Q1 2025 Industrials Sector Earnings: Live Updates & Market Reactions

Updated as of: April 30, 2025 @ 1:56PM CST

Introduction: Navigating Tariffs and Global Demand in the Industrials Sector

As Q1 2025 earnings reports unfold, the Industrials sector faces a complex landscape marked by geopolitical tensions, trade tariffs, and shifting global demand. While some companies demonstrate resilience through strategic cost management and diversified portfolios, others grapple with margin pressures and supply chain disruptions. This live-updating blog provides financial professionals with timely insights into key earnings reports, management commentary, and YCharts visualizations to inform investment decisions.

Latest Earnings Reports

YCharts users can view a full breakdown of all current and upcoming earnings calls and reports live here.

Not a YCharts user? Try a 7-Day Free Trial.

April 30, 2025 Earnings

Stanley Black & Decker Inc. (SWK) Beats EPS Estimates Amid Supply Chain Adjustments

Stanley Black & Decker reported Q1 2025 adjusted earnings per share (EPS) of $0.75, surpassing analyst expectations. The company noted improvements in gross margin due to global cost reduction programs and accelerated supply chain adjustments in response to U.S. tariffs.

View Stanley Black & Decker’s Earnings Report Here >

Oshkosh Corp (OSK) Reports Decline in Q1 Earnings

Oshkosh Corporation reported Q1 2025 net income of $112.2 million, or $1.72 per diluted share, compared to $179.4 million, or $2.71 per diluted share, in Q1 2024. Adjusted EPS was $1.92, down from $2.89 in the prior year, reflecting decreased operating income.

View Oshkosh’s Earnings Report Here >

C.H. Robinson Worldwide Inc. (CHRW) Schedules Q1 2025 Earnings Call

C.H. Robinson Worldwide Inc. is scheduled to host its Q1 2025 earnings conference call on April 30, 2025, at 5:00 PM ET to discuss financial results and provide forward-looking guidance.

View C.H. Robinson’s Earnings Call Details Here >

Caterpillar Inc. (CAT) Faces Revenue Decline Amid Tariff Concerns

Caterpillar reported Q1 2025 revenue of $14.2 billion, a 10% decrease year-over-year, primarily due to lower sales volume and unfavorable price realization. The company anticipates a Q2 2025 tariff-related cost impact of up to $350 million.

