May Jobs Report Surpasses Labor Market Expectations: Implications for Fed Policy and Market Strategy

The U.S. economy added 139,000 jobs in May 2025, exceeding forecasts and signaling resilience in the labor market despite ongoing tariff uncertainties. The unemployment rate held steady at 4.2%, and wage growth accelerated to 3.9% annually. These developments suggest a complex economic landscape where advisors must navigate the interplay between labor market strength and tariff-induced headwinds.

In this blog, we’ll cover:

- • The current state of the U.S. labor market and its implications for Federal Reserve policy

- • The performance of safe-haven assets like gold and the Japanese yen amid tariff tensions

- • Portfolio strategies for advisors in the context of evolving economic indicators

- • How YCharts tools can assist in analyzing and adapting to these market dynamics

Related read: Upcoming U.S. Labor Market Report: Preparing Client Portfolios

Labor Market Overview: Strength Amid Tariff Pressures

In May 2025, the U.S. labor market demonstrated unexpected strength by adding 139,000 jobs, surpassing the anticipated 130,000. However, this growth represents a slowdown from April’s revised figure of 147,000 jobs. The unemployment rate remained unchanged at 4.2%, indicating stability in the labor force .

Wage growth accelerated to 3.9% on an annual basis, up from 3.8% in April, suggesting that workers are experiencing real income gains despite inflationary pressures . This wage increase supports consumer spending, a critical component of economic growth.

However, the labor market is not without challenges. Manufacturing and construction sectors are experiencing headwinds due to high tariffs on raw materials like steel and aluminum, leading to cautious hiring practices . Additionally, uncertainties surrounding immigration policies and federal workforce reductions are contributing to a complex employment landscape.

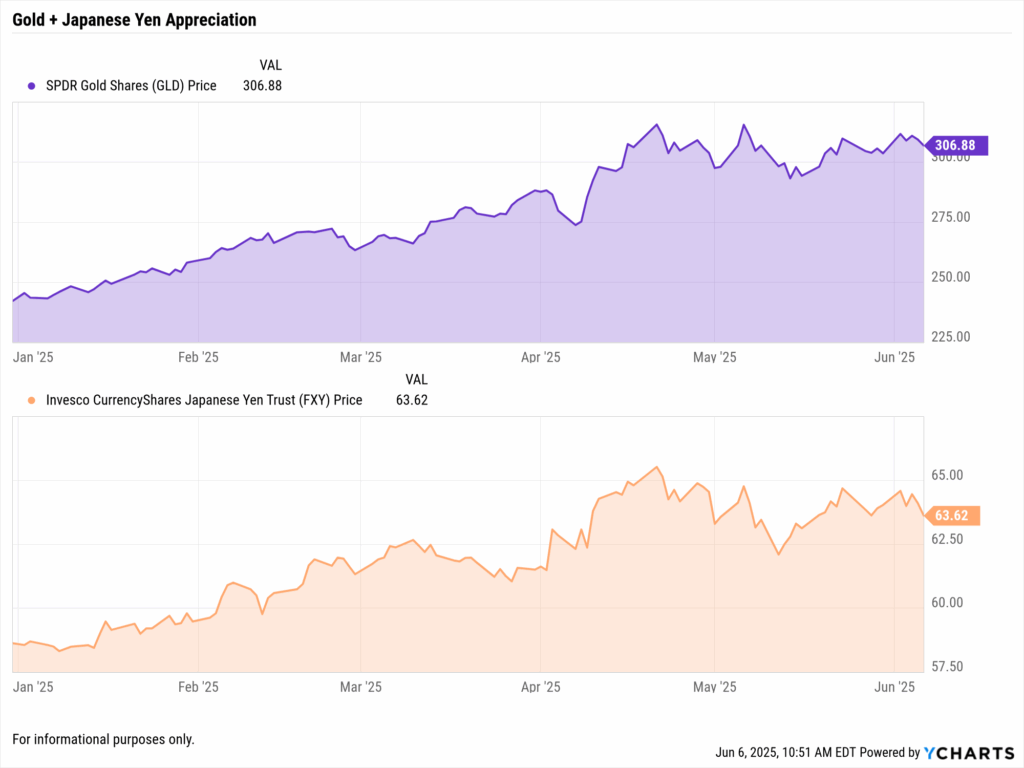

Safe-Haven Assets: Gold and Yen React to Tariff Turmoil

Amid escalating tariff tensions, investors are turning to traditional safe-haven assets. Gold prices have seen an uptick, reflecting increased demand as a hedge against economic uncertainty. Similarly, the Japanese yen has appreciated, indicating a shift in investor sentiment towards more stable currencies.

For advisors, understanding the movement of these assets is crucial. YCharts’ tools allow for real-time tracking and analysis of commodities and currency performance, enabling informed decision-making in portfolio adjustments.

