Triple Threat: Crypto Crash, China’s Rare Earth Gambit, and Government Shutdown Shake Markets

Financial Data as of October 10, 2025

Introduction: A Perfect Storm

Friday, October 10, 2025, will be remembered as one of the most turbulent trading sessions of the year. What began as a routine morning transformed into a market rout when President Trump’s 10:57 AM social media post threatening “massive” tariff increases on China sent shockwaves through global markets. The announcement came just one day after China unveiled its most aggressive rare earth export restrictions to date, targeting critical materials essential for semiconductors, electric vehicles, and defense technologies.

Meanwhile, the U.S. government shutdown dragged into its tenth day with no end in sight, furloughing 900,000 federal workers and raising concerns about economic data blackouts and disrupted government services. This toxic combination of geopolitical tensions, supply chain vulnerabilities, and domestic political dysfunction created a cascade effect across asset classes. The S&P 500 suffered its worst single-day decline since April, while cryptocurrency markets experienced what analysts called “the largest liquidation event in crypto history.” Investors now face fundamental questions about trade policy stability, critical mineral security, and the resilience of U.S. institutions in an increasingly fractured global landscape.

Table of Contents

The Cryptocurrency Meltdown

The cryptocurrency market collapsed with stunning velocity on October 10, 2025, as Trump’s tariff announcement triggered a panic sell-off that obliterated over $19 billion in trading value within 24 hours. Bitcoin, which had been trading near $125,000 just days earlier following a record-breaking rally, plunged 12% to briefly touch $108,000 before finding support. By market close, BTC stabilized around $110,000, but the damage was done. Ethereum suffered an even more brutal 16% collapse, falling below $3,700 as traders rushed to exit positions. The altcoin carnage was merciless: XRP, Solana, and Dogecoin crashed between 20% and 30%, while smaller tokens like Cardano, Chainlink, and Aave experienced apocalyptic 40% declines.

| Cryptocurrency | Peak Price | Low Price (Oct 10) | 24-Hour Decline |

|---|---|---|---|

| Bitcoin (BTC) | $125,000 | $108,000 | -12% |

| Ethereum (ETH) | $4,400 | $3,700 | -16% |

| XRP | $3.50 | $2.57 | -27% |

| Solana (SOL) | $275 | $193 | -30% |

| Dogecoin (DOGE) | $0.29 | $0.21 | -28% |

| Cardano (ADA) | $1.18 | $0.71 | -40% |

| Chainlink (LINK) | $32 | $19 | -41% |

| Aave (AAVE) | $413 | $248 | -40% |

|

Powered by

|

|||

What made this crash particularly devastating was the liquidation cascade it unleashed across overleveraged positions. According to CoinGlass, approximately $7 billion in leveraged long positions were forcibly liquidated, with some analysts suggesting the true figure approached $19 billion when including all crypto derivatives. The timing proved catastrophic for traders who had piled into Bitcoin at all-time highs, betting on continued momentum following September’s impressive rally. Trading volumes surged 758% above normal levels as exchanges struggled to process the tsunami of sell orders. Some analysts pointed to a coordinated attack on Binance’s Unified Account margin system, where certain proof-of-stake derivatives and yield-bearing stablecoins used as collateral saw prices collapse far below levels on competing exchanges.

Crypto-related equities bore the brunt of investor flight. Coinbase (COIN) plummeted, closing at $387 on October 10 after a week of volatile trading that saw the stock swing wildly on shifting sentiment. MicroStrategy (MSTR), with its massive Bitcoin treasury holdings, traded near $330, down 26% since July as investors questioned the company’s aggressive accumulation strategy. Mining stocks Marathon Digital (MARA) and Riot Platforms (RIOT) each shed significant value as Bitcoin’s price decline directly impacted their mining economics.

By October 13, Bitcoin had recovered to approximately $115,190, representing a modest 5.2% bounce from Friday’s lows. However, technical analysts warn that the market structure remains fragile. The 365-day exponential moving average now sits at a critical support level, and Bitcoin dominance metrics suggest institutional money is rotating out of riskier altcoins and into safer havens. Options markets show elevated implied volatility, indicating traders expect continued turbulence ahead. With China-U.S. trade tensions unresolved and macroeconomic uncertainty mounting, the cryptocurrency sector faces its most challenging environment since the 2022 bear market.

