Federal Reserve Holds Rates Steady: Market Impacts and Investment Strategies for 2025

Introduction: Navigating the Fed’s Decision to Maintain Interest Rates

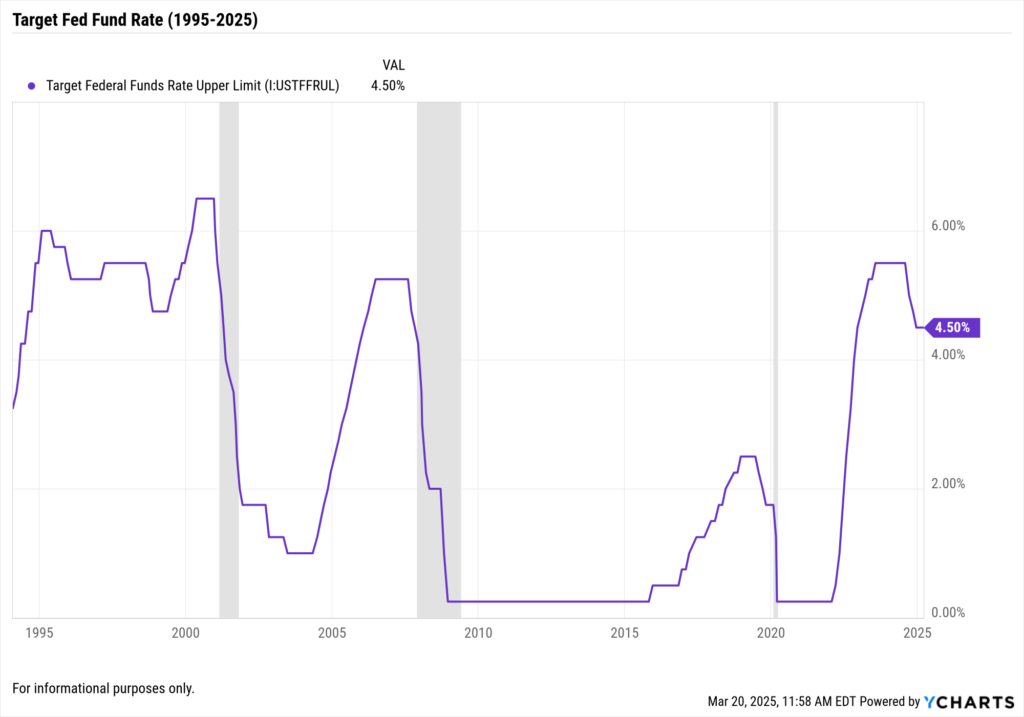

On March 19, 2025, the Federal Reserve announced its decision to keep the federal funds rate unchanged at 4.25% to 4.50%, amid heightened economic uncertainty and revised growth forecasts. This decision reflects the Fed’s cautious approach in response to factors such as ongoing trade tensions and fluctuating inflation rates.

For financial advisors and asset managers, understanding the implications of the Fed’s stance is crucial for effective portfolio management. This blog dives into:

- The market’s immediate response to the Fed’s decision

- Potential scenarios if the Fed maintains its current rate stance

- Strategies for portfolio positioning in a steady-rate environment

Utilizing YCharts’ comprehensive data and analytical tools, we provide insights to navigate this evolving economic landscape.

Market Reactions to the Federal Reserve’s Decision

The Fed’s announcement to hold rates steady has elicited notable responses across various financial markets:

