How New U.S. Tariffs Could Create Winners: Companies Positioned to Benefit from Trade Policies

Introduction: Why Tariffs Can Be a Catalyst for Certain Companies

The recent announcement of new U.S. tariffs on imports from Canada, Mexico, and China is already stirring economic debate. While tariffs typically increase costs for businesses reliant on imports, they can also create opportunities for domestic companies that benefit from reduced foreign competition or government incentives.

For financial advisors and asset managers, understanding which sectors stand to gain from these policy changes is crucial for identifying investment opportunities and mitigating portfolio risks.

This analysis will highlight:

- The industries and companies that could benefit from tariff-related protectionism

- Key ETFs and funds with exposure to these outperforming sectors

- How financial professionals can navigate investment strategies in response to changing trade dynamics

Read here for an updated insight to how the market has responded to the US’s 2025 Tariffs and which winner’s they have created.

Industries & Companies Positioned to Benefit from Tariffs

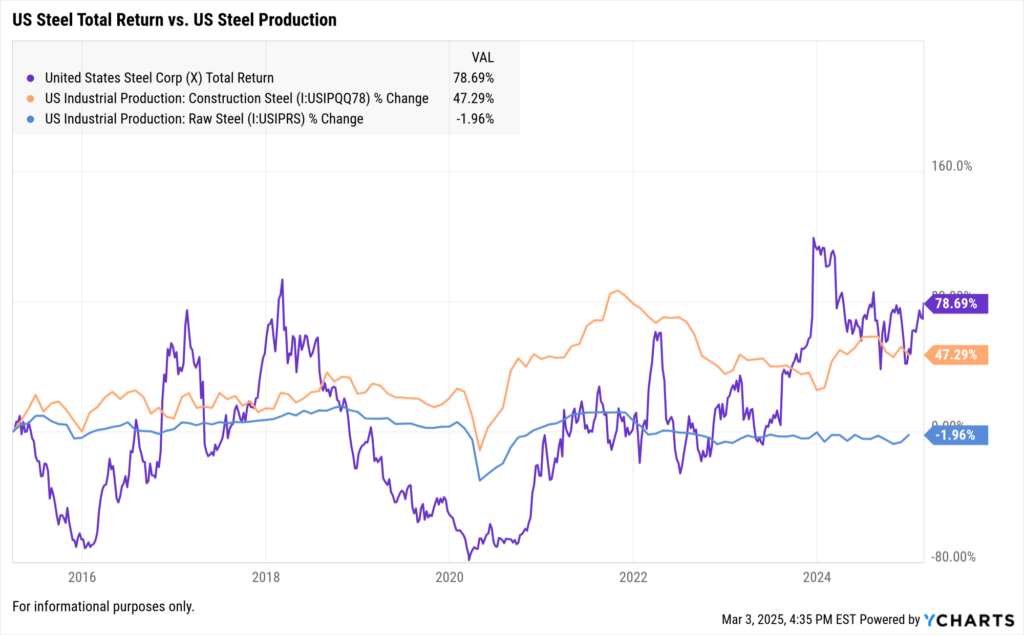

1. Domestic Manufacturing & Industrials

Companies with strong U.S.-based production facilities will likely see a competitive advantage as higher import costs make American-made goods more attractive.

Potential Beneficiaries:

- Caterpillar Inc. (CAT) – A major player in construction and heavy machinery, Caterpillar could gain from reduced competition with foreign equipment manufacturers.

- Deere & Co. (DE) – Agricultural equipment producers may see increased domestic demand if tariffs make foreign alternatives more expensive.

- Nucor Corporation (NUE) & Steel Dynamics (STLD) – As tariffs increase the cost of imported steel and aluminum, U.S.-based steel producers could benefit from higher demand for domestically sourced materials.

