These are the Fastest Growing Value ETFs in 2024

When 2024 started, the spotlight was on the sustainability of a bull market driven by advancements in artificial intelligence. However, as highlighted in our LinkedIn newsletter, the Advisor Pulse, there’s been a bit of a market rotation as value stocks have begun to outperform growth stocks so far in the second half of the year.

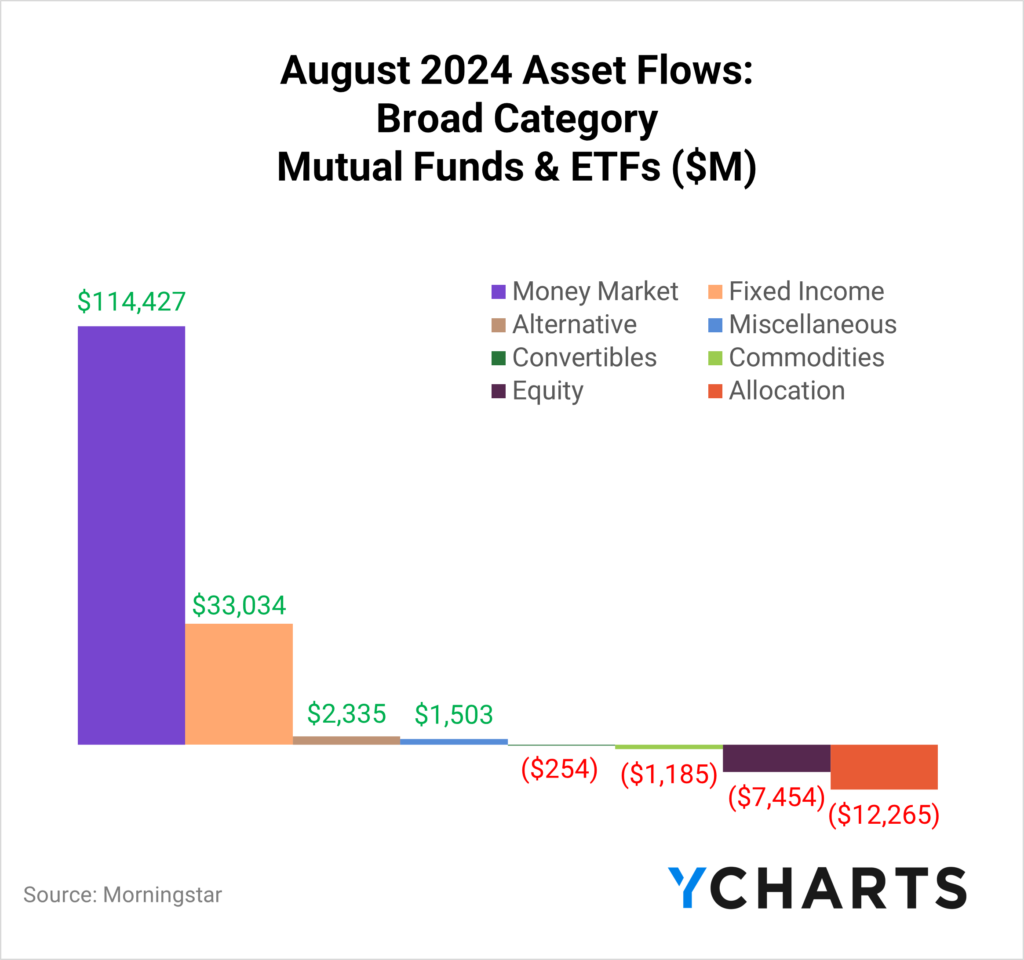

This pivot in investor sentiment is reflected in the asset allocation choices observed in August. Investors channeled $114.4B into money market funds, while fixed-income funds garnered an additional $33B.

On the other hand, equity mutual funds and ETFs had a net-negative month, collectively facing net outflows amounting to $7.5B. The swing to a more cautious stance in allocations is not surprising given the spike in the VIX early in the month and its impact on investor sentiment.

Furthermore, with the Fed pivoting to focus on maximizing employment, evidenced by the half-point cut on September 18th, a stable inflation regime could benefit value investors.

