanium—all classified as critical minerals. While not traditional rare earths, these materials face similar supply chain vulnerabilities and benefit from the broader “critical minerals independence” theme.

Pre-Production Risk: NioCorp remains a development-stage company with no current production. The Elk Creek project requires substantial additional capital and regulatory approvals before achieving commercial operations. The 18.6% gain reflects speculative positioning on future DOD support rather than near-term operational capacity.

USA Rare Earth (USAR): $1.3B Market Cap |

USA Rare Earth is developing the Round Top deposit in Texas, one of the largest rare earth resources in North America. In January 2025, the company produced its first sample of dysprosium oxide purified to 99.1% at a research facility in Wheat Ridge, Colorado—a breakthrough for domestic heavy rare earth processing.

Development Stage: Like NioCorp, USA Rare Earth remains pre-production. The company’s CEO has publicly stated they are in close contact with the Trump administration regarding potential support. However, turning laboratory samples into full-scale commercial production capable of reducing Chinese reliance requires significant capital, time, and technical de-risking.

The Reality Check: Production Constraints & Timeline

While the 36% surge in MP Materials and 33% gain in Energy Fuels captured headlines, advisors must anchor client expectations in production realities. The enthusiasm reflects hope for a transformed supply chain, but the path from current capacity to meaningful Chinese competition spans more than a decade.

| Metric | US Capacity (2025) | China Capacity | US as % of China |

|---|---|---|---|

| Rare Earth Mining | ~38,000 metric tons/year | ~240,000 metric tons/year | 15.8% |

| Rare Earth Processing/Refining | ~1,300 tons NdPr/year | ~270,000 tons/year | 0.5% |

| Magnet Manufacturing | ~1,000 tons NdFeB/year | ~138,000 tons/year | 0.7% |

| Heavy Rare Earth Processing | Minimal/None operational | Dominant global position | <1% |

| Complete Supply Chain Integration | 1 facility (MP Materials, partial) | Hundreds of integrated facilities | ~1% |

|

Powered by

|

|||

Timeline to Meaningful Capacity: According to the Department of Defense’s 2024 National Defense Industrial Strategy, the goal is to develop a complete mine-to-magnet rare earth supply chain capable of meeting all US defense needs by 2027. However, even achieving this ambitious target would only address a fraction of total rare earth demand—DOD consumption represents less than 0.1% of global rare earth usage.

For commercial-scale production competitive with China, industry experts estimate 10-15 years of sustained investment and development. The average time horizon for new mine development in the US is 29 years—the world’s second longest. Refining and processing facilities require 7-10 years of permitting and licensing before operations can begin.

The Heavy Rare Earth Problem: Most US rare earth development focuses on light rare earths (neodymium, praseodymium), which are more abundant and easier to process. Heavy rare earths (dysprosium, terbium, yttrium)—critical for high-performance magnets in defense applications—remain almost entirely sourced from China. Even with full operation of planned US facilities, heavy rare earth dependence on China will persist for the foreseeable future.

US Strategic Response: DOD Investments & Allied Partnerships

Since 2020, the Department of Defense has committed over $439 million toward building domestic rare earth supply chains through the Defense Production Act (DPA) Title III program. The July 2025 investment in MP Materials represents the largest single commitment and marks a shift toward direct equity stakes rather than solely grants and loans.

Current DOD-Funded Projects:

MP Materials: $9.6 million (2020) for light rare earth separation facility at Mountain Pass; $35 million (2022) for heavy rare earth processing facility; $400 million equity investment (July 2025) with price floor guarantees; $150 million loan (July 2025) for facility expansion.

Lynas Rare Earths (Australia): $30.4 million (2021) for US separation facility for light rare earths; $120 million (2022) for heavy rare earth processing facility. Lynas operates Malaysia’s only significant non-Chinese rare earth processing plant (16-19,000 tons of NdPr annually) and recently announced a strategic partnership with Noveon Magnetics to establish domestic permanent magnet supply chains.