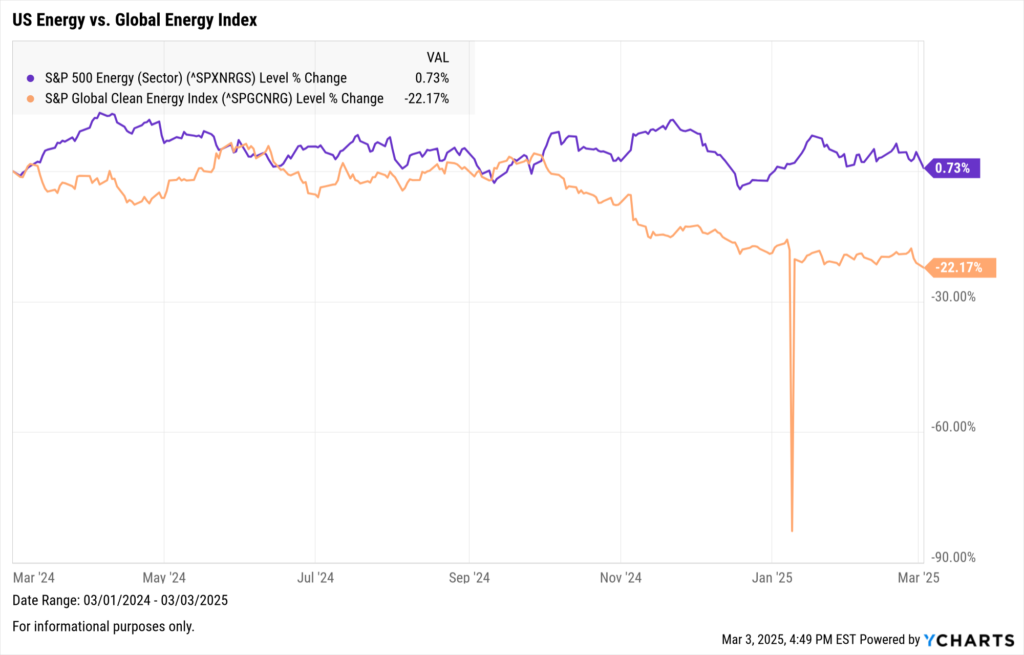

2. Energy & Domestic Resource Production

Tariffs on imported energy sources, such as liquefied natural gas (LNG) or crude oil, could favor U.S. producers and refiners.

Potential Beneficiaries:

- ExxonMobil (XOM) & Chevron (CVX) – Large-cap oil companies with strong U.S. production footprints stand to benefit from reduced foreign imports.

- EQT Corporation (EQT) & Cheniere Energy (LNG) – Natural gas producers and exporters could gain market share as domestic production becomes more cost-competitive.

