Best Performing Mutual Funds of the Last 10 Years: A Financial Advisor’s Perspective

Updated as of: January 7, 2026

Mutual funds have long been a staple in portfolios for their ability to deliver diversification, professional management, and tailored exposure to specific sectors or asset classes.

Evaluating long-term performance is essential for identifying funds that demonstrate resilience, consistent returns, and strong management practices. This article highlights the best-performing mutual funds over various lookback periods in the last decade.

To create this list, we analyzed the entire mutual fund universe using the YCharts Fund Screener to find the best-performing US-domiciled equity mutual funds over 1-year, 3-year, 5-year, and 10-year timeframes. (Leveraged and inverse mutual funds as well as those in the alternative currency strategy and options arbitrage strategy peer groups were excluded to focus on long-term investment vehicles that align with broader financial planning goals)

The following best-performing mutual funds are shown with total return, expense ratio and AUM and metrics to showcase recent trends and shifts. All performance data is standardized to ensure comparability across funds and lookback periods.

Table of Contents

Looking for lists of the best performing ETFs? Check out our analysis on the Best Performing ETFs here.

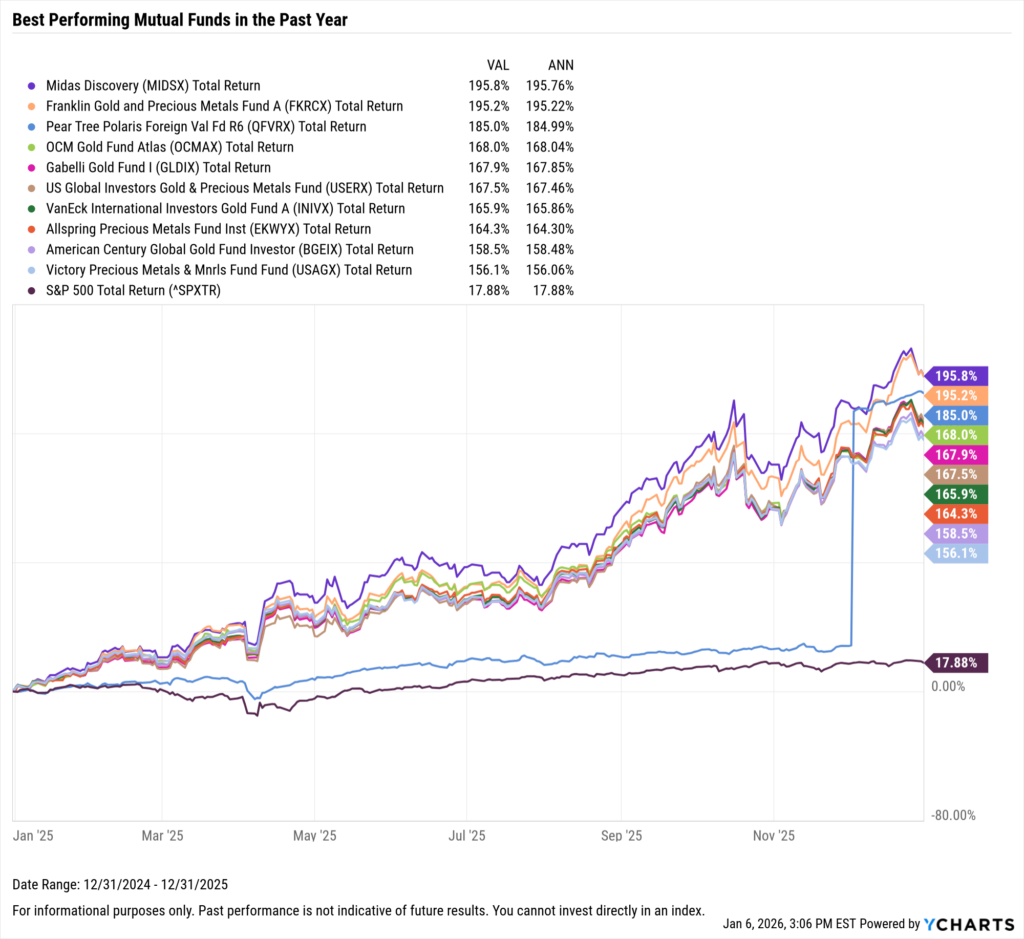

Best Performing Mutual Funds in the Last Year

These are the top-performing mutual funds over the past year, as of December 31, 2025.

