Do ESG Funds Strengthen Investor Portfolios?

Earlier this year the SEC proposed new reporting rules for investment advisors and asset managers regarding environmental, social, and governance (ESG) investments. While the SEC aims to establish standardized disclosure requirements with this rule, if adopted, it would provide investors and advisors with more robust data on which to assess their investment decisions.

But how can advisors make the most of the data available to them? What insights can they offer to clients who raise questions about ESG?

In our latest white paper, Is It Easy Being Green? How ESG-Focused Funds Impact Client Portfolios, we examined key questions about ESG-marketed funds and what’s under their hoods.

Download the free White Paper Is It Easy Being Green? to see our full findings:

Who Are the Big Players in the ESG Game?

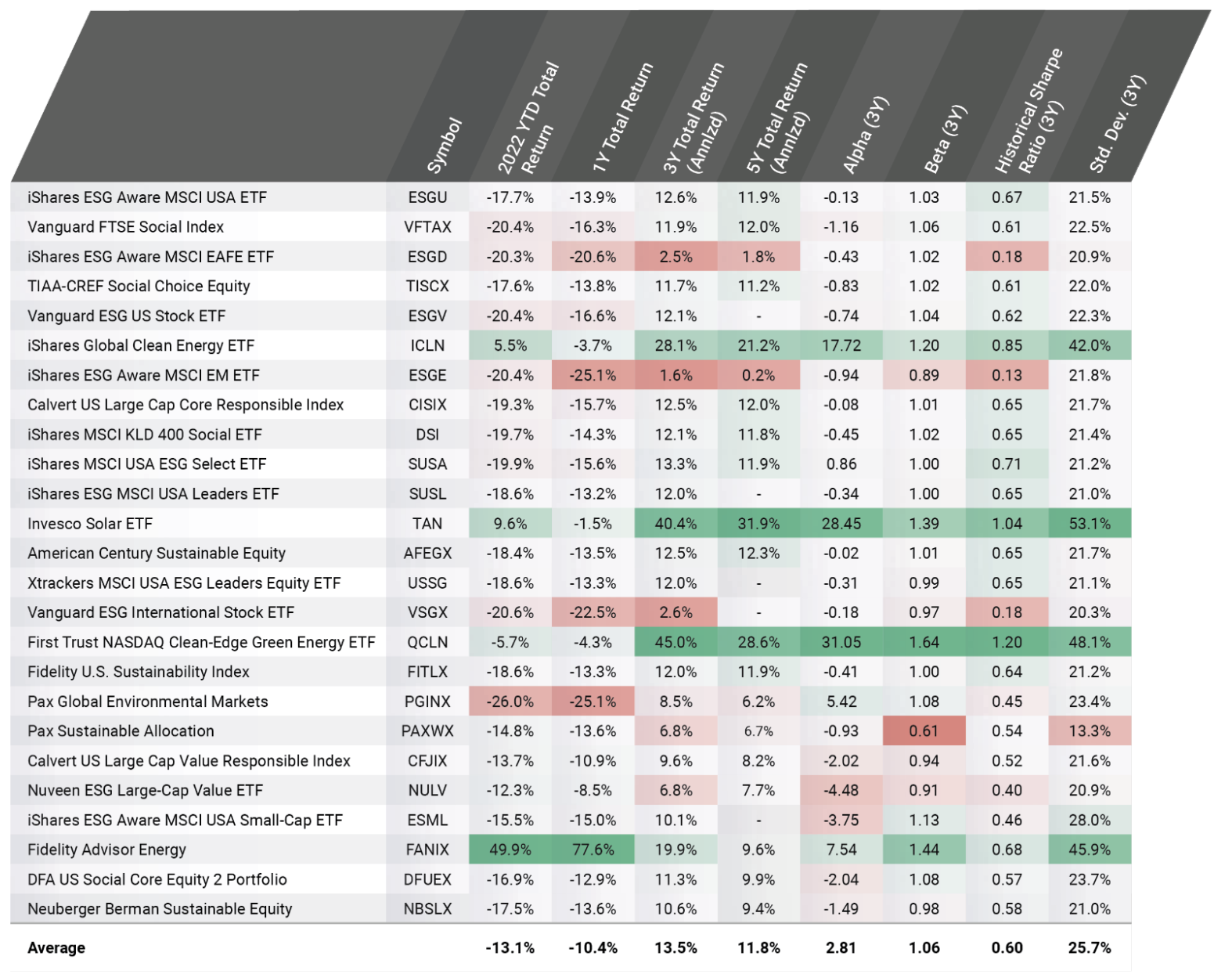

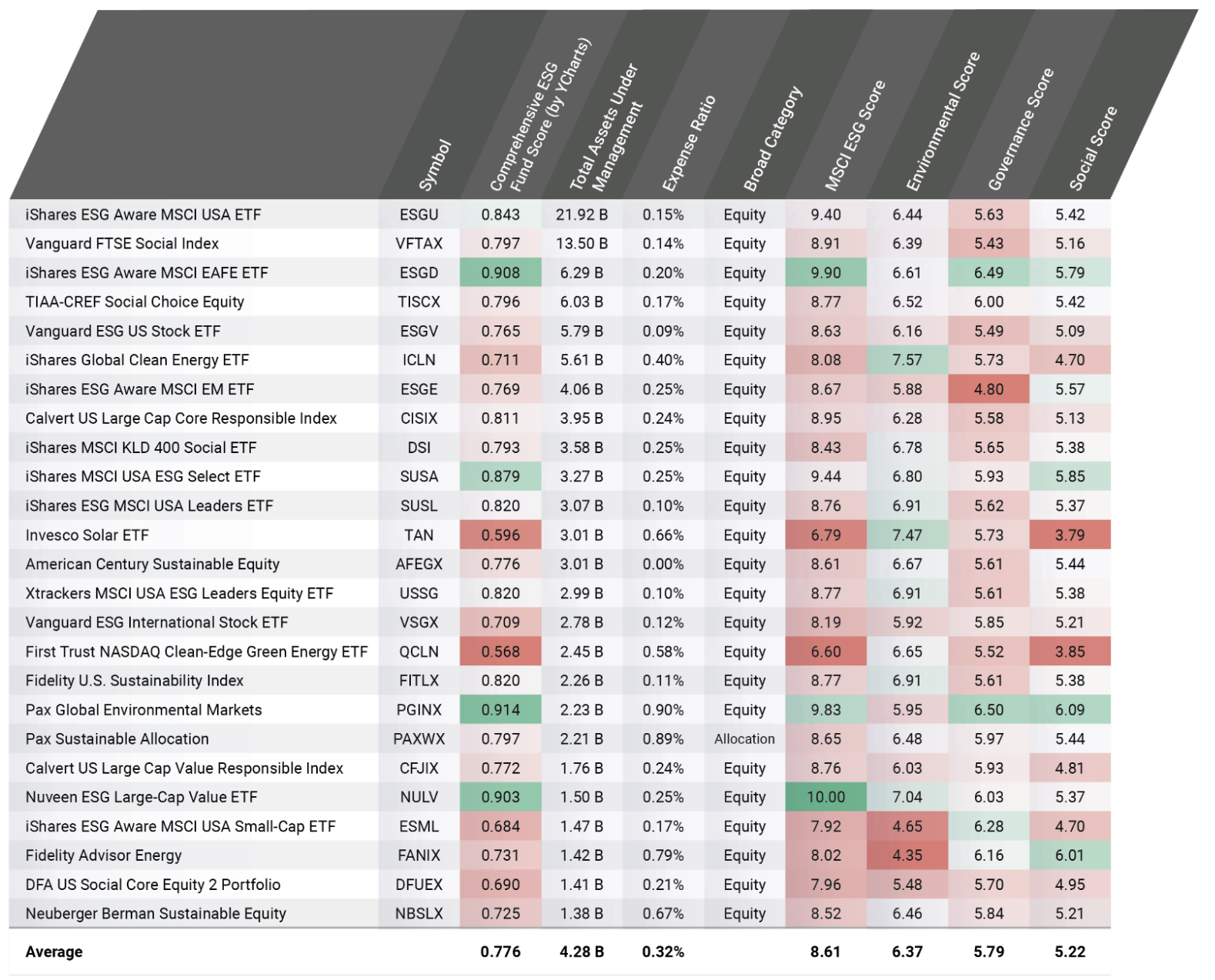

The following mutual funds and ETFs represent the 25 “most popular” ESG-marketed funds, being the largest by assets under management. Many of the funds come from some of the biggest “name brand” asset managers, however, their ESG Scores and ratings don’t particularly stand out among MSCI scoring criteria. On average, these large ESG-marketed funds earned an 8.61 out of 10 ESG Score from MSCI, while the average score for a universe of 4,867 funds (US equity and fixed income funds with at least $100 million in assets) is 7.52.

