The Hidden Cost of Cash: Why Your Clients’ Dollars Are Losing Value While the Market Gains

Market Data as of: October 13, 2025, Market Close

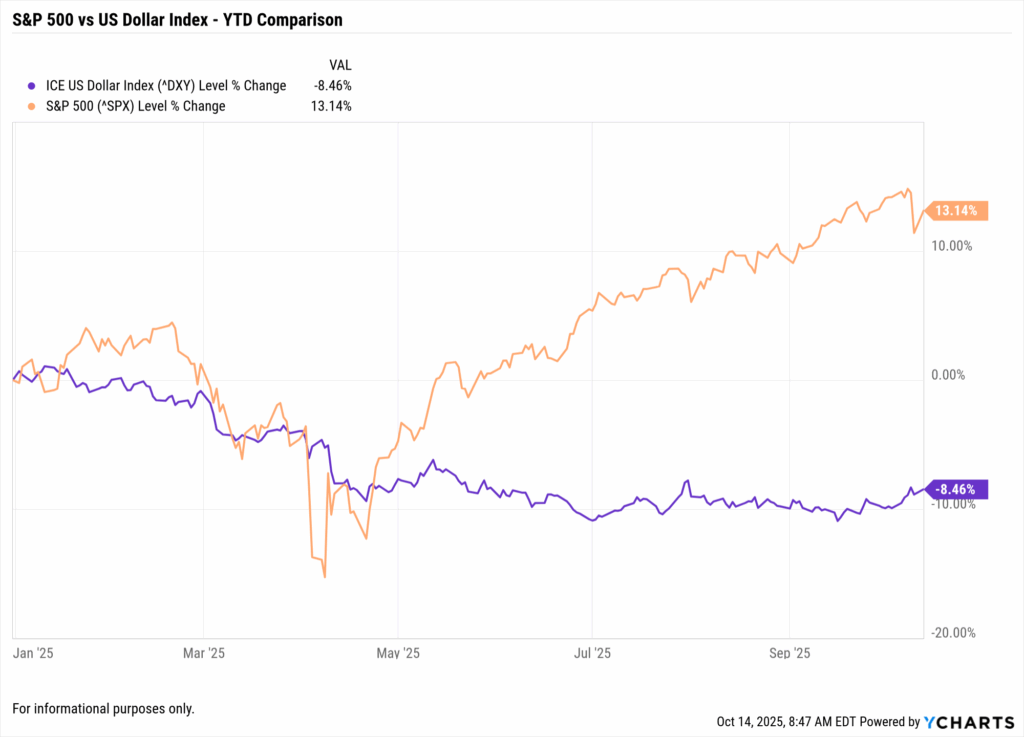

The Dollar’s Decline: What It Means for Your Clients

When the US Dollar Index declines by nearly 9% in a single year, it represents a fundamental shift in purchasing power that many investors fail to recognize. While account balances may remain stable, the value of every uninvested dollar has eroded significantly. This isn’t an abstract economic concept, it has real-world implications for everything from groceries and gasoline to international travel and imported goods.

For advisors, this creates a critical opportunity to educate clients about currency risk. Many investors view cash as the “safe” option, a place to park money without exposure to market volatility. However, in a declining dollar environment, cash positions represent a guaranteed loss of purchasing power. A client sitting on $500,000 in cash has effectively lost $44,350 in real value over the past year, money that simply evaporated due to currency depreciation.

The timing is particularly important because we’re seeing this dollar weakness persist even as the S&P 500 delivers solid returns. This divergence between equity performance and currency strength means that advisors need to reframe the conversation with clients who remain on the sidelines.

Real Returns vs. Nominal Returns: The Numbers That Matter

At first glance, the S&P 500’s 13.13% year-to-date performance appears exceptional. Media headlines tout double-digit gains, and clients may feel they’ve missed out by staying in cash. However, when we account for the dollar’s 8.87% decline, the picture becomes more nuanced. The real return, what investors actually gained in terms of purchasing power, is approximately 4.26%.

This distinction between nominal and real returns is crucial for advisors to communicate effectively. Nominal returns represent the percentage change in account values without adjusting for currency effects or inflation. Real returns reflect what investors can actually purchase with their gains after accounting for the declining value of the dollar.

| Metric | Value | Impact |

|---|---|---|

| S&P 500 Nominal Return YTD | +13.13% | Headline performance |

| US Dollar Index Change YTD | -8.87% | Currency depreciation |

| Real Return (Adjusted) | +4.26% | Actual purchasing power gain |

| $100,000 Cash Position | $100,000 | Unchanged nominal balance |

| Real Value of Cash | $91,130 | After 8.87% dollar decline |

|

Powered by

|

||

Note: Historical returns not indicative of future results. Shown for illustrative purposes only.

