Trump’s 2025 Executive Actions: How They Could Affect Financial Markets

Updated as of: February 6th, 2025

Recent Executive Orders and Their Market Implications

In recent weeks, President Trump has issued several executive orders with potential implications for financial markets. Below is a summary of these actions:

Imposing Duties to Address the Situation at the Southern Border

On February 1, 2025, President Trump signed an executive order imposing a 25% tariff on all imports from Mexico and Canada, citing concerns over illegal immigration and drug trafficking. However, the implementation of these tariffs has been paused for 30 days to allow for further negotiations.

Market Implications:

- Automotive Industry: The U.S. automotive sector relies heavily on parts imported from Mexico and Canada. The imposition of tariffs could increase production costs, potentially leading to higher vehicle prices and reduced profit margins for manufacturers.

- Agriculture: American farmers export significant amounts of produce to Mexico and Canada. Retaliatory tariffs from these countries could decrease demand for U.S. agricultural products, adversely affecting farm revenues.

- Consumer Goods: Many consumer products are imported from Mexico and Canada. Tariffs may lead to increased prices for goods such as electronics, appliances, and clothing, contributing to inflationary pressures.

Investments to Watch:

Automotive ETFs: Funds like the First Trust NASDAQ Global Auto Index Fund (CARZ) may be impacted by increased production costs due to tariffs.

Agriculture ETFs: The VanEck Vectors Agribusiness ETF (MOO) could face volatility if agricultural exports decline.

Consumer Goods ETFs: The Consumer Discretionary Select Sector SPDR Fund (XLY) may experience fluctuations due to potential increases in consumer goods prices.

Imposing Duties to Address the Synthetic Opioid Supply Chain in the People’s Republic of China

On February 1, 2025, an executive order was issued imposing a 10% tariff on all imports from China to combat the synthetic opioid supply chain.

Market Implications:

Pharmaceutical Industry: Tariffs on Chinese imports could disrupt the supply chain for active pharmaceutical ingredients (APIs), potentially increasing costs for U.S. drug manufacturers.

Technology Sector: Many technology products and components are imported from China. The tariffs may lead to higher costs for electronics, affecting companies and consumers.

Retail: Retailers sourcing goods from China might face increased costs, which could be passed on to consumers, affecting sales volumes.

Investments to Watch:

- Pharmaceutical ETFs: The iShares U.S. Pharmaceuticals ETF (IHE) may be influenced by rising production costs.

