Appetite for Credit Risk Grows Across ETFs & Mutual Funds in November 2024

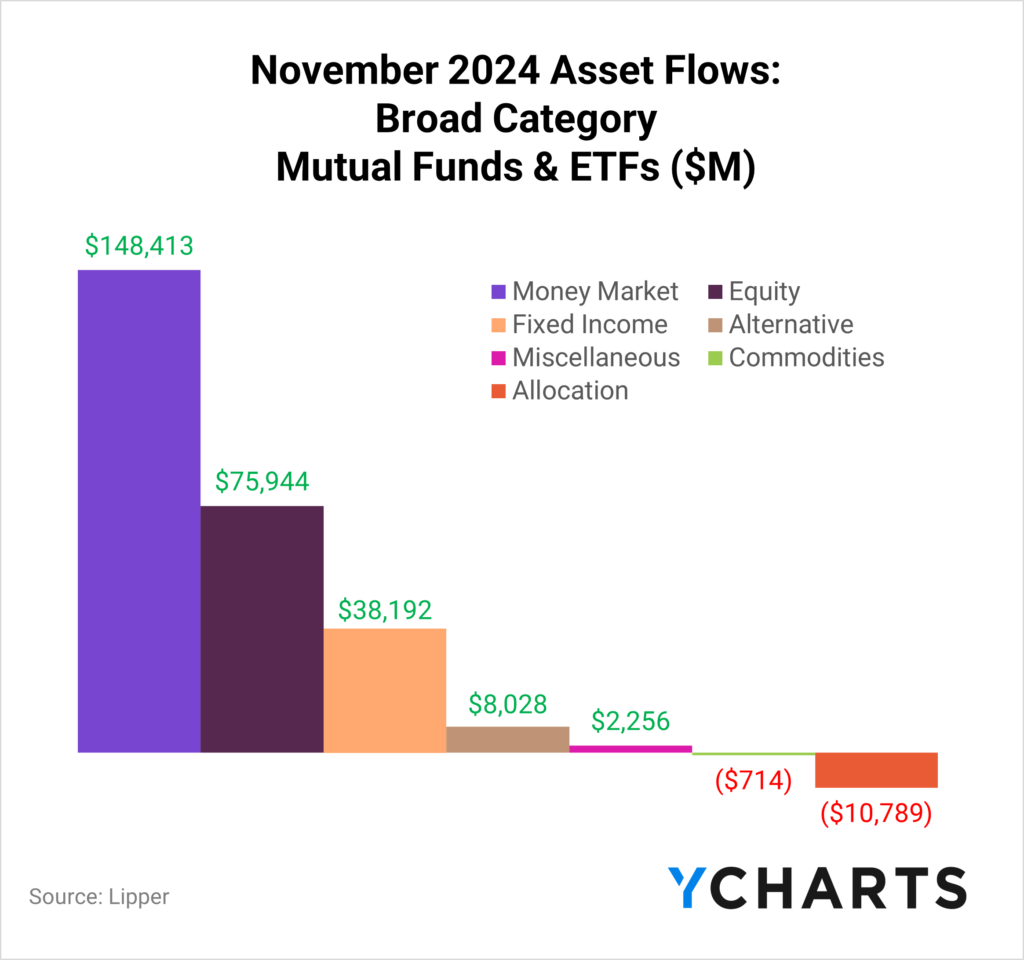

Investors continued to allocate assets across various asset classes in November 2024, with Money Market funds leading the pack again, drawing in an impressive $148.4 billion. Equity and Fixed Income funds also had strong showings, securing $75.9 billion and $38.2 billion, respectively, underscoring their enduring appeal amid a dynamic market environment.

As we’ll explore further, specific categories such as High Yield and Loan Participation strategies stood out as some of the most sought-after fixed income peer groups during the 11th month of the year.

These trends provide valuable insights into where investors are finding opportunities and how their preferences are shaping asset flows.