The table above illustrates why the conversation about “returns” needs to evolve beyond simple percentage gains. While a 13% market return sounds impressive, the 4% real return tells a more complete story about actual wealth creation. For clients who avoided the market entirely, the situation is even more stark, they’re experiencing a nearly 9% loss in purchasing power despite seeing no change in their account balances.

The Cost of Sitting in Cash

Cash feels safe. It doesn’t fluctuate. Client statements show the same number month after month, creating an illusion of stability. However, this stability is deceptive when the underlying currency is losing value. Consider a client who has maintained a $250,000 cash position throughout 2025. While their account balance hasn’t changed, the real value of that cash has declined to approximately $227,825 in purchasing power terms, a loss of $22,175.

This erosion accelerates over time. If the dollar continues weakening at similar rates, a multi-year cash position could lose 20 to 30% of its purchasing power, even as the nominal account balance remains unchanged. This represents a silent but devastating drain on client wealth that many investors fail to recognize until it’s too late.

Beyond the currency depreciation itself, there’s also the opportunity cost to consider. Money sitting in cash earns minimal interest in most accounts, often well below 1% annually. Meanwhile, diversified portfolios invested in productive assets have the potential to generate returns through dividends, capital appreciation, and compounding growth. The gap between cash returns and asset returns compounds significantly over time, creating an even larger wealth differential.

Conservative Investment Alternatives That Outperform Cash

The solution isn’t necessarily to push conservative clients into aggressive equity portfolios. Instead, advisors should present a range of conservative alternatives that can help preserve purchasing power while managing risk appropriately. Even modest exposure to income-producing or inflation-sensitive assets can make a meaningful difference in long-term outcomes.

Short-duration bonds offer one pathway for risk-averse clients. These instruments provide higher yields than cash while limiting interest rate risk through shorter maturities. Investment-grade corporate bonds, municipal bonds, and Treasury securities can all play a role in constructing portfolios that generate income without excessive volatility.

Balanced portfolios with conservative allocations represent another option. A 30% equity and 70% bond portfolio historically delivers returns in the 4-6% range while maintaining relatively low volatility. For clients with moderate risk tolerance, a 60/40 split can capture more equity upside while still providing ballast through fixed income.

Treasury Inflation-Protected Securities (TIPS) deserve special consideration in environments with currency weakness. These bonds adjust their principal based on changes in the Consumer Price Index, providing direct protection against purchasing power erosion. While TIPS yields may appear modest, they offer something cash cannot: guaranteed inflation protection.

| Strategy | Asset Allocation | Historical Avg Return (10yr) | Risk Level |

|---|---|---|---|

| Short-Term Bond Portfolio | 100% Bonds (1 to 3 year duration) | 2.5-3.5% | Very Low |

| Conservative Balanced | 30% Equity and 70% Bonds | 4-6% | Low |

| Moderate Balanced | 60% Equity and 40% Bonds | 6-8% | Moderate |

| Dividend-Focused Equity | High-quality dividend stocks | 7-9% | Moderate |

| TIPS (Inflation-Protected) | 100% TIPS | Inflation + 1-2% | Very Low |

|

Powered by

|

|||

Note: Historical returns not indicative of future results. Shown for illustrative purposes only.

Dividend-focused equity strategies can also appeal to conservative investors seeking income. High-quality dividend payers, particularly those with histories of consistent dividend growth, offer both income generation and potential capital appreciation. Companies with strong balance sheets and sustainable payout ratios can provide a measure of stability even during market volatility.

The key message for advisors: these conservative alternatives historically outperform cash over meaningful time horizons, especially when accounting for currency depreciation and inflation. The goal isn’t to maximize returns but to preserve and modestly grow purchasing power while managing risk appropriately.

What Advisors Should Do Now

The current environment creates a clear action item for advisors: proactively reach out to clients with large cash positions, particularly those holding more than $100,000 in cash, and schedule conversations about reallocating to conservative investment alternatives.

