2025 U.S. Manufacturing: Critical Policy Changes, Automation, and Investment Trends

- Tariffs and trade policy are accelerating reshoring and domestic manufacturing investment.

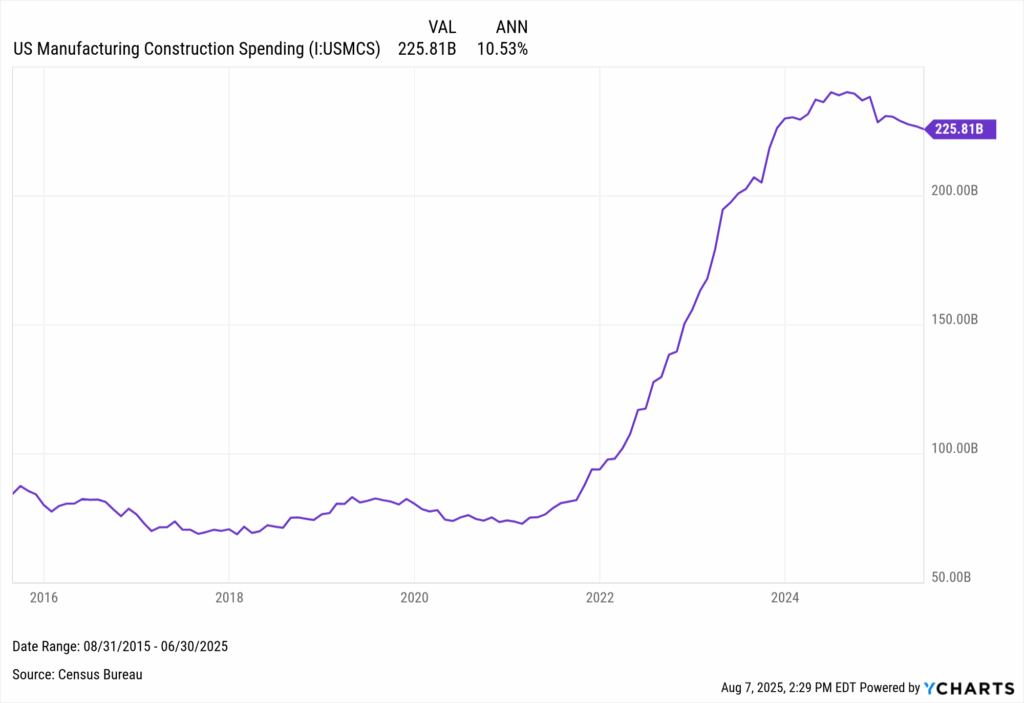

- Manufacturing construction spending has reached record highs, signaling long-term growth potential.

- Rockwell Automation is committing $2 billion to expand U.S. capacity, automation, and workforce development.

- Industrial AI and model predictive control are enabling measurable productivity gains.

Interested in testing out YCharts for free? Start a no-risk

Reshaping U.S. Manufacturing in 2025

In 2025, U.S. manufacturing is undergoing a significant transformation fueled by elevated tariffs, strategic reshoring, and surging capital investment. Policy shifts are driving companies to localize production, reduce foreign reliance, and modernize facilities to build resilience into their operations.

In developing this research, YCharts collaborated with Rockwell Automation, a Fortune 500 leader in industrial automation and digital transformation, to combine market-level analysis with operational insights.

Rockwell’s recently announced $2 billion U.S. investment over the next five years reflects the scale of change, with funding directed toward:

- Capacity Expansion – Building new facilities and retrofitting existing plants to meet domestic demand.

- Digital & Automation Upgrades – Deploying advanced automation, model predictive control, and industrial AI.

- Workforce Development – Recruiting and training skilled talent for connected, data-driven production environments.