For a more nuanced look at monthly flows, sign up for a copy of our Fund Flows Report and Visual Deck:Disclaimer: Any discrepancies in fund flow data between the figures reported in YCharts, and the images featured in this blog/newsletter are due to variations in reporting timelines and methodologies used by fund companies when providing data to their respective providers.

A Closer Look at November 2024 Fixed Income Fund Flows

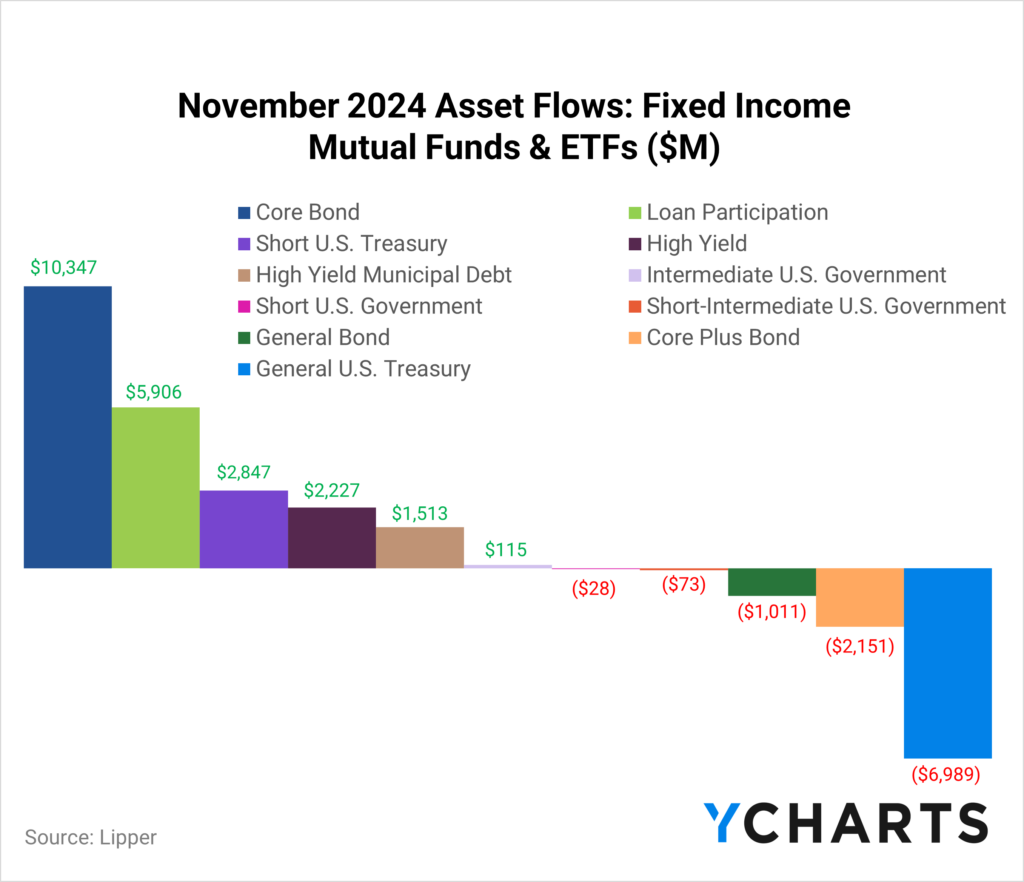

Outside of Core Bond funds, which saw inflows of $10.3 billion in November, Loan Participation and High Yield funds attracted the second and fourth most assets among fixed income peer groups, securing $5.9 billion and $2.2 billion, respectively.