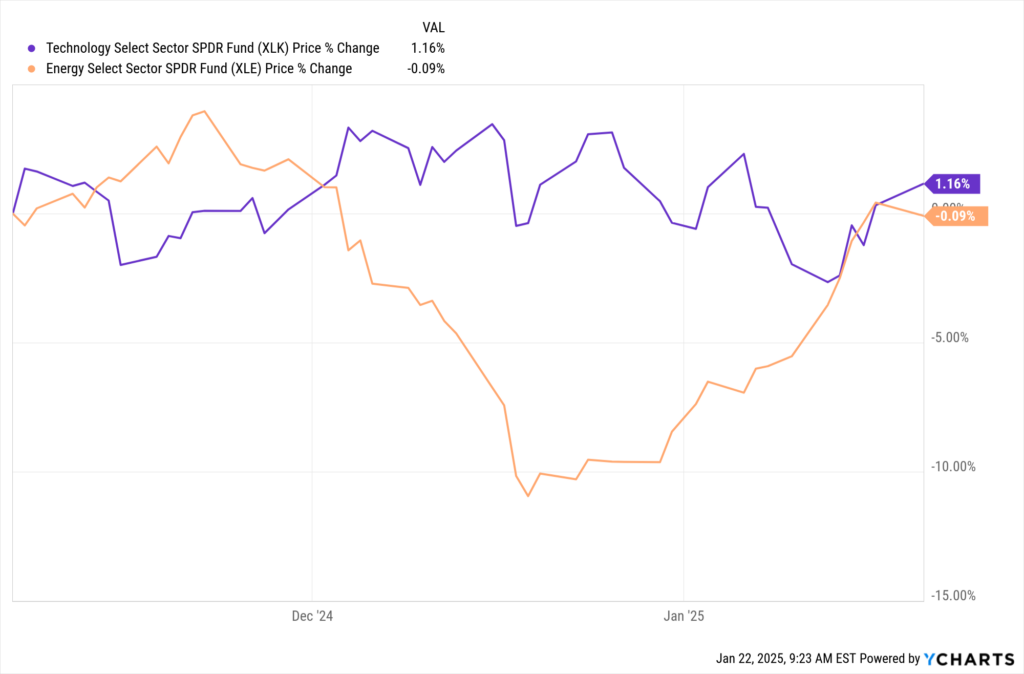

- Technology ETFs: Funds like the Technology Select Sector SPDR Fund (XLK) could experience volatility due to increased component costs.

- Retail ETFs: The SPDR S&P Retail ETF (XRT) might be affected by potential price increases and changes in consumer spending.

Plan for Establishing a United States Sovereign Wealth Fund

On February 3, 2025, President Trump announced a plan to establish a U.S. sovereign wealth fund to promote fiscal sustainability and economic security for future generations.

Market Implications:

- Government Investments: The creation of a sovereign wealth fund could lead to significant government investments in various sectors, potentially boosting selected industries.

- Fiscal Policy: Depending on the funding mechanisms, there could be implications for federal spending and taxation policies.

Investments to Watch:

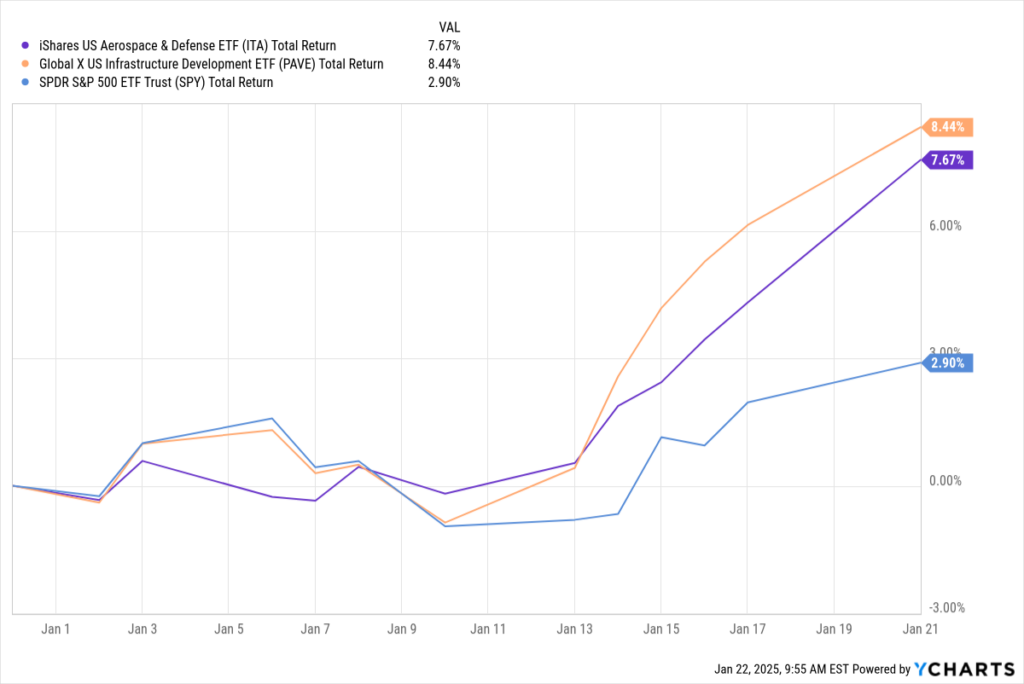

- Infrastructure ETFs: If the fund focuses on domestic development, the Global X U.S. Infrastructure Development ETF (PAVE) could benefit.

