5 Ways Advisors Are Using AI Across YCharts

Advisors are expected to deliver personalized insight quickly and clearly. From meeting prep to client follow-ups to market analysis, every task benefits from smarter tools and fewer roadblocks.

That’s why AI is built into YCharts. These tools help save time, enhance communication, and surface insights so advisors can deliver more value, faster.

Here are five ways advisors are putting AI to work across the platform.

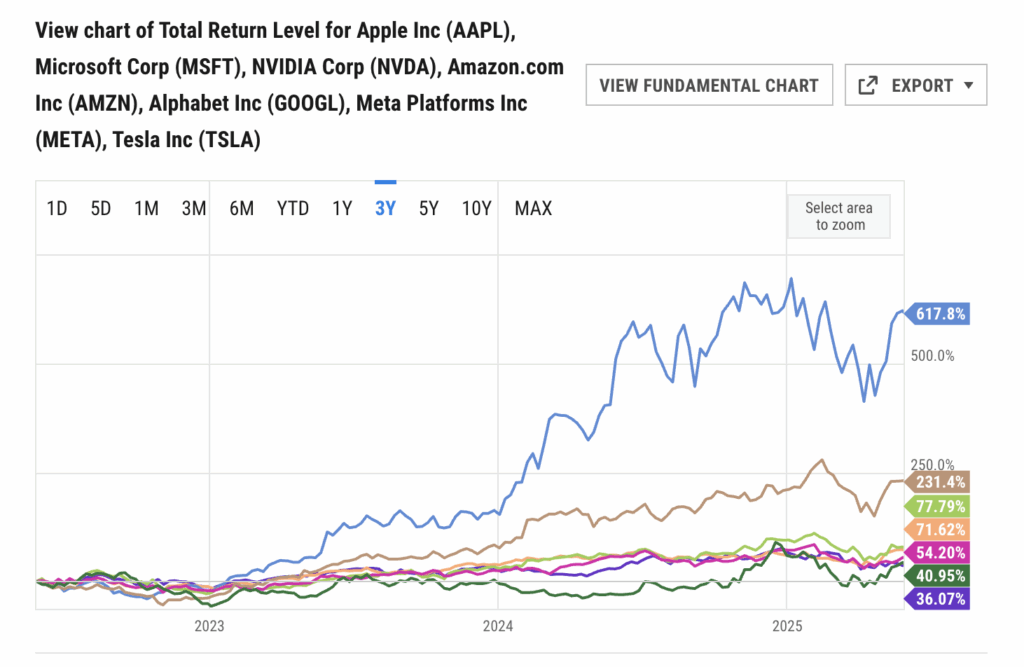

1. Create charts in seconds with AI Chat

Charts are one of the most effective ways to explain market trends and support client recommendations. With AI Chat, you can request the visual you need and receive a clean, presentation-ready chart in moments.

Each chart includes a link to open it in Fundamental Charts, where you can further customize, export, or add it to a dashboard or report.

Example prompts:

• “Build me a chart of the Magnificent 7 Stocks over the last 3 years.”

• “Build a chart of the U.S. unemployment rate and inflation over the last five years.”

This workflow makes it easy to bring visual clarity to your analysis and client conversations.

2. Stay informed with the AI Market Commentary Module

The AI Market Commentary module, featured in the Intraday Market Review Dashboard template, brings high-level insights into your workflow by highlighting recent market activity, performance standouts, and macroeconomic trends. It updates automatically throughout the day every 15-20 minutes, and can be added to any YCharts dashboard.

Use it to:

• Monitor key movements and important events across key stocks, sectors, or major market indices

• Stay aligned with broader market developments

• Support client meetings with timely, relevant insights

3. Turn PDFs and screenshots into portfolios with Quick Extract

With Quick Extract, you can turn client documents, such as account statements or screenshots, into fully functional portfolios in YCharts. Once uploaded, the portfolio is ready for performance tracking, benchmarking, and analysis.

This tool helps streamline onboarding and review workflows, especially when working with held-away assets or across multiple custodians.

Use it to:

• Eliminate manual data entry

• Build shareable, data-rich portfolios

• Support personalized conversations with real holdings

Advisors say Quick Extract helps them move from static documents to impactful insights in less time.

Reach Out to Add Quick Extract to Your Account4. Draft client commentary without starting from scratch

AI Chat helps you quickly generate content that keeps clients informed and engaged. Whether you need a quarterly update, a market recap, or a quick note responding to recent events, AI Chat provides a strong starting point based on your prompt.

You can then review, edit, and personalize the content to match your voice and firm’s messaging style.

Example prompt:

• “Write a 150-word summary highlighting current market risks and opportunities.”

• “Write a blog post about markets this year, and include wording that encourages investors to stay the course.”

This helps you maintain consistent client touchpoints while staying focused on strategy and service.

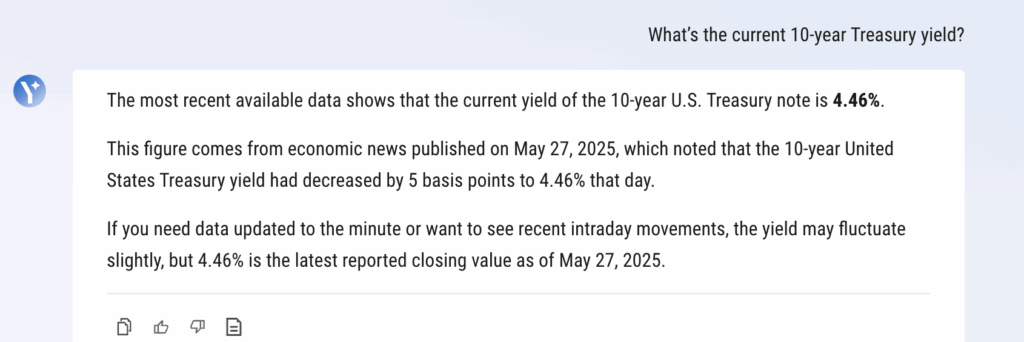

5. Find macro insights in a single step

Economic data plays a critical role in shaping recommendations and framing client conversations. AI Chat allows you to access key indicators with a simple prompt.

From interest rates to historical drawdowns, AI Chat surfaces the data you need and provides links to explore further in YCharts.

Example prompts:

• “What’s the current 10-year Treasury yield?”

• “What are the current tariffs on each country?”

It’s a faster path to context that helps support more informed, timely discussions.

It’s a faster path to context that helps support more informed, timely discussions.

If you’re looking for ways to calm investor concerns and guide long-term thinking amid geopolitical tensions, check out our Tariff Deck.

Final Takeaway

AI in YCharts isn’t a separate step. It’s built into the workflows advisors use every day. Whether you’re creating a chart, analyzing a macro trend, or writing a client update, these tools help you put AI to work—transforming insights into action with greater speed and clarity.

Whenever you’re ready, here’s how YCharts can help you:

1. Want to reduce time spent researching stocks, funds, or macro trends?

Explore how AI Chat can accelerate your workflow.

2. Want to know how much time you could save on proposals?

Calculate Your ROI with YCharts and see the impact for your business.

3. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Upcoming U.S. Labor Market Report: Preparing Client PortfoliosRead More →