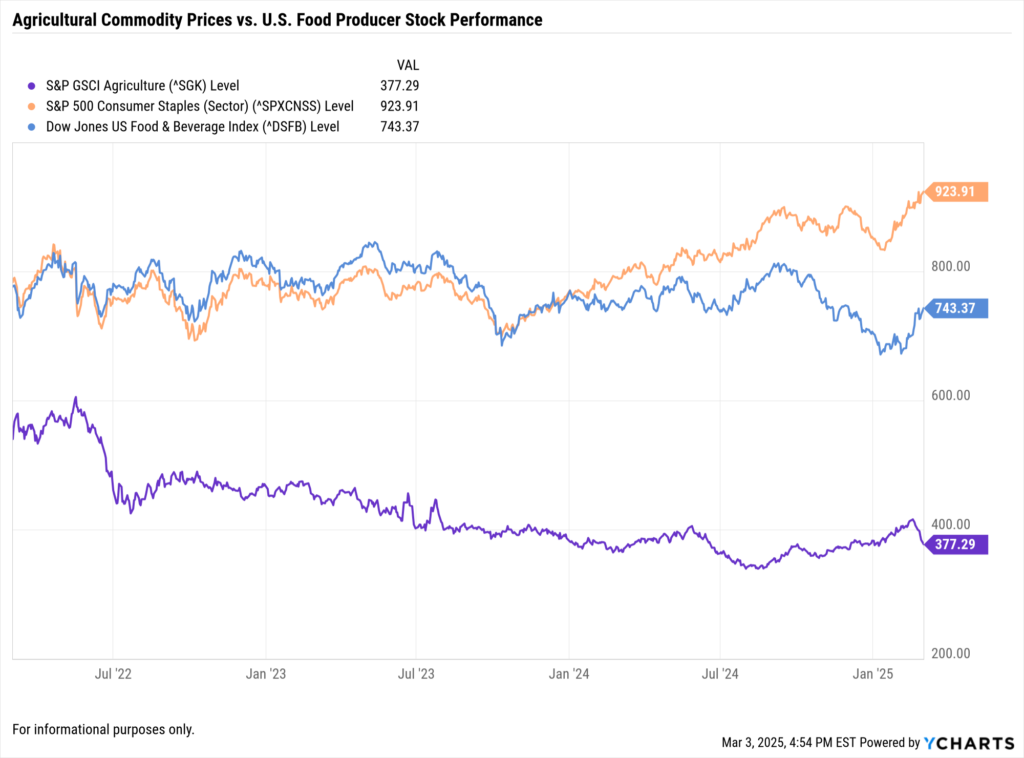

3. Agriculture & Food Production

Increased tariffs on imported agricultural products could provide a boost to U.S.-based food producers and farming operations.

Potential Beneficiaries:

- Archer Daniels Midland (ADM) & Bunge Limited (BG) – These agribusiness giants may benefit from increased domestic sourcing of grains and food ingredients.

- Tyson Foods (TSN) & Pilgrim’s Pride (PPC) – U.S.-based meat producers could see higher demand if tariffs make imported meat less competitive.

- CF Industries (CF) & Mosaic Co. (MOS) – Fertilizer producers could gain if domestic agricultural production increases.

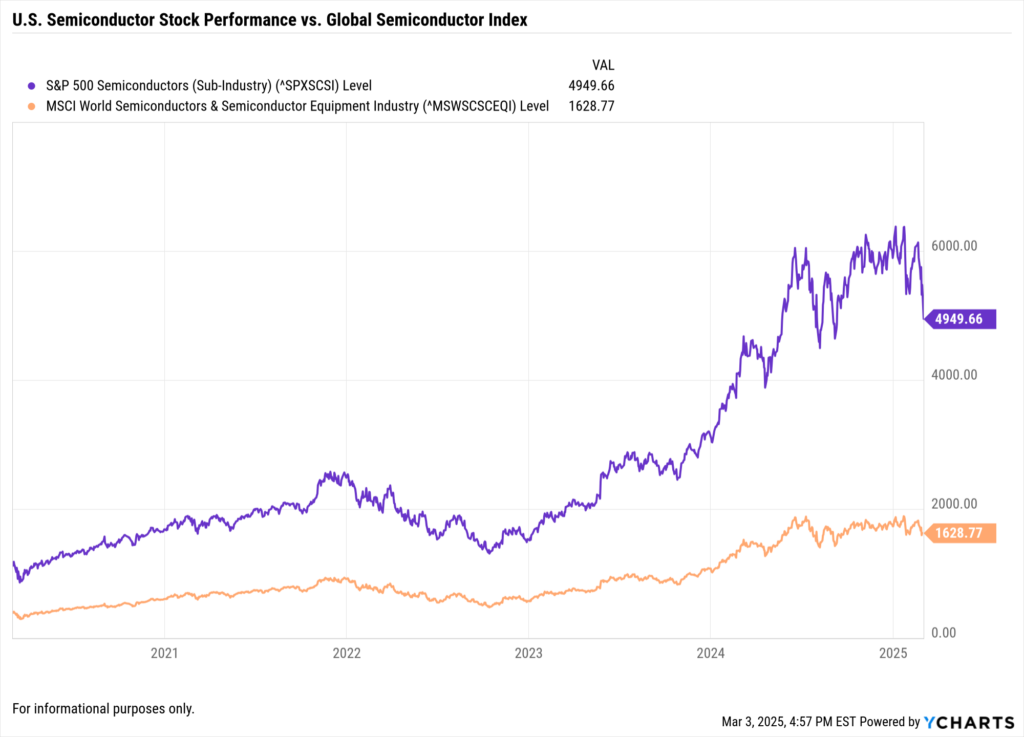

4. U.S. Semiconductor & Technology Firms with Domestic Manufacturing

While the broader tech sector faces challenges from trade tensions, some U.S.-based semiconductor and hardware manufacturers could see benefits from government incentives aimed at reshoring production.

Potential Beneficiaries:

- Intel (INTC) & Texas Instruments (TXN) – U.S. chipmakers investing in domestic production could see increased demand due to reduced reliance on foreign semiconductor supply chains.

