Charting the Success of etf.com’s Past Winners Ahead of the 2024 Awards

In anticipation of the 2024 etf.com Awards ceremony, we take a look back at how the 2023 winners have grown and performed.

2023 ETF of the Year

Active management continues to be a growing part of the ETF industry due to high and ever-increasing demand for these strategies. According to a 2023 survey conducted by the Money Management Institute, 89% of wealth managers currently use active ETFs, and 42% say their firm plans to focus on these strategies more over the next two years.

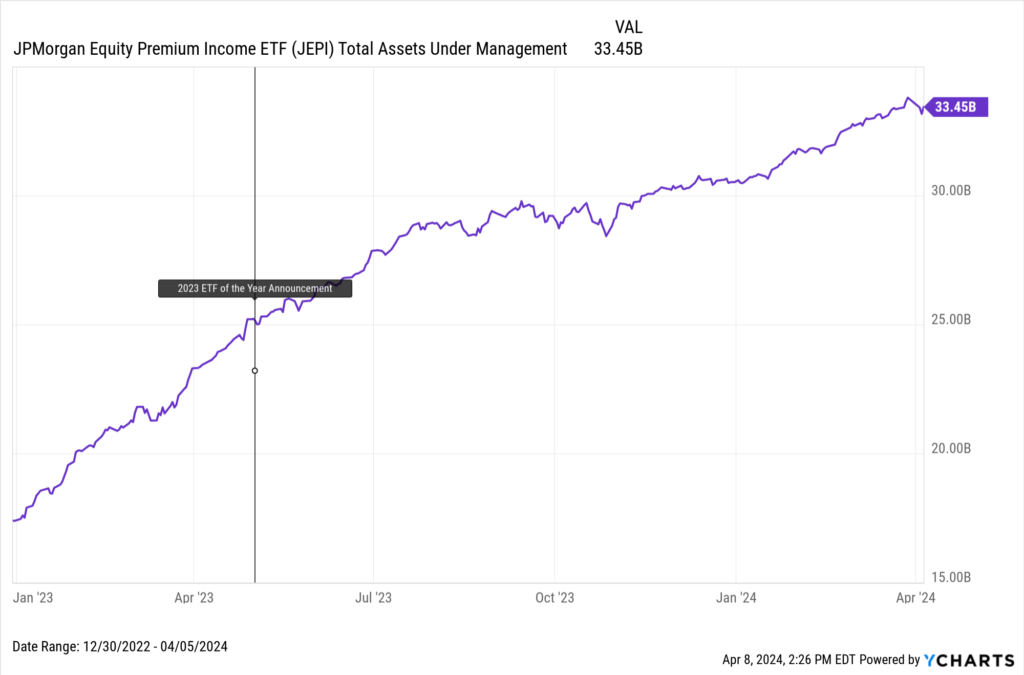

It should come as no surprise then that JPMorgan Chase’s Equity Premium Income ETF (JEPI), clinched the top spot as etf.com’s 2023 ETF of the year.

According to YCharts’ vast universe of funds, the covered call income strategy is currently in the top 2% of equity ETFs in AUM, and it is the biggest active ETF among fixed-income and equity strategies. Powered by a strong equity market and $8.56B in fund flows over the last year (as of 3/28/2024), JEPI has grown its AUM 33% since etf.com crowned the strategy ETF of the year.

Download Visual | View & Modify in YCharts

Following the success of JEPI, JPMorgan’s Nasdaq Equity Premium Income ETF (JEPQ) has a chance to add another ETF of the Year award to the covered call suite. However, it will face stiff competition from funds focusing on crypto (BITQ), tech (QQQM), and an expectation of broadening market leadership in 2024 (RSP and CALF).