| Symbol | Name | 1 Year Total Returns (Monthly) | Net Expense Ratio | Share Class Assets Under Management | Peer Group Name |

|---|---|---|---|---|---|

| MIDSX | Midas Discovery | 195.76% | 5.98% | $44,941,056 | Precious Metals Equity Funds |

| FKRCX | Franklin Gold and Precious Metals Fund A | 195.22% | 0.87% | $1,754,296,345 | Precious Metals Equity Funds |

| QFVRX | Pear Tree Polaris Foreign Val Fd R6 | 184.99% | 0.94% | $454,053,101 | International Multi-Cap Value |

| OCMAX | OCM Gold Fund Atlas | 168.04% | 1.88% | $177,721,440 | Precious Metals Equity Funds |

| GLDIX | Gabelli Gold Fund I | 167.85% | 1.19% | $429,960,087 | Precious Metals Equity Funds |

| USERX | US Global Investors Gold & Precious Metals Fund | 167.46% | 1.73% | $280,981,643 | Precious Metals Equity Funds |

| INIVX | VanEck International Investors Gold Fund A | 165.86% | 1.42% | $638,680,964 | Precious Metals Equity Funds |

| EKWYX | Allspring Precious Metals Fund Inst | 164.30% | 0.79% | $683,098,478 | Precious Metals Equity Funds |

| BGEIX | American Century Global Gold Fund Investor | 158.48% | 0.66% | $1,620,957,665 | Precious Metals Equity Funds |

| USAGX | Victory Precious Metals & Mnrls Fund Fund | 156.06% | 1.14% | $1,069,569,132 | Precious Metals Equity Funds |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

