Quickflows

Conduct high quality, automated analysis in less time with impactful workflows condensed into single-click efforts.

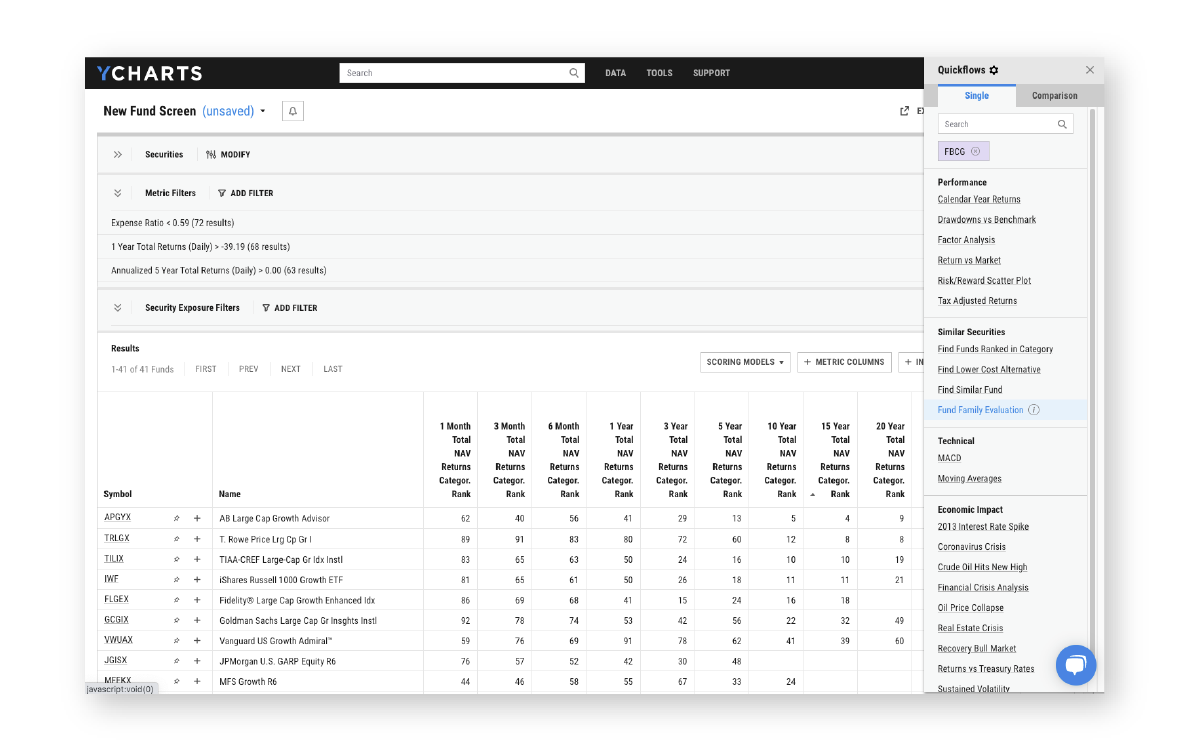

Identify suitable replacements for portfolio holdings

When making changes to a portfolio or strategy, find lower cost alternatives, similar funds with better category rankings, or evaluate an entire fund family in just one click. Expedite research for tax-loss harvesting and optimize portfolios for your clients’ goals.