The 2024 ETF of the Year finalists include:

- Bitwise Crypto Industry Innovators ETF (BITQ): 127.4% Total Return from March 31, 2023 to March 28, 2024

- Invesco NASDAQ 100 ETF (QQQM): 39.4% Total Return from March 31, 2023 to March 28, 2024

- Invesco S&P 500 Equal Weight ETF (RSP): 19.1% Total Return from March 31, 2023 to March 28, 2024

- JPMorgan Nasdaq Equity Premium Income ETF (JEPQ): 33% Total Return from March 31, 2023 to March 28, 2024

- Pacer US Small Cap Cash Cows 100 ETF (CALF): 30.7% Total Return from March 31, 2023 to March 28, 2024

2023 Best New ETF

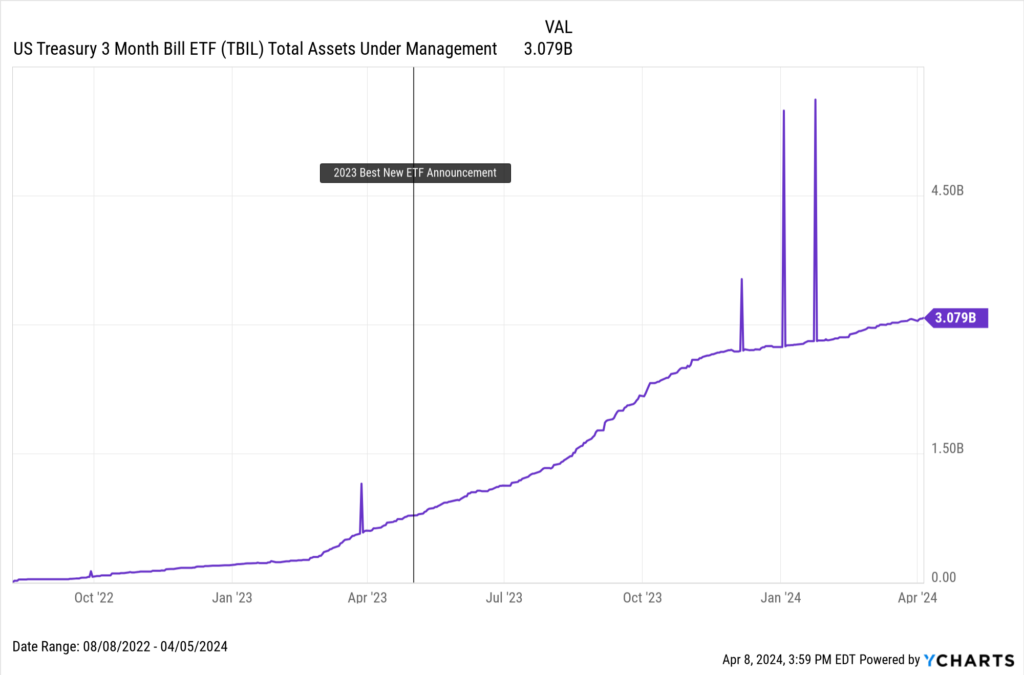

The best new ETF in 2023 was the US Treasury 3 Month Bill ETF (TBIL) from F/m Investments and distributed by North Slope Capital. TBIL is one of the ten US Benchmark Series ETFs that F/m Investments has released since 2022.

Since etf.com crowned TBIL as Best New ETF, it has increased its AUM to over $3B from $800M last year. It is now the most popular of all the funds in the US Benchmark Series.