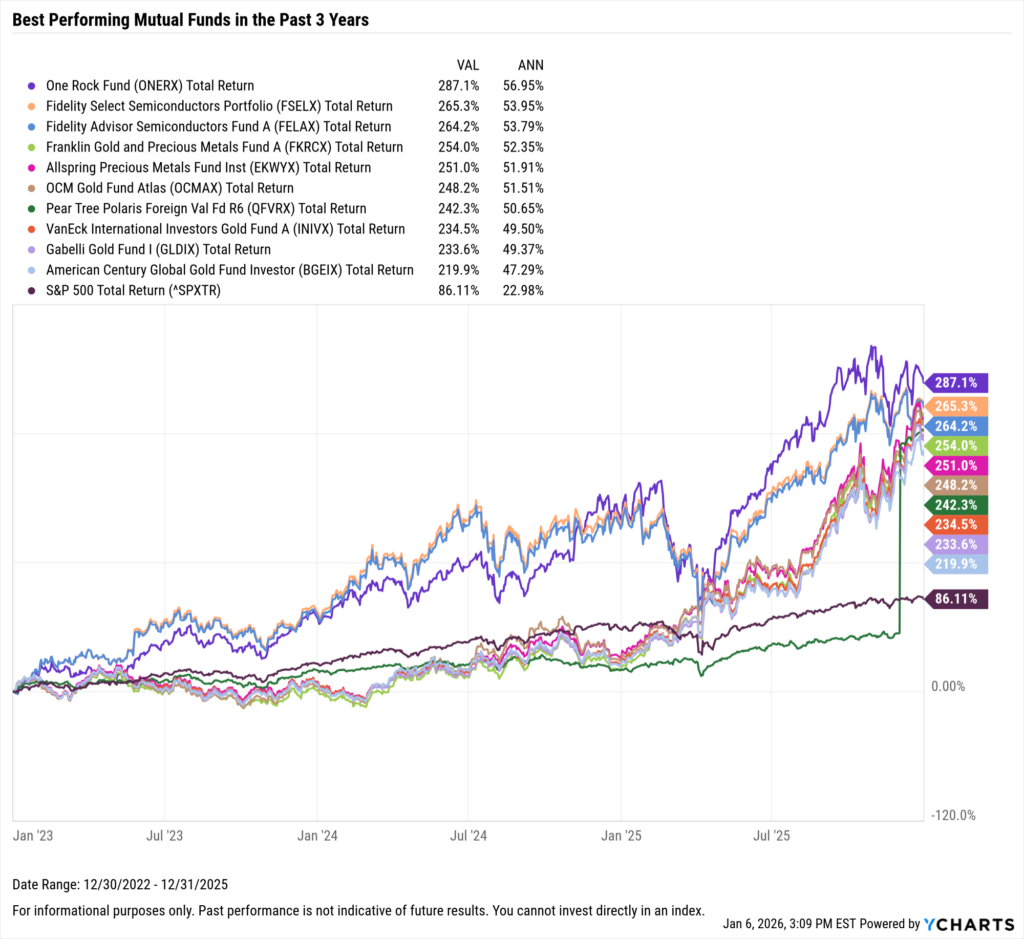

Best Performing Mutual Funds in the Last 3 Years

These are the top-performing mutual funds on an annualized basis between January 1st, 2023 and December 31, 2025.

| Symbol | Name | 3 Year Total Returns (Monthly) | Annualized 3 Year Total Returns (Monthly) | Net Expense Ratio | Share Class Assets Under Management | Peer Group Name |

|---|---|---|---|---|---|---|

| ONERX | One Rock Fund | 287.12% | 57.02% | 1.76% | $35,640,200 | Multi-Cap Growth Funds |

| FSELX | Fidelity Select Semiconductors Portfolio | 265.32% | 54.01% | 0.62% | $28,694,412,484 | Science & Technology Funds |

| FELAX | Fidelity Advisor Semiconductors Fund A | 264.18% | 53.85% | 0.94% | $1,864,957,968 | Science & Technology Funds |

| FKRCX | Franklin Gold and Precious Metals Fund A | 254.01% | 52.41% | 0.87% | $1,754,296,345 | Precious Metals Equity Funds |

| EKWYX | Allspring Precious Metals Fund Inst | 250.96% | 51.97% | 0.79% | $683,098,478 | Precious Metals Equity Funds |

| OCMAX | OCM Gold Fund Atlas | 248.22% | 51.57% | 1.88% | $177,721,440 | Precious Metals Equity Funds |

| QFVRX | Pear Tree Polaris Foreign Val Fd R6 | 242.32% | 50.71% | 0.94% | $454,053,101 | International Multi-Cap Value |

| INIVX | VanEck International Investors Gold Fund A | 234.48% | 49.55% | 1.42% | $638,680,964 | Precious Metals Equity Funds |

| GLDIX | Gabelli Gold Fund I | 233.65% | 49.43% | 1.19% | $429,960,087 | Precious Metals Equity Funds |

| BGEIX | American Century Global Gold Fund Investor | 219.87% | 47.34% | 0.66% | $1,620,957,665 | Precious Metals Equity Funds |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