Allied Partnerships: President Trump has integrated rare earths into key foreign policy discussions, including negotiations with Ukraine, Greenland, and Saudi Arabia. The first Trump state visit to Saudi Arabia resulted in a memorandum of cooperation on critical minerals, alongside a memorandum of understanding between MP Materials and Saudi Arabia’s Ma’aden to advance a complete mine-to-magnet supply chain.

Australia represents the most developed alternative to Chinese rare earth production. Australia currently produces approximately 15% of global rare earth output and is actively expanding domestic processing capabilities. Key projects include Iluka Resources’ Eneabba Rare Earths Refinery in Western Australia (supported by a $1.25 billion government loan) and Northern Minerals’ Browns Range project, positioned to become the first significant dysprosium producer outside China.

Why This Matters: Defense & Clean Energy Implications

Rare earth elements are not optional components in modern defense systems and clean energy technologies—they are foundational requirements with limited substitutes. Understanding the specific applications helps advisors contextualize the strategic imperative driving government investment and the long-term structural demand supporting these companies.

Defense Applications: F-35 fighter jets require approximately 417 kg of rare earth materials per aircraft. Virginia-class and Columbia-class submarines use rare earth permanent magnets in propulsion systems and sonar arrays. Tomahawk missiles, Predator drones, radar systems, and Joint Direct Attack Munition smart bombs all depend on rare earth components. Each precision-guided weapon contains small but critical quantities of neodymium, dysprosium, and terbium.

The newly announced restrictions represent China’s most consequential measures targeting the defense sector. Starting December 1, 2025, companies with any affiliation to foreign militaries—including those of the United States—will be largely denied export licenses. The Ministry of Commerce has made clear that requests to use rare earths for military purposes will be automatically rejected.

Clean Energy Transition: Each utility-scale wind turbine contains approximately 600 kg of rare earth permanent magnets. Electric vehicles require 1-2 kg of rare earths per vehicle for motors and power electronics. The global transition to renewable energy and electric mobility creates structural demand growth exceeding 10% annually for neodymium and dysprosium.

However, China’s restrictions specifically target advanced semiconductor and AI applications. Export licenses will be reviewed on a case-by-case basis for rare earths used in sub-14 nanometer semiconductors, advanced memory chips, semiconductor manufacturing equipment, or AI systems with potential military applications.

Risk Factors to Discuss with Clients:

Geopolitical Volatility: Stock performance is highly sensitive to US-China trade negotiations. The October surge could reverse quickly if tensions de-escalate or alternative supply agreements emerge.

Execution Risk: Pre-production companies (NioCorp, USA Rare Earth) may face capital shortfalls, permitting delays, or technical challenges that prevent commercial operations.

Commodity Price Exposure: Rare earth prices are cyclical and volatile. Chinese overproduction has historically crushed prices when Beijing chooses to flood markets.

Liquidity Constraints: Several names on this list trade with limited daily volume, creating potential exit challenges during market stress.

Long Development Timelines: The 10-15 year timeline to meaningful US production capacity exceeds most client investment horizons and requires patient capital.

Advisor Action Plan: Client Conversations & YCharts Tools

For advisors looking to implement rare earth exposure or field client questions following media coverage of this sector, a structured approach helps balance opportunity recognition with appropriate risk management.

| Action Step | YCharts Tool | Client Communication Tip |

|---|---|---|

| 1. Screen Existing Portfolios | Portfolio Analytics → Holdings Analysis | Identify clients with existing rare earth exposure (often through sector ETFs or materials funds). Assess whether positions align with risk tolerance. |

| 2. Create Comparison Charts | Fundamental Chart → Add MP, UUUU, LAC, NB | Show relative performance since October 9. Use YCharts’ volatility metrics to illustrate risk vs S&P 500. Include clear annotations for China announcement date. |

| 3. Analyze Valuation Metrics | Stock Screener → Custom Metrics | Pull P/S ratios, EV/Revenue, and cash burn rates. MP Materials trades at premium to diversified miners due to DOD backing—explain the “strategic premium” concept. |

