Challenges Facing the Technology Sector in 2025: Navigating Uncertainty and Embracing Innovation

Introduction: Navigating the Complex Landscape of 2025

The technology sector stands at a pivotal juncture in 2025, grappling with unprecedented challenges that threaten to disrupt its trajectory. From integrating artificial intelligence (AI) and fortifying cybersecurity to retaining top talent and navigating regulatory landscapes, technology companies must adapt swiftly to maintain their competitive edge. Financial advisors and asset managers need to understand these dynamics to guide their clients effectively.

In this blog, we will dive into:

- The critical challenges facing the technology sector in 2025

- The impact of these challenges on sector performance

- Strategies for advisors and asset managers to navigate this evolving landscape

Key Challenges Confronting the Technology Sector

1. Accelerating Integration of Artificial Intelligence (AI)

The rapid advancement of AI presents both opportunities and challenges. While AI has the potential to revolutionize operations, many companies struggle with data quality issues and unclear implementation roadmaps. Effectively deploying AI is no longer optional, and those who fail to integrate it risk falling behind.

2. Escalating Cybersecurity Threats

With vast amounts of valuable intellectual property and customer data, technology firms are prime targets for cybercriminals. The rapid adoption of generative AI introduces new vulnerabilities, necessitating robust risk management strategies to protect assets and maintain trust.

3. Talent Retention and Motivation

Attracting and retaining high-performance talent remains a significant challenge. Building a culture of excellence and innovation is crucial for maintaining a competitive edge, especially as the demand for skilled professionals intensifies.

4. Regulatory and Geopolitical Pressures

The technology sector faces increasing scrutiny from regulators worldwide. Geopolitical tensions, particularly between major economies, add layers of complexity to global operations, impacting supply chains and market access.

5. Economic Uncertainties

Global economic fluctuations, including trade tensions and fiscal deficits, influence investment and consumer spending in technology. These uncertainties require companies to be agile and resilient in their strategic planning.

Data-Driven Analysis: Performance Metrics

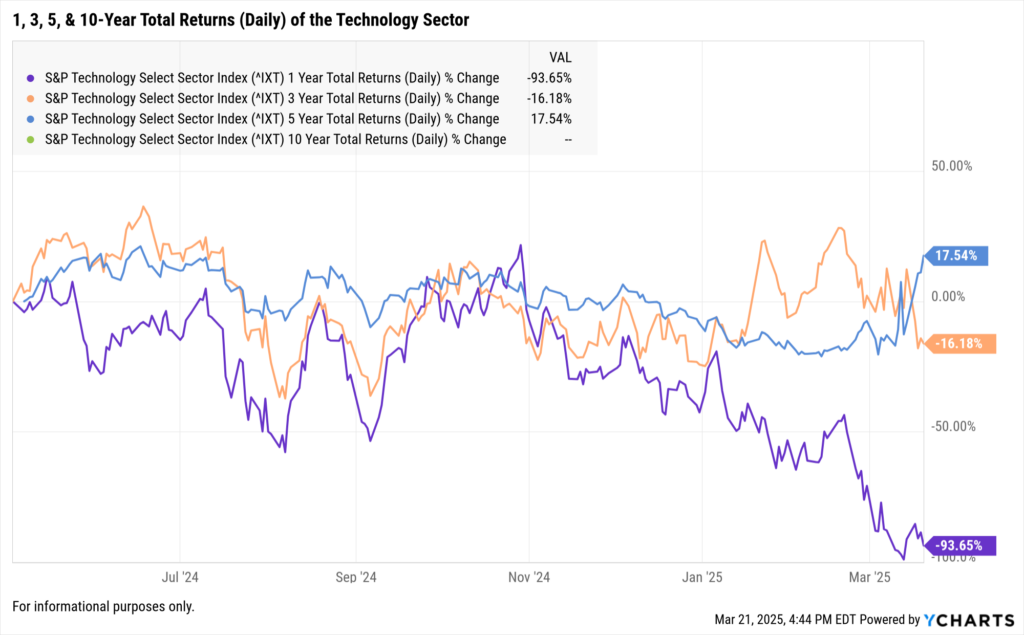

Understanding the performance of the technology sector over various time horizons provides valuable insights:

- 1-Year Performance: As of March 20, 2025, the S&P 500 Information Technology (Sector) Net Total Return Index experienced a 9.86% decline year-to-date.

- 3-Year Performance: The index achieved an annualized return of 15.78%, reflecting robust growth despite recent downturns.

- 5-Year Performance: Over five years, the sector boasted an impressive annualized return of 27.90%, underscoring its long-term growth potential.

- 10-Year Performance: The technology sector delivered a remarkable annualized return of 20.30%, highlighting sustained expansion over the past decade.

Use Cases for Advisors and Asset Managers

Understanding these challenges and performance metrics is crucial for financial professionals:

- Portfolio Diversification: Advisors may want to assess clients’ exposure to the technology sector, considering both the growth potential and inherent risks.

- Risk Management: Staying informed about cybersecurity threats and regulatory changes enables proactive risk mitigation strategies.

- Talent Investment: Companies prioritizing talent retention may offer more stable long-term returns, making them attractive investment options.

- AI Integration: Investing in firms effectively leveraging AI may provide a competitive advantage in portfolios.

How YCharts Can Assist

YCharts offers a suite of tools to help advisors and asset managers navigate the complexities of the technology sector:

Fundamental Charts

Analyze time-series data on technology companies’ performance, aiding in trend identification and investment decisions.

Scenario & Stress Testing

Assess potential impacts of cybersecurity threats or regulatory changes on portfolios, enhancing risk management.

Economic Indicators

Monitor macroeconomic factors influencing the technology sector, such as trade policies and fiscal deficits, to inform strategic decisions.

Custom Reports

Create client-ready visuals and reports to effectively communicate the implications of sector challenges and performance metrics.

Conclusion: Strategizing Amidst Challenges

The technology sector in 2025 is characterized by rapid innovation alongside significant challenges. By comprehensively understanding these dynamics and leveraging data-driven insights, financial advisors and asset managers can guide their clients through uncertainty, positioning them to capitalize on opportunities while mitigating risks.

For a deeper analysis and to harness the power of YCharts in navigating the technology sector’s landscape, start your free trial today.

Whenever you’re ready, here’s how YCharts can help you:

1. Looking to Move On From Your Investment Research and Analytics Platform?

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

What Happened to the Magnificent Seven Stocks?Read More →