View Caterpillar’s Earnings Report Here >

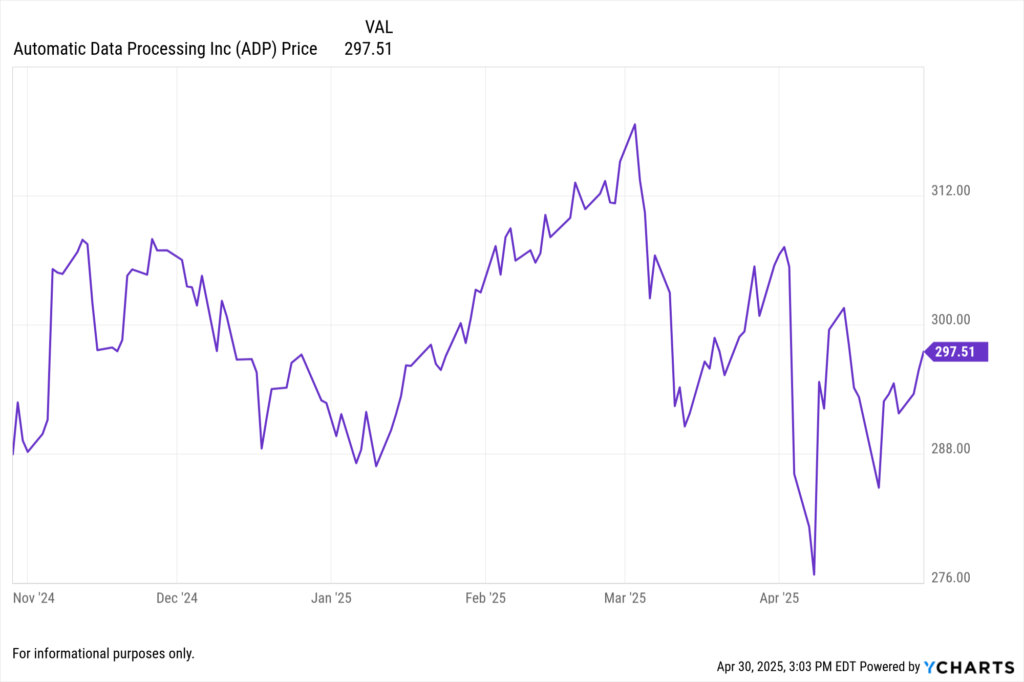

Automatic Data Processing Inc. (ADP) Reports Q3 Fiscal 2025 Results

Automatic Data Processing Inc. (ADP) reported Q3 fiscal 2025 revenue of $5.55 billion, exceeding analyst expectations of $5.49 billion. This performance reflects a 5% year-over-year increase, driven by robust demand for payroll and human capital management services amid a stable U.S. labor market.

View ADP’s Earnings Report Here >

April 29, 2025 Earnings

United Parcel Service Inc. (UPS) Exceeds Q1 Estimates; Announces Workforce Reduction

UPS reported Q1 2025 revenue of $21.5 billion and net income of $1.19 billion, surpassing Wall Street expectations. The company announced plans to cut 20,000 jobs and close 73 facilities in response to declining demand and economic uncertainty.

View UPS’s Earnings Report Here >

Waste Management Inc. (WM) Reports Revenue Growth in Q1 2025

Waste Management reported Q1 2025 revenue of $6.018 billion, a 16.7% increase year-over-year. The company highlighted strong operational performance and growth in its healthcare solutions segment.

View Waste Management’s Earnings Report Here >

PACCAR Inc. (PCAR) Reports Lower Q1 Revenue; Highlights Growth in Parts and Financial Services

PACCAR reported Q1 2025 revenue of $7.44 billion, down from $8.74 billion in Q1 2024. Net income was $505.1 million, including a $264.5 million after-tax charge related to civil litigation in Europe. The company noted continued growth in its aftermarket parts and financial services segments.

View PACCAR’s Earnings Report Here >

Honeywell International Inc. (HON) Surpasses Q1 Expectations; Raises Full-Year Guidance

Honeywell reported Q1 2025 adjusted EPS of $2.51 on revenue of $9.82 billion, exceeding analyst forecasts. The company raised its full-year guidance and announced plans to separate its Aerospace and Automation businesses, as well as spin off its Advanced Materials unit by the second half of 2026.

View Honeywell’s Earnings Report Here >

April 24, 2025 Earnings

Union Pacific Corp. (UNP) Reports Flat Q1 Earnings Amid Fuel Headwinds

Union Pacific reported Q1 2025 net income of $1.6 billion, or $2.70 per diluted share, consistent with Q1 2024 results. The company noted a 7% headwind from fuel costs and leap year effects.

View Union Pacific’s Earnings Report Here >

Southwest Airlines Co. (LUV) Reports Better-Than-Expected Q1 Results

Southwest Airlines reported Q1 2025 revenue of $6.43 billion, slightly above expectations. The company posted an EPS of -$0.13, surpassing the forecasted -$0.17, and announced plans to reduce flight capacity later in the year amid economic uncertainty.

View Southwest Airlines’ Earnings Report Here >

American Airlines Group Inc. (AAL) Reports Q1 Loss; Withdraws Full-Year Outlook

American Airlines reported Q1 2025 revenue of $12.6 billion and a GAAP net loss of $473 million, or ($0.72) per diluted share. The company withdrew its full-year 2025 financial outlook amid ongoing economic uncertainty and tariff impacts. American Airlines NewsroomInvestopedia

View American Airlines’ Earnings Report Here >

April 23, 2025 Earnings

The Boeing Company (BA) Narrows Q1 Loss Amid Tariff Challenges

Boeing reported Q1 2025 earnings revenue of $19.5 billion, an 18% increase year-over-year, driven by a 57% rise in commercial aircraft deliveries. The company posted an adjusted loss per share of $0.49, significantly better than the expected loss of $1.54. Despite ongoing U.S.-China trade tensions and elevated tariffs, Boeing managed to redirect aircraft initially destined for China to other international customers. The company also announced plans to increase 737 MAX production to 38 aircraft per month by year-end, with aspirations to reach 42 per month pending FAA approval.

