Bitcoin for Financial Advisors: Price Trends, Portfolio Strategy, and Client Communication in 2025

Introduction

Bitcoin’s rise cannot be ignored. Over the past year, the bitcoin price has roughly doubled, reaching new all-time highs. This surge comes with significant volatility, raising questions about how advisors should approach Bitcoin. From its latest price trends to portfolio strategy and client communication, advisors in 2025 need a well-rounded understanding of Bitcoin.

Table of Contents

Bitcoin Price Trends in 2025

Bitcoin’s price momentum in 2025 has been fueled by a mix of market forces and events. A major catalyst was the approval of multiple spot Bitcoin ETFs in early 2024, which vastly expanded investor access. Following the SEC’s decision, Bitcoin’s value soared over 50%, hitting record levels in mere months.

Another key factor was the 2024 Bitcoin “halving”, a programmed supply cut, which historically has preceded outsized gains. In fact, past halving events in 2016 and 2020 were followed by price increases over 300% in the subsequent year. Post-halving enthusiasm and fresh demand in 2025 have helped Bitcoin climb to unprecedented heights.

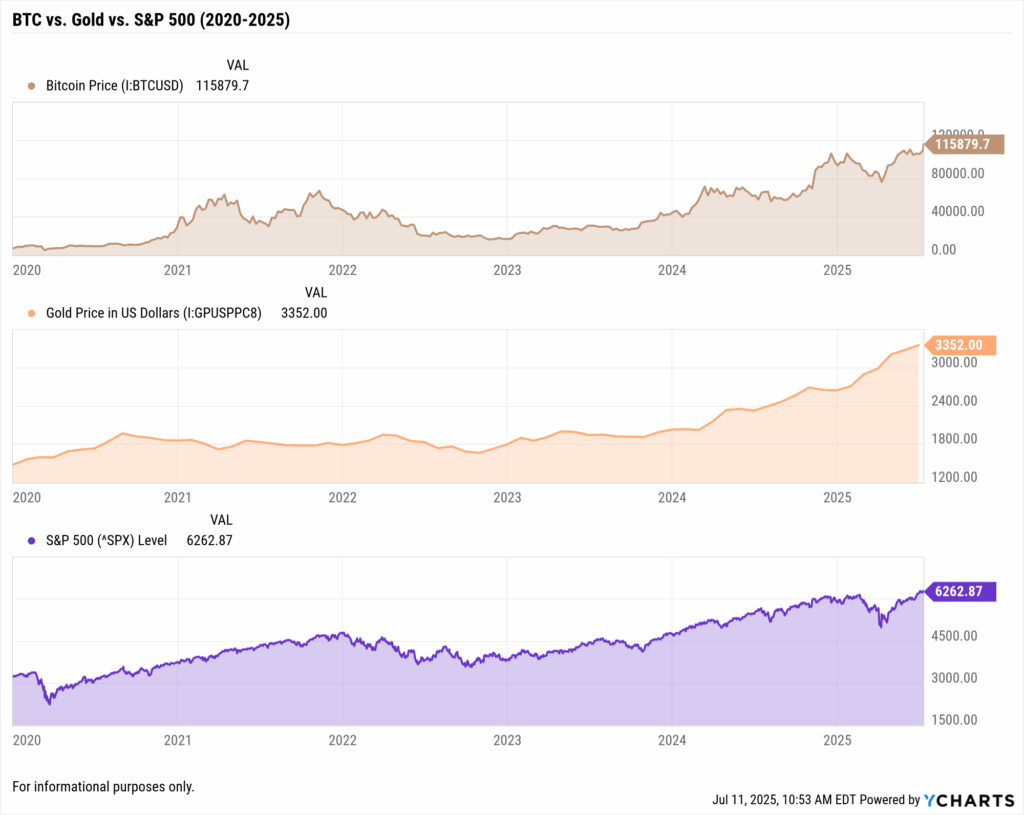

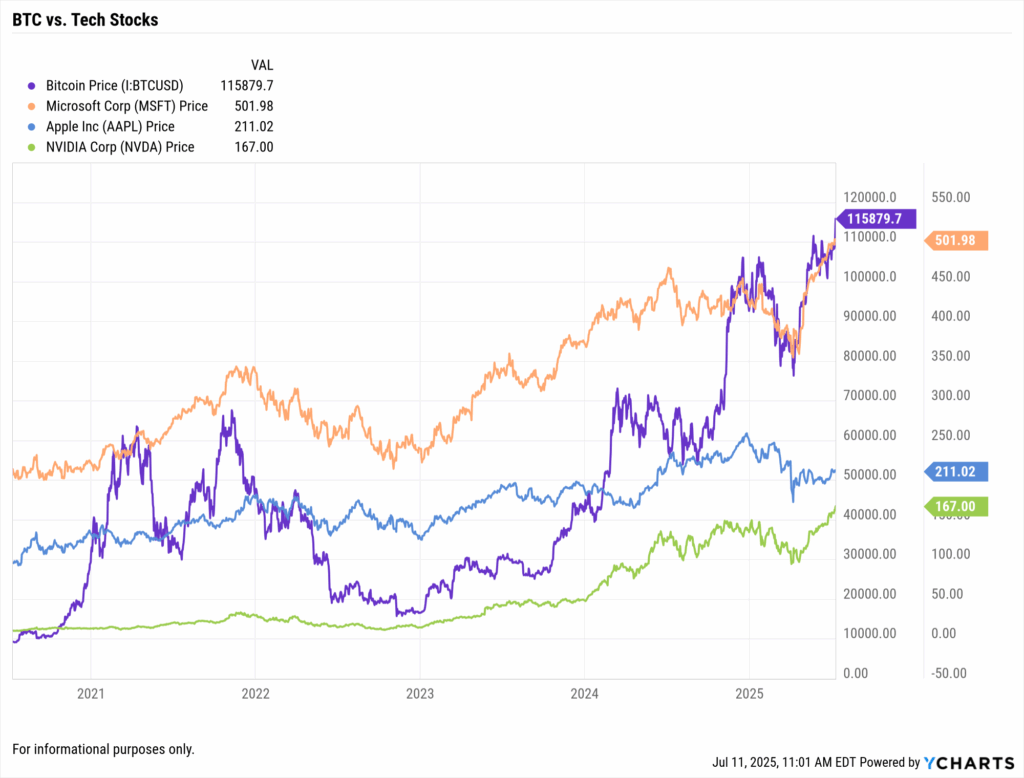

Macro conditions have also played a role. Notably, Bitcoin did not behave as an inflation hedge in the traditional sense. Instead, it often traded in tandem with risk assets. For example, despite rising interest rates in 2023–2024, Bitcoin rallied alongside stocks when investor sentiment was optimistic.

Conversely, during the 2022 tightening cycle, Bitcoin suffered sharp drawdowns just like high-growth equities. The lesson is that context matters: a spike in Treasury yields might not sink crypto if it’s driven by economic optimism, whereas a spike driven by inflation fears could spell trouble. Advisors must interpret why Bitcoin is moving, not just how.