This isn’t about pushing reluctant clients into risky investments. Rather, it’s about helping them understand that doing nothing has become the riskiest strategy of all. Frame the conversation around protecting purchasing power, not chasing returns. Use visual tools to illustrate how the dollar’s decline affects real wealth, making abstract currency movements concrete and actionable.

YCharts provides powerful visualization capabilities that can transform these conversations. By showing clients side-by-side comparisons of the S&P 500 and US Dollar Index, you can demonstrate exactly how currency movements impact portfolio returns. Custom charts showing nominal versus real returns make the case for action in ways that spreadsheets and verbal explanations cannot.

When conducting these conversations, focus on three key points:

| Key Point | Strategy | Client Message |

|---|---|---|

| 1. Acknowledge Market Concerns | Validate feelings while reframing risk | Market volatility feels uncomfortable, but cash guarantees purchasing power erosion in the current environment. The “safety” of cash is illusory when the underlying currency is weakening. |

| 2. Match Risk Tolerance | Customize conservative alternatives | Not every cash-heavy client needs a 60/40 portfolio. Some may be better served with short-duration bonds or a 20/80 allocation. The goal is incremental progress, not dramatic transformation. |

| 3. Use Specific Numbers | Personalize the impact calculation | If a client has $300,000 in cash, show them the $26,610 in purchasing power they’ve lost year-to-date. Make the cost of inaction tangible and personal, not abstract. |

|

Powered by

|

||

Consider segmenting your client base to prioritize outreach. Start with clients who have: Cash positions exceeding $100,000, No recent portfolio activity or conversations about rebalancing, Expressed concerns about market volatility that led them to raise cash, and Upcoming liquidity needs but excessive cash relative to those needs.

The urgency of these conversations increases if dollar weakness persists or accelerates. While predicting currency movements is difficult, the year-to-date data provides compelling evidence that cash positioning carries meaningful costs in the current environment.

Key Takeaways for Advisors

- Real returns matter more than nominal gains. The S&P 500’s 13.13% year-to-date return shrinks to approximately 4.26% when adjusted for the dollar’s 8.87% decline. Advisors must reframe client conversations to focus on purchasing power, not just account values.

- Cash loses 9% in purchasing power. In a declining dollar environment, cash represents a guaranteed erosion of wealth. Clients holding $100,000 in cash have effectively lost $8,870 in real value despite unchanged account balances.

- Conservative portfolios outperform cash. Even risk-averse strategies like short-duration bonds or 30/70 balanced portfolios historically provide better long-term protection against currency depreciation than cash holdings.

- Proactive outreach is essential. Advisors should systematically reach out to clients with large cash positions, particularly those exceeding $100,000, and schedule conversations about conservative reallocation strategies.

- Use data to drive action. YCharts visualization tools can transform abstract currency discussions into concrete, actionable insights. Show clients the real impact of dollar weakness on their portfolio and demonstrate how strategic asset allocation preserves purchasing power over time.

Conclusion: Time to Act

The divergence between market performance and dollar strength creates both a challenge and an opportunity for financial advisors. While headline returns appear strong, the reality of currency depreciation means many clients are experiencing far more modest wealth growth than they realize. More concerning, clients sitting in cash are suffering silent but significant erosion of purchasing power.

This environment demands proactive advisor engagement. The cost of inaction, both for clients and for advisor relationships, grows with each passing month that substantial cash positions remain uninvested. By initiating strategic conversations about conservative reallocation, advisors can help clients protect wealth while demonstrating the value of professional guidance.

The message to clients should be clear: doing nothing is not a neutral choice. In today’s environment, maintaining large cash positions represents an active decision to accept purchasing power losses. Even conservative investment strategies offer superior long-term outcomes compared to the guaranteed erosion that cash delivers.

Use YCharts to visualize these dynamics, making complex currency relationships accessible and actionable. Show clients the data, walk them through the implications, and present conservative alternatives that align with their risk tolerance. The conversations may be uncomfortable initially, but they’re essential to protecting client wealth and strengthening advisor-client relationships.

The time to act is now. Reach out to your cash-heavy clients this week, schedule strategic reviews, and help them understand why staying invested, even conservatively, remains the best defense against currency depreciation and purchasing power erosion.

Ready to Move On From Your Investment Research and Analytics Platform?

Follow YCharts Social Media to Unlock More Content!

Next Article

Triple Threat: Crypto Crash, China's Rare Earth Gambit, and Government Shutdown Shake MarketsRead More →