View The Boeing Company’s Earnings Report Here >

General Dynamics Corporation (GD) Achieves Strong Q1 Growth Across Segments

General Dynamics reported Q1 2025 revenue of $12.2 billion, a 13.9% increase year-over-year, with diluted EPS rising 27.1% to $3.66. Operating margin expanded by 70 basis points to 10.4%. All four business segments saw revenue and earnings growth, notably the Aerospace segment, which experienced a 45.2% revenue increase and a 69.4% rise in operating earnings, with margins expanding by 210 basis points to 14.3%.

View General Dynamics Corporation’s Earnings Report Here >

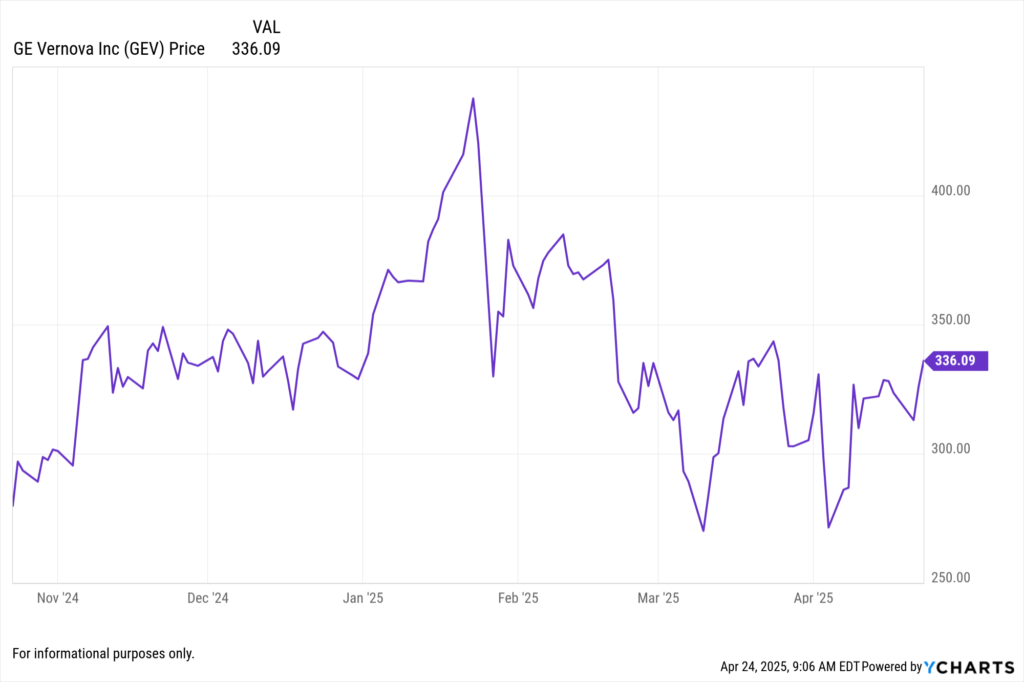

GE Vernova Inc. (GEV) Posts Robust Q1 Results, Reaffirms 2025 Guidance

GE Vernova reported Q1 2025 revenue of $8.03 billion, surpassing analyst expectations of $7.54 billion, with EPS of $0.91 beating estimates of $0.73. The company’s Power and Electrification segments drove growth, with core profit in the Electrification segment tripling to $214 million and the Power segment rising to $508 million from $345 million a year ago. Despite a $300–$400 million estimated impact from tariffs and inflation, GE Vernova reaffirmed its full-year revenue guidance of $36 to $37 billion.

View GE Vernova Inc’s Earnings Report Here >

April 22, 2025 Earnings

GE Aerospace (GE) Tops Q1 Estimates, Aims to Control Costs to Offset Tariffs

GE Aerospace reported Q1 2025 adjusted EPS of $1.49 and revenue of $9.94 billion, surpassing analyst expectations. The company maintained its full-year guidance of adjusted EPS between $5.10 and $5.45. CEO Larry Culp attributed the performance to strategic cost control measures and trade program leverage amid a challenging macroeconomic environment.