China’s Rare Earth Export Ban

On October 9, 2025, China’s Ministry of Commerce unveiled “Announcement No. 61 of 2025,” implementing the most comprehensive rare earth export restrictions in modern trade history. The new rules, effective December 1, 2025, expand upon earlier April 2025 restrictions by adding five critical elements: holmium, erbium, thulium, europium, and ytterbium. Combined with the seven elements already under control, China now regulates exports of 12 of the world’s 17 rare earth elements. More significantly, Beijing employed the foreign direct product rule (FDPR) for the first time, requiring licenses for any product globally that contains more than 0.1% Chinese-sourced rare earths or was manufactured using Chinese extraction technologies. This extraterritorial reach fundamentally disrupts global supply chains.

| Rare Earth Element | Restriction Date | Key Applications |

|---|---|---|

| Samarium | April 2025 | Permanent magnets, nuclear reactors |

| Gadolinium | April 2025 | MRI contrast agents, nuclear reactors |

| Terbium | April 2025 | Green phosphors, solid-state devices |

| Dysprosium | April 2025 | High-performance magnets, hybrid vehicles |

| Lutetium | April 2025 | PET scan detectors, high-refractive glass |

| Scandium | April 2025 | Aerospace alloys, solid oxide fuel cells |

| Yttrium | April 2025 | LEDs, superconductors, cancer treatment |

| Holmium | October 2025 | Laser surgery, nuclear control rods |

| Erbium | October 2025 | Fiber optic amplifiers, lasers |

| Thulium | October 2025 | Portable X-ray devices, solid-state lasers |

| Europium | October 2025 | Red phosphors in displays, euro banknotes |

| Ytterbium | October 2025 | Stainless steel, fiber lasers |

|

Powered by

|

||

The strategic timing was unmistakable. Announced just weeks before Trump’s planned meeting with President Xi Jinping at the Asia-Pacific Economic Cooperation summit in South Korea, the restrictions gave Beijing maximum leverage in trade negotiations. China controls approximately 90% of global rare earth processing capacity and 70% of raw material production. These elements are indispensable for manufacturing semiconductors, electric vehicle motors, wind turbines, smartphone displays, and advanced weapons systems including F-35 fighter jets, Tomahawk missiles, and Virginia-class submarines. Pentagon officials privately acknowledge that U.S. defense contractors face critical shortages, with some production lines already experiencing delays despite not yet being subject to formal export denials.