Table of Contents

How Policy Is Steering U.S. Manufacturing’s Next Chapter

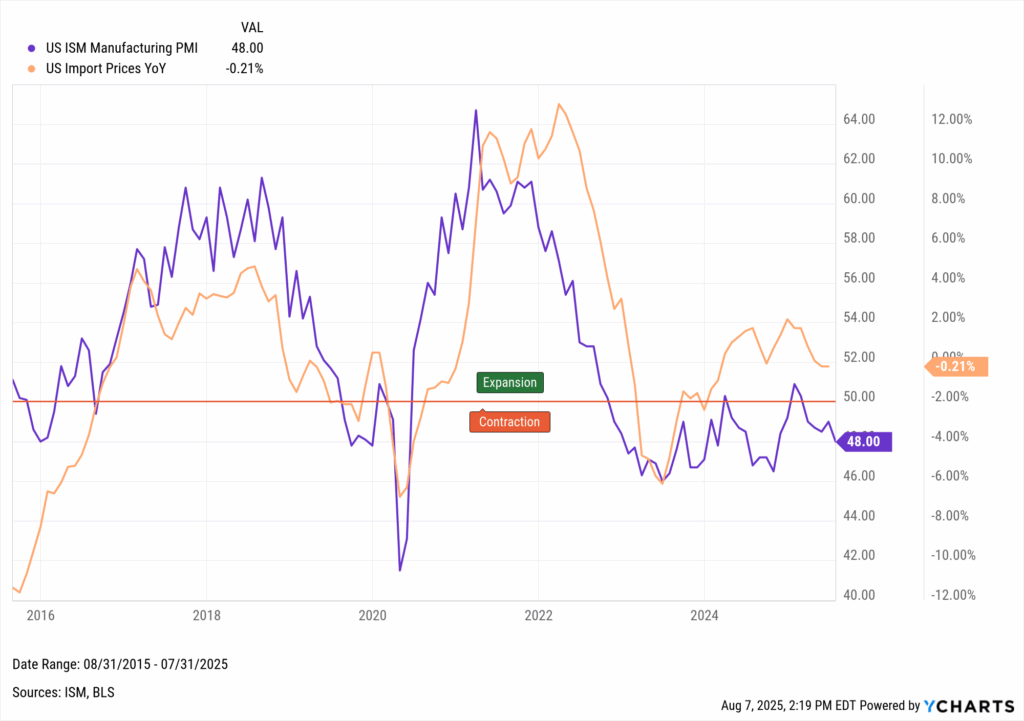

Elevated tariffs, including 50% on steel and aluminum and 25% on auto parts, are reshaping global supply chains. Companies are prioritizing supply chain localization to improve cost predictability and control. This structural shift is influencing where and how goods are manufactured, creating long-term competitive implications.

Download Visual | Modify in YCharts

U.S. Manufacturing PMI vs. U.S. Import Prices shows the widening spread since 2022.

