Are U.S. Gold Reserves Overstated? Potential Market Implications for Investors

Introduction: Why U.S. Gold Reserves Matter to Investors

Gold has long been viewed as a safe-haven asset during economic uncertainty, with central banks stockpiling reserves to back monetary stability. The United States has historically held one of the world’s largest official gold reserves—with the U.S. Treasury reporting holdings of 8,133.5 metric tons stored at Fort Knox, West Point, and the Federal Reserve Bank of New York.

However, recent developments have raised concerns over the accuracy and transparency of these reserves. Speculation about potential shortages or overstatements in U.S. gold reserves could have significant ramifications for financial markets, inflation expectations, and investor sentiment.

This blog will explore:

- How past U.S. gold reserve policies have influenced markets

- Why recent calls for an audit have surfaced in 2025

- Market implications if reserves are found to be overstated

- How financial professionals can prepare for potential volatility

Historical Trends: U.S. Gold Reserves & Market Impact

Gold Reserves and Market Movements (1971-Present)

The last official gold reserve audit was conducted in 1974, leaving decades of speculation over the actual amount of physical gold held by the U.S. Treasury. Over time, key government actions have influenced market sentiment and gold prices:

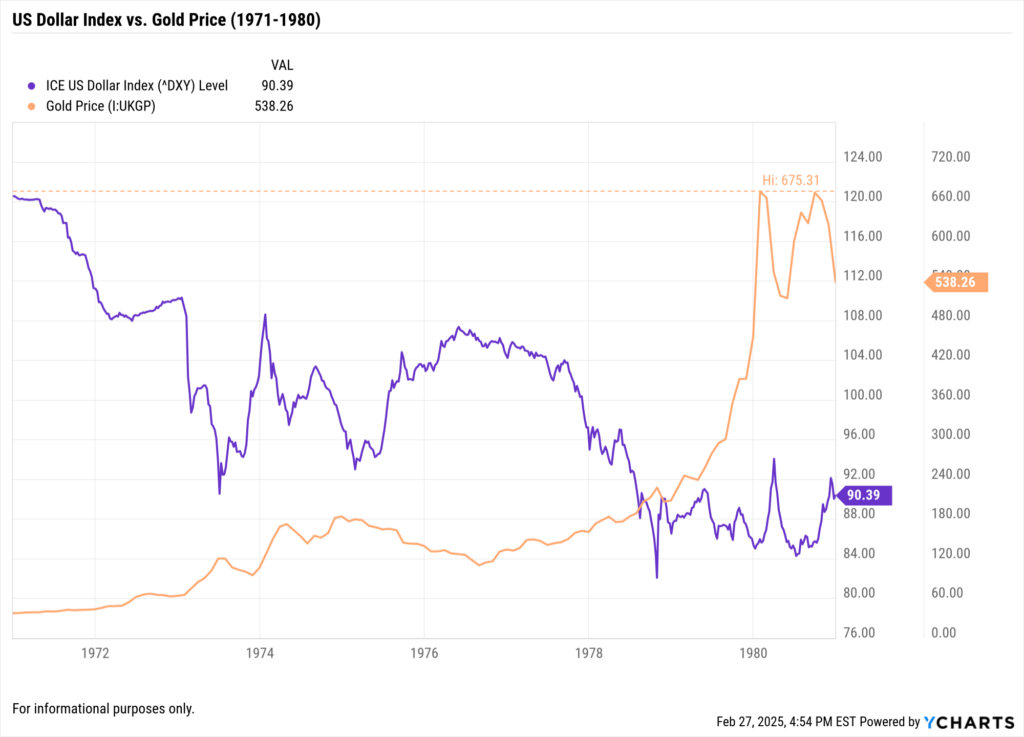

1971 – The End of the Gold Standard

- President Nixon suspended the gold standard, ending the convertibility of U.S. dollars into gold.

- This led to a rapid decline in the dollar’s value and gold prices soared from $35/oz to over $800/oz by 1980.