Technology ETFs: Investments in innovation might boost funds like the Invesco QQQ Trust (QQQ).

Withdrawing the United States from and Ending Funding to Certain United Nations Organizations and Reviewing United States Support to All International Organizations

On February 4, 2025, an executive order was signed to withdraw the U.S. from specific United Nations organizations and to review support for international organizations.

Market Implications:

- Defense and Security: Reduced participation in international organizations may lead to increased defense spending as the U.S. takes on a more unilateral approach to security.

- Foreign Aid: Cuts in funding could impact companies and NGOs involved in international development and aid.

Investments to Watch:

- Defense ETFs: The iShares U.S. Aerospace & Defense ETF (ITA) might see growth due to potential increases in defense budgets.

- Emerging Markets ETFs: Funds like the iShares MSCI Emerging Markets ETF (EEM) could be affected by changes in U.S. foreign aid and policy.

It is important to note that some of these executive orders have been suspended for 30 days pending further review and discussions. Investors and financial advisors should monitor these developments closely, as they may influence market dynamics and investment strategies.

The above actions represent the latest in a series of executive orders issued by the administration. For a comprehensive overview of prior executive actions and their potential effects on financial markets, please refer to the sections below.

Updated as of: January 27th, 2025

Introduction: Policy and Markets in 2025

Executive actions often serve as a window into a president’s policy priorities, and for financial markets, these decisions can be transformative. In 2025, President Donald Trump signed a series of executive actions that are already influencing the U.S. economy and global markets. From changes in environmental policies to tariffs and defense spending, these actions are shaping sectors like energy, trade, and technology.

For financial advisors, asset managers, and institutional investors, understanding these changes is key to navigating risks and uncovering opportunities. This article explores eight major executive actions from 2025 and analyzes their potential market implications.

Putting America First in International Environmental Agreements

On January 20, 2025, President Trump issued an executive order redirecting the United States’ approach to international environmental agreements. The directive emphasized prioritizing domestic economic interests, energy independence, and national sovereignty while reevaluating commitments to global environmental initiatives like the Paris Climate Agreement.

Market Implications:

- Energy Sector Impact: With a renewed focus on domestic energy independence, traditional energy companies such as ExxonMobil and Chevron may see increased opportunities for growth, while renewable energy firms could face reduced federal incentives and subsidies.

- Global Market Dynamics: This shift could create divergence between the U.S. and other nations focused on renewable energy investments, potentially affecting global competitiveness for American clean energy firms.

- Trade Relations: By moving away from international environmental frameworks, the U.S. may experience challenges in negotiating trade agreements with environmentally-focused nations, potentially impacting industries reliant on exports.

Investments to Watch:

- Traditional Energy ETFs: Funds such as the Energy Select Sector SPDR Fund (XLE) may benefit from increased domestic fossil fuel production.

- ESG Portfolios: Investors should monitor the potential impact on ESG-focused funds, such as the iShares Global Clean Energy ETF (ICLN), as diminished federal support for renewables may affect their performance.

- Energy Infrastructure Funds: Funds focused on U.S. energy infrastructure, like the Alerian MLP ETF (AMLP), could see gains as domestic energy production increases.

America First Trade Policy Directive: A Renewed Focus on Trade Deficits and Fair Practices