U.S. Labor Availability Driving Automation Demand

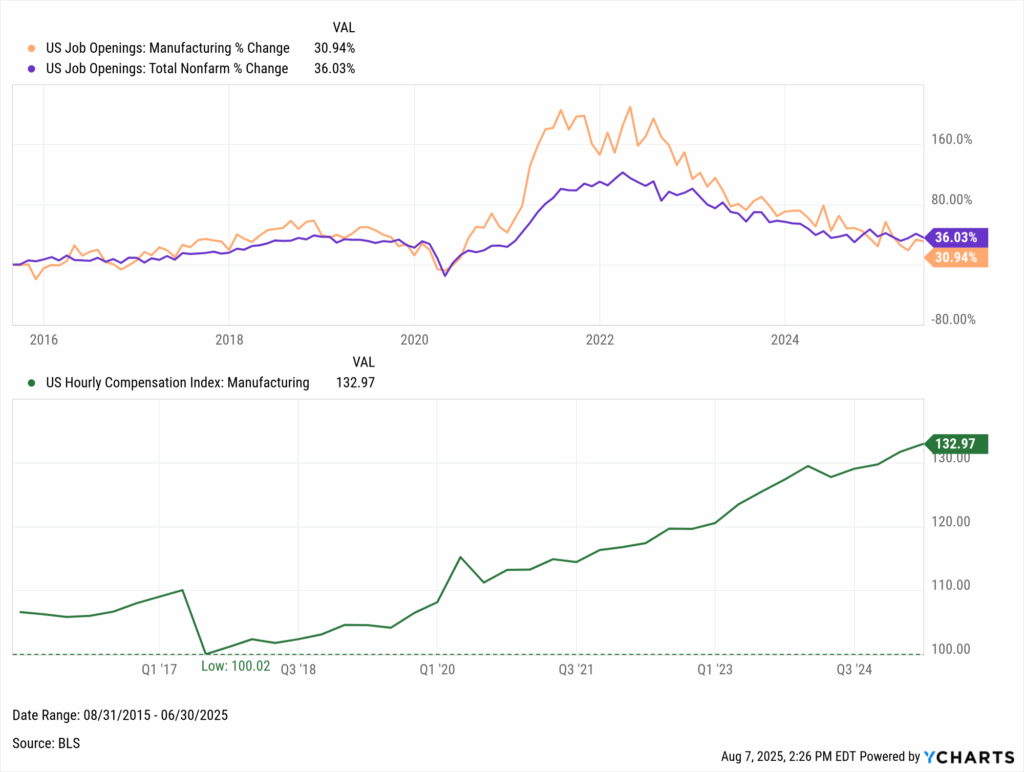

Persistent labor shortages and rising wages are a continued challenge for manufacturers, with job openings outpacing available workers for much of the past decade. This has accelerated the adoption of automation, robotics, and industrial IoT solutions, enabling manufacturers to maintain output while managing labor constraints.

Download Visual | Modify in YCharts

U.S. Job Openings in Manufacturing compared with Hourly Compensation highlights wage pressures alongside easing labor demand.

U.S. Manufacturing Construction Spending

Manufacturing construction spending has surged to record highs. Companies are investing in new facilities and retrofit projects to expand domestic production capacity. As these projects often take over two years to complete, today’s investment levels serve as a leading indicator for future sector growth.

Download Visual | Modify in YCharts

U.S. Manufacturing Construction Spending illustrates the sharp rise in capital deployment since 2021.