Download Visual | View & Modify in YCharts

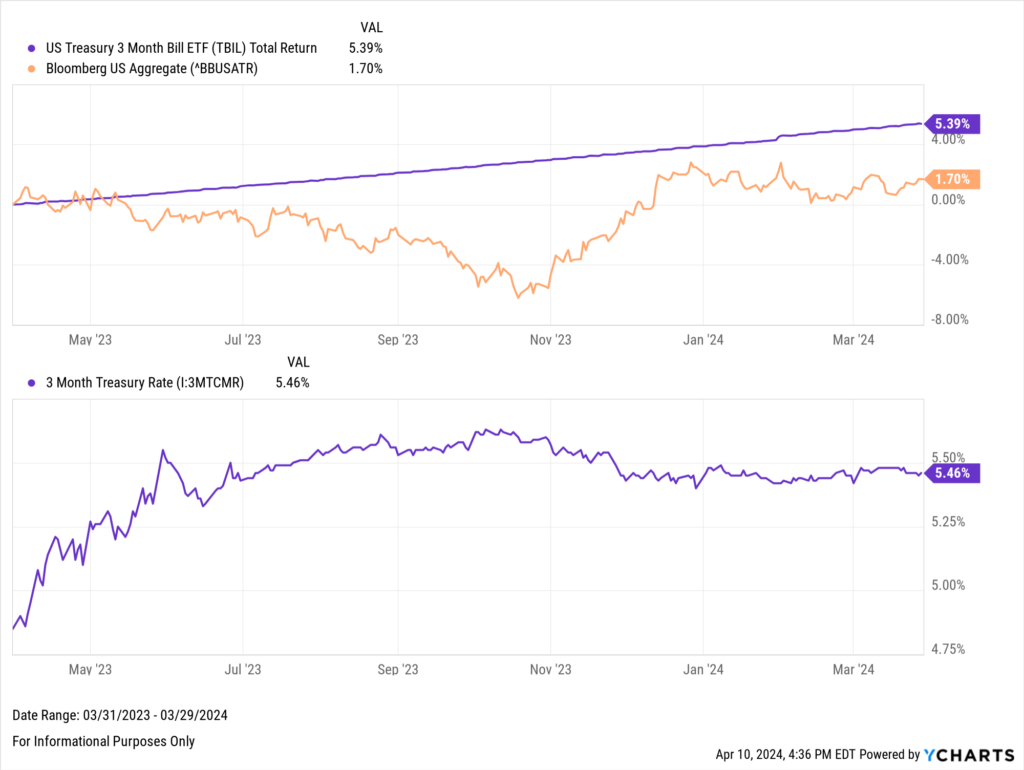

Its popularity is driven by rate environment changes since 2022. Since TBIL’s launch on August 8, 2022, the 3-month treasury rate has increased from 2.62% to 5.43% amid the Fed’s interest rates hikes. Through TBIL, investors have seen 5.4% returns (from March 31, 2023 to March 28, 2024) while getting exposure to the now-attractive short end of the yield curve for a 0.15% expense ratio.

Download Visual | View & Modify in YCharts

This year’s Best New ETF nominees are less concerned with the yield curve. Some, like Roundhill’s Generative AI & Technology ETF (CHAT) and Magnificent Seven ETF (MAGS) strategies, are focused on current market themes. Others are focused on adding income (ProShares’ ISPY), risk management (Innovator’s TJUL), and asset diversification (Capital Group’s CGBL) to equity portfolios.

2023 Best ETF Issuer and Best New Active ETF

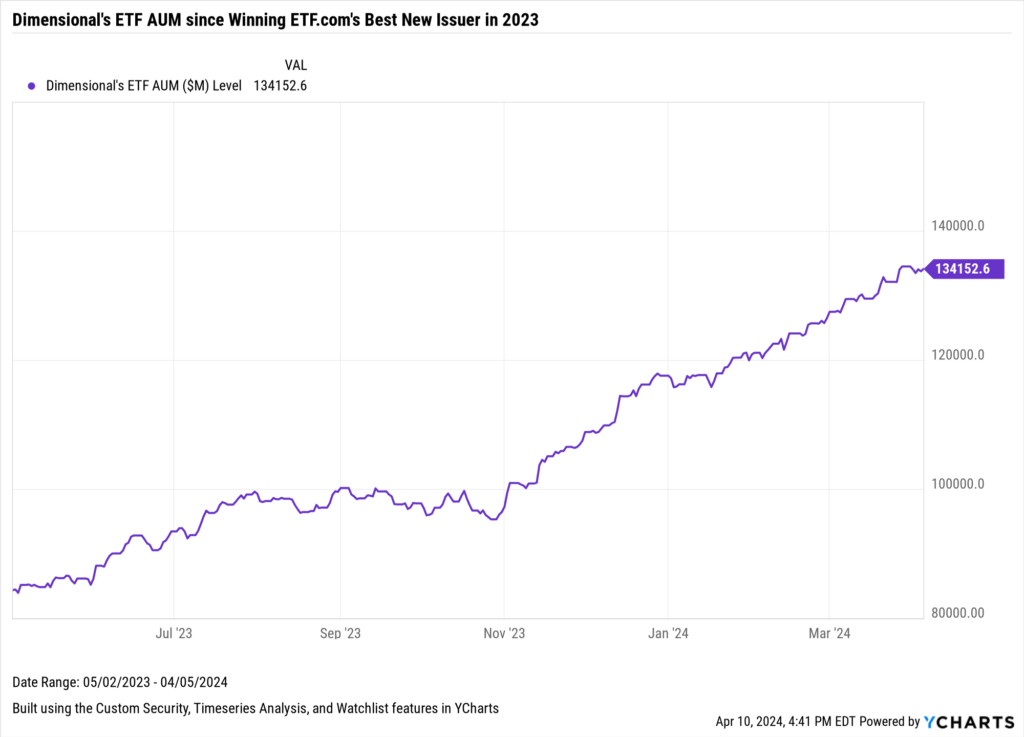

Dimensional Fund Advisors won etf.com’s Issuer of the Year award in 2023. Since winning, the issuer’s AUM has grown 59% to $134.15B from $84.4B.