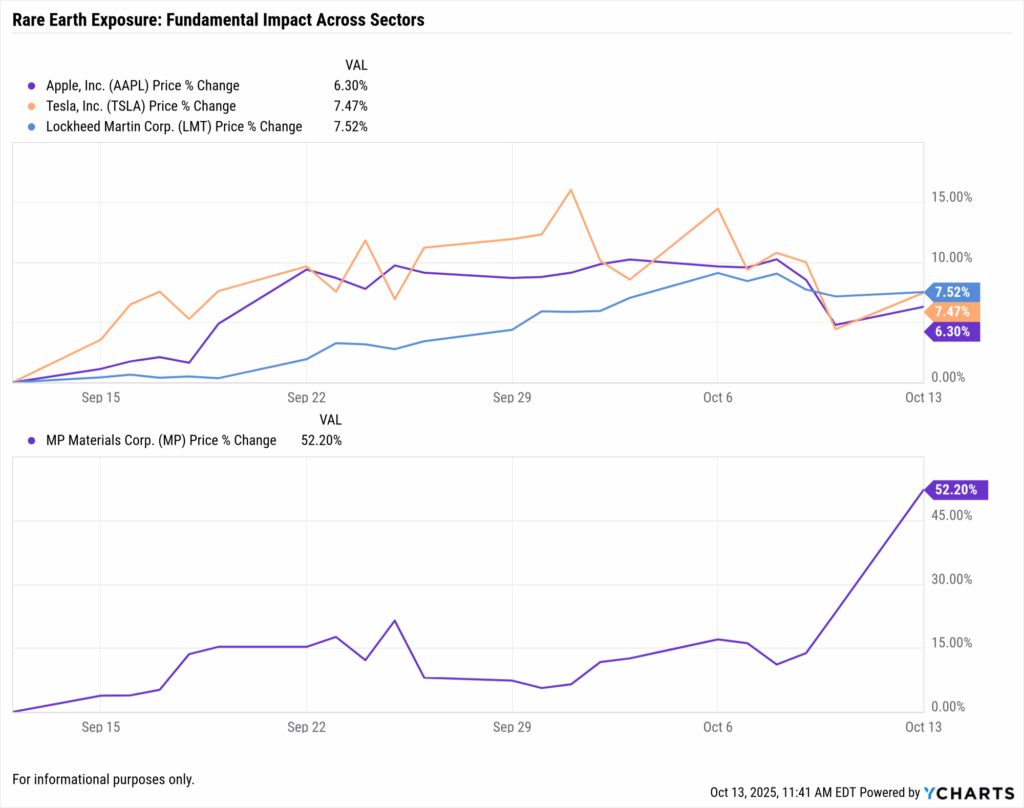

The immediate market reaction highlighted which sectors face the greatest vulnerability. MP Materials (MP), America’s only integrated rare earth mining and processing operation, surged as investors bet on domestic supply chain development. The company received a $400 million equity investment from the Department of Defense in July 2025, making the Pentagon its largest shareholder. MP Materials’ Mountain Pass, California facility is racing to establish end-to-end production capacity, but analysts note it won’t produce more than 1,000 tons of neodymium-iron-boron magnets by year-end 2025—less than 1% of China’s 138,000-ton annual output.

Technology giants face acute exposure. Apple (AAPL) relies heavily on rare earth magnets for iPhone speakers, Taptic Engines, and MagSafe components. The company announced a $500 million supply agreement with MP Materials in July, but diversification efforts remain years from fruition. Tesla (TSLA) announced progress toward rare-earth-free permanent magnet motors, yet current Model 3 and Model Y production still depends on Chinese-supplied materials. Ford (F) and other legacy automakers face similar constraints as they accelerate electric vehicle production targets.

Defense contractor Lockheed Martin (LMT) must now navigate not only the government shutdown’s impact on contract payments but also potential rare earth shortages that could delay critical weapons deliveries. The Center for Strategic and International Studies warns that China’s restrictions specifically target companies affiliated with foreign militaries, essentially barring U.S. defense firms from accessing Chinese rare earth supplies. This creates an unprecedented supply chain crisis for programs like the F-35, which requires 920 pounds of rare earth elements per aircraft. Alternative sources exist—Australia’s Lynas Rare Earths, Canadian deposits, and Greenland’s reserves—but developing these into production-ready operations requires 5-10 years and tens of billions in capital investment.

Government Shutdown Fallout

The federal government entered its 13th consecutive day of shutdown on October 13, 2025, with Congress and the White House locked in an intractable standoff over Affordable Care Act subsidy extensions. The impasse began when funding expired at 12:01 AM on October 1 after Senate Democrats rejected a House-passed continuing resolution, demanding that Republicans agree to extend expiring ACA health insurance subsidies through 2025. Senate Minority Leader Chuck Schumer characterized the Democratic position as defending healthcare access for millions, while Republican leaders accused Democrats of holding essential government services hostage for partisan healthcare policy gains. President Trump further escalated tensions on October 10 by authorizing “substantial” federal employee layoffs, with over 4,000 workers receiving reduction-in-force notices from agencies including the CDC, NIH, and Department of Education.

The shutdown’s economic impact compounds daily. Approximately 900,000 federal employees sit furloughed without pay, while another 700,000 deemed “essential” continue working but face delayed compensation. The critical October 15 military payroll deadline looms, threatening to leave service members without paychecks for the first time during an active shutdown. Air travel disruptions cascaded through the system as Federal Aviation Administration air traffic controllers called in sick, forcing ground stops at Phoenix Sky Harbor, Nashville International, and a dozen other major airports. The TSA warned of mounting security screening delays as unpaid officers contemplate leaving for private sector jobs. National parks remain accessible but unstaffed, leading to reports of illegal parking, trash accumulation, and dangerous visitor behavior at sites like Great Falls Park in Virginia.

Defense contractors face a particularly acute crisis as the shutdown collides with China’s rare earth restrictions. Lockheed Martin (LMT) maintains operations thanks to multi-year contracts with built-in funding, but new contract awards and modifications sit frozen pending congressional appropriations. The company’s stock showed relative resilience, trading near $511, supported by its 2.9% dividend yield and guidance reaffirmation despite tariff headwinds. RTX (RTX) faces greater pressure, having warned investors of an $850 million tariff impact on 2025 operating profit. The stock trades around $170, down from earlier highs. Northrop Grumman (NOC) missed Q2 earnings expectations badly, sending shares to approximately $622 as investors question whether the shutdown will delay critical B-21 stealth bomber payments.