Portfolio Strategies: Navigating a Complex Economic Landscape

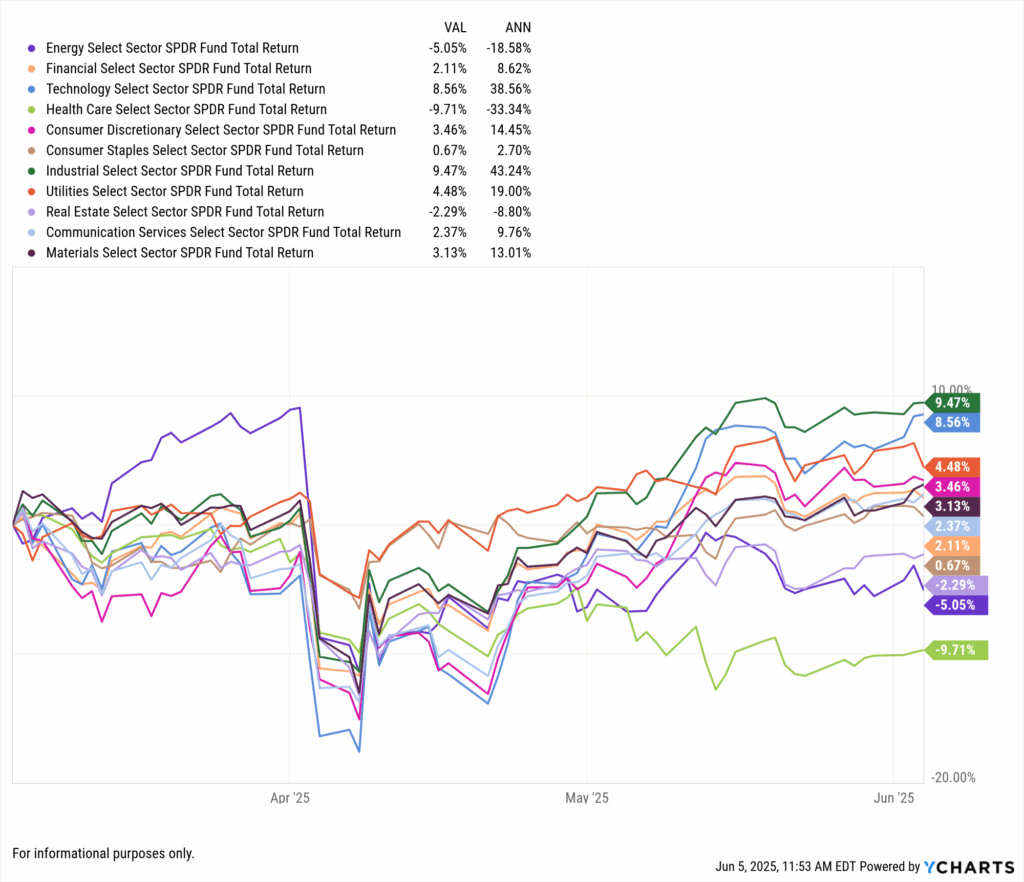

The current economic environment presents both opportunities and risks. While the labor market shows resilience, sectors affected by tariffs require careful monitoring. Advisors should consider diversifying portfolios to mitigate risks associated with trade policies.

Incorporating assets like gold and the Japanese yen can provide a buffer against volatility. Additionally, focusing on sectors less impacted by tariffs, such as technology and healthcare, may offer more stable returns. YCharts’ sector analysis tools can assist in identifying these opportunities.

Leveraging YCharts Tools for Informed Decision-Making

YCharts offers a suite of tools designed to help advisors navigate the complexities of the current market:

- Economic Indicators: Monitor key metrics like employment rates, wage growth, and inflation to stay ahead of market trends.

- Sector Performance Analysis: Identify which sectors are thriving or struggling in the current economic climate, aiding in strategic asset allocation.

- Commodity and Currency Tracking: Analyze the performance of safe-haven assets to make informed decisions about portfolio diversification.

- Customizable Reports: Create tailored visuals to communicate complex data effectively to clients.

By utilizing these tools, advisors can develop strategies that align with their clients’ goals while navigating the challenges posed by tariffs and other economic factors.

Conclusion: Turning Data into Direction

The May 2025 jobs report delivered a stronger-than-expected headline, but beneath the surface lie mixed signals—steady unemployment, accelerating wages, and ongoing sector-specific challenges tied to tariffs. For advisors, this moment demands more than market awareness; it calls for translating economic complexity into confident client guidance.

Staying responsive to macro indicators like labor market growth, inflation, and central bank signaling is critical. But so is recognizing where tariff pressures may create risk—or opportunity—across sectors, asset classes, and portfolio strategies.

With YCharts, advisors can quickly analyze trends, build data-backed narratives, and deliver clarity to clients, even when the market narrative shifts by the day. From labor metrics to gold and currency performance, it’s all about turning economic noise into portfolio insight.

Whenever you’re ready, here’s how YCharts can help you:

1. Looking to Move On From Your Investment Research and Analytics Platform?

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

5 Ways Advisors Are Using AI Across YChartsRead More →