Dimensional Fund Advisors have found great success attracting assets with its suite of actively managed strategies. Notably, with $27.1B AUM, the Dimensional US Core Equity 2 ETF (DFAC) is second only to JEPI in assets among active fixed-income and equity ETFs.

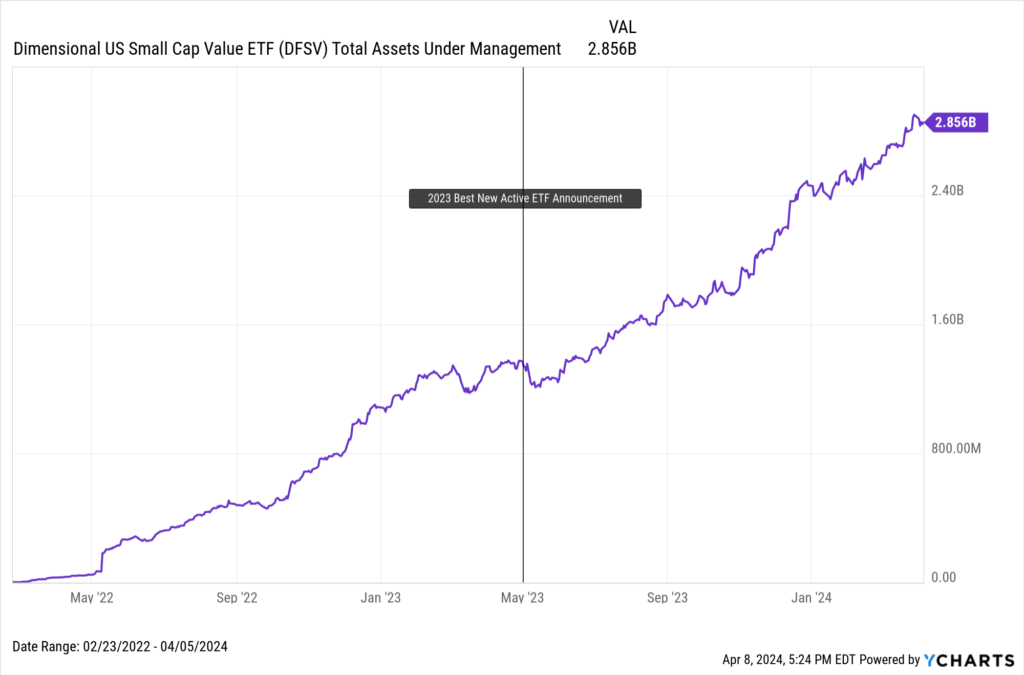

Dimensional continued its momentum by adding the Dimensional US Small Cap Value ETF (DFSV) in February 2022. Since Dimensional launched DFSV, the fund’s AUM has grown to over $2.8B, attracting over $1.1B in assets in the past year (as of March 28, 2024). Since the fund won Best New Active ETF, its AUM has more than doubled.