Institutional adoption is another storyline in Bitcoin’s 2025 ascent. Major asset managers have launched Bitcoin funds and big brokerages now offer crypto strategies, cementing Bitcoin in the mainstream. This new credibility has clients more curious than ever, many ask if they should invest, from those fearing they’ve missed out to those who remain skeptical.

Q: Bitcoin just hit record highs, should clients invest now or wait?

A: Advisors should urge caution and a plan. Jumping in on headlines isn’t wise. If appropriate, consider a small or gradual investment rather than a big bet all at once. Bitcoin’s history shows rapid surges and crashes, so timing it perfectly is nearly impossible. A disciplined, patient approach works best.

Bitcoin’s Role in a Diversified Portfolio

Determining how (or if) Bitcoin fits into portfolios is now a common exercise. The starting point is understanding Bitcoin’s risk-return profile. Bitcoin has delivered eye-popping long-term returns, but with extreme volatility. Drawdowns of 50–80% have occurred multiple times, far beyond the typical swings of stocks or bonds.

It’s also not a reliable safe haven. Despite nicknames like “digital gold,” Bitcoin behaves more like a high-beta tech stock than a defensive asset. In other words, it tends to thrive when risk appetite is high and can plummet when markets turn fearful.

Bitcoin’s correlation with traditional assets is historically low, so even a small allocation can improve diversification. One analysis found its correlation to U.S. stocks around 0.27 and to bonds only 0.11. Such low correlation means adding a little Bitcoin could boost portfolio returns without closely mirroring stocks or bonds.

For example, in the March 2020 market crash, nearly all assets, including Bitcoin, fell in tandem. That’s a reminder that Bitcoin’s correlation can spike during periods of stress, eliminating its diversification benefit when it’s needed most. Advisors should be cautious not to overstate this benefit.

