Portfolio Optimizer

Minimize Risk, Maximize Performance & Enhance Portfolio Construction.

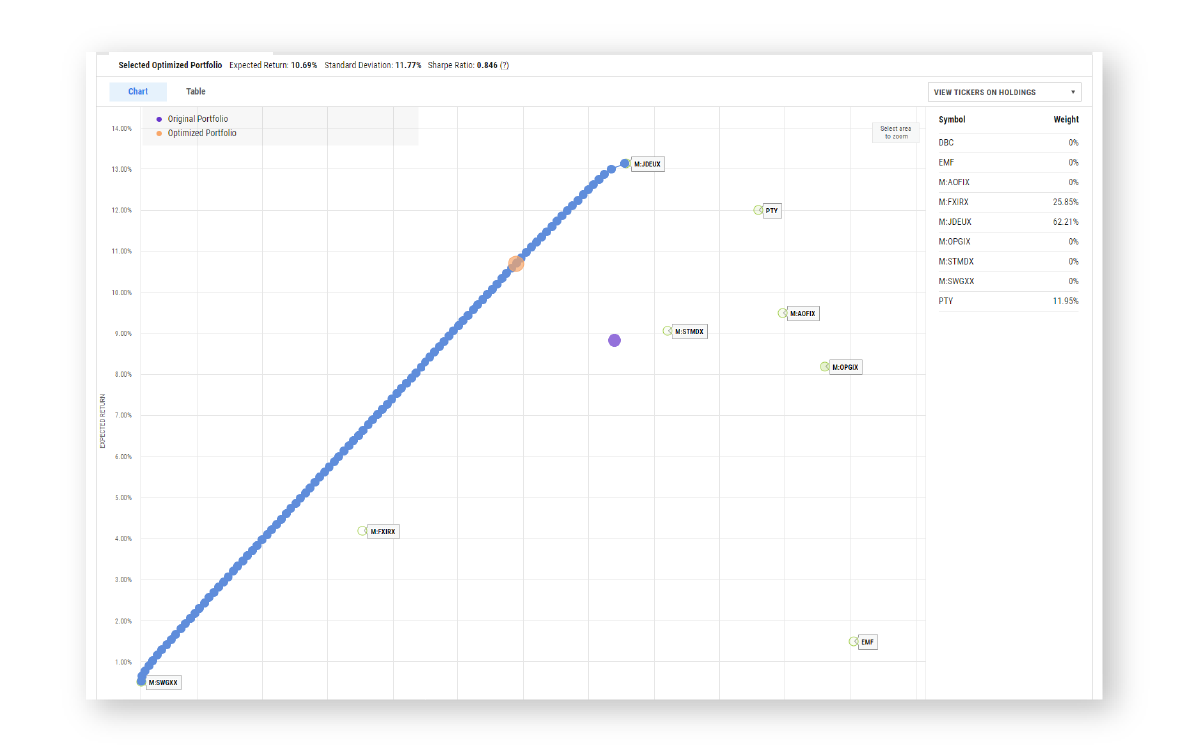

Develop the ideal asset allocation strategy

Optimize portfolio allocations by aligning them with your clients’ risk-reward appetite against an efficient frontier. Choose from a range of strategies to create a well-balanced and efficient portfolio, including maximizing the Sharpe Ratio, minimizing Standard Deviation, targeting a specific return, or targeting a desired level of Standard Deviation.