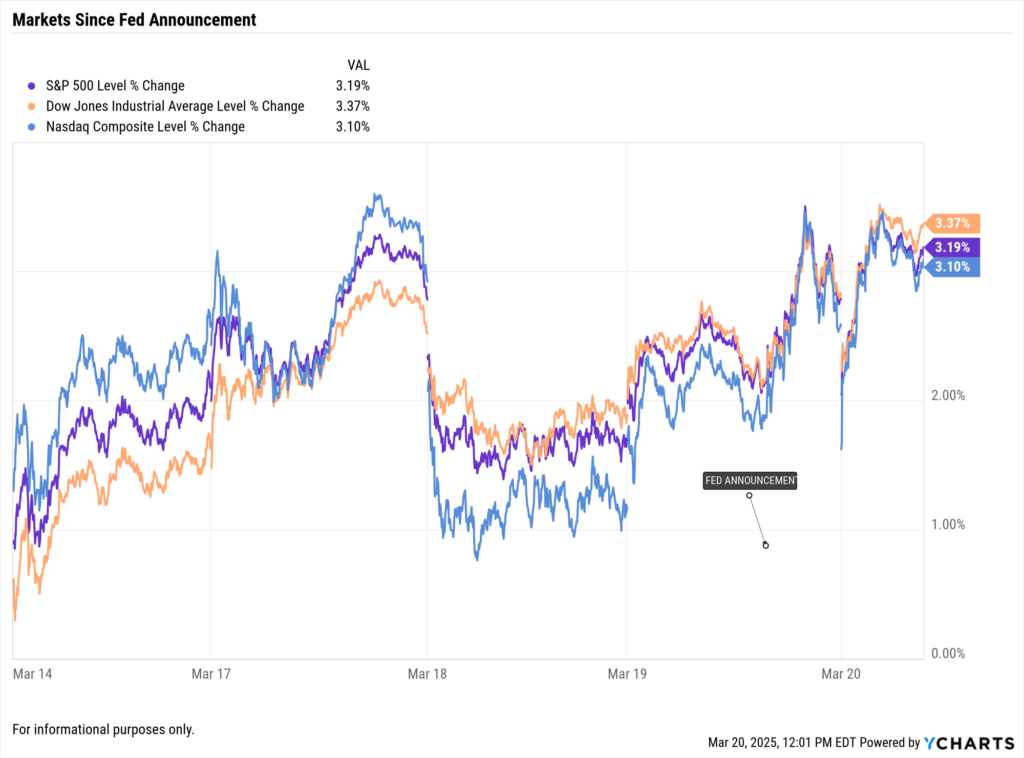

- Equity Markets: Major indices experienced gains following the announcement. The S&P 500 rose by 0.8%, the Dow Jones Industrial Average added 0.5%, and the Nasdaq Composite increased by 1.2%.