- Micron Technology (MU) – As a leading producer of memory chips with strong U.S. manufacturing capabilities, Micron may gain an advantage if tariffs disrupt international supply chains.

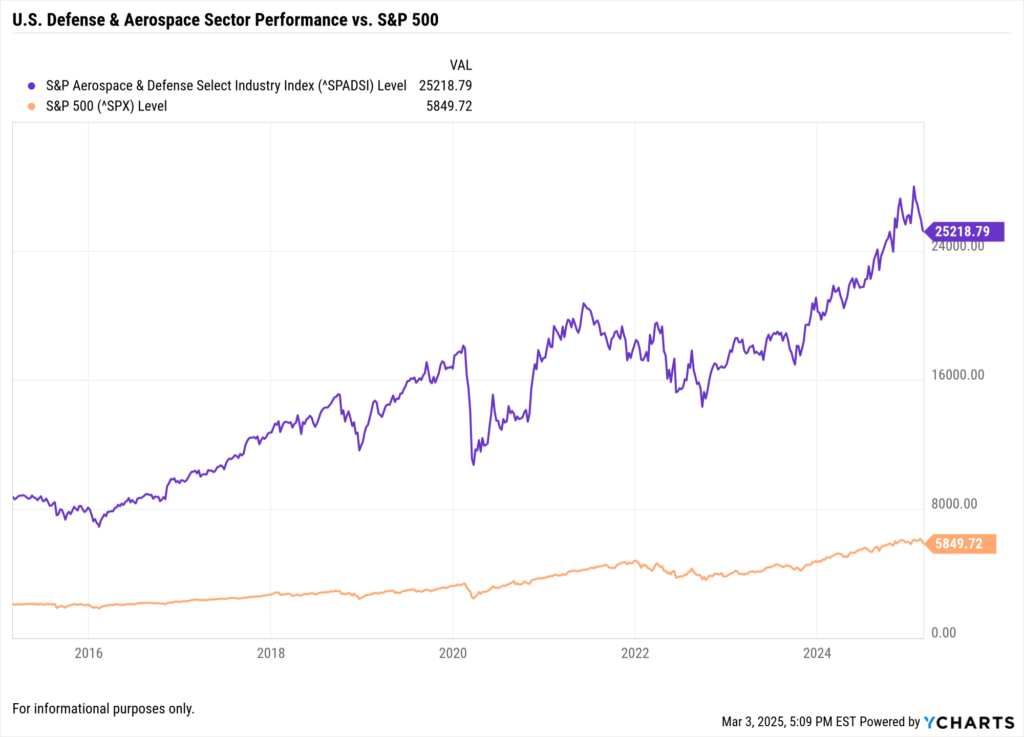

5. Defense & Aerospace Industry

As the U.S. government prioritizes domestic production in defense procurement, companies in this sector could see increased contract opportunities.

Potential Beneficiaries:

- Lockheed Martin (LMT), Raytheon Technologies (RTX), Northrop Grumman (NOC) – Defense contractors may benefit from increased demand for U.S.-made military equipment and aerospace components.

- Boeing (BA) – If tariffs on foreign aircraft components are implemented, Boeing could see increased government and commercial aircraft orders.

