Survey Says: Just 60-70% of Advisor Conversations “Click” for Clients

Do clients fully grasp what their advisor is saying during meetings? Are they turning to social media instead of their advisor to get investing questions answered? Apparently, the answer depends on your communication style as an advisor.

In our recent survey of 670+ individuals, How Can Advisors Better Communicate with Clients?, we reveal what has changed about advisor-client relationships since Covid-19 and in particular, clients’ new expectations for communication.

A couple of key findings from the survey: as the frequency of advisor touch points is reduced, clients’ comprehension of meeting topics can suffer. Also, clients turn to outside media sources in greater numbers when their advisor checks in less frequently.

Download the free White Paper to see all our findings:

How much of what’s discussed in a meeting resonates with clients?

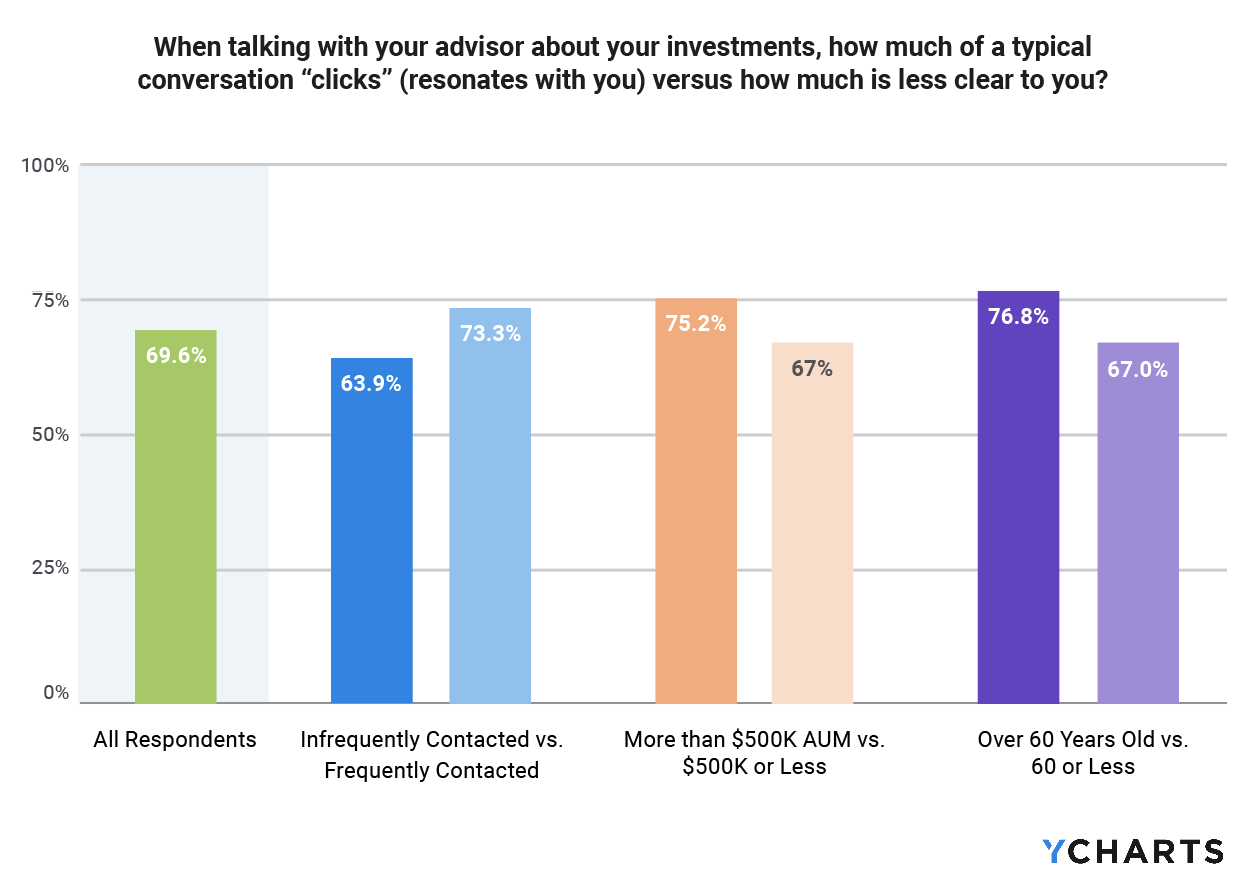

Advisors received decent marks from their clients, with the average respondent saying that 70% of the content in a typical meeting with their advisor resonates or “clicks” for them.

However, those who said previously in the survey that they are contacted infrequently or very infrequently averaged just 63.9% compared to the frequently and very frequently contacted clients for whom 73.3% of the material “clicked”.

It goes to show that frequent communication reinforces concepts discussed during client meetings, which can reduce further uncertainty down the line. Based on responses from clients under 60, the earlier innings of each individual’s financial journey are especially important for building an understanding of investment concepts.