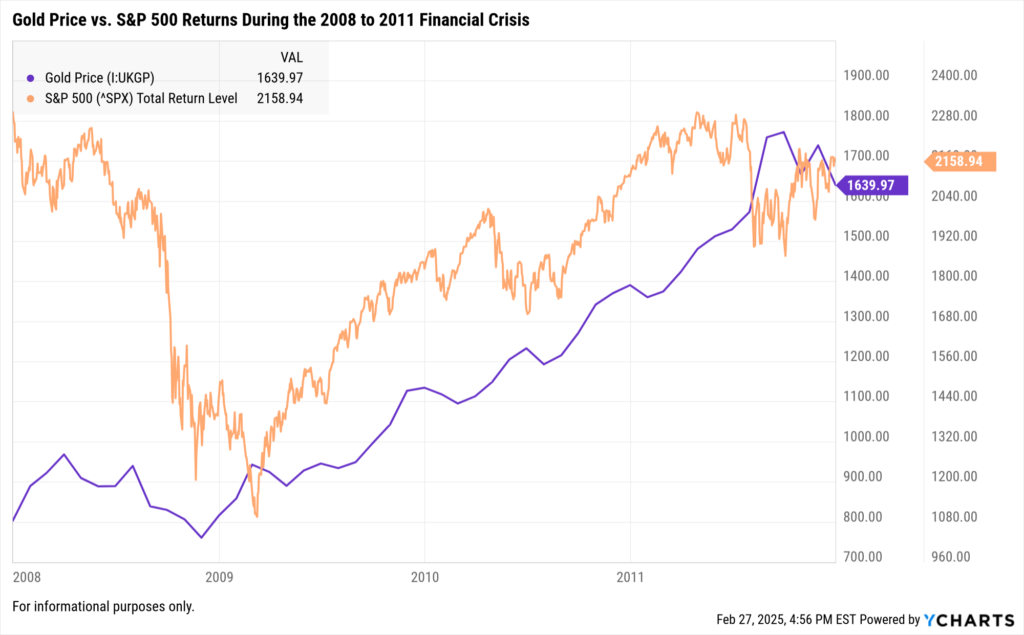

2008-2011 – Financial Crisis & Gold Boom

- During the Great Recession, central banks and investors turned to gold as a hedge against systemic risk.

- Gold prices peaked at $1,900/oz in 2011, driven by fears of U.S. monetary instability.

