Federal Reserve’s June 2025 Meeting: What Advisors Must Know

Summary: The Federal Reserve begins its June 2025 policy meeting today (June 17), with its rate decision, updated dot plot, and Chair Powell’s press conference scheduled for Wednesday, June 18. While no policy change is widely expected, financial advisors must be prepared for key signals about the second half of the year. With inflation easing, economic growth slowing, and tariffs re-emerging as a wildcard risk, the Fed finds itself at a turning point.

Markets are bracing for what could be a pivotal message. The June meeting may solidify whether the Fed sees a need to cut later in 2025—or stay higher for longer due to inflation and policy uncertainty.

This blog covers:

- • What key macro data is shaping the Fed’s June outlook

- • How gold, yen, and Treasury yields are reacting to rate speculation

- • Portfolio positioning ideas advisors can implement right now

- • How tariffs could reshape monetary policy strategy

- • YCharts tools to visualize and communicate your insights to clients

For a deeper dive into why the Fed paused rates in June and what the updated Fed dot plot projections imply, check out our supporting analysis: “Fed’s June 2025 Rate Pause Explained“

Federal Reserve Market Context – Before the Decision

Markets enter the June FOMC meeting in wait-and-see mode. Inflation is falling, growth is cooling, and new trade-related risks, especially tariffs, are complicating the picture.

Retail Sales for May surprised to the downside, falling 0.9% vs. expectations of 0.1%, the second consecutive decline. This suggests consumer demand may be weakening, raising the odds of slower growth in Q2. Meanwhile, May nonfarm payrolls rose 139,000, slightly above expectations, but less than April’s revised 177,000. Wage growth ticked up to 3.9% year-over-year. These data points point to a resilient, but gradually cooling labor market.

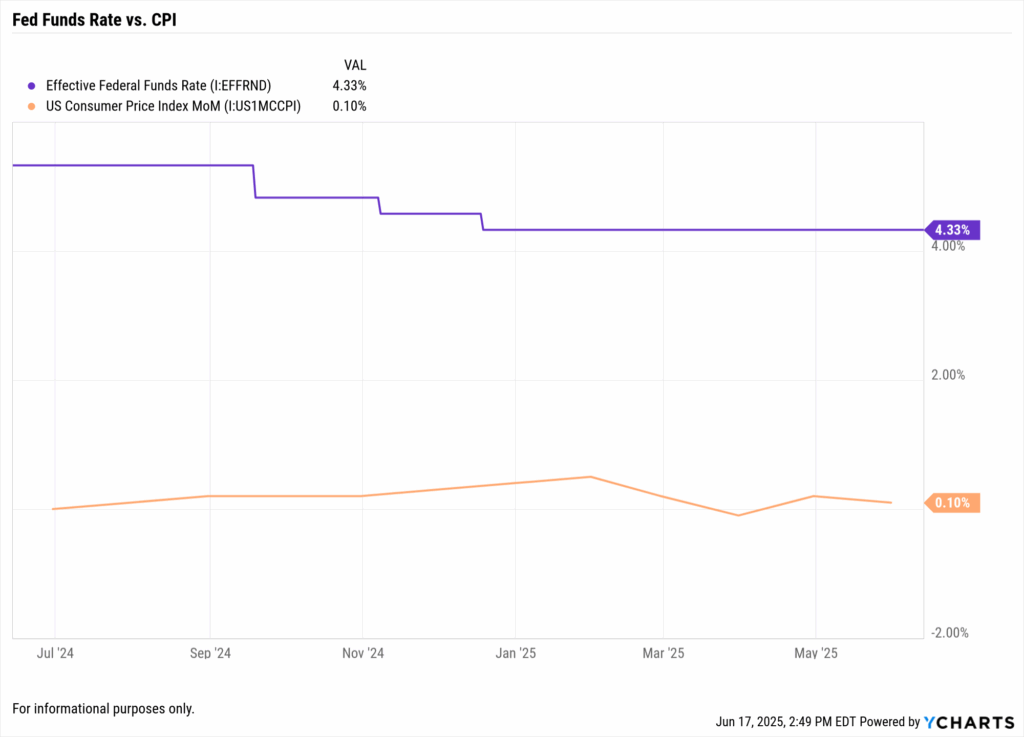

Inflation, as measured by CPI, is now running around 2.4% year-over-year for headline, and ~2.8% for core. This represents meaningful progress from peaks above 6% in 2023. However, tariffs remain a wildcard. The Trump administration’s reciprocal tariff policies, implemented in April and currently under a 90-day pause, could reignite price pressures later this summer. Several Fed officials have already flagged these risks in public comments, suggesting that a cautious approach remains warranted.