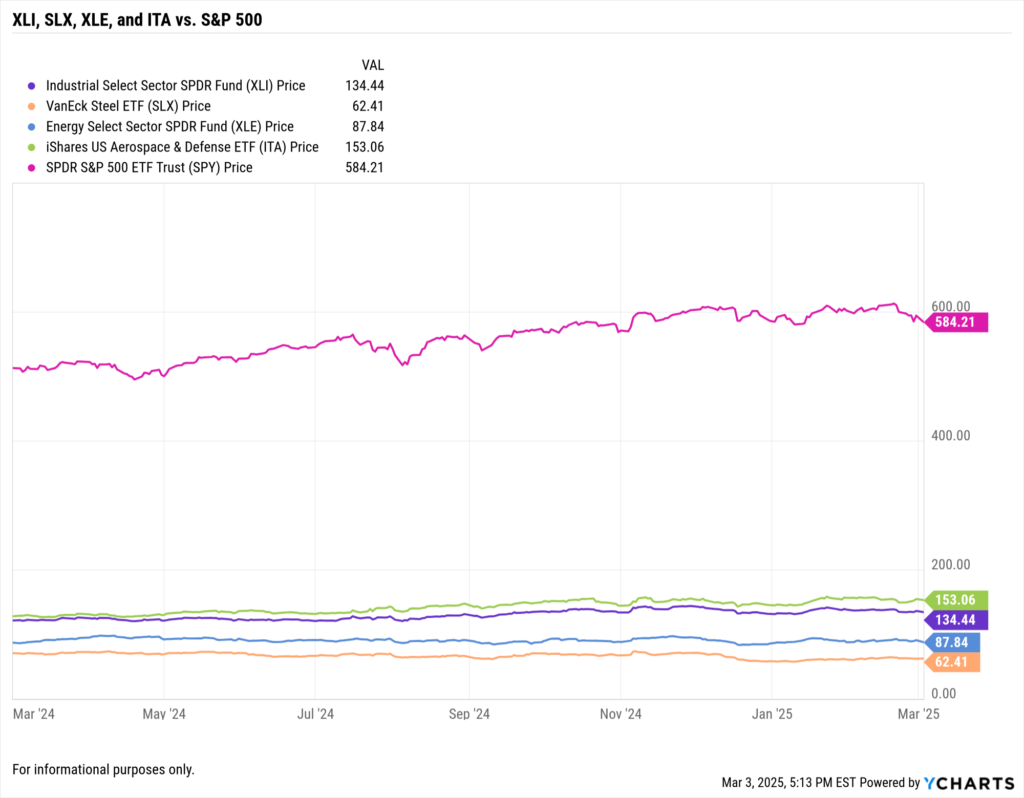

Funds & ETFs with Exposure to Tariff Beneficiaries

For investors looking to gain exposure to industries positioned to benefit from tariffs, several ETFs focus on domestic manufacturing, agriculture, and energy:

- Industrial Select Sector SPDR ETF (XLI) – Focuses on U.S. manufacturing and industrial stocks

- VanEck Steel ETF (SLX) – Provides targeted exposure to steel producers that could benefit from import restrictions

- Energy Select Sector SPDR ETF (XLE) – Offers broad exposure to U.S.-based energy companies

- iShares U.S. Aerospace & Defense ETF (ITA) – Tracks U.S. defense and aerospace stocks

