How YCharts Helps Asset Managers Secure Assets in the Model Explosion

Asset managers and home offices across the country are rapidly expanding into the model portfolio business, and business is booming.

According to Broadridge’s Q1 2025 “Model Portfolio Trends” report, model portfolios now hold an estimated $8 trillion in assets. The same research shows that more than eight in 10 fee-based advisors in the U.S. use models for at least part of their client assets.

This is a favorable trend for asset managers, particularly because funds included in models tend to represent stickier, longer-term assets. However, the challenge differs depending on the type of model.

In open-architecture portfolios, advisors can select from any asset manager’s products, meaning your strategies must compete head-to-head for inclusion and ongoing usage. Gaining shelf space with asset-manager-provided models may be easier, but the true challenge is convincing advisors to implement your model over a competitor’s.

In both cases, success depends on moving beyond shelf presence and clearly showing why your model should be implemented with clients.

That’s where YCharts comes in.

Nearly all of our clients tell us YCharts helps them position funds more effectively, and you can use those same tools to position models with advisors.

By creating clear, compelling comparisons, YCharts can power you to drive adoption and capture assets in a market that Broadridge projects will grow to $13 trillion by 2029.

The Forces Driving Model Portfolio Growth

Several forces are fueling the surge in model portfolios:

- Advisors are prioritizing efficiency. Custom-building portfolios for every client consumes time and limits scalability. Models provide a repeatable framework that delivers consistency while freeing up capacity for client relationships and organic growth.

- Broker-dealers and home offices are centralizing oversight. Home offices use models to standardize investment decisions, strengthen due diligence, and reduce compliance risk, ensuring consistency across their advisor networks.

- Asset Managers are tapping a new distribution path. Models allow firms to position active ETFs alongside their passive counterparts, while shifting distribution efforts from thousands of individual advisors toward a smaller group of home-office decision-makers who influence large flows.

As models reshape the way advisors, home offices, and asset managers operate, the implications for distribution are clear: it’s no longer enough to have a model available; you need tools to get it off the bench and into the game.

3 Ways YCharts Helps Distribution Teams Win with Models

1. From the Shelf to Implementation

Having a model on a platform is only the start. To get an advisor to pull it off the shelf and implement it with their clients requires showing, not just telling, why your model is a better fit.