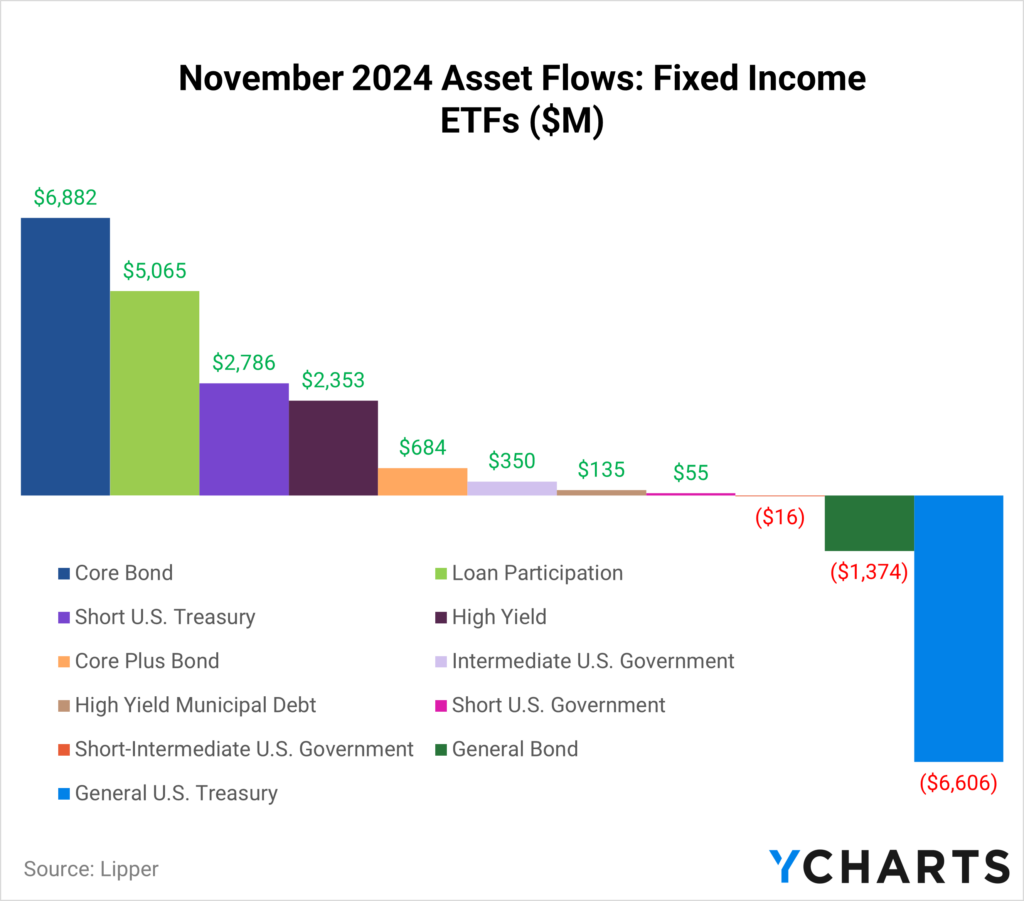

Loan Participation strategies reeled in $5.1 billion in assets in the ETF space. This demand for ETFs dwarfs the over $800 million in mutual fund inflows in the category, highlighting a clear investor preference for the ETF vehicle in this segment.

High Yield ETFs brought in $2.4 billion compared to the nearly $130 million in mutual fund outflows, further underscoring the preference for ETFs in credit-focused strategies.

Below, you’ll find the fastest-growing Loan Participation and High Yield strategies in November.