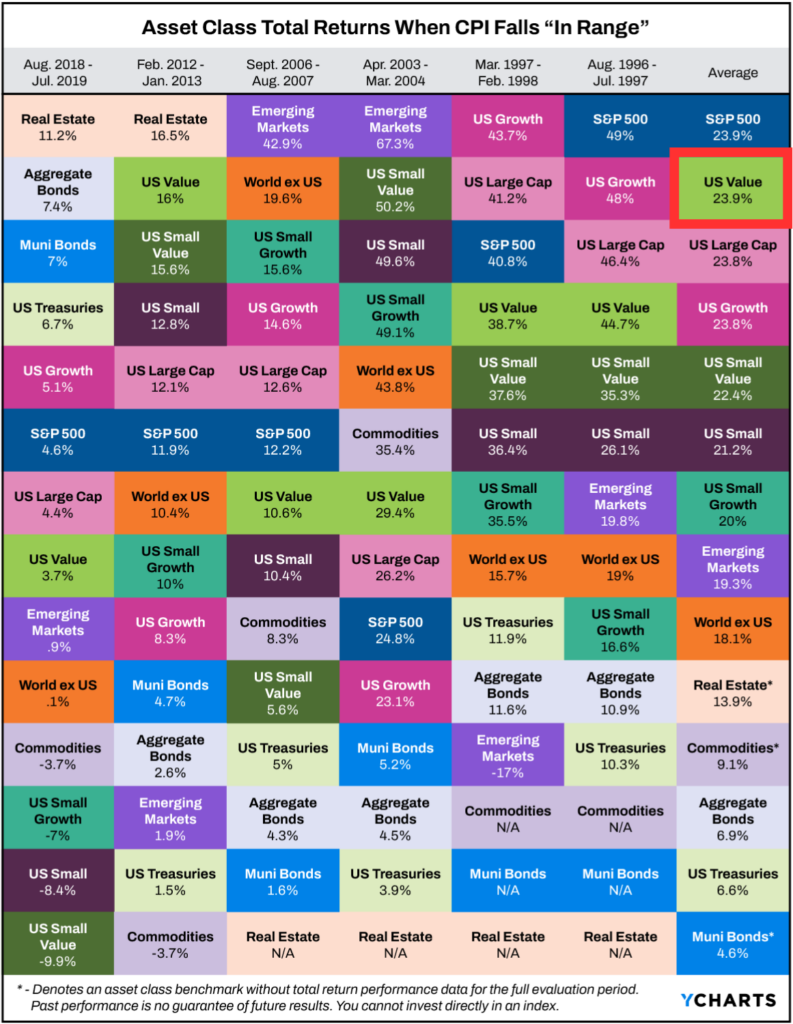

In our latest white paper, we observed six periods where inflation fell into the Fed’s preferred range and price stability was maintained for at least one year. Our findings indicate that large-cap value stocks were the second-best performing asset class during these periods, only slightly trailing behind the broader S&P 500.

Get your copy of “Which Asset Classes Perform Best As Inflation is Driven Lower” here:

Download Visual | Download the White Paper

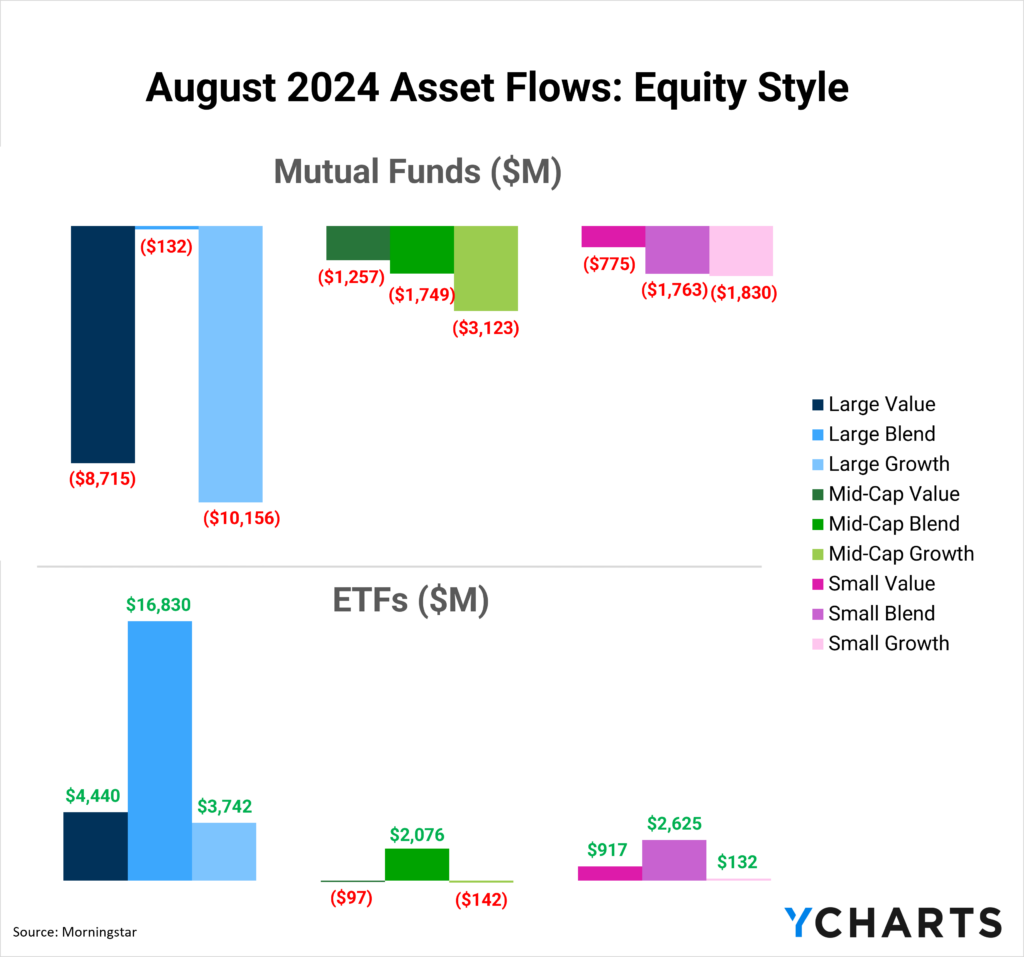

Additionally, investors seem to favor value strategies right now, evidenced by recent ETF inflows. In August alone, large-cap value ETFs reeled in $4.4B, while small-cap value ETFs attracted $917 million—both surpassing their growth-oriented counterparts.

With at least some of the market’s momentum tilting toward value, we examined which ETFs have been most effective at winning over advisors in 2024, both in terms of raw inflows and in relation to their end-of-August AUM.

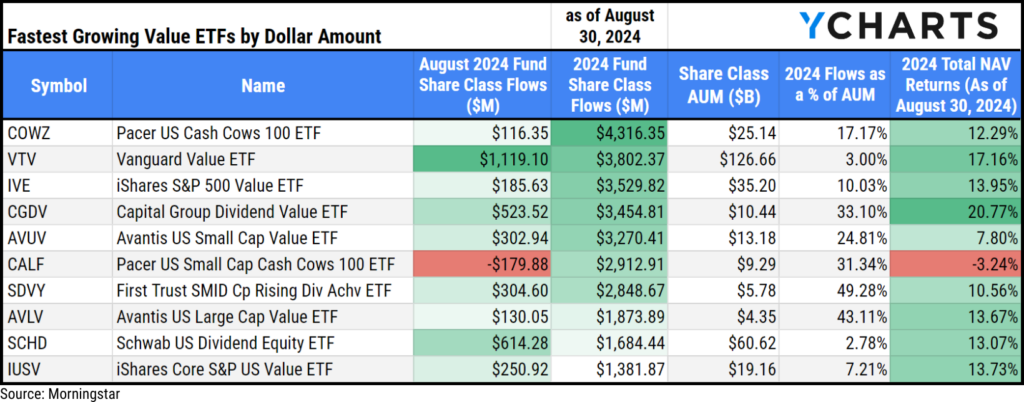

Fastest Growing Value ETFs by Dollar Amount

Based on our data provider’s classification of large, small, and mid-cap value strategies, we screened a list of 204 ETFs, all with an inception date of at least one year ago. We then added the equivalent of a popularity filter, excluding any strategy that currently has less than $1B AUM (as of September 23, 2024). This refinement yielded a focused group of 68 ETFs.