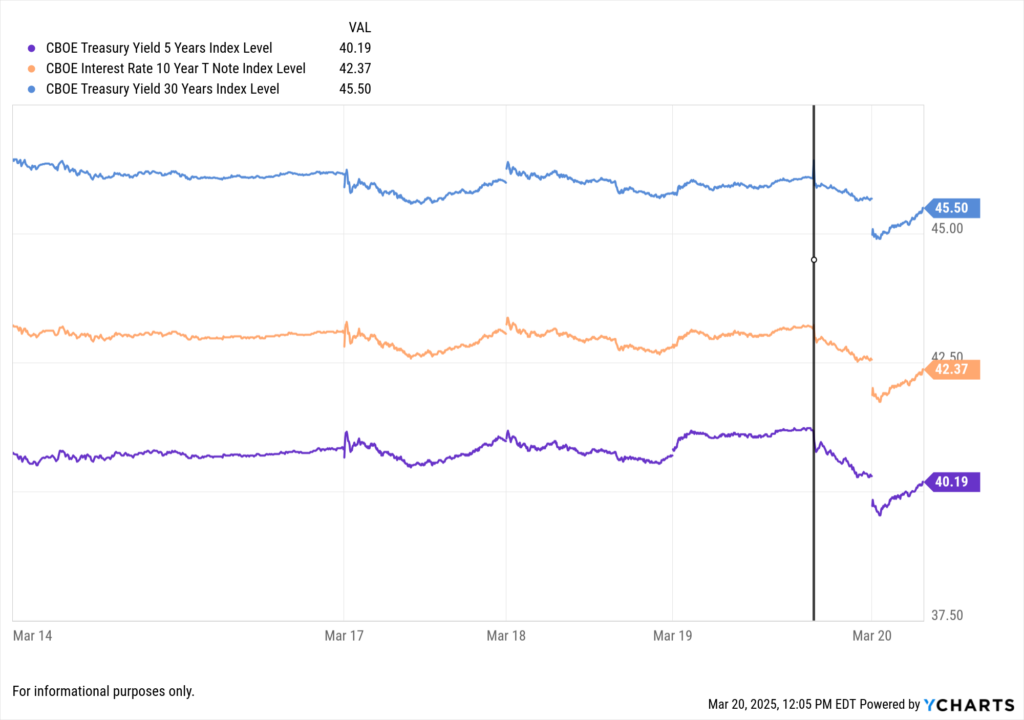

- Bond Markets: Yields on U.S. Treasury notes fell, reflecting increased demand for government debt.

- Currency Markets: The U.S. dollar index experienced minor changes, indicating a cautious market sentiment.

These movements suggest that investors are adjusting their strategies in light of the Fed’s cautious approach and the prevailing economic uncertainties.

Implications of the Fed Maintaining Current Rates

If the Federal Reserve continues to hold interest rates steady, several potential outcomes may influence various asset classes:

- Equity Markets: Prolonged rate stability could lead to increased caution among investors, potentially resulting in elevated volatility. Sectors sensitive to interest rates, such as utilities and real estate, may face headwinds.

- Bond Markets: Stable rates may lead to a flattening yield curve, impacting long-duration bonds. Investors might favor shorter-duration bonds to mitigate interest rate risk.

- Currency Markets: The U.S. dollar could strengthen if other central banks pursue more accommodative policies, affecting the competitiveness of U.S. exports.

Commodity Markets: A stronger dollar may exert downward pressure on commodity prices, including oil and gold, as they become more expensive for holders of other currencies.

Investment Strategies for Advisors and Asset Managers

In light of the Fed’s decision to maintain current interest rates, financial professionals should consider the following strategies:

Fixed Income Allocation Adjustments:

- Short-Duration Bonds: Emphasize short-duration bonds to reduce sensitivity to potential future rate changes.

- Credit Quality: Focus on high-quality corporate bonds to balance yield and credit risk.

Equity Sector Positioning:

- Defensive Sectors: Overweight sectors like consumer staples and healthcare, which tend to be more resilient in uncertain economic conditions.

- Dividend-Paying Stocks: Consider companies with strong balance sheets and consistent dividend payouts to provide income and stability.

Alternative Investments:

- Commodities: Monitor commodities such as gold, which can serve as a hedge against economic uncertainty.

- Real Estate: Evaluate real estate investments that may offer diversification benefits and potential income streams.

Risk Management:

- Diversification: Maintain a well-diversified portfolio to mitigate sector-specific risks.

- Liquidity: Ensure adequate liquidity to capitalize on potential market dislocations.

How YCharts Can Assist Financial Professionals

YCharts offers a suite of tools to help advisors and asset managers navigate the current economic environment:

- Economic Indicators: Access real-time data on inflation, GDP, and employment to inform investment decisions.

- Fundamental Charting Tools: Analyze performance trends across asset classes and sectors to identify opportunities and risks.

- Fixed Income Screening: Utilize the Bond Screener to identify bonds that align with specific duration and credit quality criteria.

- Portfolio Analysis: Employ scenario analysis and stress testing to assess portfolio resilience under various economic conditions.

Conclusion: Strategizing in a Steady-Rate Environment

The Federal Reserve’s decision to hold interest rates steady reflects a cautious approach amid economic uncertainties. For financial professionals, this underscores the importance of adaptable strategies that account for potential market volatility and sector-specific dynamics.

Leveraging YCharts’ comprehensive data and analytical capabilities can enhance investment decision-making processes, enabling advisors and asset managers to effectively navigate the evolving economic landscape.

Whenever you’re ready, here’s how YCharts can help you:

1. Looking to Move On From Your Investment Research and Analytics Platform?

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Unlock Insights Faster with AI ChatRead More →