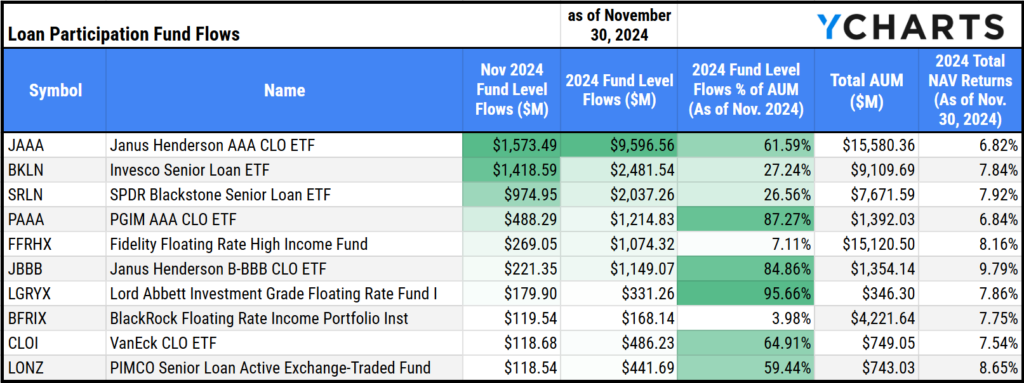

Fastest Growing Loan Participation Funds in November 2024

In November 2024, Loan Participation funds recorded net positive flows of $5.9 billion, lifting the year-to-date total flows in the category to $18.2 billion by the end of the month.

Based on November flows (aggregated across all share classes), the Janus Henderson AAA CLO ETF (JAAA) led the charge within this $150 billion-plus category, garnering $1.6 billion in inflows. Close behind, the Invesco Senior Loan ETF (BKLN) accumulated $1.4 billion, while the SPDR Blackstone Senior Loan ETF (SRLN) brought in $975 million in net new assets.

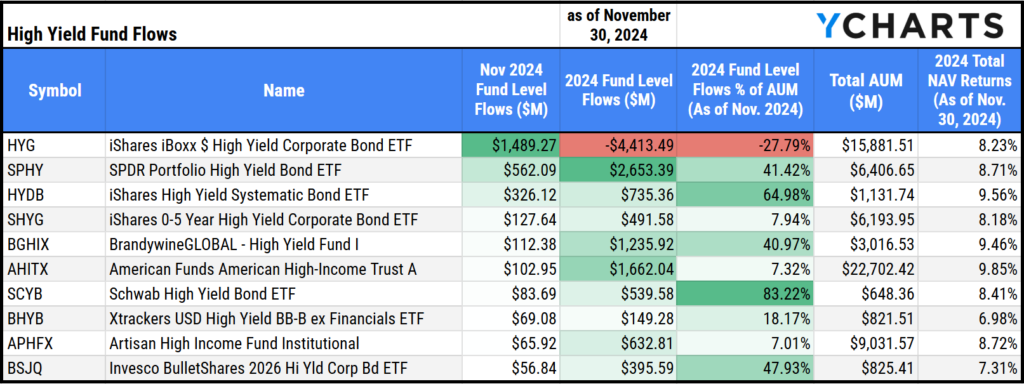

Fastest Growing High Yield Funds in November 2024

High Yield funds posted net positive flows of $2.2 billion in November 2024, boosting the category’s year-to-date total flows to $15.2 billion as of the end of November.

Leading the way in this $300 billion-plus category, based on November flows (aggregated across all share classes), was the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), which attracted $1.5 billion in inflows. The SPDR Portfolio High Yield Bond ETF (SPHY) secured $562 million, while the iShares High Yield Systematic Bond ETF (HYDB) added $326 million in net new assets.

In November 2024, fixed income flows highlighted a strong investor preference for credit-focused strategies, with Loan Participation and High Yield funds standing out as key drivers of asset growth. The continued dominance of ETFs in these categories underscores their appeal as the favored investment vehicle in 2024.

To stay up-to-date on fund flows, subscribe to the full report here.

Whenever you’re ready, there are three ways YCharts can help you:

Have questions about how YCharts can help you grow AUM and prepare for meetings?

Email us at hello@ycharts.com or call (866) 965-7552. You’ll get a response from one of our Chicago-based team members.

Unlock access to our Fund Flows Report and Visual Deck by becoming a client.

Dive into YCharts with a no-obligation 7-Day Free Trial now.

Sign up for a copy of our Fund Flows Report and Visual Deck:

Disclaimer

©2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

The S&P 500 Just Crossed 6,000. What’s Next?Read More →