Market Expectations: Fed funds futures currently price in no rate cut at this meeting, with about 65% odds of a cut by September, and two total cuts priced in by year-end. However, the updated dot plot, to be released tomorrow, will provide critical insight into how the Fed’s own expectations are shifting. Markets will also scrutinize Chair Powell’s tone during the press conference for signs of dovishness or concern about tariff-fueled inflation.

➡ See: For a deeper dive into what the Fed’s dot plot means for rate expectations, portfolio positioning, and client conversations.

Asset Focus – Gold, Yen, and Treasuries

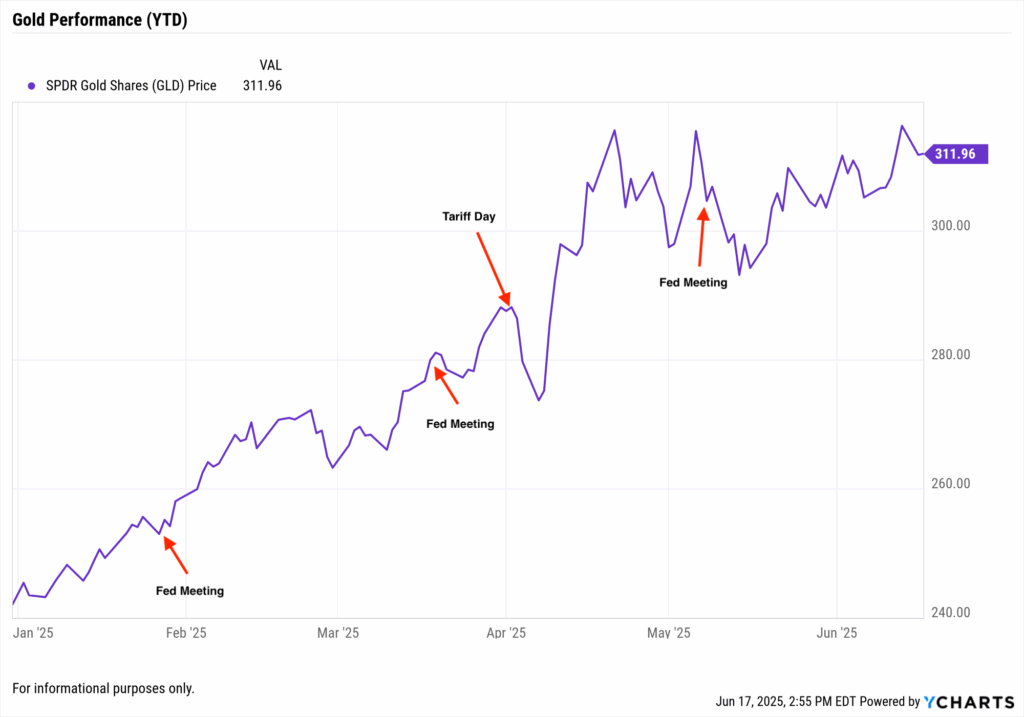

Gold (GLD)

Gold prices remain elevated, reflecting both economic and geopolitical uncertainty. The SPDR Gold Shares (GLD) is trading near $310, down slightly from its $315 April peak, which coincided with the start of the tariff standoff.

Gold has historically performed well when:

- • Real rates are low or declining

- • Inflation is sticky

- • Investors seek protection from volatility or currency devaluation

If the Fed signals concern about growth or potential easing, gold may test new highs. If the Fed stays hawkish, gold may consolidate, but strong demand from central banks and retail buyers may provide support.

➡ See: [Tariff Shock: Top S&P 500 Winners and Losers (April 2–16, 2025)]