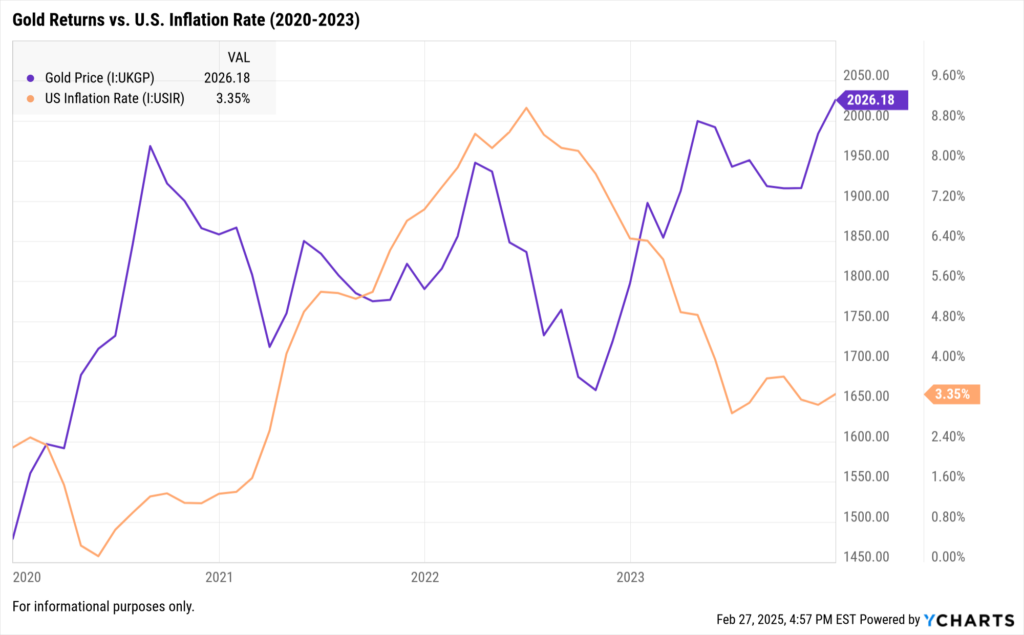

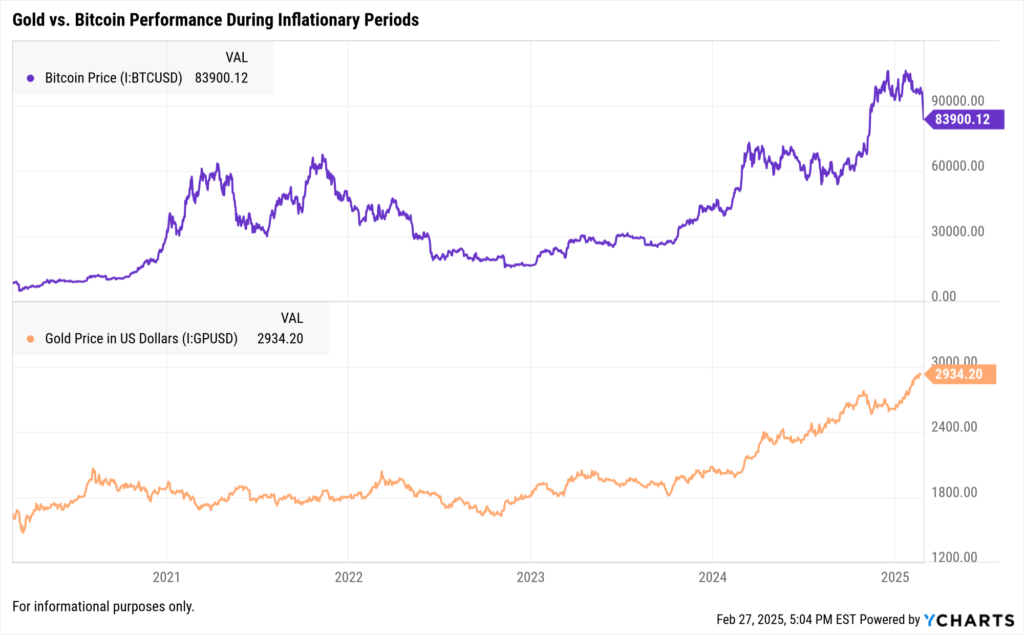

2020-2023 – Inflation & Flight to Safety

- COVID-19 stimulus programs led to massive money supply expansion, fueling inflation concerns.

- Gold reached a new all-time high of $2,075/oz in August 2020, with central banks increasing gold purchases.

2025 Gold Reserve Audit Speculation: What’s Driving Market Concerns?

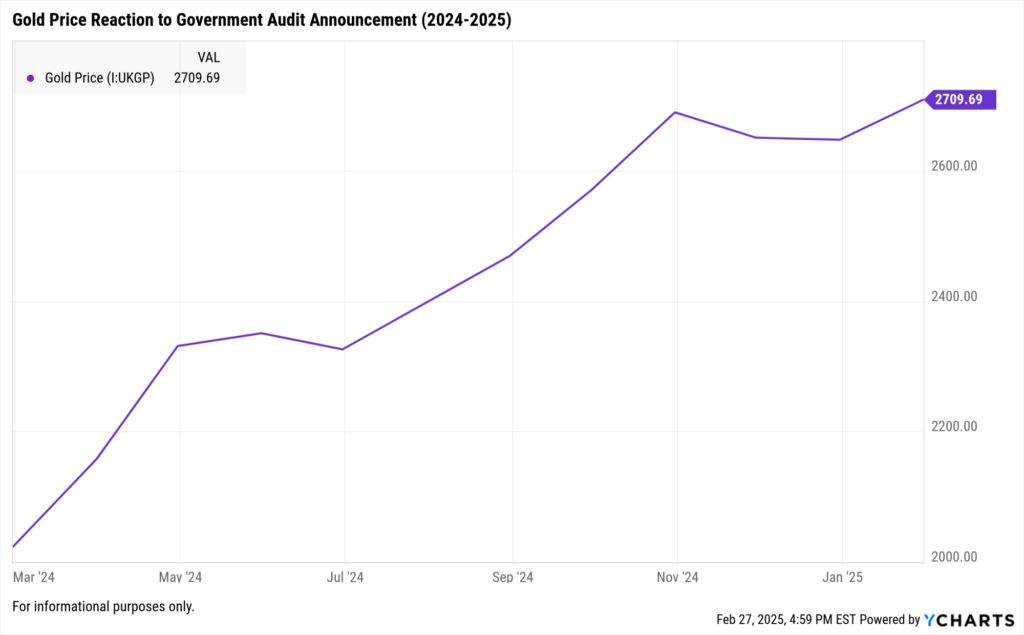

In early 2025, President Trump announced that his administration, alongside the Department of Government Efficiency (DOGE), would conduct a physical audit of U.S. gold reserves for the first time in over 70 years.

Market Reactions to Audit Announcement

- Gold Prices Surge → Since the announcement, gold has rallied to $2,963 per troy ounce, approaching record highs.

