Q1 2025 Communication Services Sector Earnings: Key Highlights & Market Reactions

Introduction: Balancing Growth and Margin Expansion in Communication Services

The Q1 2025 Communication Services Sector Earnings season highlights a crucial balancing act. As digital advertising rebounds and 5G expansion moderates, telecom giants and media platforms alike are navigating tighter consumer budgets and intensified competitive pressures. Companies with diversified revenue streams, resilient subscriber bases, and strong cost discipline are outperforming expectations, while others face margin compression despite top-line growth.

This live-updating blog provides financial professionals with timely earnings insights, strategic takeaways from management commentary, and actionable YCharts visualizations to aid in portfolio decision-making during this dynamic earnings season.

Latest Earnings Reports

YCharts users can view a full breakdown of all current and upcoming earnings calls and reports live here.

Not a YCharts user? Try a 7-Day Free Trial.

April 25, 2025 Earnings

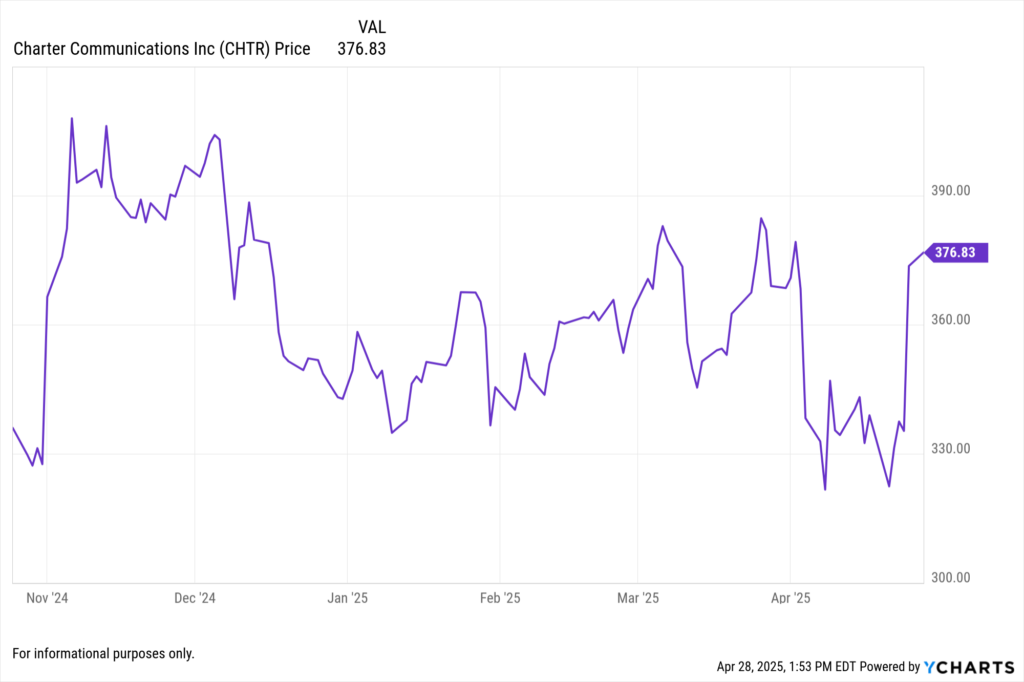

Charter Communications Inc. (CHTR) Grows Broadband Revenue Despite Cord-Cutting Headwinds

Charter Communications reported Q1 2025 revenue of $13.8 billion, reflecting a modest 1% year-over-year increase. Net income reached $1.2 billion, with trailing twelve-month normalized diluted EPS at 35.83. Despite ongoing video subscriber declines, broadband revenue rose 4.3% year-over-year, driven by demand for faster connectivity tiers. Charter remains focused on expanding rural broadband initiatives with substantial government funding support.

View Charter Communications Inc.’s Earnings Report Here >

April 24, 2025 Earnings

Alphabet Inc. (GOOGL) Reports Strong Q1 Led by Ad Revenue Rebound

Alphabet reported Q1 2025 revenue of $80.5 billion, up 9% year-over-year, with net income of $23.6 billion. Normalized diluted EPS reached 7.908 for the trailing twelve months. Advertising revenues climbed 8.4%, driven by strength in YouTube and Search, while Google Cloud posted 25% revenue growth. Alphabet announced a new $70 billion share repurchase authorization, signaling confidence in future cash flows.

View Alphabet Inc.’s Earnings Report Here >

T-Mobile US Inc. (TMUS) Continues to Lead Wireless Net Adds

T-Mobile posted Q1 2025 revenue of $20.5 billion, a 2.7% year-over-year increase. Net income was $2.3 billion, with trailing twelve-month normalized diluted EPS of 9.66. TMUS led the industry in postpaid phone net additions for the 10th straight quarter, adding 1.3 million postpaid customers. The company reaffirmed its full-year 2025 guidance for service revenue and adjusted EBITDA growth.

View T-Mobile US Inc.’s Earnings Report Here >

April 23, 2025 Earnings

AT&T Inc. (T) Beats Q1 Expectations Amid Focus on Core Connectivity

AT&T reported Q1 2025 revenue of $30.0 billion, roughly flat year-over-year, but beat earnings expectations with normalized diluted EPS of 2.045 for the trailing twelve months. Free cash flow came in at $4.7 billion, supporting a stable dividend outlook. The company emphasized wireless and fiber subscriber growth as key pillars for margin expansion in 2025 and beyond.

View AT&T Inc.’s Earnings Report Here >

April 22, 2025 Earnings

Verizon Communications Inc. (VZ) Maintains Cash Flow Strength Despite Competitive Pressures

Verizon reported Q1 2025 revenue of $33.2 billion, slightly down 1.2% year-over-year, with net income of $4.1 billion. Trailing twelve-month normalized diluted EPS stood at 4.149. While postpaid phone churn rose slightly, Verizon grew fixed wireless access (FWA) connections by 10% year-over-year. Management reiterated a focus on balancing capital spending discipline with competitive positioning.

View Verizon Communications Inc.’s Earnings Report Here >

How YCharts Can Help

From tracking wireless subscriber trends to visualizing digital advertising growth, YCharts empowers financial professionals to make faster, more data-driven decisions during earnings season.

Event Calendar: Track upcoming earnings releases for telecom, media, and internet companies

Fundamental Charts: Analyze revenue, EPS, and segment growth trends over time

Stock Screeners: Identify Communication Services stocks with positive EPS surprises and subscriber growth

Custom Reports: Build dynamic earnings recaps tailored to Communication Services portfolios

Conclusion: Subscriber Growth and Diversification Drive Communication Services Outperformance

The Q1 2025 Communication Services Sector Earnings season reveals a sector leaning on cost discipline, diversified revenue streams, and subscriber retention to weather macro headwinds. Leaders like Alphabet and T-Mobile are extending competitive advantages through ad platform resilience and network scale, respectively, while broadband leaders like Charter and Comcast pivot to capture rural expansion opportunities.

Bookmark this page — as more earnings reports continue, we’ll update it live with key takeaways, financial metrics, and investment implications.

Whenever you’re ready, here’s how YCharts can help you:

1. Looking to Move On From Your Investment Research and Analytics Platform?

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Q1 2025 Energy Sector Earnings: Key Highlights & Market ReactionsRead More →