June CPI Preview: Is the US Inflation Rate Heating Up?

Introduction

June’s Consumer Price Index (CPI) report could mark a turning point for the US inflation rate. Advisors and investors are watching closely, asking: Is inflation about to reignite? After months of cooling price pressures, shifting market trends and policy changes hint that inflation might be stirring again. In our overview of the CPI Report, we noted all of the things to know about historical CPI trends, now June’s data will test whether the recent calm was fleeting or durable.

Table of Contents

Why June’s Inflation Data Matters for Advisors

Inflation has been trending downward throughout 2025, with headline CPI cooling to 2.4% year-over-year in May 2025 (down from over 6% a year prior). This relief allowed the Fed to hit pause on rate hikes. However, consensus forecasts predict a bump to about 2.6% YoY inflation in June (with core inflation near 3.0%). Even a small uptick would signal that price pressures remain, keeping advisors on alert for renewed inflation risk.

For a deeper breakdown of the latest CPI reading and its implications for interest rate policy, explore our follow-up piece: US CPI Trends and Fed Rate Cuts. It covers why even modest inflation surprises can delay cuts, and how advisors can use YCharts to guide client conversations in a “higher for longer” environment.

Financial markets could react swiftly to an upside surprise. A hotter CPI print may push up Treasury yields and pull stocks down as investors price in tighter Fed policy. Conversely, a softer inflation reading would likely support a continued market rally.

Q: Should clients be concerned that inflation is heating up again?

A: Even if the US inflation rate rises from May’s ~2.4%, it remains a far cry from 2022’s peaks. However, a reversal upward suggests price pressures aren’t completely tamed. Advisors should explain that while runaway inflation isn’t back, a mild resurgence can still impact interest rate policy and portfolios. Vigilance and proactive adjustments are prudent.

Tariffs, Core Inflation and What’s Driving Prices

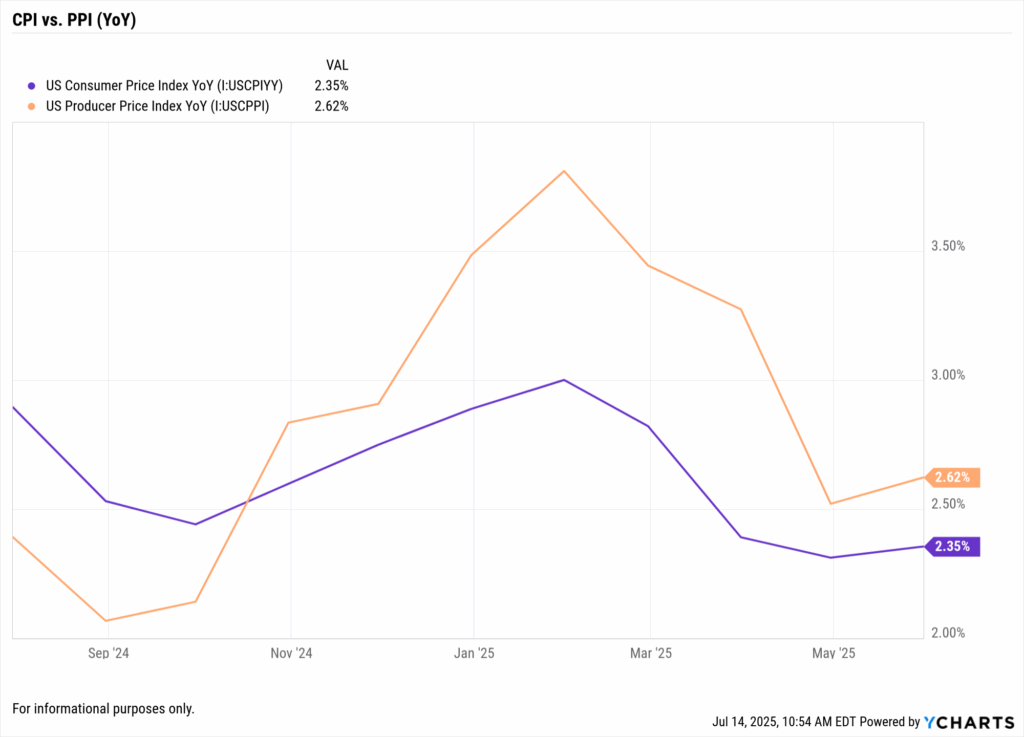

June’s inflation bump isn’t coming out of nowhere, a few forces are at play. The U.S. recently reimposed tariffs on major imports like metals and machinery, raising input costs for many industries. Those higher costs can trickle down into consumer prices. June’s CPI may even show the first signs of these tariffs pushing up goods prices. Meanwhile, producer price inflation (PPI) has leveled off around 2.5% YoY, hinting that the pipeline of cost pressures is no longer shrinking.