Download Visual | View & Modify in YCharts

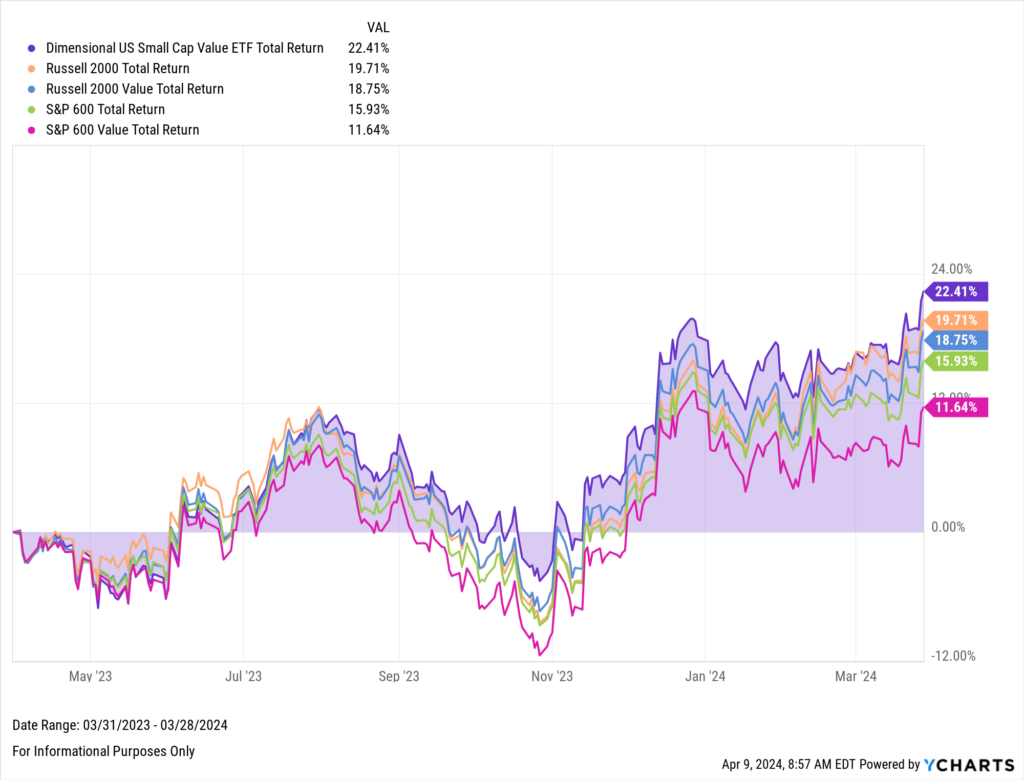

DFSV has outperformed the Russell 2000, Russell 2000 Value, S&P 600, and S&P 600 Value, with 22.4% total returns over the past year (as of March 28, 2024), thanks to little sector overlap with some of its passive peers during the same period.

Download Visual | View & Modify in YCharts

Dimensional is once again in the running for ETF Issuer of the Year. Here’s 2024’s complete list of finalists for the crown:

- Capital Group: 14 ETFs

- Dimensional Fund Advisors: 38 ETFs

- Fidelity Investments: 67 ETFs

- Franklin Templeton: 72 ETFs

- Invesco: 221 ETFs

- VanEck: 71 ETFs

Followed by the finalists for the 2024 Best New Active ETF:

- AB Disruptors ETF (FWD): 38.9% Total Return from March 31, 2023 to March 28, 2024

- Capital Group Core Balanced ETF (CGBL): 17.3% Total Return from March 31, 2023 to March 28, 2024

- Fidelity Disruptive Technology ETF (FDTX): 25% Total Return from March 31, 2023 to March 28, 2024

- Panagram BBB-B CLO ETF (CLOZ): 17.3% Total Return from March 31, 2023 to March 28, 2024

- PIMCO Commodity Strategy Active ETF (CMDT): 11.5% Total Return from March 31, 2023 to March 28, 2024