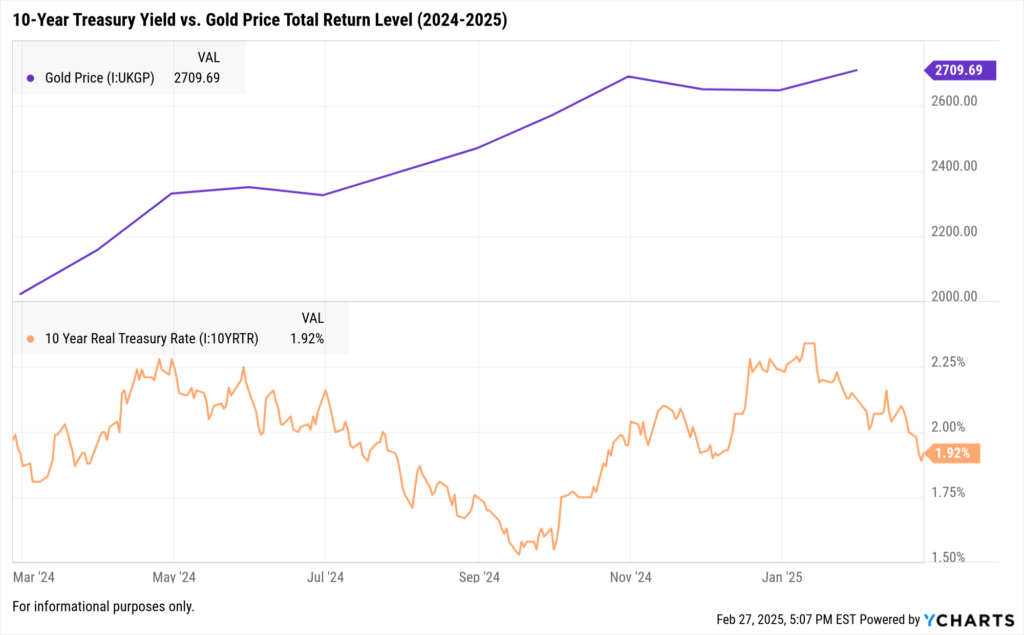

- Bond Market Adjusts → The 10-year Treasury yield has climbed to 4.85%, as inflationary fears resurface.

- Stock Market Volatility → The S&P 500 experienced a 3.5% decline amid uncertainty over gold-backed financial assets.

Potential Risks if Reserves Are Overstated

Loss of Confidence in U.S. Treasury Holdings

- If reserves are lower than reported, investor confidence in Treasury-backed securities could decline.

- This may trigger higher yields on U.S. government debt, as investors demand higher risk premiums.

U.S. Dollar Weakness & Inflation Risk

- A shortfall in reserves could undermine faith in the dollar as a store of value, leading to devaluation.

- Commodity prices, including gold, oil, and metals, may likely rise as investors hedge against currency weakness.

Repricing of Global Central Bank Holdings

- Many central banks hold U.S. gold reserves as collateral for international trade.

- A discrepancy in gold reserves could force central banks to diversify into alternative assets like Bitcoin or commodities.

Investment Implications for Financial Professionals

1. Adjusting Asset Allocation Strategies

Financial advisors and asset managers should assess portfolio exposure to gold and inflation-sensitive assets:

May want to increase Precious Metals Allocation

- Allocating 3-10% of portfolios to gold ETFs, miners, or bullion can hedge against inflation risks.

- Use YCharts Fundamental Charts to Compare historical gold price trends against CPI inflation metrics.

May want to diversify into Alternative Assets

Real estate, commodities, and cryptocurrencies like Bitcoin can offer additional inflation protection.

May want to reduce Exposure to Dollar-Sensitive Assets

If the dollar weakens, foreign equities and international bonds may outperform U.S.-based holdings.

2. Fixed Income Adjustments: Positioning for Treasury Yield Movements

If confidence in Treasury-backed assets declines, advisors should consider the following bond strategies:

May want to shift Toward Shorter Duration Bonds

- Rising yields increase interest rate risk for long-term bonds.

- Potential Considerations: Short-term Treasuries, floating-rate bonds, or inflation-protected securities (TIPS).

May want to monitor Corporate Bond Risk

- Companies reliant on government-backed funding may face higher credit risk.

- Use YCharts Bond Screener for assessing corporate bond spreads.

How YCharts Can Help Advisors & Asset Managers Track Gold & Market Risks

YCharts provides institutional-grade data and visualization tools for monitoring gold market trends, inflation, and portfolio risks:

- Monitor Macroeconomic Indicators → Use YCharts Economic Indicators to track inflation, Treasury yields, and gold price movements.

- Compare Gold’s Role in Portfolios → Fundamental Charts allow for side-by-side comparisons of gold, equities, and fixed-income assets.

- Create Data-Driven Client Reports → Generate insights on gold’s historical performance during economic downturns using Custom Reports.

Conclusion: Navigating the Gold Reserve Uncertainty

The speculation around U.S. gold reserves highlights the need for investors to remain vigilant about macroeconomic risks. While past market trends suggest gold serves as a strong hedge against uncertainty, advisors must also consider portfolio diversification and inflation hedging strategies.

By leveraging YCharts’ analytical tools, financial professionals can make informed decisions to manage risk and optimize client portfolios in response to these developments.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking for a best-in-class data & visualization tool?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Get your copy of The Top Metrics Advisors Used in Portfolio Reports: 2024

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Nvidia’s Strong Q4 2025 Earnings: What It Means for Investors & Financial AdvisorsRead More →