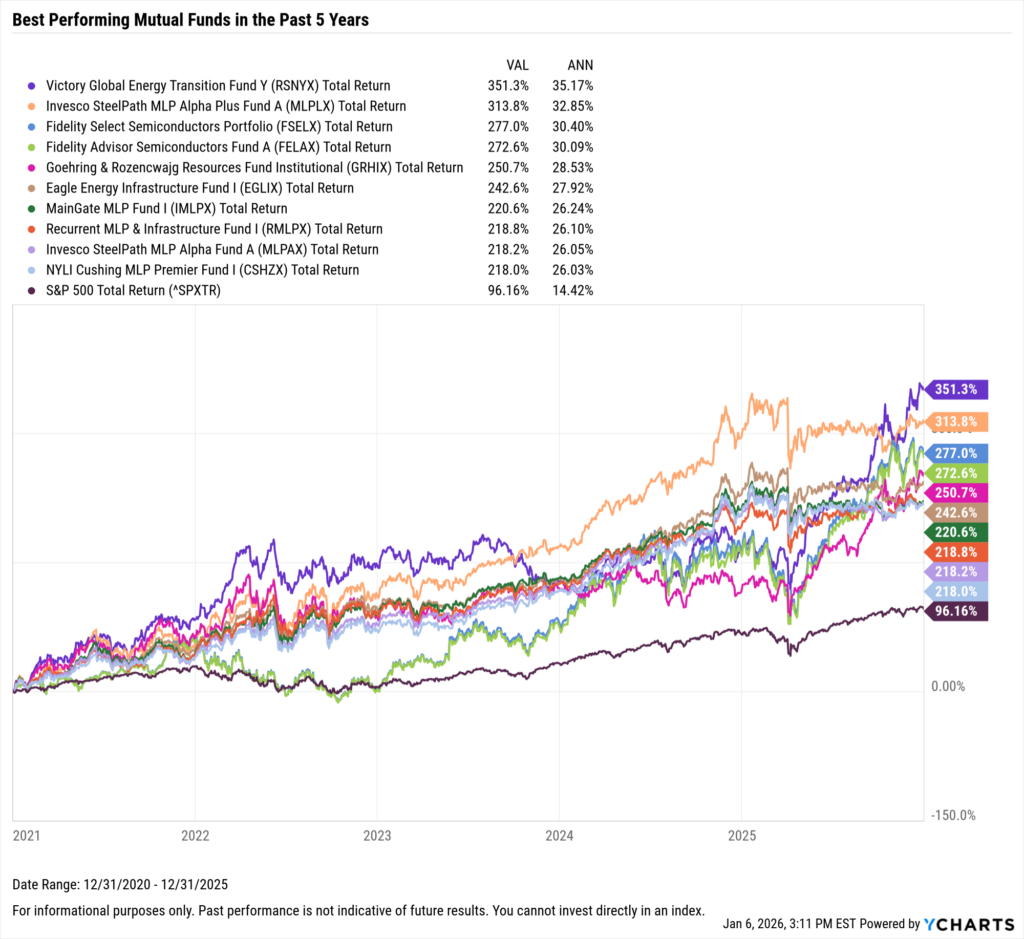

Best Performing Mutual Funds in the Last 5 Years

These are the top-performing mutual funds on an annualized basis between January 1, 2021 and December 31, 2025.

| Symbol | Name | 5 Year Total Returns (Monthly) | Annualized 5 Year Total Returns (Monthly) | Net Expense Ratio | Share Class Assets Under Management | Peer Group Name |

|---|---|---|---|---|---|---|

| RSNYX | Victory Global Energy Transition Fund Y | 351.29% | 35.17% | 1.15% | $378,158,020 | Global Natural Resources Funds |

| MLPLX | Invesco SteelPath MLP Alpha Plus Fund A | 313.76% | 32.85% | 17.25% | $164,489,081 | Energy MLP Funds |

| FSELX | Fidelity Select Semiconductors Portfolio | 276.97% | 30.40% | 0.62% | $28,694,412,484 | Science & Technology Funds |

| FELAX | Fidelity Advisor Semiconductors Fund A | 272.59% | 30.09% | 0.94% | $1,864,957,968 | Science & Technology Funds |

| GRHIX | Goehring & Rozencwajg Resources Fund Institutional | 250.74% | 28.53% | 0.95% | $735,350,412 | Global Natural Resources Funds |

| EGLIX | Eagle Energy Infrastructure Fund I | 242.57% | 27.92% | 1.40% | $147,240,537 | Energy MLP Funds |

| IMLPX | MainGate MLP Fund I | 220.62% | 26.24% | 11.21% | $690,232,469 | Energy MLP Funds |

| RMLPX | Recurrent MLP & Infrastructure Fund I | 218.85% | 26.10% | 1.10% | $1,182,214,305 | Energy MLP Funds |

| MLPAX | Invesco SteelPath MLP Alpha Fund A | 218.24% | 26.05% | 6.63% | $502,805,406 | Energy MLP Funds |

| CSHZX | NYLI Cushing MLP Premier Fund I | 218.01% | 26.03% | 1.25% | $513,372,315 | Energy MLP Funds |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

