What Sets YCharts Apart

In today's vast wealth-tech landscape, wealth management firms seek cutting-edge tools to make informed decisions, win new business, and better communicate with their clients. Finding the right solutions for you and your business can be overwhelming. YCharts, Factset, and Koyfin stand out as three top investment research platforms to consider. Let’s analyze the differences.

YCharts vs Factset

YCharts offers the comprehensive data sets and advanced investment analysis tools that Factset is known for, but stands out with its more intuitive user interface. Compared to Factset’s high price point of $12,000 per year, YCharts costs a fraction of that, providing better value to investment advisors, portfolio managers, and analysts alike.

YCharts vs Koyfin

Koyfin offers one of the best investment research tools for retail investors. YCharts combines Koyfin’s extensive data and investment analysis with a fully integrated platform that includes proposal and report generation capabilities. It stands out with comprehensive client communication tools made for today’s wealth management professionals.

Why YCharts?

YCharts has become the top choice for over 12,000 wealth managers by adapting to market changes, managing compliance challenges, and meeting client demands. It stands out as the leading software advisors are considering adding in 2024 (per T3). Designed for forward-thinking advisors and asset managers, YCharts is the key to unlocking growth.

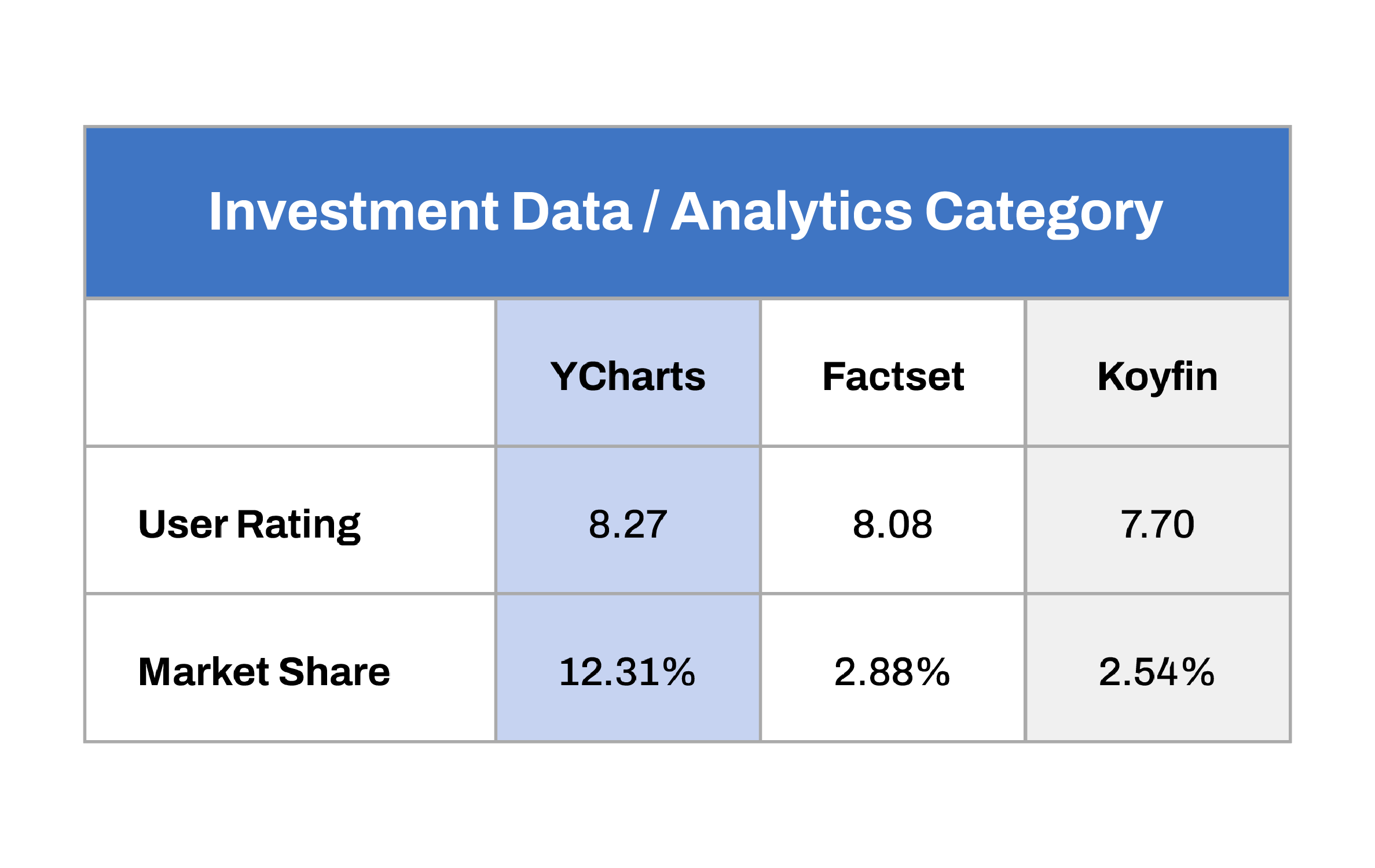

How Do Advisors Rank Each Solution?

User ratings and market share as reported by a 2024 third-party industry survey. (Per T3 Report)

“ Recognized as the Investment Research Market Leader, surpassing industry competitors in customer satisfaction and purchase value. ”

Michael Kitces

“ YCharts has been an amazing partner for many years. Their software is easy to use and awesome, but they also use a high-touch approach to ensure our success in market and portfolio analysis, and in enabling us to clearly and visually communicate our insights. ”

Josh Brown

“ YCharts is a graphical interface to all the market data any firm would require, the advisory profession’s (much less expensive) answer to the Bloomberg Terminal. ”

Joel Bruckenstein & Bob Veres

Feature Comparison

| YCharts | Koyfin | Factset | |

| FEATURES | |||

| Portfolio Construction & Management | |||

| Attribution Analysis | |||

| Screening Capabilities (Stocks, Mutual Funds, ETFs) | |||

| Market Monitoring | |||

| Research List Management | |||

| Team Sharing & Collaboration | |||

| Dedicated Portfolio Optimizer | |||

| Economic Analysis | |||

| Excel Model Automation | |||

| Scenarios Modeling | |||

| Custodian Holdings Integration | |||

| Pre-Built Research & Visual Templates | |||

| Web-based Tool | |||

| CLIENT COMMUNICATION | |||

| Portfolio & Security Comparisons | |||

| Investment Proposals | |||

| Sales Collateral Sharing | |||

| Custom Report Builder | |||

| Tearsheets, Overview & Multi-Comparison Reports | |||

| SEC-compliant & FINRA-reviewed Templates | |||

| CUSTOMIZATIONS | |||

| Charts & Visuals | |||

| Custom Benchmarks & Investment Scoring | |||

| User Dashboard | |||

| Firm Logo & Colors | |||

| Reports (Portfolio & Securities) | |||

| DATA | |||

| Stocks, Mutual Funds, CEFs, UITs & ETFs | |||

| Cryptocurrencies | |||

| Analyst Recommendations | |||

| Economic Indicators | |||

| ESG Data | |||

| Separate Accounts (SMAs) |

A Tailored Experience for You & Your Team

YCharts offers customized solutions tailored to different user roles and responsibilities. Contact the YCharts team to learn about plan options, including discount partnerships for Broker-Dealers and other affiliate firms.

Streamline Your Research & Client Communication

What's Your Primary Role?