Tariff Impact and Supply Chain Localization

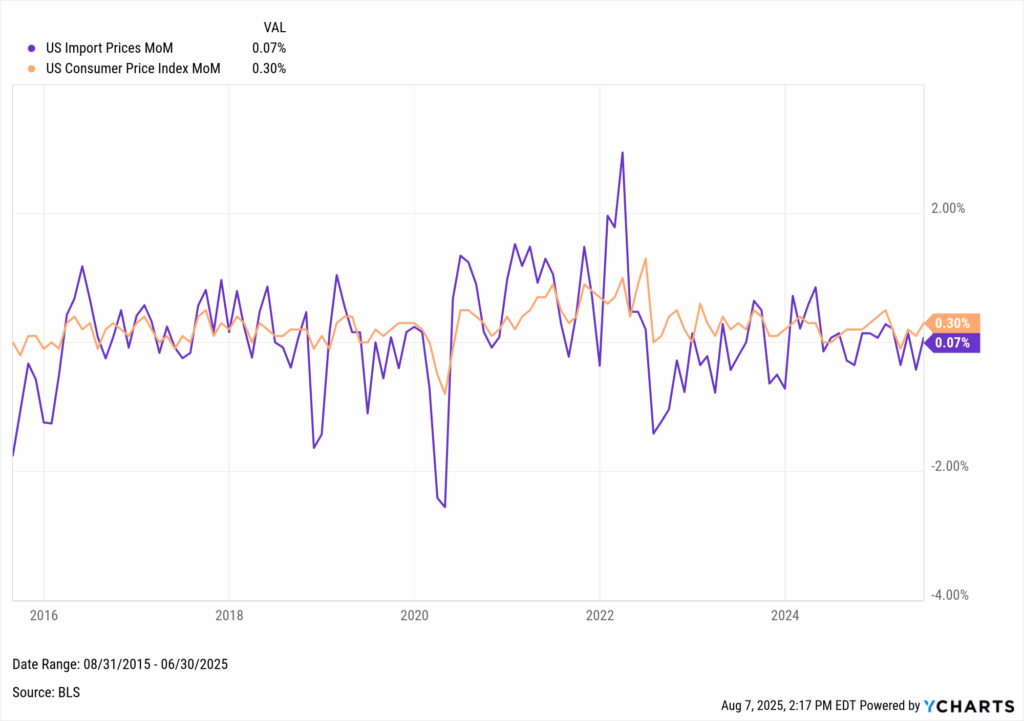

Elevated tariffs on key imports are driving a shift toward domestic production, prompting companies to reconfigure supply chains for greater resilience, control, and cost predictability. CPI and import prices have not yet shown major effects from localization, but companies are investing ahead of potential cost pressures. This transition is reshaping where and how goods are manufactured, with lasting implications for competitiveness and capacity.

Download Visual | Modify in YCharts

CapEx spending and supply chain realignment are accelerating in anticipation of supply chain localization amplified by tariffs. This is positioning domestic manufacturers and their suppliers in materials and industrial inputs to benefit when cost pressures emerge in import prices.

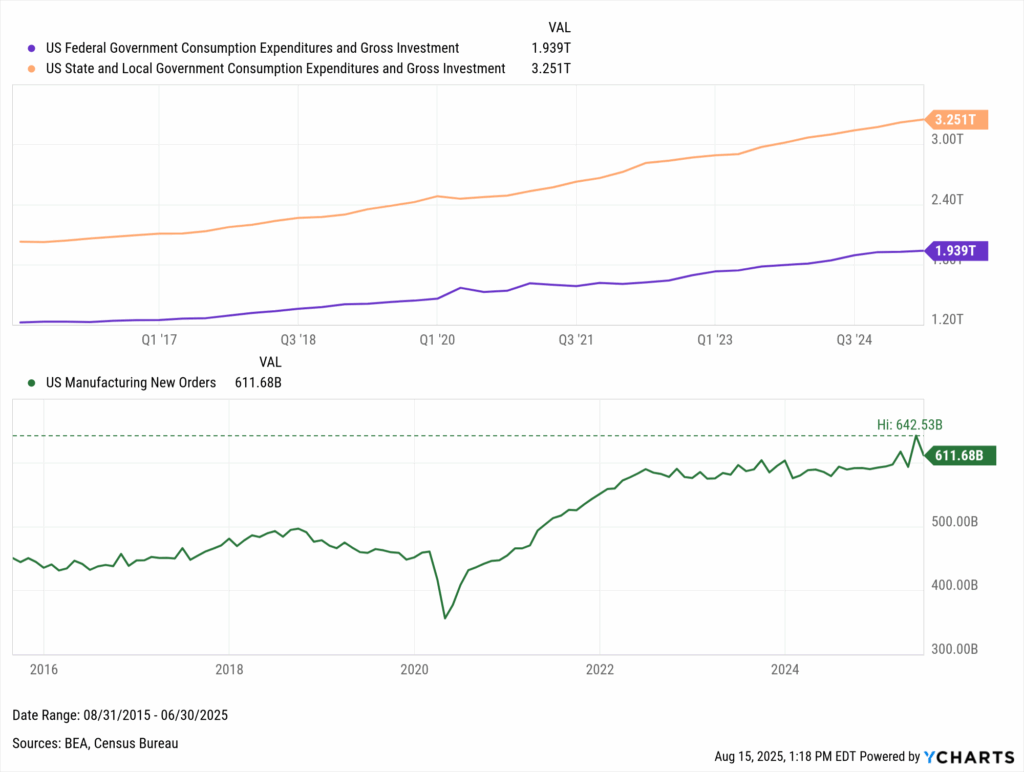

Federal, State, and Local Policy Incentivization

Federal, state, and local policies are fueling domestic manufacturing growth. Programs like the One Big Beautiful Bill and Fast-41 are cutting red tape, speeding project approvals, and channeling investment into energy production and industrial capacity.

US Manufacturing new orders hit a 10-year high in April, following tariff announcements and the push to bring production back to the US. The alignment of federal, state, and local spending underscores a coordinated effort to strengthen and expand domestic manufacturing.