While consumer inflation has cooled in recent months, producer prices remain elevated. This divergence suggests ongoing upstream cost pressure that could flow into future CPI prints.

Another factor is core inflation, which strips out volatile food and energy prices. Core CPI has been stubbornly high due to services like housing and healthcare. Shelter costs remain a major contributor, for instance, shelter rose about 0.6% in a single month earlier this year, and because housing is a large portion of CPI, even modest rent increases keep core inflation elevated. Wage growth and labor costs are also feeding into service prices. For advisors, this means inflation’s “sticky” elements could prevent overall rates from falling much further, even if gas or grocery prices stabilize.

Q: Will new tariffs make inflation worse in the coming months?

A: Tariffs raise costs on imported goods, and companies often pass those expenses to consumers. If these levies persist, advisors should warn that inflation could run higher than it otherwise would. However, the impact might unfold gradually, businesses can adjust supply chains. The key is to track the data (using YCharts) to see if prices in tariff-affected categories jump.

Inflation Outlook: Cautious Optimism or More Surprises?

Broadly, inflation has cooled significantly from its 40-year highs in 2022 (over 9% YoY at one point). The US inflation rate hovering in the 2–3% range marks a return to relative normalcy, and many forecasts expect price gains to moderate further by year-end.

However, advisors should maintain cautious optimism. Uncertainties abound, newly enacted tariffs, a still-tight labor market (the U.S. unemployment rate remains about 4.2%), volatile energy costs, and wage pressures could each stir prices back up unexpectedly in the coming months. Fed officials have signaled patience, but remain wary of these risks.

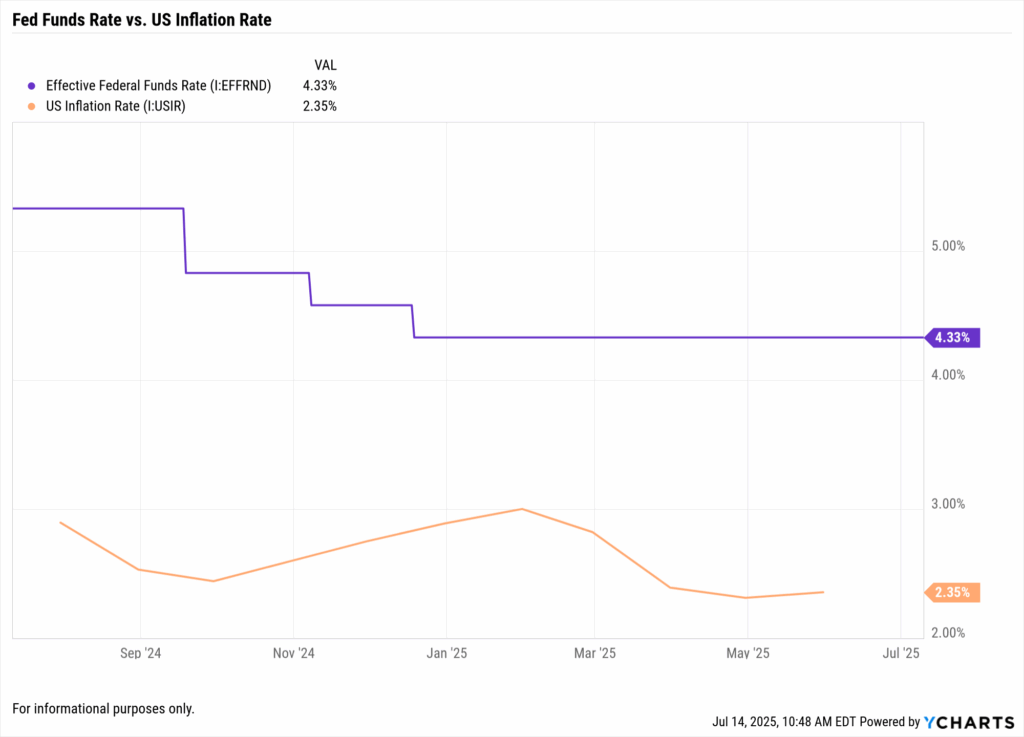

The Fed has held rates steady since early 2025, even as the US inflation rate has declined. Advisors should monitor whether a new inflation uptick forces a policy shift.