Start a Free Trial to Compare Models

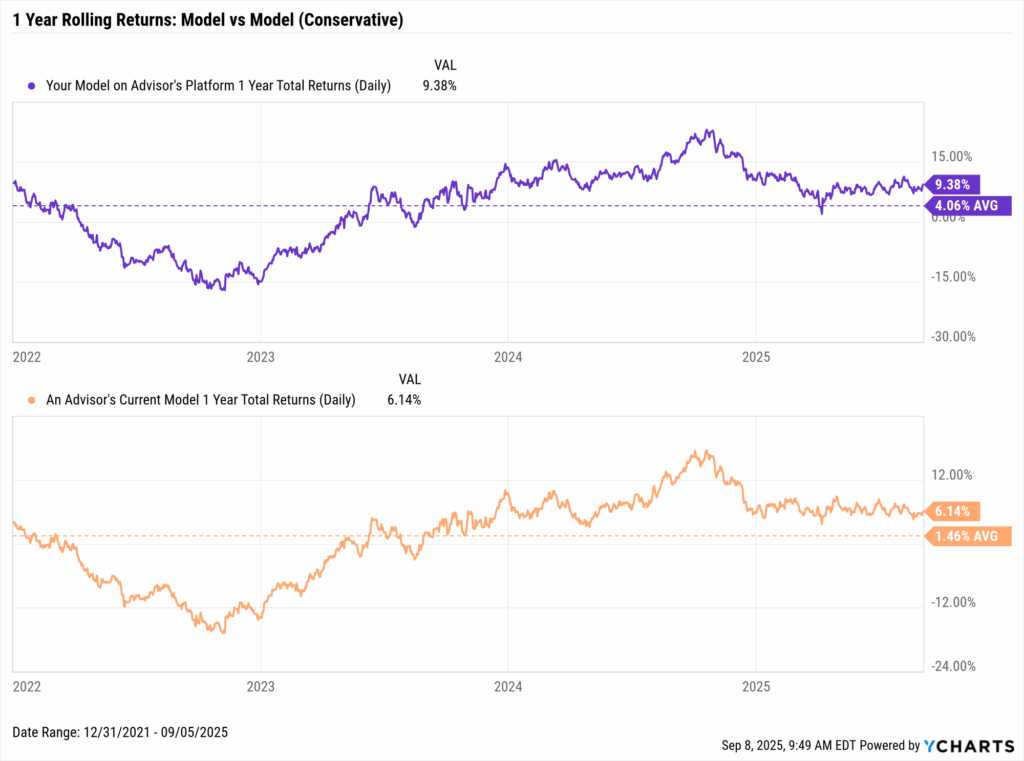

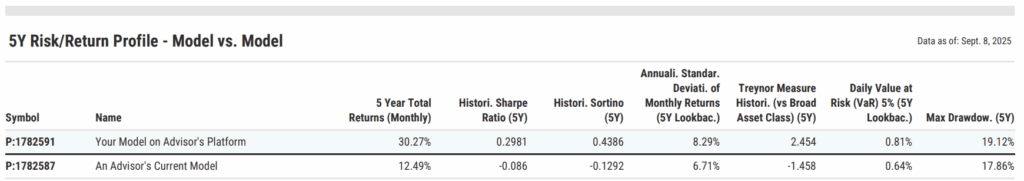

With YCharts Portfolios, you can recreate an advisor’s current allocation (including fees and rebalancing rules) and run clean side-by-side comparisons.

If your firm offers its own models, you can easily compare them against similar-risk portfolios to visually highlight differences in return, risk, and allocations in the same clear and compelling format already used for fund-to-fund positioning.

Start a Free Trial to Compare Models

2. Real-Time Meeting Edge

In most cases, distribution teams will encounter open-architecture model portfolios, which can draw from any asset manager’s products.

That’s where Quick Extract becomes especially powerful. With a single statement or screenshot of one, you can instantly build a ready-to-analyze portfolio, then duplicate and optimize it using your firm’s philosophy.

Within the same meeting, you can obtain an advisor’s statement and run a live, side-by-side comparison between the advisor’s model and an optimized version. This turns the conversation from conceptual to actionable in minutes, without needing to secure a follow-up meeting.

3. Scalable Collaboration & Branded Delivery

Winning shelf space and showcasing value in meetings are critical, but sustaining adoption at scale requires consistency and communication.

Firms like Aptus Capital Advisors use YCharts to streamline client reviews, share updated models directly with advisors, and generate polished, white-labeled reports. By embedding YCharts in their workflows, Aptus cut prep time by nearly 50% and strengthened engagement with advisors and end clients.

Additionally, YCharts provides direct sharing capabilities, so distribution teams can:

- Share firm-specific models and strategies directly with advisors on the platform.

- Equip advisors with dashboards, rebalancing notes, and marketing resources tailored to their firm.

- Maintain scale and consistency while delivering personalized outputs that build trust at the advisor and end-client levels.

Conclusion: Securing Your Share of the Model Explosion

Model portfolios already hold $8 trillion in assets and are projected to reach $13 trillion by 2029. Winning assets depends on showing advisors, in real time, why your model is the better fit.

With YCharts, distribution teams can run side-by-side comparisons, build instant portfolio analyses from statements, and share branded reports at scale. The result: clearer storytelling, stronger adoption, and lasting client trust in a fast-growing market.

Whenever you’re ready, here’s how YCharts can help you:

Start researching and optimizing portfolios by becoming a client.

Dive into YCharts with a no-obligation 7-Day Free Trial now.

Sign up for a copy of our Fund Flows Report to see which funds advisors are graviting to:

Follow YCharts Social Media to Unlock More Content!

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Next Article

Monthly Market Wrap: August 2025Read More →