2023 Best New U.S. Equity ETF

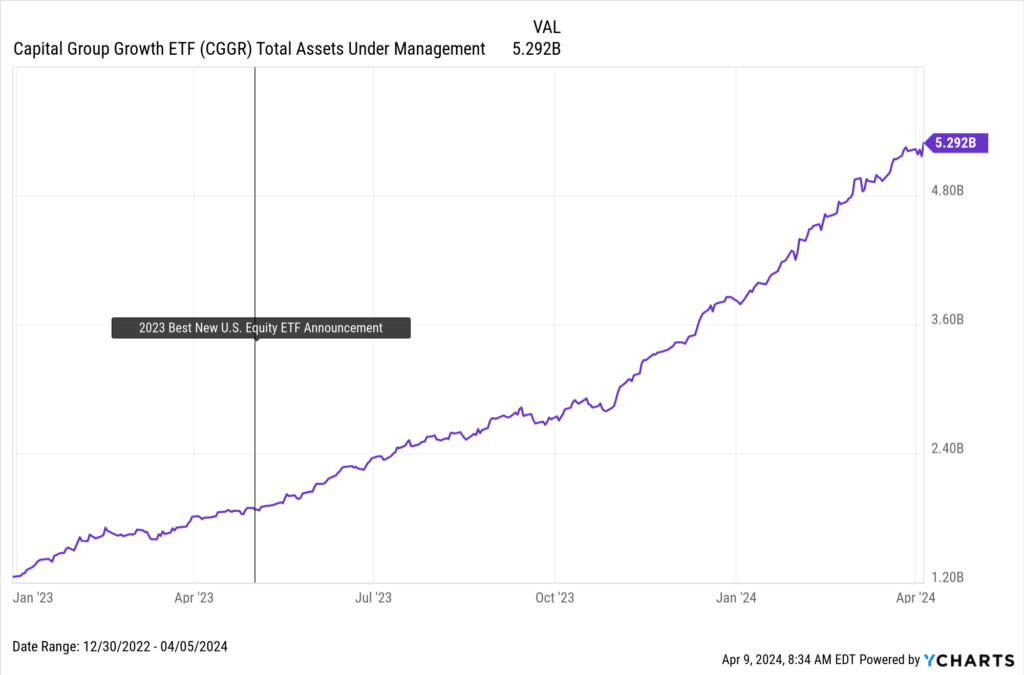

Capital Group Growth ETF (CGGR) won the Best New U.S. Equity ETF award last year amid growing popularity in the active ETF space. As one of Capital Group’s original six ETFs launched in February 2022, the large growth strategy has accumulated $5.3B in AUM, making it the second largest fund in Capital Group’s suite.

Over the last year, CGGR has brought in $2.2B in fund flows (as of March 28, 2024), and its AUM has more than doubled since the ETF won the award, propelling it to become the most popular large growth active ETF in terms of AUM.

Download Visual | View & Modify in YCharts

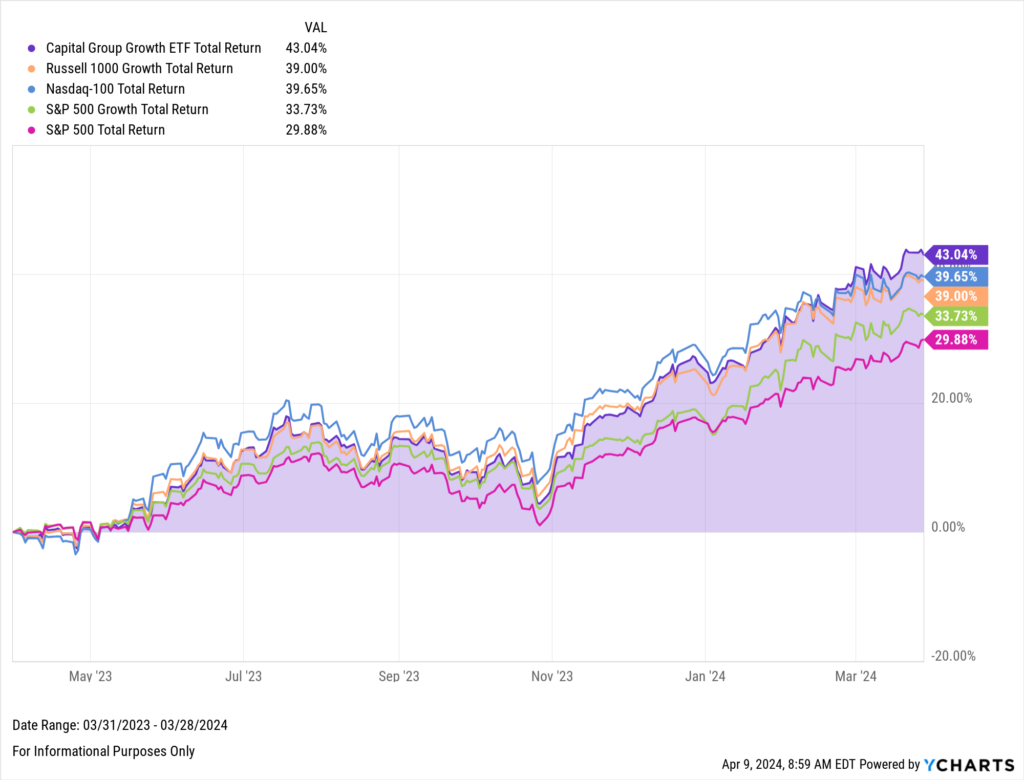

Its popularity comes as large growth experiences tailwinds like the AI boom propelling the “Magnificent Seven” stocks and broader tech higher.