For example, crude oil jumped roughly 6% in June amid geopolitical tensions, a reminder that commodity shocks can swiftly feed into consumer prices (even though gas prices held steady for now).

In the coming months, it’s wise to “trust but verify” the inflation downtrend, staying vigilant even as conditions improve. Clients may appreciate the recent relief, but you should clarify that a few hotter readings wouldn’t be too surprising.

By tracking a broad set of indicators, from CPI and Core PCE to wages and import prices, you can stay ahead of potential surprises. The goal isn’t to predict every wiggle, but to have a plan if inflation runs hotter (or cooler) than expected. With a data-driven, flexible approach, advisors can turn uncertainty into a chance to demonstrate value through active monitoring and timely adjustments.

Portfolio Moves if Inflation Reignites

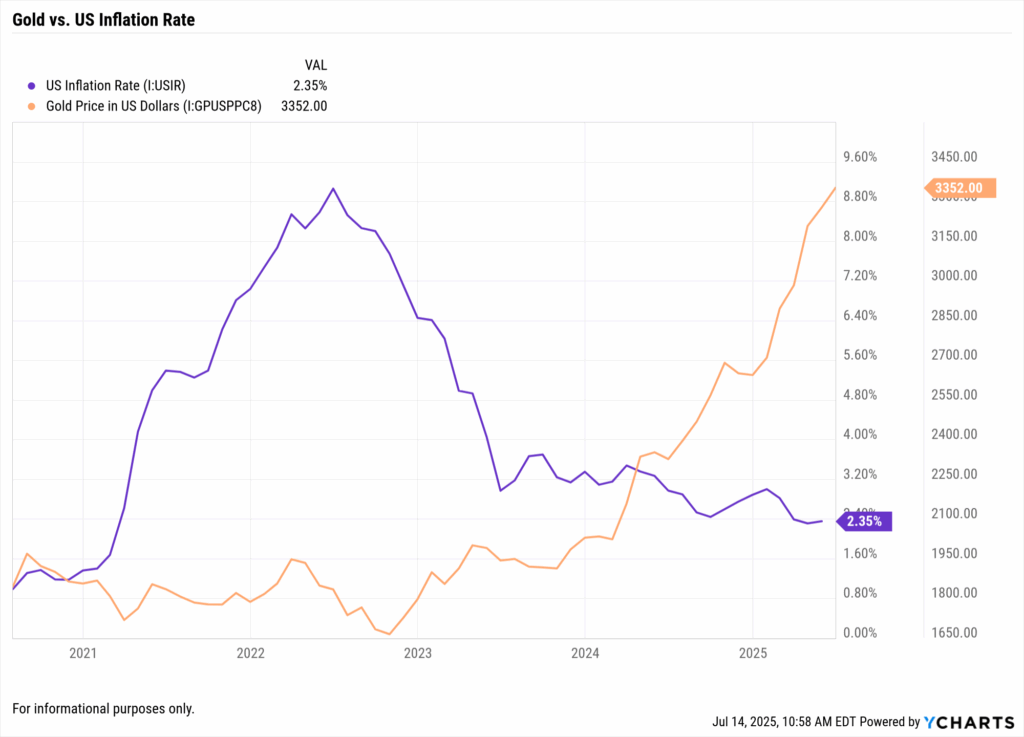

A resurgence of inflation calls for dusting off the inflation playbook. Advisors may consider tilting portfolios toward inflation hedges. In the past, assets like commodities and gold have helped offset spikes in consumer prices (see our inflation hedging guide), as their values often climb when inflation surprises to the upside. Treasury Inflation-Protected Securities (TIPS) are another tool: these bonds automatically adjust their principal with CPI changes, directly preserving purchasing power. Real assets like real estate (REITs) can also provide a buffer, as property values and rents tend to rise in inflationary periods.