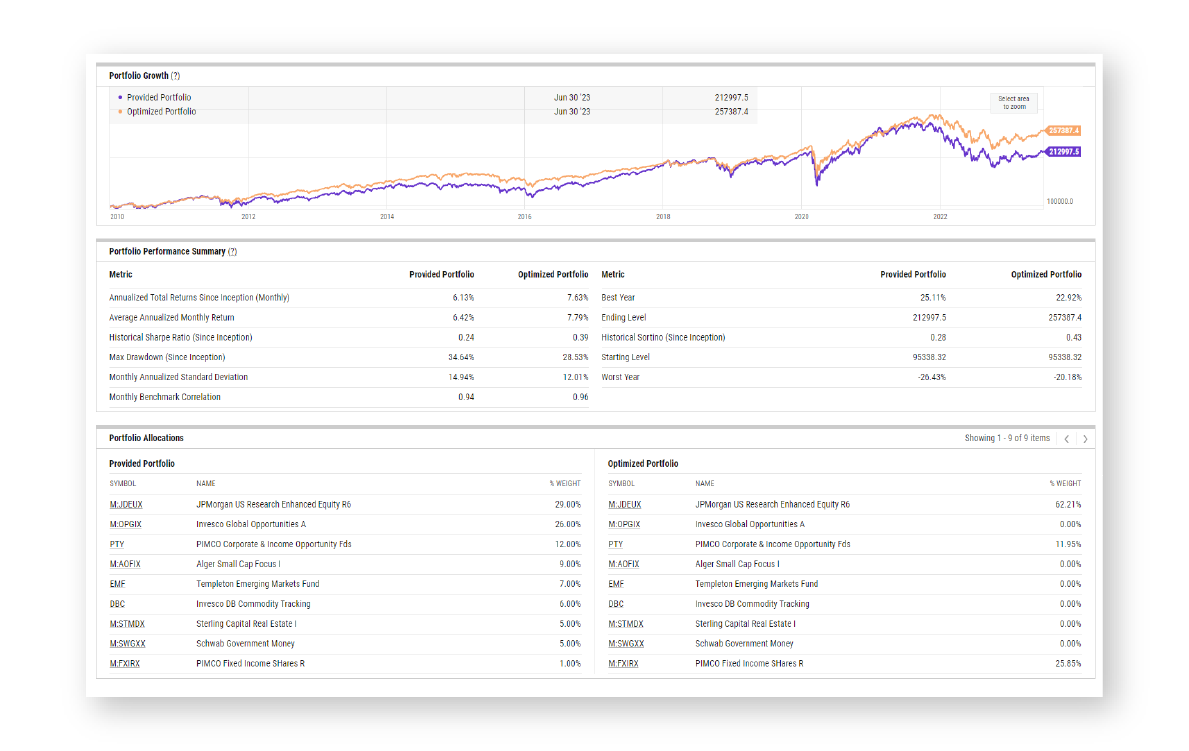

Illustrate the impact of an optimized portfolio

Test and refine firm models to gain insights such as associated risks, potential returns, and other fundamentals, ensuring they align with your firm’s objectives. Additionally, utilize the optimizer during conversations with clients and prospects to present engaging, compelling visuals that effectively highlight the advantages of a recommended portfolio allocation while answering any questions in the room.

See Portfolio Optimizer in Action

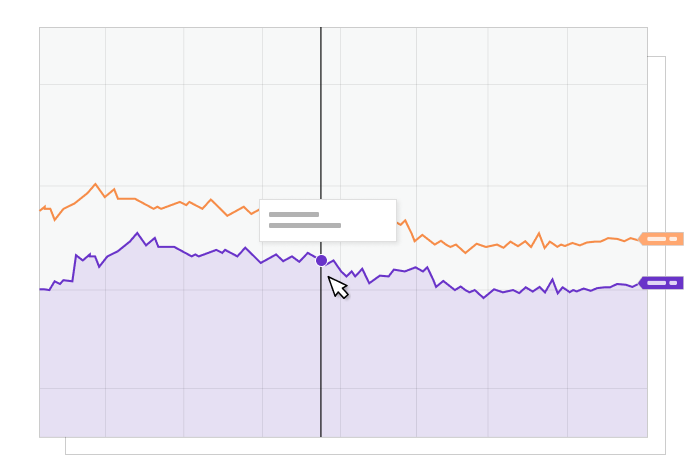

Build a diversified, balanced portfolio

Utilize the Correlation Matrix to analyze the positive or negative correlations among securities, enabling you to assess performance similarities and make informed decisions to maintain a diversified portfolio. Once confirmed, import the corresponding weights directly into YCharts’ Model Portfolios to streamline portfolio construction.