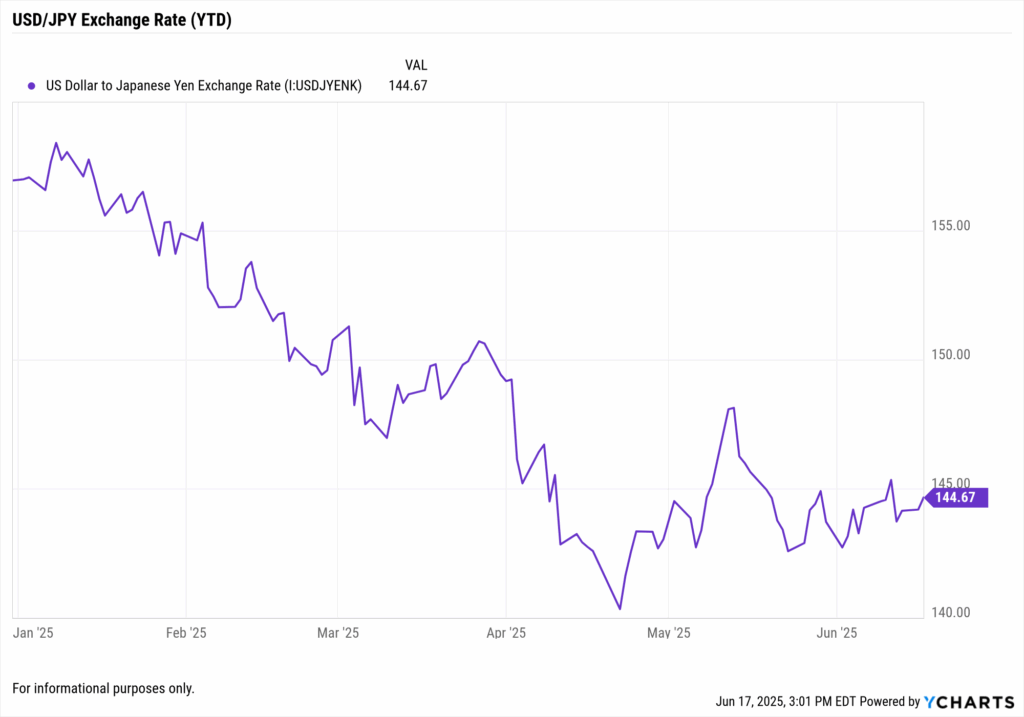

Japanese Yen (USDJPY=X)

The yen has depreciated against the dollar in 2025, trading near ¥145/USD, as Japan’s ultra-loose monetary policy continues. But sudden safe-haven flows in April (during the first week of tariffs) showed the yen’s ongoing relevance.

If the Fed sounds dovish, the dollar may weaken, giving the yen a short-term boost. A hawkish Fed will likely continue to suppress yen strength.

Advisors managing international allocations should monitor USDJPY as a volatility barometer.

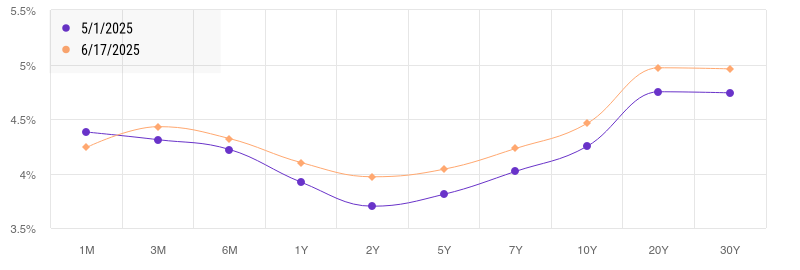

Treasuries (TLT)

Long-dated bonds have faced sharp moves in 2025. In April, TLT plunged more than 3% in a day, despite rising rate-cut expectations—highlighting the impact of supply concerns and tariff-induced inflation fears.

Ahead of the June Fed meeting:

- The 10-year yield is stable near 4.4%

- The 2s/10s curve remains inverted

- Volatility in bond markets is low, but fragile

Advisors should prepare for duration sensitivity. A dovish Fed may push yields lower; a hawkish stance or revived tariffs may trigger a sharp yield rebound.

➡ See: [TLT Plunges Despite Fed Rate Cut Expectations: What’s Driving Bond Market Volatility?]

Portfolio Strategy – Positioning into the Fed Meeting

1. Stay Flexible on Duration

If the Fed holds steady but signals concern about growth, duration-sensitive bonds may rally. If tariffs resurface or inflation expectations pick up, yields could spike. Advisors should maintain flexibility: overweight short-term fixed income (e.g., T-Bills) for capital preservation, while slowly scaling into longer-duration positions if recession risk rises.