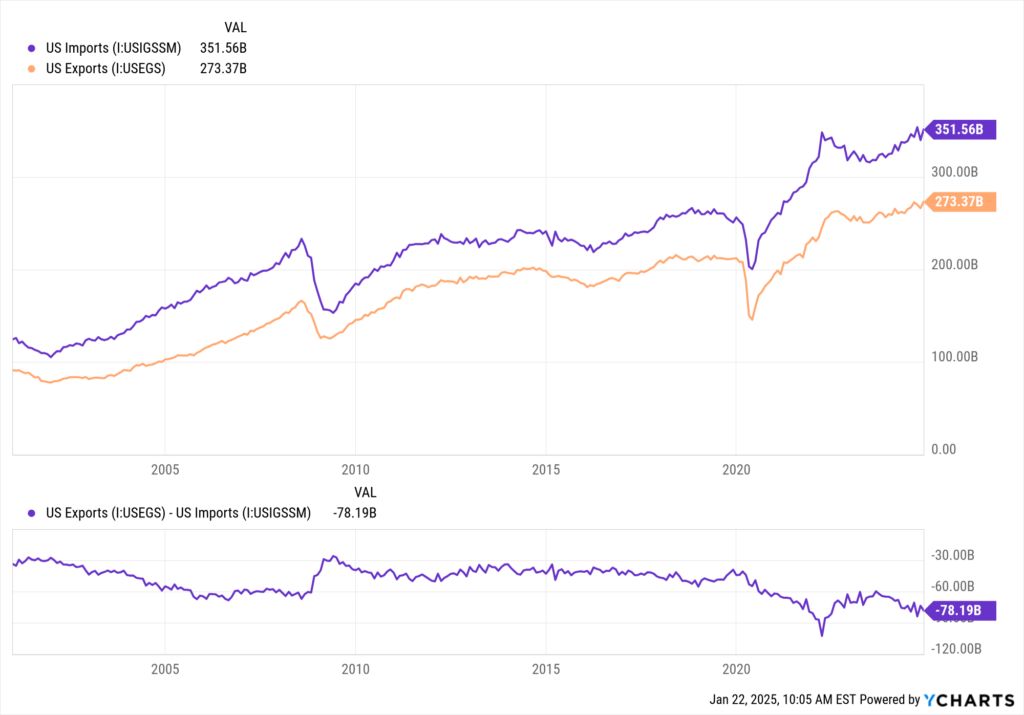

The Trump administration introduced the “America First Trade Policy” through a detailed memorandum aimed at addressing persistent trade deficits, currency manipulation, and unfair trade practices. While no tariffs have been enacted yet, the policy outlines measures that could reshape trade relations with key partners, including Canada and Mexico.

Key Provisions of the Directive:

- Global Supplemental Tariff: The administration has directed investigations into trade deficits and the feasibility of a supplemental tariff to protect American industries.

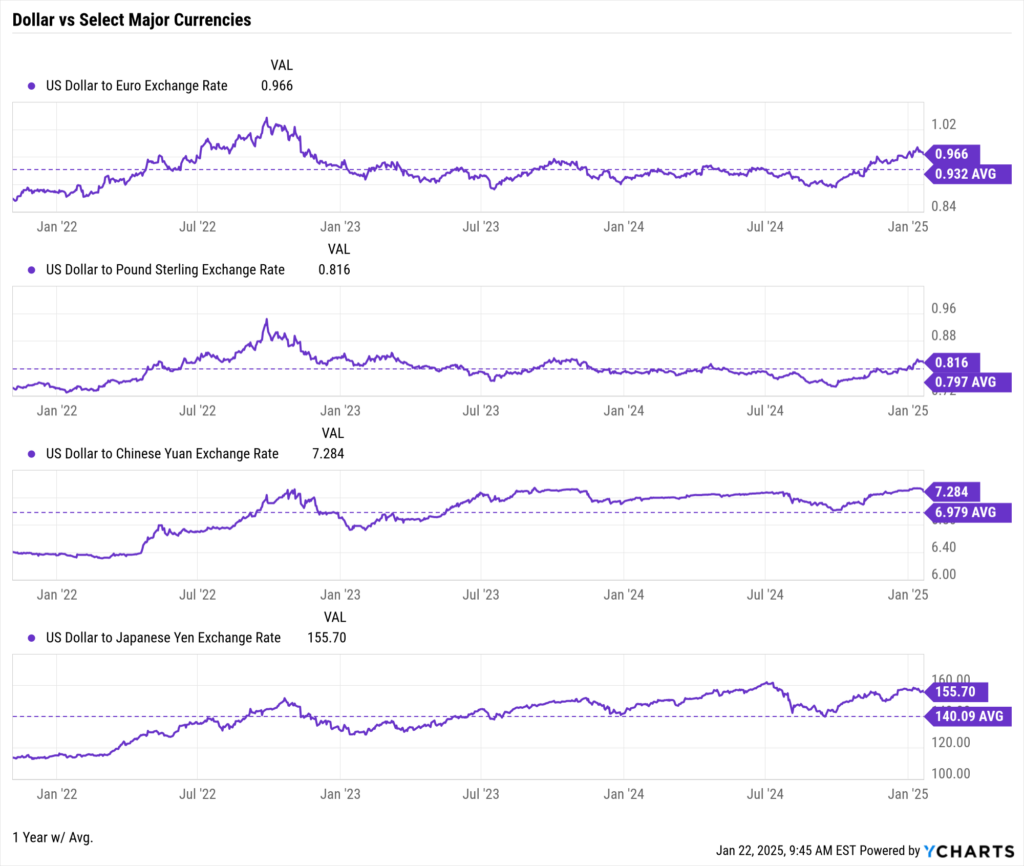

- Currency Oversight: Greater scrutiny of currency practices among major U.S. trading partners could lead to targeted economic measures.

- USMCA Review: Ahead of the 2026 USMCA review, the administration is prioritizing assessments of the agreement’s economic impact on U.S. industries.

Market Implications:

- Trade Relations: The policy signals stricter trade enforcement and heightened scrutiny of agreements like the USMCA. Any resulting tensions could impact industries such as agriculture, automobiles, and technology.

- Currency Markets: Increased oversight on currency manipulation may lead to volatility in forex markets, especially for the U.S. dollar against currencies like the Mexican peso and Canadian dollar.

- Regulatory Costs: If the proposed External Revenue Service (ERS) is established, companies engaging in international trade could face additional compliance challenges.

Investments to Watch:

- Domestic Manufacturing Funds: Funds like the iShares U.S. Industrials ETF (IYJ) may stand to benefit as the policy aims to boost domestic production.

- Global Diversification Risks: Funds heavily reliant on global supply chains or international trade agreements might encounter headwinds due to increased regulatory complexity.

Unleashing Alaska’s Extraordinary Resource Potential

On January 20, 2025, President Trump signed an executive order to promote energy independence by expanding oil and gas exploration in Alaska, including the Arctic National Wildlife Refuge (ANWR). This move aims to boost domestic energy production, create jobs, and reduce reliance on foreign energy sources.

Market Implications:

- Energy Sector Growth: The development of Alaskan oil and gas resources could provide significant opportunities for companies involved in exploration, production, and infrastructure. This may lead to increased revenues for major energy corporations and energy services providers.

- Environmental Concerns: Expanding drilling operations in environmentally sensitive areas like ANWR could draw criticism from ESG-focused investors and organizations, potentially creating reputational risks for companies involved.

- Supply Chain Impact: Increased domestic production may stabilize energy supply chains, reducing price volatility and benefiting industries reliant on stable energy costs.

Investments to Watch:

- Energy ETFs: Funds like the Energy Select Sector SPDR Fund (XLE) could benefit from expanded U.S. oil and gas production.

- Infrastructure Funds: Investments such as the Global X MLP & Energy Infrastructure ETF (MLPX) may see opportunities as new projects in Alaska require infrastructure development.

- ESG Considerations: Funds focused on sustainability and environmental concerns, such as the iShares MSCI USA ESG Select ETF (SUSA), may experience shifts in sentiment due to policy changes that prioritize traditional energy over environmental protection.

This executive order underscores a significant pivot toward maximizing domestic resource potential, particularly in Alaska, which could have far-reaching effects on energy markets and investment strategies.

National Emergency Declaration at the Southern Border

On January 20, 2025, President Trump signed an executive order declaring a national emergency at the U.S.-Mexico border. This measure aims to enhance border security through increased personnel, technology, and infrastructure development, citing concerns about illegal immigration, drug trafficking, and national security.

Market Implications:

- Defense and Security Sector: The focus on border security is expected to drive demand for defense and surveillance technologies, potentially benefiting companies specializing in advanced security solutions and infrastructure development.

- Cross-Border Trade: Heightened security measures could slow down the flow of goods across the U.S.-Mexico border, creating potential disruptions in supply chains, particularly for industries like automotive manufacturing and agriculture that rely heavily on cross-border trade.

- Labor Markets: Stricter immigration controls may impact industries reliant on migrant labor, such as agriculture, construction, and hospitality, potentially leading to higher labor costs.

Investments to Watch:

- Defense and Security ETFs: Funds like the iShares U.S. Aerospace & Defense ETF (ITA) and SPDR S&P Aerospace & Defense ETF (XAR) could benefit from increased government spending on security technologies and infrastructure.

- Agriculture ETFs: Funds such as the VanEck Agribusiness ETF (MOO) may experience volatility if stricter border controls disrupt agricultural labor markets and supply chains.

- Infrastructure Funds: The Global X U.S. Infrastructure Development ETF (PAVE) could see opportunities tied to new infrastructure projects aimed at bolstering border security.

The national emergency declaration highlights a significant shift in federal priorities, with potential ripple effects across multiple sectors, including defense, agriculture, and manufacturing. Financial professionals should monitor developments closely to identify investment opportunities and risks stemming from these policy changes.

Executive Order Targeting TikTok and Other Foreign-Controlled Applications

On January 25, 2025, President Trump signed an executive order under the Protecting Americans from Foreign Adversary-Controlled Applications Act, mandating stricter data security measures and limiting the operations of TikTok and similar applications within the U.S. This move is part of a broader effort to safeguard national security and protect user data from foreign adversaries.

Market Implications:

- Technology Sector: U.S.-based technology companies, particularly social media platforms like Meta (Facebook) and Snap, could see increased user acquisition if TikTok’s operations are significantly curtailed. This shift could lead to enhanced advertising revenues for domestic platforms.

- Data Security Companies: Heightened focus on protecting user data is likely to boost demand for cybersecurity solutions, benefiting companies specializing in data encryption and network security.

- Consumer Goods: Brands heavily reliant on TikTok for marketing may need to reallocate advertising budgets, potentially affecting sectors like fashion, beauty, and consumer electronics.

Investments to Watch:

- Technology ETFs: Funds such as the Invesco QQQ Trust (QQQ) and the Technology Select Sector SPDR Fund (XLK) may benefit from the reallocation of advertising spend to domestic platforms and growth in cybersecurity investments.

- Cybersecurity ETFs: Funds like the ETFMG Prime Cyber Security ETF (HACK) could gain traction as businesses invest more in data protection technologies.

- Consumer Discretionary ETFs: The Consumer Discretionary Select Sector SPDR Fund (XLY) could experience short-term shifts as companies adjust marketing strategies.

This executive action underscores the growing significance of digital privacy and national security in shaping market dynamics. Financial professionals should monitor the evolving regulatory landscape for potential investment opportunities and risks tied to data privacy and technology trends.

Initial Rescissions of Harmful Executive Orders and Actions

On January 27, 2025, the Trump administration rescinded a series of executive orders and actions from previous administrations that were deemed to be harmful to economic growth, national security, or energy independence. These reversals included rollbacks of environmental regulations, labor policies, and trade-related mandates, signaling a shift toward deregulation and economic revitalization.

Market Implications:

- Energy Sector: Rollbacks on environmental restrictions are expected to lower operational costs for oil, gas, and coal companies, potentially boosting profitability. This could lead to increased domestic energy production and exports, particularly in natural gas and crude oil markets.

- Financial and Manufacturing Sectors: Deregulatory policies aimed at reducing compliance burdens may create more favorable conditions for financial services and manufacturing firms, driving investment and innovation in these sectors.

- ESG Investment Concerns: While deregulation may attract traditional capital, it could also deter ESG-focused investors due to concerns about sustainability and long-term environmental impacts.

Investments to Watch:

- Energy ETFs: Funds such as the Vanguard Energy ETF (VDE) and the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) could see growth from increased investment in the energy sector.

- Infrastructure Funds: Policies encouraging domestic production and energy independence could benefit funds like the iShares U.S. Infrastructure ETF (IFRA).

- Broad Market ETFs: Reduced compliance costs across multiple industries could have a positive impact on funds like the SPDR S&P 500 ETF Trust (SPY), which represents a diverse range of sectors.

The rescission of these executive actions reflects a strategic shift toward prioritizing economic growth and energy independence, providing opportunities for financial professionals to adjust portfolios in alignment with these regulatory changes.

Withdrawal from the OECD Global Tax Deal

On January 20, 2025, President Trump announced the withdrawal of the United States from the Organization for Economic Co-operation and Development (OECD) Global Tax Deal. This deal, originally designed to establish a global minimum tax on multinational corporations, aimed to prevent tax base erosion and profit shifting. The decision reflects the administration’s focus on domestic economic priorities and maintaining the competitive tax advantages for U.S.-based companies.

Market Implications:

- Corporate Tax Environment: The withdrawal allows U.S. corporations to retain a more favorable tax environment compared to global peers. This could enhance profitability for large multinational companies based in the U.S.

- Foreign Direct Investment (FDI): A competitive tax structure could attract foreign investment, as corporations may choose the U.S. as a hub for operations due to its tax advantages.

- Global Trade Relations: While beneficial domestically, the withdrawal could strain international relations with key trading partners who support the deal, potentially affecting cross-border trade dynamics.

Investments to Watch:

- U.S. Multinational ETFs: Funds like the iShares U.S. Technology ETF (IYW) and the Vanguard Mega Cap ETF (MGC), which track companies benefiting from lower tax rates, could see gains.

- Tax-Advantaged Corporations: Sectors with significant multinational operations, such as technology, pharmaceuticals, and financial services, are likely to benefit from the absence of a global minimum tax.

- Global Market ETFs: Conversely, global funds like the iShares MSCI ACWI ETF (ACWI) may face pressures due to trade tensions stemming from the U.S. withdrawal.

The withdrawal from the OECD Global Tax Deal reinforces the administration’s “America First” economic strategy, emphasizing domestic economic growth and corporate competitiveness while presenting new considerations for international trade and investment strategies.

Strengthening American Leadership in Digital Financial Technology

President Trump recently signed an executive order titled “Strengthening American Leadership in Digital Financial Technology,” marking a pivotal step in shaping the regulatory and innovation landscape for digital assets. The order outlines a framework to establish the United States as a global leader in digital financial technology by fostering innovation, protecting consumers, and ensuring national security.

The executive order emphasizes key priorities:

- Innovation-Friendly Regulation: Directing federal agencies to collaborate on developing a regulatory framework that promotes innovation while mitigating risks like fraud and financial instability.

- International Cooperation: Encouraging U.S. leadership in shaping global digital asset standards to prevent currency manipulation and unfair practices.

- Consumer Protection: Establishing guidelines to safeguard consumers and investors from cybersecurity threats and fraudulent activities.

Research and Development: Allocating resources for the development of blockchain technology and exploring the feasibility of a U.S. central bank digital currency (CBDC).

Market Implications

The executive order introduces a clearer pathway for digital financial technology, presenting both opportunities and challenges for investors and the crypto market:

- Increased Regulatory Clarity: By prioritizing collaboration between federal agencies, the order could reduce regulatory uncertainty, paving the way for more institutional investment in digital assets.

- Global Competitiveness: The emphasis on U.S. leadership in digital financial technology could strengthen the country’s competitive edge, encouraging growth in blockchain startups and attracting foreign investment.

- CBDC Exploration: The order signals the government’s interest in exploring a U.S. central bank digital currency, which could transform the payments landscape and elevate the dollar’s role in global markets.

- Enhanced Security Measures: By focusing on cybersecurity and consumer protection, the order may reduce fraud and bolster investor confidence in digital asset markets.

Investments to Watch

- Bitcoin and Ethereum: As the most established cryptocurrencies, Bitcoin and Ethereum are likely to benefit from increased regulatory clarity, fostering further adoption and integration into institutional portfolios.

- XRP: Ripple’s XRP token may see a surge in adoption and value if the regulatory environment supports its use case as a payment-focused cryptocurrency. Its ongoing legal challenges could also find resolution under this more defined framework.

- Crypto ETFs: Funds such as the ProShares Bitcoin Strategy ETF (BITO) and Grayscale Ethereum Trust (ETHE) provide regulated exposure to the crypto market, attracting risk-conscious investors.

- Blockchain Stocks: Companies such as Coinbase (COIN), Riot Platforms (RIOT), and Marathon Digital (MARA) stand to benefit from growing demand for blockchain services and increased government support for the technology.

- CBDC Technology Providers: Firms involved in CBDC infrastructure development, such as IBM and Accenture, could experience significant growth as the U.S. explores launching its own digital currency.

Looking Ahead

The executive order reflects a decisive shift toward establishing the United States as a global leader in digital financial technology. For financial professionals, this regulatory clarity presents an opportunity to assess how cryptocurrencies and blockchain-based solutions fit into client portfolios.

However, challenges remain. As the U.S. positions itself as a leader in digital assets, heightened scrutiny may introduce short-term volatility in crypto markets. For advisors and asset managers, staying informed on updates to the regulatory framework will be critical for leveraging these opportunities while mitigating risks.

Implications for Financial Professionals

For financial advisors, asset managers, and institutional investors, Trump’s 2025 executive actions present a mixed bag of challenges and opportunities.

- Advisors: Use tools like YCharts to assess how policy shifts impact client portfolios. Analyze sector performance, risk metrics, and ESG considerations to provide tailored advice.

- Asset Managers: Stay proactive by monitoring changes in trade policies, defense spending, and regulatory environments. Leverage tools like correlation matrices to optimize asset allocation strategies.

- Institutions: Institutions managing large portfolios should focus on scenario analysis to understand how policy changes could affect long-term performance.

How YCharts Can Help Navigate Policy Changes

YCharts empowers financial professionals to navigate complex markets by providing robust data and visualization tools. Here’s how YCharts can assist:

- Scenario Analysis: Use YCharts’ fundamental charts to model the impact of tariffs or regulatory changes on specific sectors.

- ESG Screening: Identify funds aligned with or diverging from new DEI policies using YCharts’ fund screener.

- Portfolio Insights: Monitor portfolio performance in sectors affected by policy shifts, such as energy and defense.

By leveraging YCharts, professionals can provide clients with actionable insights during periods of political and economic uncertainty.

Conclusion: Navigating 2025 with Informed Insights

President Trump’s 2025 executive actions highlight the importance of understanding how policy changes influence financial markets. From trade and defense to energy and healthcare, these actions will shape the economic landscape for years to come.

For financial professionals, staying ahead of these changes is crucial. By leveraging data-driven tools like YCharts, you can navigate market complexities, optimize investment strategies, and provide clients with the insights they need to succeed in an evolving economic environment.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking to better communicate the importance of economic events to clients?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Download a copy of the Quarterly Economic Update slide deck:

Download the Economic Summary Deck:Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

YCharts Features: In-Depth Look at the Tools That Empower Financial AdvisorsRead More →