View GE Aerospace’s Earnings Report Here >

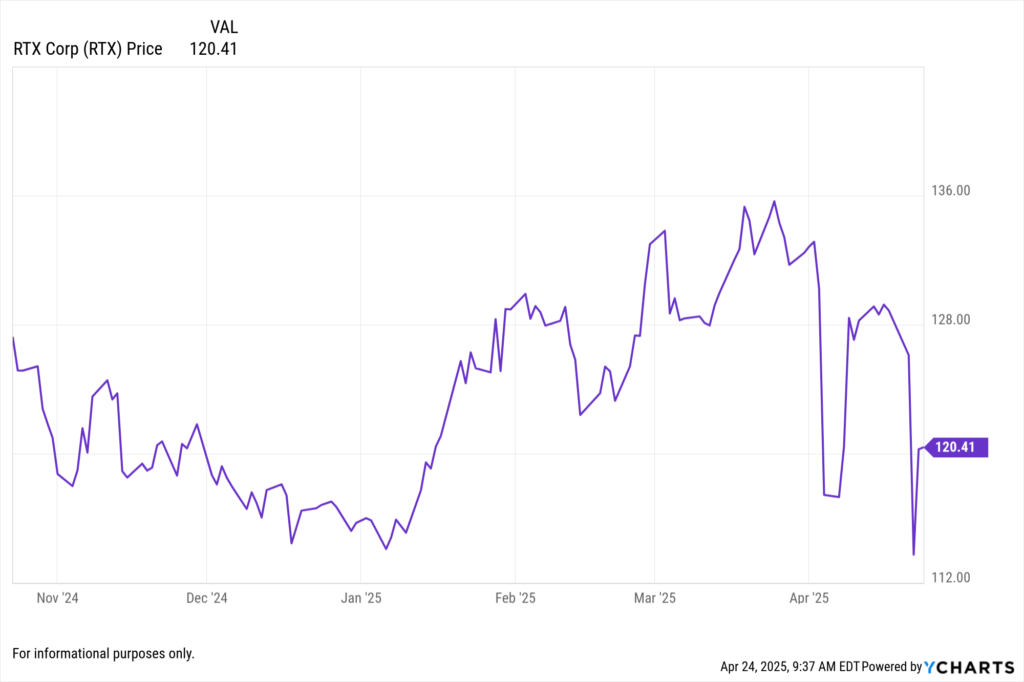

RTX Corporation (RTX) Reports Strong Q1 Performance Amid Tariff Concerns

RTX Corporation reported Q1 2025 sales of $20.3 billion, a 5% increase year-over-year, with organic sales growth of 8%. Adjusted earnings per share (EPS) rose 10% to $1.47, surpassing analyst expectations of $1.35. The company achieved a segment margin expansion of 120 basis points and generated free cash flow of $0.8 billion. However, RTX warned that recently enacted U.S. and international tariffs could impact its full-year outlook, with potential effects to be detailed in future earnings calls.

View RTX Corporation’s Earnings Report Here >

Northrop Grumman Corporation (NOC) Faces Q1 Profit Decline Due to B-21 Program Costs

Northrop Grumman reported Q1 2025 revenue of $9.5 billion, a 7% decrease year-over-year, falling short of analyst expectations. The company posted a pre-tax loss of $477 million related to its B-21 Raider stealth bomber program, attributed to higher-than-anticipated manufacturing and material costs. Despite the setback, Northrop Grumman maintains a record backlog of $92.8 billion and continues to invest in scaling up B-21 production to meet future defense demands.