2. Evaluate Equity Sector Rotation

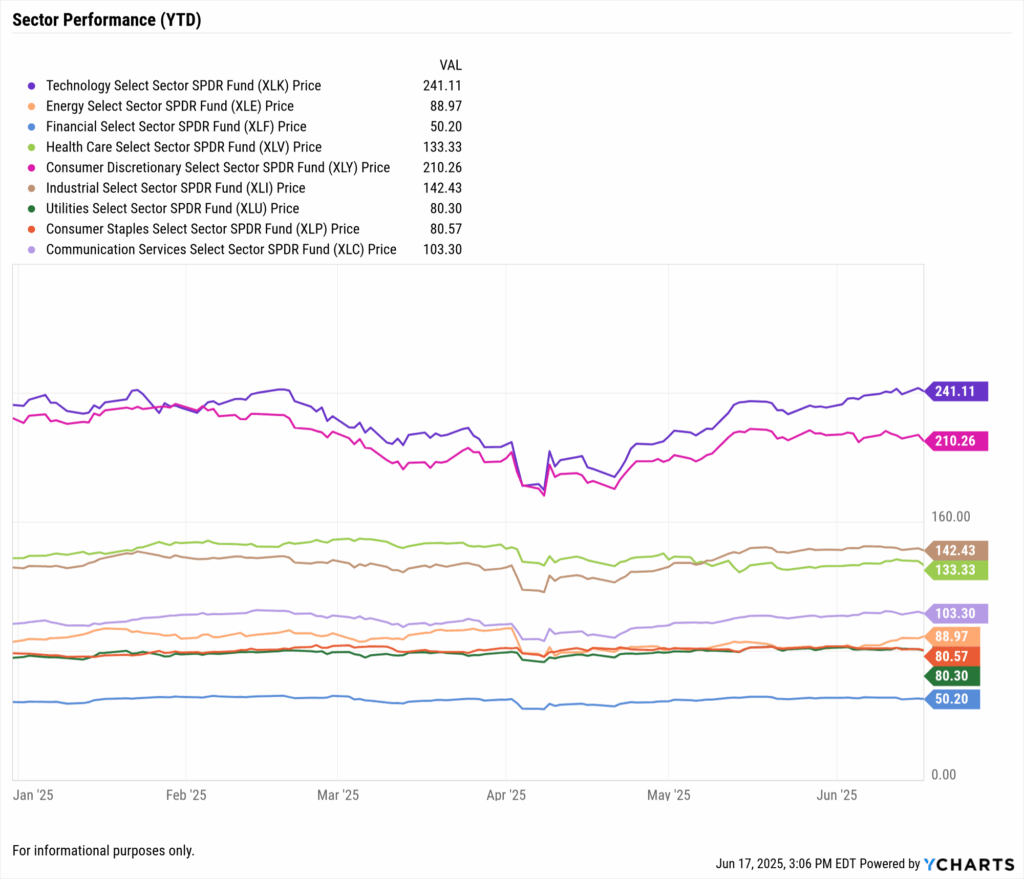

Sectors like Technology and Consumer Discretionary could continue leading if the Fed pivots dovish. But if tariffs return in July, more cyclical and internationally exposed sectors could suffer. Advisors might consider shifting modestly into defensive sectors like Utilities, Healthcare, or Consumer Staples, while remaining selective in growth allocations.

➡ See: [Why Treasury Yields Are Spiking and What It Means for Your Portfolio]

3. Use Gold and Cash as Volatility Buffers

Gold remains a core hedge in portfolios — especially with monetary policy at an inflection point and tariffs threatening price stability. Cash and ultra-short instruments also allow dry powder for future rebalancing.

➡ See: [Trump Tariffs 2025: One Week In and a 90-Day Pause – What Advisors Should Know]

4. Stress-Test for Inflation Surprises

Use forward-looking scenario planning. What happens if tariffs are reinstated in July and CPI reaccelerates? What if growth slows faster than expected? Advisors should prepare clients for either scenario — and explain the logic behind a diversified, risk-aware portfolio.

➡ See: [TLT Plunges Despite Fed Rate Cut Expectations: What’s Driving Bond Market Volatility?]

Conclusion

Advisors are entering the June 2025 Fed decision with many variables in play; economic deceleration, falling inflation, and uncertainty around tariffs and trade policy. The meeting on June 18 won’t just deliver a rate hold or hike; it will offer a forward-looking roadmap for the rest of the year.

Whether the Fed leans dovish or hawkish, your clients need context. They need to understand why your strategy is data-driven — and how you’re preparing for both inflation surprises and recession risks.

YCharts helps you deliver that clarity. With economic overlays, rate and inflation trend charts, sector analysis, and macro dashboards, YCharts gives you the storytelling edge in real-time, before your clients even ask.

Whenever you’re ready, here’s how YCharts can help you:

1. Looking to Move On From Your Investment Research and Analytics Platform?

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Inflation Week 2025: What Advisors Need to Know Ahead of CPI & PPI ReleasesRead More →