| 4. Monitor News & Events | Alerts → Create custom alert for DOD announcements | Set alerts for: DOD funding announcements, Trump-Xi meeting outcomes (late Oct), December 1 restriction implementation, quarterly production updates from MP/UUUU. |

| 5. Build Thematic Model Portfolios | Model Portfolio Tool → Critical Minerals Theme | Create three model variants: Conservative (1% MP only), Moderate (2% MP + broad materials ETF), Aggressive (4% basket). Share with clients as educational resources. |

| 6. Client Education Resources | Report Builder → Custom Client Reports | Generate one-page summaries showing: Timeline of restrictions, company comparison tables, risk disclosure, allocation recommendations. Use YCharts branding for professional presentation. |

|

Powered by

|

||

The YCharts Advantage for Rare Earth Analysis

Unlike terminal-based platforms designed for institutional traders, YCharts empowers advisors to conduct sophisticated rare earth sector analysis with tools built for client-facing professionals:

- Custom screeners with critical minerals filters, DOD contractor tags, and supply chain exposure metrics

- Client-ready visualizations that transform complex supply chain data into clear charts for portfolio reviews

- Automated alerts for DOD funding announcements, quarterly production releases, and key Chinese policy changes

Use YCharts to stay ahead of this rapidly evolving sector and deliver institutional-quality rare earth analysis to every client portfolio review.

Key Takeaways for Advisors

- Pure-play rare earth stocks surged 18-36% following China’s October 9 restrictions, but these gains reflect long-term supply chain transformation hopes rather than near-term production capacity. US rare earth output remains at less than 1% of China’s magnet manufacturing capacity.

- MP Materials received unprecedented $550M in combined DOD investment, making it the only US rare earth company with operational capacity and government backing. This positions MP as the core holding for rare earth exposure in moderate-to-aggressive portfolios.

- Pre-production companies (NioCorp, USA Rare Earth) carry substantial execution risk despite market enthusiasm. Development timelines of 10-15 years and capital requirements exceeding $500M per facility make these appropriate only for speculative allocations.

- Heavy rare earths remain almost entirely China-dependent, creating ongoing vulnerability for defense applications even as US light rare earth capacity expands. No US facility currently produces commercial quantities of dysprosium or terbium.

- Implementation requires position sizing discipline and active monitoring. Maximum allocations of 1-5% depending on client risk tolerance, with MP Materials as the only recommended position for conservative accounts. Use YCharts to track DOD announcements, quarterly production metrics, and geopolitical developments.

Conclusion: A Decade-Long Transformation Begins

The 36% surge in MP Materials and 33% gain in Energy Fuels capture investor attention, but the real story extends far beyond five days of trading. China’s escalating rare earth export restrictions represent a fundamental shift in the global critical minerals landscape, one that will reshape supply chains, defense procurement, and clean energy manufacturing for decades.

For financial advisors, this creates both opportunity and obligation. The opportunity lies in positioning client portfolios for a multi-year infrastructure build-out backed by billions in government investment and structural demand growth. The obligation involves managing expectations, maintaining position sizing discipline, and ensuring clients understand that progress will be measured in decades, not quarters.

The United States will not achieve rare earth independence by 2027, despite DOD goals. China will retain dominant market position through 2030 and likely beyond. But the trajectory has changed. The $550 million invested in MP Materials, the strategic partnerships with Australia and Saudi Arabia, and the renewed focus on critical minerals security signal a sustained commitment to building alternatives.

Use YCharts to track this transformation, monitor DOD funding announcements, and translate complex geopolitical developments into portfolio decisions. The advisors who help clients navigate this sector with appropriate allocations, realistic expectations, and disciplined risk management will add substantial value as this decade-long transformation unfolds.

The rare earth reckoning has begun. Position your clients accordingly.

Ready to Move On From Your Investment Research and Analytics Platform?

Follow YCharts Social Media to Unlock More Content!

Next Article

The Hidden Cost of Cash: Why Your Clients' Dollars Are Losing Value While the Market GainsRead More →