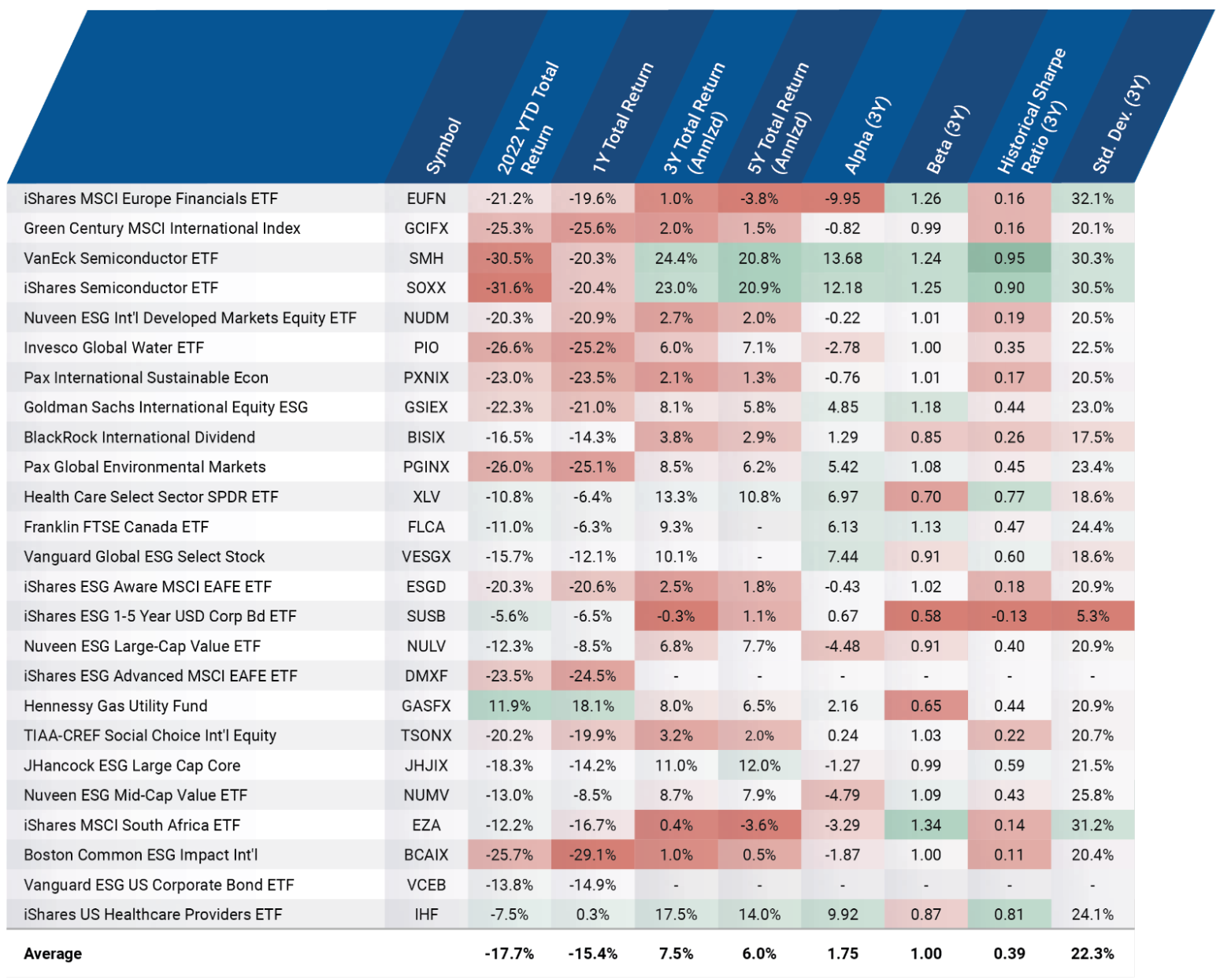

Interestingly, some of the big standout funds with respect to ESG scores and ratings aren’t necessarily labeled with an “ESG” sticker. The following 25 funds have the highest ESG scores among a universe of 4,800+ funds examined, irrespective of ESG marketing language. This data-driven screening process yielded several funds with noticeably higher ESG scores. Of the 25 funds, 13 scored a perfect 10 based on MSCI criteria. Of note, three funds made both the top scoring and the most popular lists:

iShares ESG Aware MSCI EAFE ETF (ESGD)

Nuveen ESG Large-Cap Value ETF (NULV)

Pax Global Environmental Markets (PGINX)

Download the free White Paper Is It Easy Being Green? to see our full findings:

Can ESG Funds Strengthen a Portfolio?

Knowing that ESG-labeled funds don’t always translate into high-ranking ESG scores, how do funds’ performance and risk profiles compare? Based on total returns, Alpha and Beta, Sharpe Ratio, and standard deviation of returns, it seems that the most popular funds are superior to the higher-scoring funds, on average. The average Sharpe ratio of the “most popular” cohort was .21 points higher than that of its “top-scoring” counterpart. Standard deviation, however, came in slightly higher at 25.7% compared to 22.3%.

Notably, funds with top ESG Scores have suffered in line with the broader market. As of August 31, 2022, the S&P 500 was down 16.1% year-to-date and 11.2% year-over-year on a total return basis. The top-scoring ESG cohort averages were -17.7% and -15.4%, respectively.

Download the latest White Paper to learn how ESG Focused Funds Impact Client Portfolios:

Connect with YCharts

To get in touch, contact YCharts via email at hello@ycharts.com or by phone at (866) 965-7552

Interested in adding YCharts to your technology stack? Sign up for a 7-Day Free Trial.

Disclaimer

©2022 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

TSLA's Long Road Ahead, Bond Yields, US v. CAN | What's Trending on YCharts?Read More →