View Northrop Grumman Corporation’s Earnings Report Here >

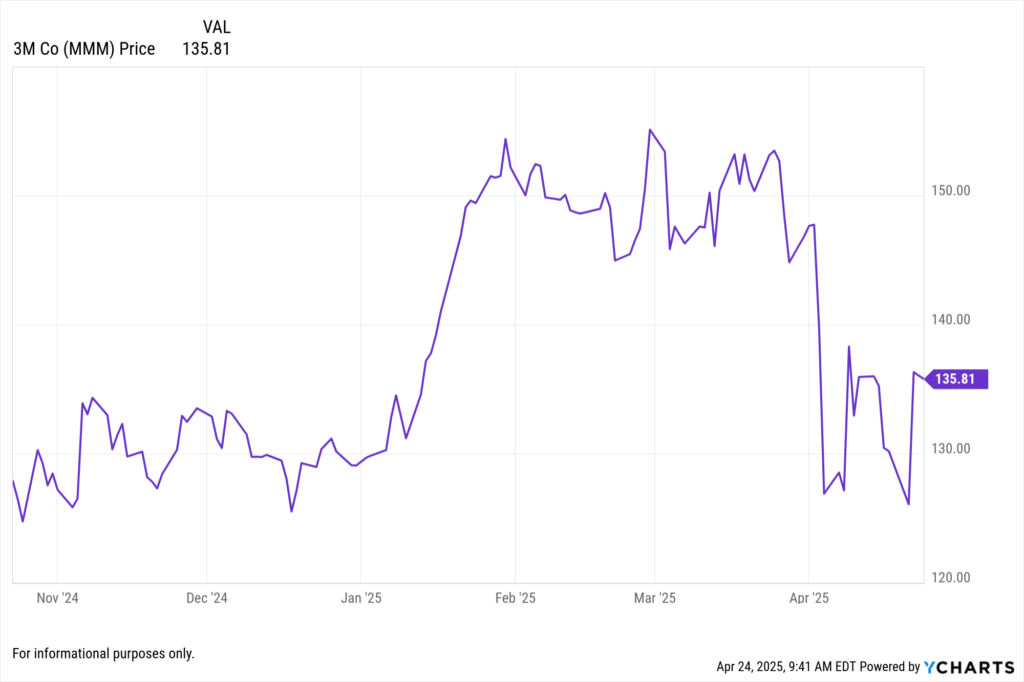

3M Company (MMM) Exceeds Q1 Expectations but Flags Tariff Risks

3M reported Q1 2025 adjusted EPS of $1.88 on revenue of $5.95 billion, surpassing analyst estimates despite a 1% year-over-year revenue decline. Growth was driven by a 2.5% increase in the Safety & Industrial segment and a 1.1% rise in the Transportation & Electronics group. The company maintained its full-year adjusted EPS guidance of $7.60 to $7.90 but warned that ongoing trade tensions and tariffs could reduce earnings by $0.20 to $0.40 per share.

View 3M Company’s Earnings Report Here >

Lockheed Martin Corporation (LMT) Delivers Robust Q1 Results Amid Strong Defense Demand

Lockheed Martin reported Q1 2025 earnings net income of $1.71 billion, or $7.28 per share, exceeding analyst expectations of $6.34. Total revenue rose 4.5% year-over-year to $17.96 billion, with gains across all divisions except the space unit. The aerospace segment, which includes the F-35 fighter jet program, saw a 3.1% increase in sales. The company reaffirmed its annual forecast, citing sustained global demand for defense products and potential benefits from a higher U.S. defense budget.

View Lockheed Martin Corporation’s Earnings Report Here >

April 15, 2025 Earnings

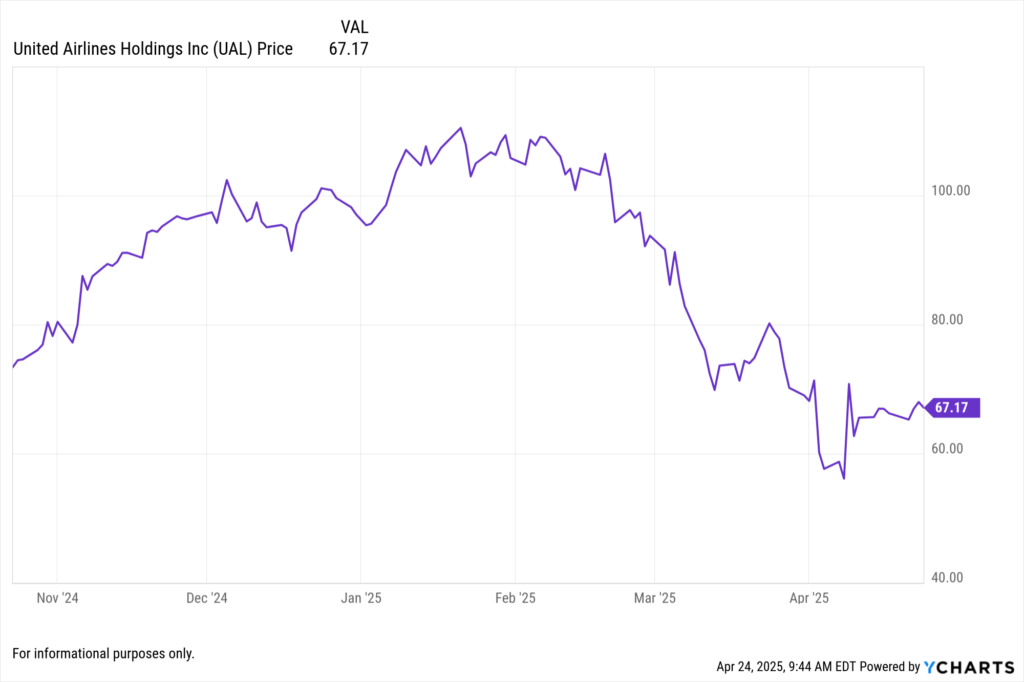

United Airlines Holdings Inc. (UAL) Reports Record Q1 Profit Amid Economic Uncertainty