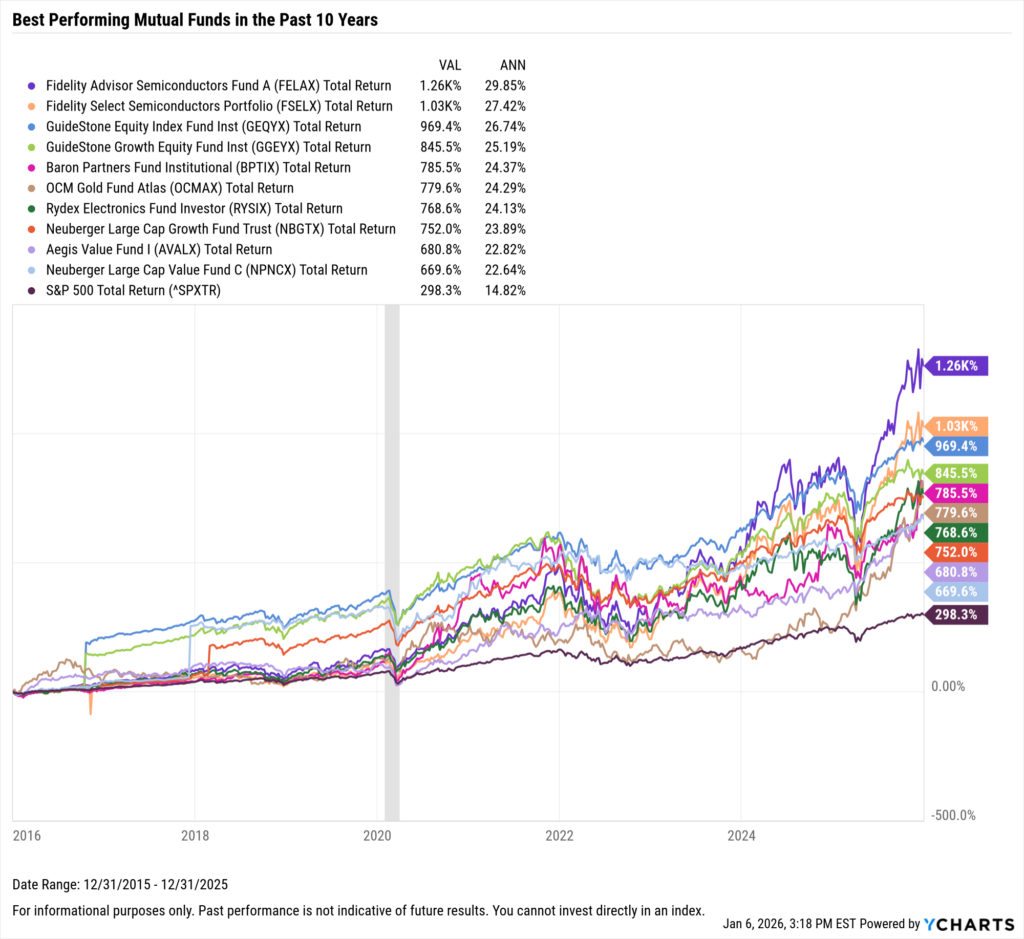

Best Performing Mutual Funds in the Last 10 Years

These are the top-performing mutual funds on an annualized basis between January 1, 2016 and December 31, 2025.

| Symbol | Name | 10 Year Total Returns (Monthly) | Annualized 10 Year Total Returns (Monthly) | Net Expense Ratio | Share Class Assets Under Management | Peer Group Name |

|---|---|---|---|---|---|---|

| FELAX | Fidelity Advisor Semiconductors Fund A | 1263.21% | 29.85% | 0.94% | $1,864,957,968 | Science & Technology Funds |

| FSELX | Fidelity Select Semiconductors Portfolio | 1027.91% | 27.42% | 0.62% | $28,694,412,484 | Science & Technology Funds |

| GEQYX | GuideStone Equity Index Fund Inst | 969.43% | 26.74% | 0.12% | $4,327,506,553 | S&P 500 Index Funds |

| GGEYX | GuideStone Growth Equity Fund Inst | 845.53% | 25.19% | 0.65% | $1,069,047,526 | Large-Cap Growth Funds |

| BPTIX | Baron Partners Fund Institutional | 785.49% | 24.37% | 1.99% | $5,132,058,727 | Multi-Cap Growth Funds |

| OCMAX | OCM Gold Fund Atlas | 779.61% | 24.29% | 1.88% | $177,721,440 | Precious Metals Equity Funds |

| RYSIX | Rydex Electronics Fund Investor | 768.57% | 24.13% | 1.38% | $129,910,464 | Science & Technology Funds |

| NBGTX | Neuberger Large Cap Growth Fund Trust | 751.96% | 23.89% | 1.00% | $49,181,703 | Large-Cap Growth Funds |

| AVALX | Aegis Value Fund I | 680.83% | 22.82% | 1.45% | $1,048,097,475 | Small-Cap Value Funds |

| NPNCX | Neuberger Large Cap Value Fund C | 669.63% | 22.64% | 1.72% | $206,977,587 | Large-Cap Value Funds |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