Gold prices have surged even as the US inflation rate cooled, highlighting investor interest in traditional hedges ahead of potential inflation surprises.

On the flip side, higher inflation can spell trouble for long-duration bonds and high-growth stocks. If price pressures persist, the Federal Reserve might delay cutting interest rates – or even consider more hikes, to contain inflation. That scenario would push up long-term yields and could hurt bond prices. Advisors can respond by shortening portfolio duration (favoring short-term bonds over 10- or 30-year ones) and emphasizing equity sectors with pricing power (e.g., consumer staples, energy) that can pass on costs to customers. For example, companies in sectors like utilities or branded consumer goods often navigate inflation better because demand for essentials stays steady.

Finally, don’t overlook global diversification. If U.S. inflation stays elevated while other economies see milder price increases, international stocks or funds could benefit. Shifting a portion of assets overseas might add an extra layer of defense when domestic inflation flares up.

Q: What portfolio changes should advisors make if inflation stays elevated?

A: The core idea is to get more inflation-resistant: allocate more to assets like TIPS, commodities, or defensive stocks that can raise prices, while dialing down exposure to assets hurt by rising rates (like long-term bonds or pricey tech shares). Using YCharts to model “what-if” scenarios helps quantify how those tweaks could protect a portfolio if inflation reignites.

Communicating the Outlook: Data-Driven Conversations

Many investors remember high inflation not long ago, so an uptick could spark concern. Advisors should be ready to put any higher CPI reading in context, explaining whether it’s a brief blip or a worrisome trend. Even as we hope for stable prices, a small rise would prove that inflation isn’t completely vanquished. Using clear visuals and historical context can turn a complex data point into an understandable story for clients.

Fortunately, advisors have more tools than ever to stay on top of economic data. YCharts’ Dashboard allows you to track CPI alongside other indicators (like the Fed Funds rate or jobs data) all in one place. By setting up alerts or regularly reviewing updated charts, you can quickly spot inflation changes and keep clients informed.

The ability to show, not just tell, is key. A chart of the US inflation rate versus a client’s portfolio returns, or against interest rates, can powerfully illustrate why you’re making certain portfolio tweaks. Visual evidence reinforces your insights and helps maintain trust during uncertain times.

Advisors can also integrate these charts and insights into client reviews. For example, YCharts’ Proposal Tool makes it easy to insert custom commentary and economic visuals into client-ready reports, reinforcing the message that you’re proactively managing their plan in light of new inflation data.

Q: How can I show clients what rising inflation means for their investments?

A: Bring data into the conversation. With YCharts, for instance, you can chart inflation against key portfolio metrics like bond yields or stock returns. Seeing those relationships helps clients grasp the impact, and it backs up your advice with real evidence. It shows you’re making decisions based on data, not headlines.

Conclusion: Stay Ahead of Inflation Surprises with Data-Driven Strategy

June’s CPI release could shape the inflation narrative for the second half of 2025. Even a modest rise in the US inflation rate may stir market volatility, shift Fed expectations, and prompt portfolio adjustments. For advisors, now is the time to re-engage clients around inflation risk, not with alarm, but with actionable guidance.

The key to navigating an evolving inflation landscape is staying informed and nimble. By monitoring inflation data alongside macro indicators and portfolio performance, advisors can turn uncertainty into opportunity. Tools like YCharts’ Dashboard and Proposal Builder make it easier to track developments, stress-test portfolios, and clearly communicate changes to clients.

Inflation may be cooling, or it may just be catching its breath. Either way, clients look to you to interpret the data and protect their financial plans. With the right insights and tools, you’re positioned to do just that.

Whenever you’re ready, here’s how YCharts can help you:

1. Looking to Move On From Your Investment Research and Analytics Platform?

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Sign up for a copy of our Fund Flows Report and Visual Deck to stay on top of ETF trends:

Sign up to recieve a copy of our monthly Fund Flows Report:Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Next Article

Bitcoin Value Hits Record High Amid Regulatory OptimismRead More →