But that’s where CGGR differentiates itself, as the strategy has far less exposure to the technology sector than its passive peers yet posted a 43% 1Y total return (as of March 28, 2024).

Download Visual | View & Modify in YCharts

Some of this year’s finalists are either focused on befitting from— or adding an income component to —the concentration of returns that have come from the technology sector, such as Fidelity’s Disruptive Technology ETF (FDTX), REX’s FANG & Innovation Equity Premium Income ETF (FEPI), and Roundhill’s Magnificent Seven ETF (MAGS).

The remaining finalists are more concerned with quality (GMO’s QLTY and Astoria’s ROE) or increasing the income potential for clients holding the S&P 500 (ProShares’ ISPY).

2023 Best New ETF Issuer and Best New International/Global Fixed Income ETF

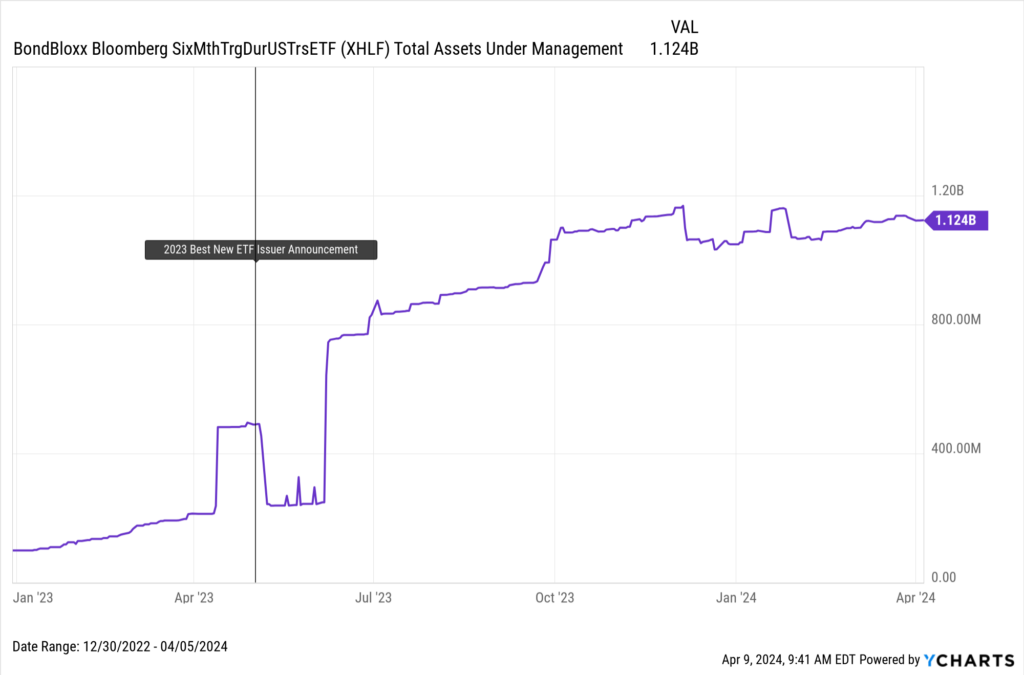

Last year’s Best New ETF Issuer, BondBloxx Investment Management, launched 19 ETFs in 2022. All 19 focused on some aspect of the fixed income sleeve of portfolios. Currently, the issuer has 24 funds and $2.8B in AUM.

Like TBIL, the change in the rate environment has made the Bloomberg Six Month Target Duration US Treasury ETF (XHLF) Bondbloxx’s most popular strategy. With over $1B in assets, XHLF’s AUM has more than doubled since the issuer won the award. The strategy aims to provide exposure to the short end of the yield curve at a 0.03% expense ratio.