Government IT services providers face existential threats. Booz Allen Hamilton (BAH) and Leidos (LDOS) derive over 95% of revenue from federal contracts, leaving them completely exposed to shutdown duration. Historical precedent offers mixed comfort. The 2018-2019 shutdown lasted 35 days and cost an estimated $11 billion in economic output, but markets largely shrugged off the disruption. However, 2025’s shutdown arrives amid unprecedented geopolitical tensions and supply chain fragility, potentially amplifying its impact. The Office of Management and Budget’s refusal to guarantee back pay for furloughed workers marks a sharp break from past practice, raising constitutional questions while deepening worker anxiety.

Senate negotiations remain deadlocked, with no votes scheduled until October 15. Speaker Mike Johnson cancelled House sessions for the week, effectively abandoning efforts to broker compromise until political pressure becomes unbearable. Economists warn that if the shutdown extends beyond October 15, GDP growth could contract by 0.2% per week, unemployment claims will spike as contractor layoffs begin, and consumer confidence—already battered by shutdown optics—will crater further. Markets historically rebound quickly once shutdowns resolve, but the confluence of trade war escalation and rare earth supply constraints creates unprecedented downside risk if political dysfunction persists into November.

For a full scope of the US Government Shutdown, read our blog: Government Shutdown October 2025: Analyzing Market Impact and Sector Performance.

The Confluence Effect: When Crises Collide

The simultaneous unfolding of these three crises created a rare market dynamic where traditional safe havens failed to perform their defensive roles. Gold surged 1.1% to $4,044.70 per ounce, but this modest gain paled compared to historical flight-to-safety episodes. The dollar index actually declined 0.2% to 97.54 despite U.S. political chaos, reflecting concerns about American institutional stability. Treasury yields fell only marginally, with the 10-year dropping 4 basis points to 4.11%, suggesting bond markets had already priced in significant risk before Friday’s selloff. The VIX volatility index spiked 31.8% to 21.66, confirming investor panic, yet options positioning data reveals sophisticated money managers view this as a short-term dislocation rather than the beginning of a sustained bear market.

| Safe Haven Asset | Value (Oct 10) | Daily Change | Performance Assessment |

|---|---|---|---|

| Gold | $4,044.70/oz | +1.1% | Modest gain vs historical crisis levels |

| Dollar Index (DXY) | 97.54 | -0.2% | Declined despite U.S. political chaos |

| 10-Year Treasury Yield | 4.11% | -4 bps | Marginal decline, already priced risk |

| VIX (Volatility Index) | 21.66 | +31.8% | Significant spike, elevated fear |

| Japanese Yen | Stable | Flat | Limited safe haven demand |

| Swiss Franc | Stable | Flat | Muted flight-to-quality response |

|

Powered by

|

|||

What makes this moment particularly treacherous is how each crisis amplifies the others. China’s rare earth restrictions would constitute a major supply chain disruption under normal circumstances, but the government shutdown eliminates critical policy coordination mechanisms. The Commerce Department, State Department, and U.S. Trade Representative’s office operate with skeleton crews, unable to conduct the sophisticated diplomatic and industrial policy responses required. Meanwhile, cryptocurrency’s collapse stems directly from Trump’s tariff threats, which themselves were retaliation for China’s rare earth moves—a feedback loop where each escalation begets another. Investors attempting to model outcomes face extraordinary uncertainty because the resolution of any single crisis depends on progress in the others.

Sector rotation patterns reveal how institutional investors are repositioning portfolios. Technology stocks bore the brunt of selling pressure, with the Nasdaq suffering its worst day since April. Chipmakers like Nvidia and AMD plunged 5% and 8% respectively as rare earth concerns compounded existing tariff anxieties. Yet defensive sectors offered little refuge. Healthcare fell despite government shutdown risks theoretically boosting pharma stocks. Utilities underperformed as rising Treasury yields pressured dividend-paying equities. The only true winners were domestic rare earth producers and precious metals, narrow sectors representing a tiny fraction of market capitalization. This lack of effective diversification suggests investors face binary outcomes: either tensions de-escalate quickly, triggering a sharp relief rally, or they continue escalating, forcing much deeper portfolio re-ratings.