United Airlines posted Q1 2025 earnings net income of $387 million, or $1.16 per share, reversing a year-ago loss as premium and international travel demand surged. Revenue rose 5.4% to $13.21 billion, driven by strong growth in higher-margin seats, while domestic coach bookings declined. United issued dual full-year guidance—$11.50 to $13.50 EPS in a stable economy and $7.00 to $9.00 in a recession—highlighting confidence in its profitability across market conditions.

View United Airlines Holdings Inc’s Earnings Report Here >

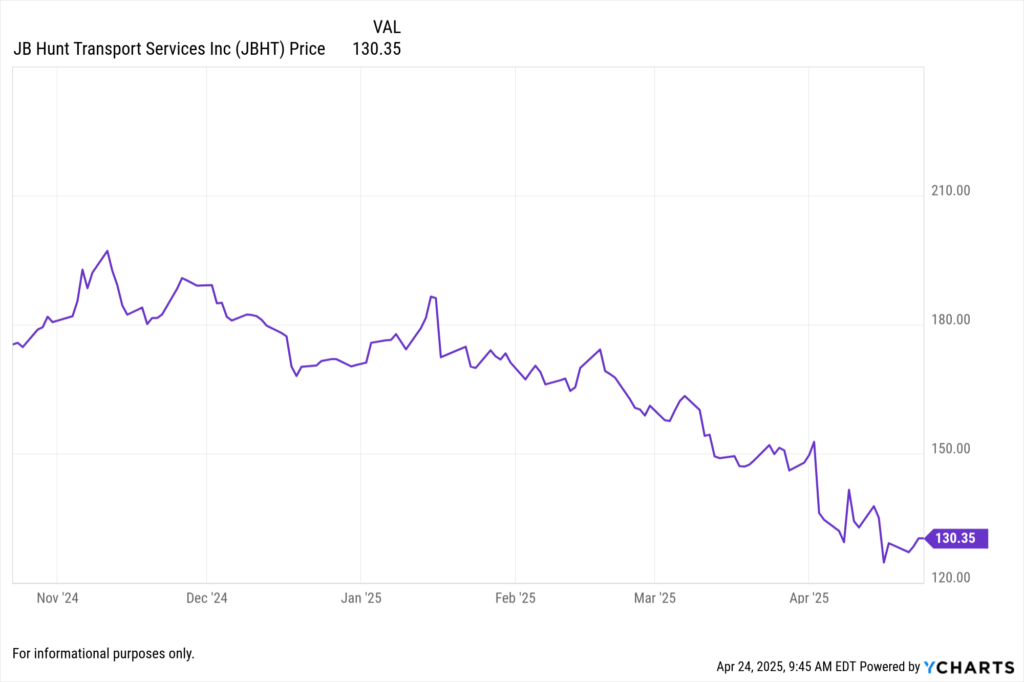

J.B. Hunt Transport Services Inc. (JBHT) Navigates Freight Recession with Mixed Q1 Results

J.B. Hunt reported Q1 2025 EPS of $1.17 on revenue of $2.92 billion, with Intermodal volume up 8% year-over-year despite pricing pressure. Total earnings declined modestly as Dedicated, Final Mile, and Truckload segments saw revenue and margin headwinds tied to inflation, equipment costs, and weaker demand. Management emphasized discipline in navigating ongoing freight softness and macro volatility.

View J.B. Hunt Transport Services Inc’s Earnings Report Here >

How YCharts Can Help

Event Calendar: Monitor all upcoming Industrials sector earnings.

Fundamental Charts: Visualize revenue, EPS, and segment growth over time.

Stock Screeners: Identify high-performing Industrials stocks by EPS growth or surprise.

Custom Reports: Build shareable earnings decks for client updates.

Whenever you’re ready, here’s how YCharts can help you:

1. Looking to Move On From Your Investment Research and Analytics Platform?

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Q1 2025 Consumer Staples Earnings: Live Updates & Market ReactionsRead More →