Download Visual | View & Modify in YCharts

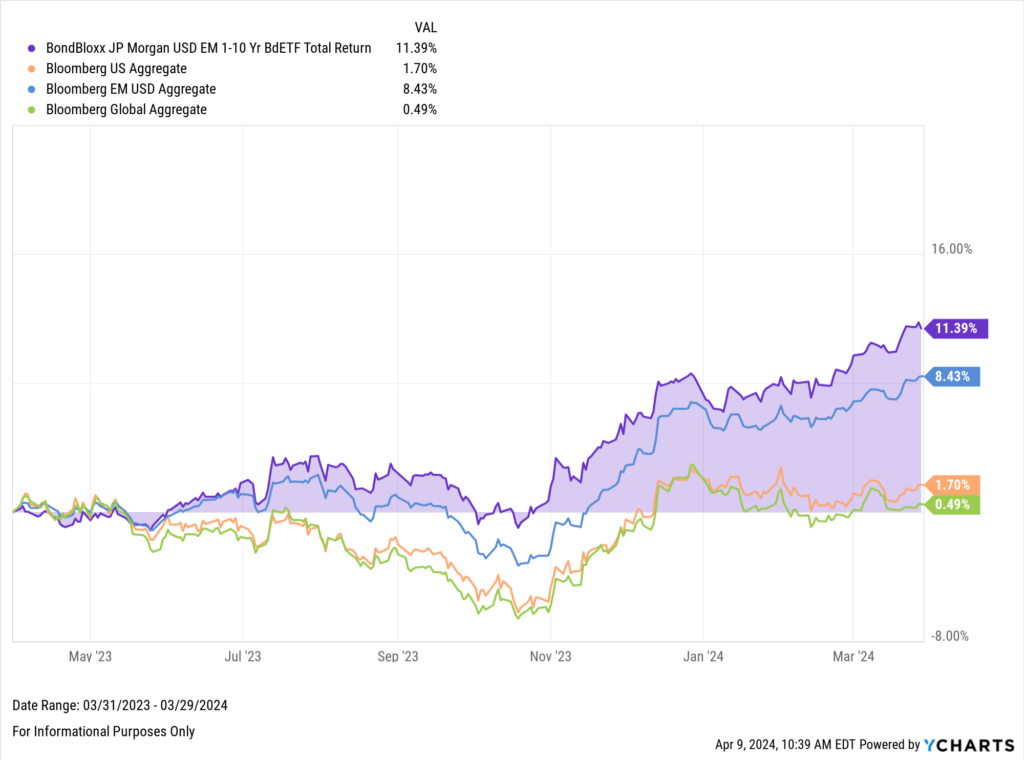

BondBloxx’s third most popular fund, the BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF (XEMD), won Best New International/Global Fixed Income ETF last year. The strategy targets short and intermediate-term maturity across emerging markets. And with higher rates in every region worldwide except Asia, it’s unsurprising to see XEMD outperform several fixed-income benchmarks over the past year.

Download Visual | View & Modify in YCharts

Here’s the 2024 complete list of finalists for the Best New ETF Issuer of the Year crown:

- Calamos Investments: 4 ETFs

- Madison Investments: 4 ETFs

- Morgan Stanley Investment Management: 14 ETFs

- Panagram Structured Asset Management: 2 ETFs

- Tema ETFs: 7 ETFs

Followed by the 2024 finalists for the Best New International/Global Fixed Income ETF:

- Defiance Israel Bond ETF (CHAI)

- Dimensional Global Credit ETF (DGCB)

- Franklin Templeton Western Asset Bond ETF (WABF)

etf.com has a proven track record of recognizing and honoring innovative and timely strategies that benefit both advisors and investors. As we eagerly anticipate the unveiling of the 2024 winners, it’s crucial for advisors and asset managers to stay informed and equipped with the right tools. Start a free trial on YCharts for comprehensive insights and resources to navigate the ETF landscape effectively. From visualizing market trends to crafting custom sales collateral, YCharts empowers you to engage clients and drive AUM growth.

Join us on April 17th for the etf.com awards ceremony and witness the celebration of excellence in the ETF industry. Don’t miss this opportunity to chart a path to success in the dynamic world of ETFs!

1. Interested in doing further ETF research with YCharts??

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Download a copy of The Best Performing ETFs of 2023 to compare strategies across size, style, and sector:

Get your copy of The Best Performing ETFs of 2023 here:Disclaimer

©2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Monthly Market Wrap: March 2024Read More →