From this group, we further narrowed our analysis to identify the 25 fastest-growing ETFs by the amount of assets they brought in so far in 2024 (as of August 2024).

The Pacer US Cash Cows 100 ETF (COWZ) led the pack, bringing in $4.3B in new assets in 2024. The Vanguard Value ETF (VTV) and iShares S&P 500 Value ETF (IVE) pulled in $3.8B and $3.5B, respectively, to round out the top three.

The subsequent tier includes the Capital Group Dividend Value ETF (CGDV), which attracted $3.5B in inflows, the Avantis US Small Cap Value ETF (AVUV) with $3.3B, and the Pacer US Small Cap Cash Cows 100 ETF (CALF) which secured $2.9B.

Download Visual | View the Full Top 25

Notably, CGDV’s year-to-date flows represented 33% of its AUM as of August 30, 2024, marking the highest flow-to-AUM ratio among the six leaders.

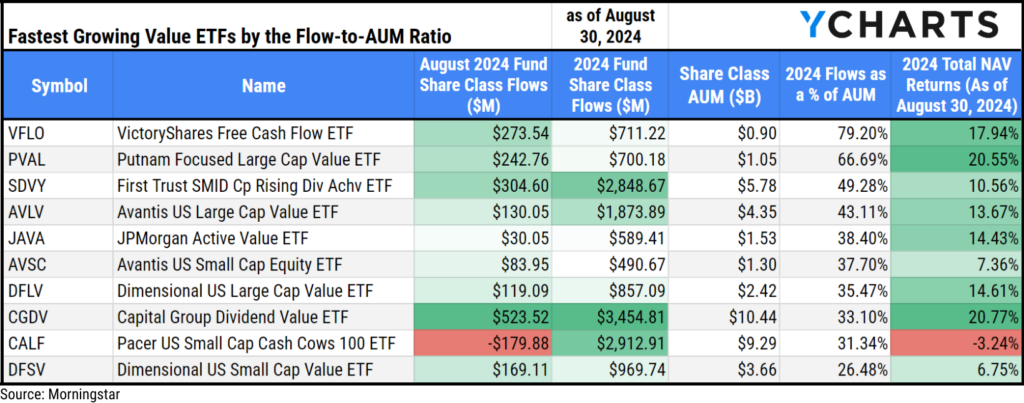

Fastest Growing Value ETFs by the Flow-to-AUM Ratio

Diving further into the flow-to-AUM ratio, this metric indicates how effectively distribution teams are expanding a fund relative to its AUM.

To reduce bias from smaller or newer funds, we once again applied a filter for ETFs with at least $1B in AUM (as of September 23, 2024) and that are at least 1 year old. Then, we produced a list of the 25 fastest-growing ETFs based on their flow-to-AUM ratios as of August 2024.

The clubhouse leader was the VictoryShares Free Cash Flow ETF (VFLO), which amassed over $711M in 2024, representing 79.2% of its AUM. Trailing behind VFLO are the Putnam Focused Large Cap Value ETF (PVAL) and the First Trust SMID Cap Rising Dividend Achievers ETF (SDVY), with inflows surpassing $700M and $2.9B, respectively. These inflows represent 66.7% and 49.3% of their respective AUMs.

The next three fastest-growing strategies were the Avantis US Large Cap Value ETF (AVLV), with $1.9B in 2024 inflows representing 43.1% of its AUM, the JPMorgan Active Value ETF (JAVA) with over $589M (38.4% of AUM), and the Avantis US Small Cap Equity ETF (AVSC) with over $490M year-to-date, equating to 37.7% of its AUM.

Download Visual | View the Full Top 25

For more fund flow insights, subscribe to our monthly fund flow report (clients only).

Data used in this article is sourced from Morningstar.

Whenever you’re ready, there are three ways YCharts can help you:

Have questions about how YCharts can help you grow AUM and prepare for meetings?

Email us at hello@ycharts.com or call (866) 965-7552. You’ll get a response from one of our Chicago-based team members.

Unlock access to our Fund Flows Report and Visual Deck by becoming a client.

Dive into YCharts with a no-obligation 7-Day Free Trial now.

Sign up for a copy of our Fund Flows Report and Visual Deck (clients only):

Disclaimer

©2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Streamline Portfolio Creation & Analysis with YCharts Quick ExtractRead More →