Position sizing is critical. For most portfolios, Bitcoin (and crypto broadly) is treated as a speculative satellite allocation, not a core holding. Advisors often cap Bitcoin exposure to a small percentage (say 1–5%) depending on the client’s risk tolerance. This way, if Bitcoin soars, the portfolio gains some upside; if it crashes, overall losses are limited.

It’s also important to choose the investment vehicle. Some clients may hold Bitcoin directly, but many prefer regulated products like ETFs for ease and safety. Advisors can use YCharts’ Fund Screener to compare Bitcoin fund options on cost, performance, and credibility, ensuring any crypto investment meets due diligence standards.

Q: How can I determine an appropriate Bitcoin allocation for a client portfolio?

A: Keep Bitcoin to a small slice of the portfolio, often just a few percent. Advisors can model different allocations (1%, 2%, etc.) using tools like YCharts to see how Bitcoin might have affected historical returns and volatility. This analysis guides an appropriate level, including possibly 0% for conservative clients.

Communicating About Bitcoin with Clients

Whether a client is enthusiastic about Bitcoin or skeptical, proactive communication is key. Advisors who talk about emerging assets early tend to build trust. A recent YCharts survey found clients who hear from their advisor frequently feel much more confident (71% very comfortable) in their plan than those who hear rarely (22%).

Even if a client doesn’t own Bitcoin, they likely see news about it. By checking in and offering an informed viewpoint, advisors can reinforce their value. For instance, if Bitcoin plunges 20% in a week, a quick call or email to affected clients can reassure them that this volatility was anticipated in their plan.

Likewise, if Bitcoin skyrockets and clients are exuberant, it’s an opportunity to revisit their allocation. Advisors might even suggest rebalancing or taking some gains off the table, ensuring the exposure remains aligned with the client’s risk tolerance and long-term plan.

Share some historical perspective. Remind clients Bitcoin has had periods of losing half its value in months (like in 2022) and later recovering. Visual aids can be powerful. Showing a long-term Bitcoin price chart, highlighting dramatic booms and busts, reinforces that volatility is the norm, not the exception.

Managing expectations is paramount. Some clients think Bitcoin is a ticket to quick riches, while others worry it’s a bubble about to burst. Advisors should address both extremes with facts and perspective, highlighting that past performance is no guarantee and that sharp downturns can and do happen.

It’s also worth validating Bitcoin’s potential. Bitcoin’s finite supply and increasing institutional adoption are often cited as reasons to believe in its long-term value. Advisors can acknowledge this upside, but even then, any crypto investment should be based on a sound strategy, not emotion or hype.

Q: How can advisors explain Bitcoin’s volatility to worried clients?

A: Be transparent about Bitcoin’s big swings. It’s not unusual for Bitcoin to drop 30% or more and later recover. Use concrete examples (e.g., a $50k position falling to $35k) to make the risk clear. Emphasize that this volatility is why the client’s Bitcoin exposure is kept limited and monitored.

Q: Is Bitcoin just a passing fad or a legitimate investment?

A: Bitcoin has been around for over a decade and survived multiple boom-bust cycles – it’s not just a passing fad. Large institutions are involved now, lending it credibility. However, “legitimate” doesn’t mean low-risk or guaranteed. Bitcoin’s future is still uncertain, so treat it as a high-risk piece of a diversified strategy.

Conclusion: A Balanced Approach to Bitcoin in 2025

For financial advisors, Bitcoin has transitioned from an abstract concept to a tangible asset class that merits thoughtful consideration. 2025 finds Bitcoin more integrated into the financial landscape than ever before, it’s on major platforms, in portfolios, and in client conversations daily. The key for advisors is to approach it neither with blind enthusiasm nor unwarranted fear.

That means staying informed on Bitcoin’s trends, incorporating it judiciously when appropriate, and keeping communication clear. Leveraging data (via tools like YCharts for charts and analysis) and framing crypto in a long-term plan helps advisors navigate its opportunities and risks. With a balanced, well-informed approach, you can prepare clients for whatever the next chapter brings.

Whenever you’re ready, here’s how YCharts can help you:

1. Looking to Move On From Your Investment Research and Analytics Platform?

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Sign up for a copy of our Fund Flows Report and Visual Deck to stay on top of ETF trends:

Sign up to recieve a copy of our monthly Fund Flows Report:Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Next Article

June 2025’s Top Market Movers: Stocks, ETFs, and Mutual Funds That Led the WayRead More →