Download Visual | Modify in YCharts

U.S. State and Local Government Spending continues climbing, reinforcing manufacturing growth and investment momentum.

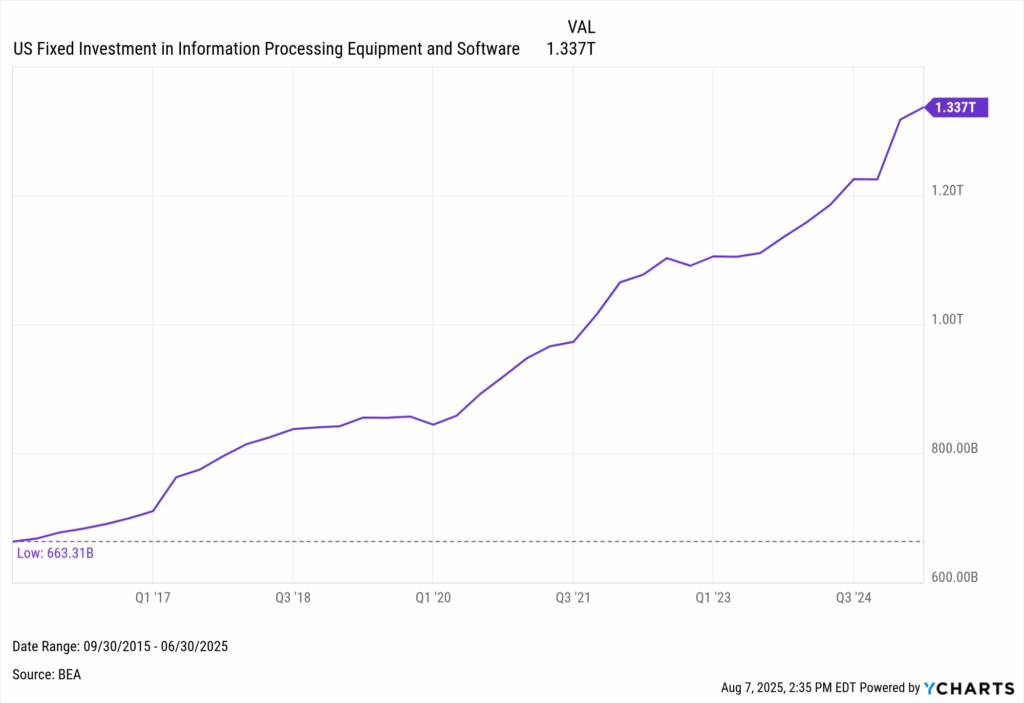

Industrial Digital Transformation and IIoT Operational Impacts

Industrial network solutions, model predictive control, and industrial AI are enabling high-quality output with lower operational costs. These technologies integrate advanced analytics and connected workflows, improving efficiency, adaptability, and competition across the sector.

Download Visual | Modify in YCharts

U.S. Fixed Investment in Information Processing Equipment and Software tracks the rapid acceleration of technology spending.

The Multi-Year Opportunity Ahead

The convergence of trade policy, technology adoption, and capital investment is reshaping the U.S. manufacturing landscape. Domestic manufacturers, automation providers, and material suppliers are positioned to capture long-term growth opportunities, while import-reliant firms face rising cost pressures.

Be the calm in the headlines. YCharts helps you track policy shifts, quantify sector impact, and translate complex trends into actionable insights.

Ready to Move On From Your Investment Research and Analytics Platform?

Insights Provided By:

Brenden Lowe

Global Director of New Capacity, Rockwell Automation

As the leader of Rockwell Automation’s New Capacity Organization, Brenden offers a global perspective on re-shoring U.S. manufacturing, drawing on over a decade of experience guiding industrial leaders through modern facility design, scaling strategies, policy shifts, and operational excellence.

Follow YCharts Social Media to Unlock More Content!

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Next Article

What Is Inflation Doing to the Market? A Comprehensive Analysis for AdvisorsRead More →