Adding Market Volatility Insights: GDP Growth vs. Market Uncertainty

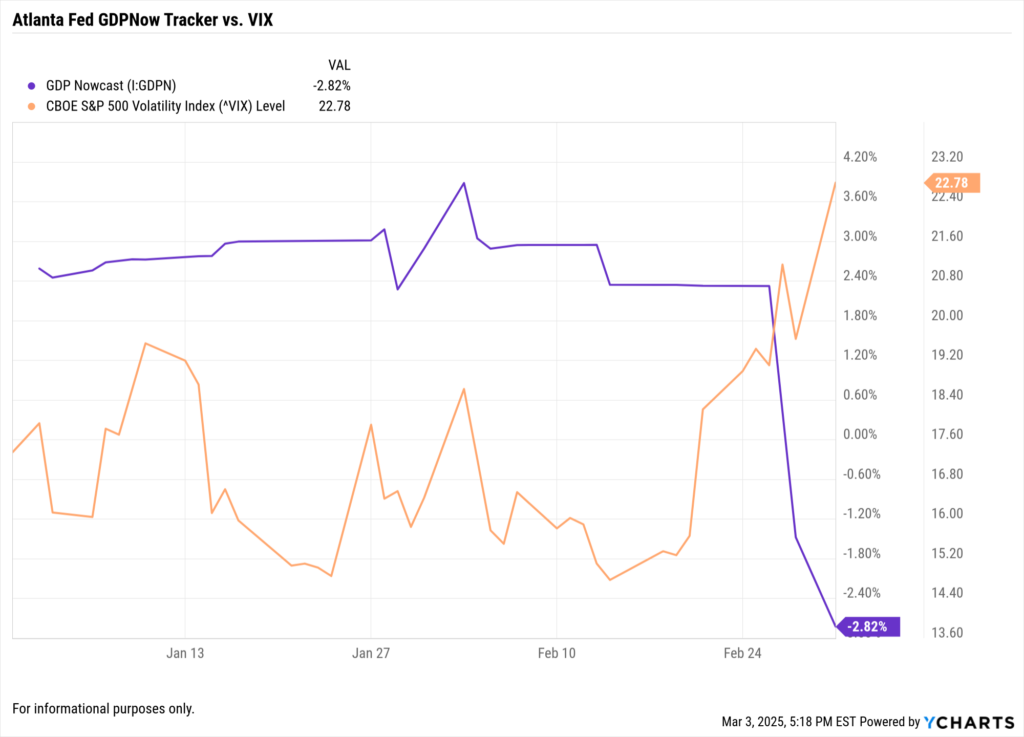

Atlanta Fed GDPNow Tracker vs. VIX: How Tariffs Impact Growth & Volatility

One of the key concerns surrounding new tariffs is their potential impact on economic growth and market volatility. While certain industries stand to benefit, broader macroeconomic factors—such as GDP growth expectations and stock market uncertainty—must be closely monitored by financial professionals.

Why This Matters:

- GDP Growth Expectations: The Atlanta Fed GDPNow Tracker provides real-time estimates of U.S. economic growth based on high-frequency data.

- Market Volatility (VIX): The VIX index, also known as the “fear gauge,” measures expected stock market volatility over the next 30 days. Spikes in VIX often indicate increased investor uncertainty, which can be influenced by trade policies, corporate earnings revisions, and macroeconomic sentiment.

Atlanta Fed GDPNow Tracker vs. VIX (Post-Tariff Announcement)

- Why It Matters: This chart visualizes how tariff announcements influence economic growth expectations and market uncertainty. A widening gap between higher VIX levels and declining GDP projections could signal increased recession risks for certain industries.

- What to Watch: If GDP expectations drop while volatility rises, asset managers may need to adjust allocations toward defensive sectors, alternative assets, or cash equivalents.

Portfolio Takeaways for Financial Advisors & Asset Managers:

- Watch for GDP growth slowdowns that could impact cyclical industries.

- Monitor VIX spikes as signals of increased market risk.

- Reevaluate sector exposure if economic growth expectations shift significantly.

By leveraging YCharts Economic Indicators, financial professionals can track GDP forecasts, analyze market volatility trends, and adjust portfolios accordingly.

Investment Considerations for Financial Professionals

While tariffs create opportunities for some sectors, advisors and asset managers should consider broader market risks:

Sector Rotation Strategies

- Shifting allocations toward industries benefiting from protectionist policies can enhance portfolio performance.

- Leveraging YCharts tools to compare historical sector performance under past trade policies can help guide allocation decisions.

Potential Inflationary Pressures

- Tariffs could drive up prices for consumer goods, impacting inflation-sensitive investments.

- Monitoring CPI trends and inflation-protected securities (TIPS) may help mitigate risk.

Global Trade Retaliation Risks

- If other countries respond with counter-tariffs, industries reliant on exports may face headwinds.

- Advisors may want to balance exposure across domestic and international equities.

How YCharts Helps Financial Professionals Navigate Trade Policy Impacts

YCharts provides institutional-grade data and visualization tools to help advisors make data-driven investment decisions in response to trade policy changes:

- Track Sector & ETF Performance → Use YCharts Fundamental Charts to compare tariff-sensitive industries.

- Monitor Economic Indicators → Analyze inflation trends, commodity prices, and Treasury yields to assess tariff-related market impacts.

- Generate Client-Ready Reports → Create Custom Reports that illustrate the effects of tariffs on different sectors.

Conclusion: Positioning Portfolios for Tariff-Induced Market Shifts

While tariffs create challenges for some industries, they also present significant opportunities for U.S.-based manufacturers, energy producers, and defense contractors. By identifying sectors poised for growth and leveraging ETF strategies, financial professionals can proactively position portfolios to take advantage of shifting trade policies.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking for a best-in-class data & visualization tool?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Get your copy of The Top Metrics Advisors Used in Portfolio Reports: 2024

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Are U.S. Gold Reserves Overstated? Potential Market Implications for InvestorsRead More →