Download: How Can Advisors Better Communicate with Clients?

Where do advisors’ clients go when they have questions?

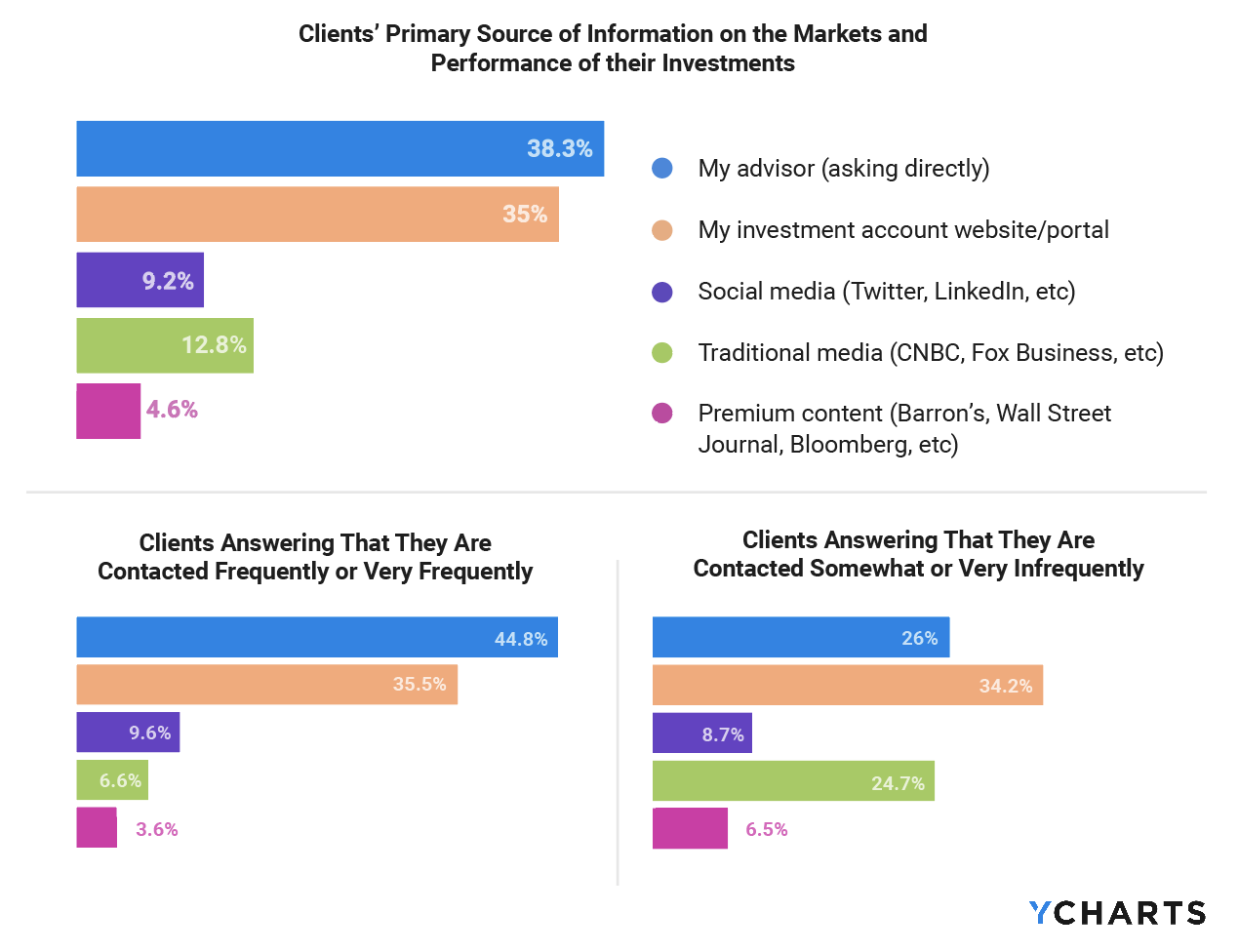

Financial advisors are still the main resource for clients seeking information on the markets and the performance of their portfolios: 73.3% of surveyed clients leverage their advisor or an account portal as their primary source of information.

However, when factoring in contact frequency, clients who say their advisor contacts them infrequently are about four times more likely to consult media sources first, rather than going to their advisor.

Increased contact might help position an advisor as their client’s go-to resource, creating opportunities to add value and reducing the chance that their clients pursue potentially misleading advice from outside sources.

Download: How Can Advisors Better Communicate with Clients?

Download the free White Paper to see all our findings:

Connect with YCharts

To get in touch, contact YCharts via email at hello@ycharts.com or by phone at (866) 965-7552

Interested in adding YCharts to your technology stack? Sign up for a 7-Day Free Trial.

Disclaimer

©2023 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer, or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure