Debunking Investing Myths

It’s already a new year, and with the turn of the calendar comes the annual flurry of New Year’s resolutions for many. This year, the top resolution among U.S. adults is to save more money, according to Statista.

While it’s great that more Americans are seeking to improve their finances, this is even better news for advisors seeking to add new clients and grow assets under management. More money saved is more in the bank for the American saver, but for advisors, increased savings means a higher amount of dry powder sitting on the sidelines that could be invested.

To help advisors take advantage of opportunities to win new clients and increase wallet share, we put together the free Debunking Investing Myths slide deck, a handy resource filled with data and visuals that disprove common misconceptions about investing to increase client comfort with putting their money to work.

This Advisor Pulse debunks some of the most common investing myths, plus many more in the free slide deck.

“Investing is Like Gambling”

Unlike gambling, which relies on chance, investing is about compounding growth and has historically rewarded long-term commitment with positive returns.

Consider the probabilities of winning various casino games:

- Craps: ~50%

- Blackjack: ~49%

- Roulette: ~47% to 49%

- Baccarat: ~44% to 46%

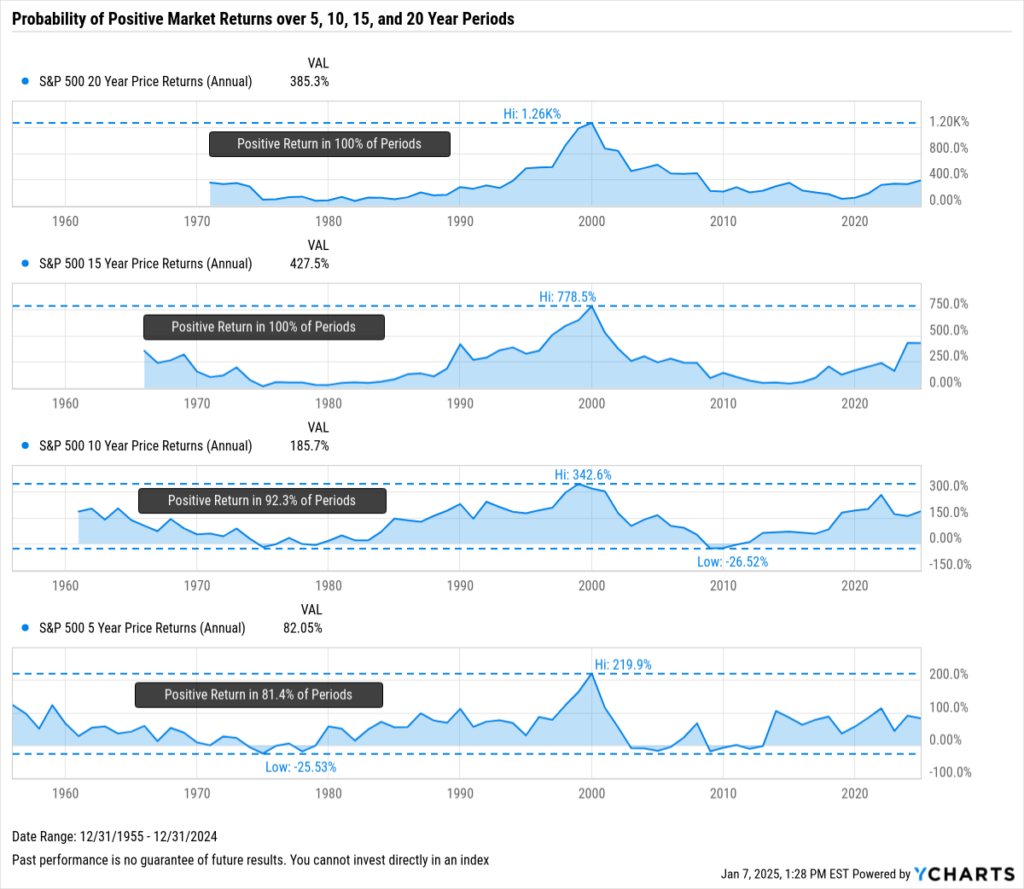

Then, consider the probabilities of S&P 500 returns over…

- 5-year periods since 1955: 81.4%

- 10-year periods since 1960: 92.3%

- 15-year periods since 1965: 100%

- 20-year periods since 1970: 100%

Download Visual | Modify in YCharts

While games of chance provide instantaneous fun, clients ought to be thrilled with the chances of growing their portfolio’s value through investing.

“Investing is Only for the Rich”

The power of compounding can grow small, regular investments over time. Compounding, coupled with advances in technology (like fractional shares) helps make investing accessible to a wide range of income levels.

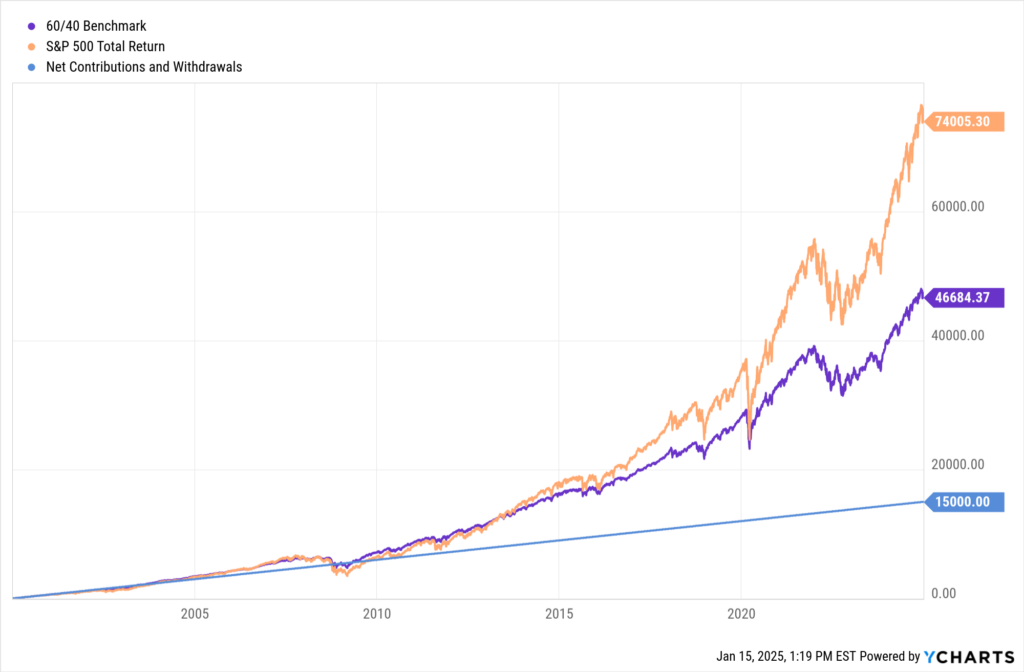

This Scenario illustrates the power of small contributions over time. By investing $50 a month for the last 25 years, the total amount contributed would be $15,000. Invested into a 60/40 portfolio, that $15,000 would have grown into $46,000 thanks to the power of long-term investing.

If the same $50 monthly contributions were invested in an all-S&P 500 portfolio, that nest egg would grow to more than $74,000–almost 5x the original investment.

Download Visual | Modify in YCharts

One doesn’t have to be inherently wealthy to invest; small contributions over time indeed make a big impact later on in life.

“Holding Cash is Better Than Investing”

Holding cash might feel safe, but over time inflation erodes its purchasing power.

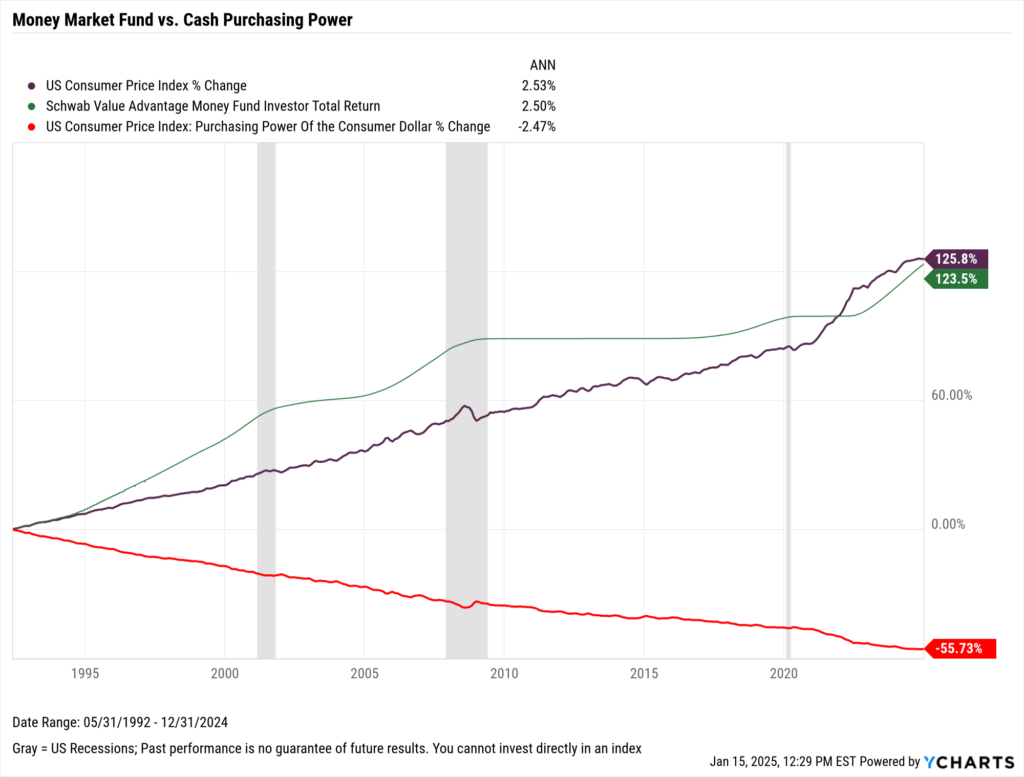

Investing cash in a money market fund can help mitigate the effects of inflation, but it doesn’t generate significant growth. In fact, as illustrated in the example below, oftentimes money market funds merely cancel out inflation, resulting in net-zero real growth.

Download Visual | Modify in YCharts

And cash that truly sits uninvested–such as in a checking account or tucked away under that mattress–actually loses value over time due to diminished purchasing power.

“Market Timing Is Key to High Returns”

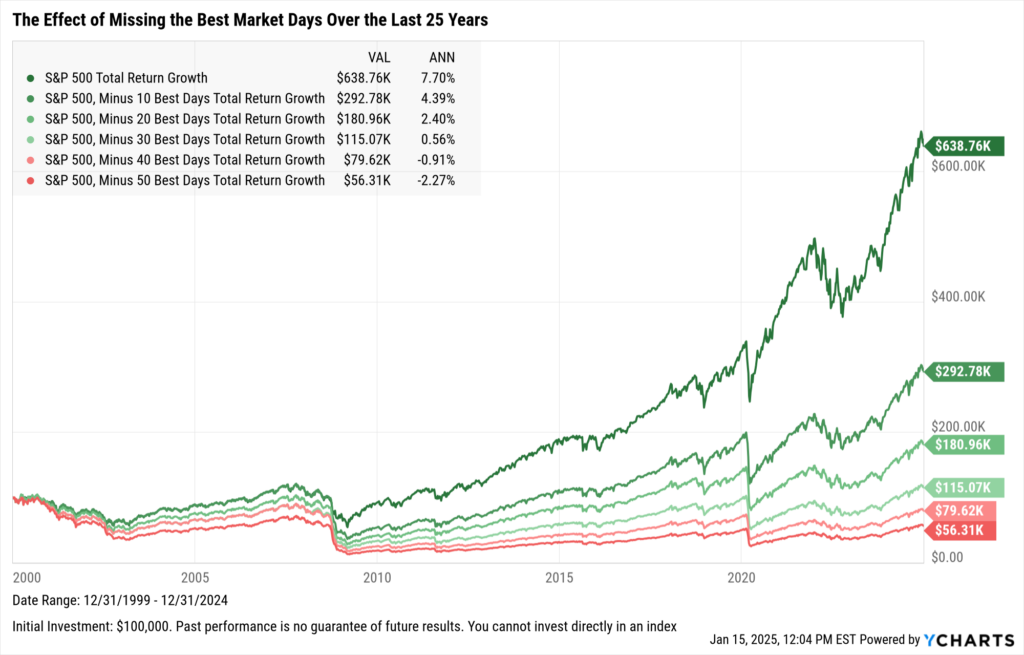

Many believe timing is key, but missing just a few top-performing days significantly impacts long-term returns.

Download Visual | Modify in YCharts

The S&P 500’s annualized return over the last 25 years is 7.70%. However, missing just the 10 best market days over 25 years cuts returns nearly in half. Here are the annualized returns when missing increasingly more of the market’s best days over the last 25 years:

- 0 days: 7.70%

- 10 days: 4.39%

- 20 days: 2.40%

- 30 days: 0.56%

- 40 days: -0.91%

- 50 days: -2.27%

Staying fully invested ensures a client’s long-term growth potential is maximized.

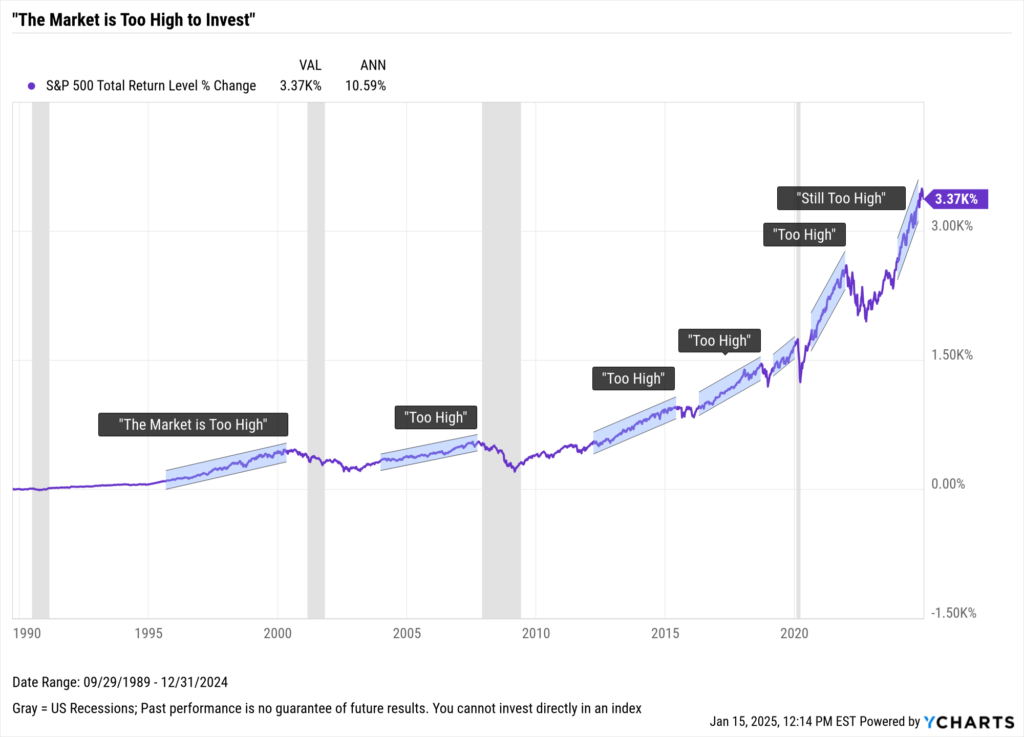

“Now is the Wrong Time to Invest”

Have your clients ever thought the market was simply too high to invest in?

Just like the myth that “market timing is key to high returns,” fretting about whether or not the present moment is the wrong time to invest can be detrimental, especially if the market is at an all-time high.

Download Visual | Modify in YCharts

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking for a best-in-class data & visualization tool?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Get your copy of Debunking Investing Myths slide deck:

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Trump's 2025 Executive Actions: How They Could Affect Financial MarketsRead More →