Systemic risk indicators remain elevated but not catastrophic. Credit default swap spreads widened modestly, indicating limited contagion concerns in corporate debt markets. Banking sector stability metrics show no stress, with major institutions well-capitalized and liquid. However, private credit markets face scrutiny following automotive parts supplier First Brands’ bankruptcy, which exposed overleveraged lending practices. Jefferies Financial Group’s stock tumbled 4% on Friday and another 6% after-hours as investors questioned exposure levels. If the shutdown extends into late October and economic data releases remain suspended, Fed policymakers will navigate interest rate decisions essentially blind—a scenario with no modern precedent that could amplify market volatility exponentially.

| Company | Ticker | Today’s Change | Primary Impact |

|---|---|---|---|

| Coinbase Global | COIN | -0.1% | Crypto Crash |

| MicroStrategy | MSTR | -26.0% | Crypto Crash |

| MP Materials | MP | +13.0% | Rare Earth Ban |

| Apple Inc. | AAPL | -3.0% | Rare Earth Ban |

| Tesla Inc. | TSLA | -5.0% | Rare Earth Ban |

| Lockheed Martin | LMT | -0.6% | Govt Shutdown |

| RTX Corporation | RTX | +0.7% | Govt Shutdown |

| Northrop Grumman | NOC | +0.5% | Govt Shutdown |

|

Powered by

|

|||

Key Takeaways for Investors

- Crypto Crash: Bitcoin’s 12% plunge and $19 billion in liquidations exposed dangerous leverage levels across the cryptocurrency ecosystem. The recovery to $115,190 remains fragile, with technical indicators suggesting further downside risk if macro conditions deteriorate. Crypto-related equities face sustained pressure until regulatory clarity emerges and institutional confidence rebuilds.

- Rare Earth Ban: China’s export restrictions on 12 of 17 rare earth elements represent the most consequential supply chain threat since the 1970s oil embargoes. Companies with Chinese rare earth exposure face years of supply uncertainty, while domestic producers like MP Materials gained strategic importance. Technology, automotive, and defense sectors must accelerate diversification efforts despite the decade-long timelines required.

- Government Shutdown: The 13-day shutdown enters dangerous territory as the October 15 military payroll deadline approaches. Defense contractors face delayed payments and frozen contract awards, compounding rare earth supply challenges. If the impasse extends beyond mid-October, GDP contraction and unemployment claims will spike, potentially forcing Federal Reserve intervention despite limited policy ammunition.

- Market Interconnection: The confluence of crises eliminated traditional diversification benefits, with correlations across asset classes approaching 1.0 during Friday’s selloff. This suggests markets perceive systemic risk rather than isolated events. The VIX’s 31.8% spike indicates elevated uncertainty, but credit markets remain stable, suggesting investors view current turmoil as temporary rather than the start of a deeper correction.

- Action Item: Investors should maintain defensive positioning until at least one of the three crises shows clear resolution. Focus on companies with minimal China exposure, strong balance sheets to weather government payment delays, and business models insulated from cryptocurrency volatility. Quality dividend payers in essential services sectors offer relative safety, while tactical traders might find opportunities in oversold technology names once selling exhaustion appears.

Conclusion: Navigating Uncharted Waters

The convergence of cryptocurrency collapse, China’s rare earth restrictions, and the U.S. government shutdown represents a stress test of unprecedented complexity for global financial markets. History offers limited guidance because these three crises interact in ways that amplify rather than offset each other’s impacts. Cryptocurrency’s vulnerability to geopolitical tensions, rare earth supply chains’ criticality for both civilian and military technology, and Washington’s political dysfunction all trace back to deeper structural fractures in the post-Cold War global order. Investors cannot simply wait for “normal” to return because the definition of normal is itself being rewritten.

Looking ahead, the near-term path depends heavily on three key catalysts. First, Trump and Xi’s meeting at the Asia-Pacific Economic Cooperation summit later in October could produce a trade truce, though China’s rare earth leverage complicates U.S. negotiating position. Second, the October 15 military payroll deadline may finally force congressional action on the shutdown, particularly if service member protests gain media attention. Third, cryptocurrency markets must demonstrate that the October 10 liquidation cascade truly cleared overleveraged positions rather than merely starting a longer deleveraging cycle. Any two of these three resolving favorably would likely spark a significant relief rally; all three remaining unresolved through November would darken the outlook considerably.

For investors, this environment rewards patience and discipline over aggressive positioning. Companies like Coinbase, Tesla, and defense contractors face headwinds that will take quarters to resolve fully. Meanwhile, businesses with pricing power, minimal China exposure, and government-independent revenue streams should outperform. The S&P 500‘s 2.7% decline on October 10 marked the worst day since April, but historical precedent suggests buying the dip proves profitable once clarity emerges on trade policy and shutdown resolution. The challenge lies in distinguishing between temporary dislocations and permanent regime changes—a task that requires careful monitoring of both price action and evolving fundamental conditions in the weeks ahead.

Ready to Move On From Your Investment Research and Analytics Platform?

Follow YCharts Social Media to Unlock More Content!

Next Article

YCharts Monthly Product Update: September 2025Read More →