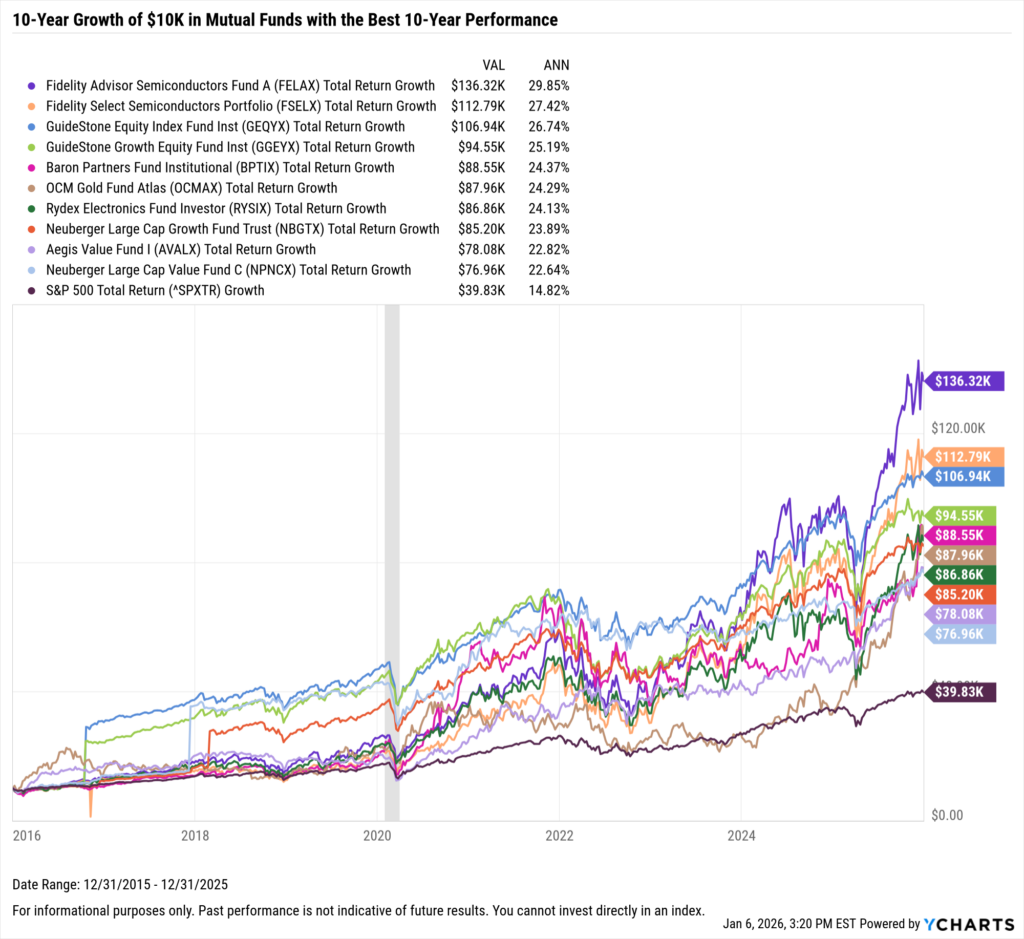

What Was the Growth of $10,000 in the Top Bond Mutual Funds Over the Last 10 Years?

If you invested $10,000 10 years ago into any of the ten best-performing mutual funds over the last 10 years, your balance today would be no less than $76K.

The two best-performing mutual funds in the last 10 years were semiconductor funds. A $10,000 investment into the Fidelity Advisor Semiconductors Fund (FELAX) would be worth about $136K today. Behind the Fidelity Advisor Semiconductors Fund was the Fidelity Select Semiconductors Portfolio mutual fund (FSELX); investing $10,000 into FSELX back in 2015 would’ve turned into a little over $112,790.

Download Visual | Modify in YCharts

Whenever you’re ready, here’s how YCharts can help you:

1. Looking to Move On From Your Investment Research and Analytics Platform?

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Sign up for a copy of our Fund Flows Report and Visual Deck to stay on top of mutual fund trends:

Sign up to recieve a copy of our monthly Fund Flows Report:Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Next Article

The 10 Best Performing ETFs Over the Last 10 YearsRead More →