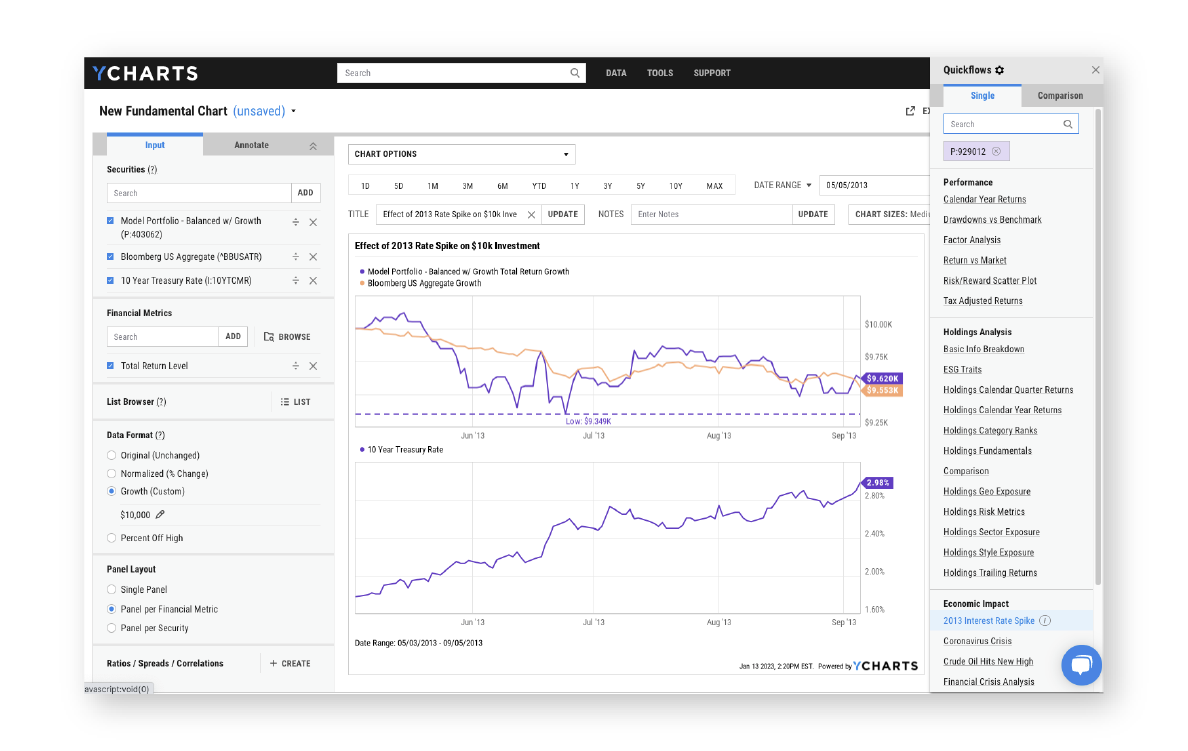

Use historical events to stress-test investment strategies

Explain portfolio strengths and weaknesses in the context of market drawdowns with economic impact scenarios. Use stress testing tools on the fly to visualize a strategy’s hypothetical performance through key events like increased volatility, a market correction, rising interest rates, and more.

See how you can leverage Quickflows

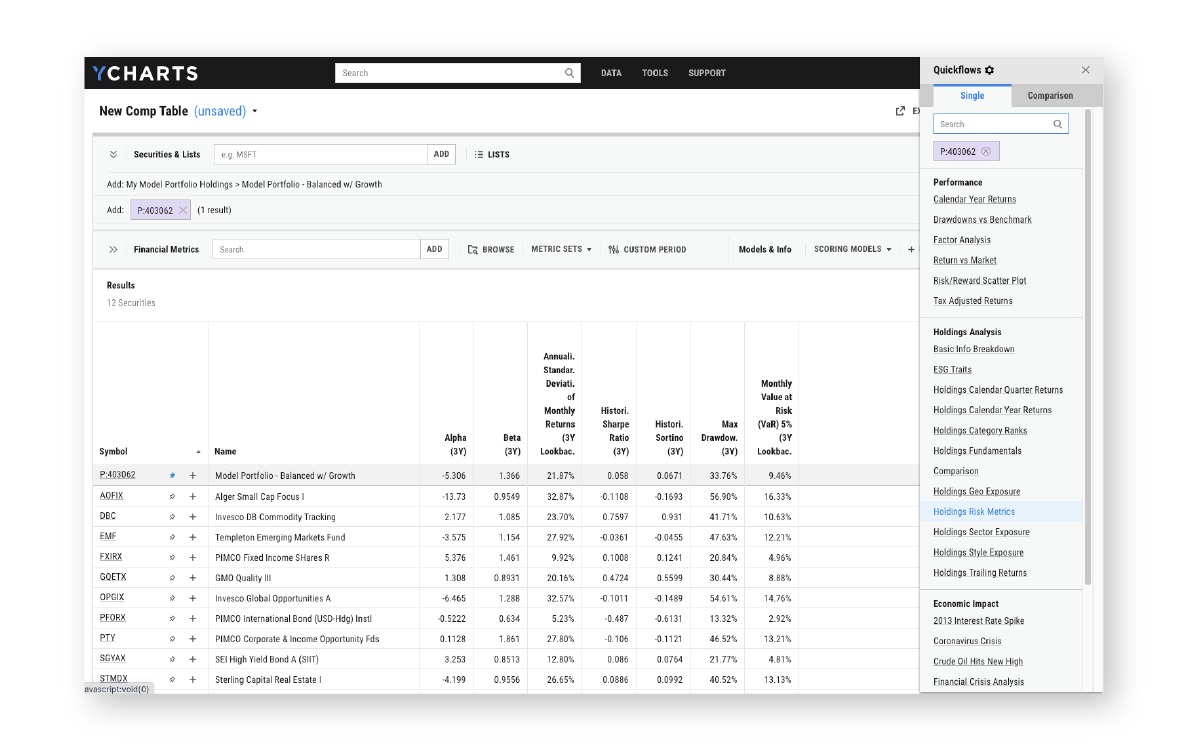

Build automated visuals and tables to compare securities

Add up to 12 securities to the Quickflows Comparison list and with a single click, run a correlation analysis, visualize earnings misses and beats, or create tables for performance, risk, fundamental, and ESG comparisons.