The Best Performing International ETFs over the Last 10 Years

Updated as of: October 8, 2025

Advisors often look beyond domestic borders for portfolio diversification opportunities and attractive equity valuations in other countries. While the U.S. stock market is currently valued around a staggering $60 trillion, it accounts for only half of the world’s market capitalization.

International investing helps advisors’ clients gain exposure to the other half of total worldwide market capitalization, and ETFs enable convenient access to a basket of underlying equities in a specific country, region, or ex-US as a whole through a single investment vehicle.

This article contains the best-performing international ETFs from the last year all the way back to the past decade, with data routinely updated by YCharts.

To create this list, we analyzed the entire ETF universe using the YCharts Fund Screener to find the best-performing international equity ETFs that are US-domiciled on a 1-year, 3-year, 5-year, and 10-year basis. (ETFs with leveraged or inverse attributes as well as those in the alternative currency strategy and options arbitrage strategy peer groups were excluded to focus on long-term investment vehicles that align with broader financial planning goals)

Table of Contents

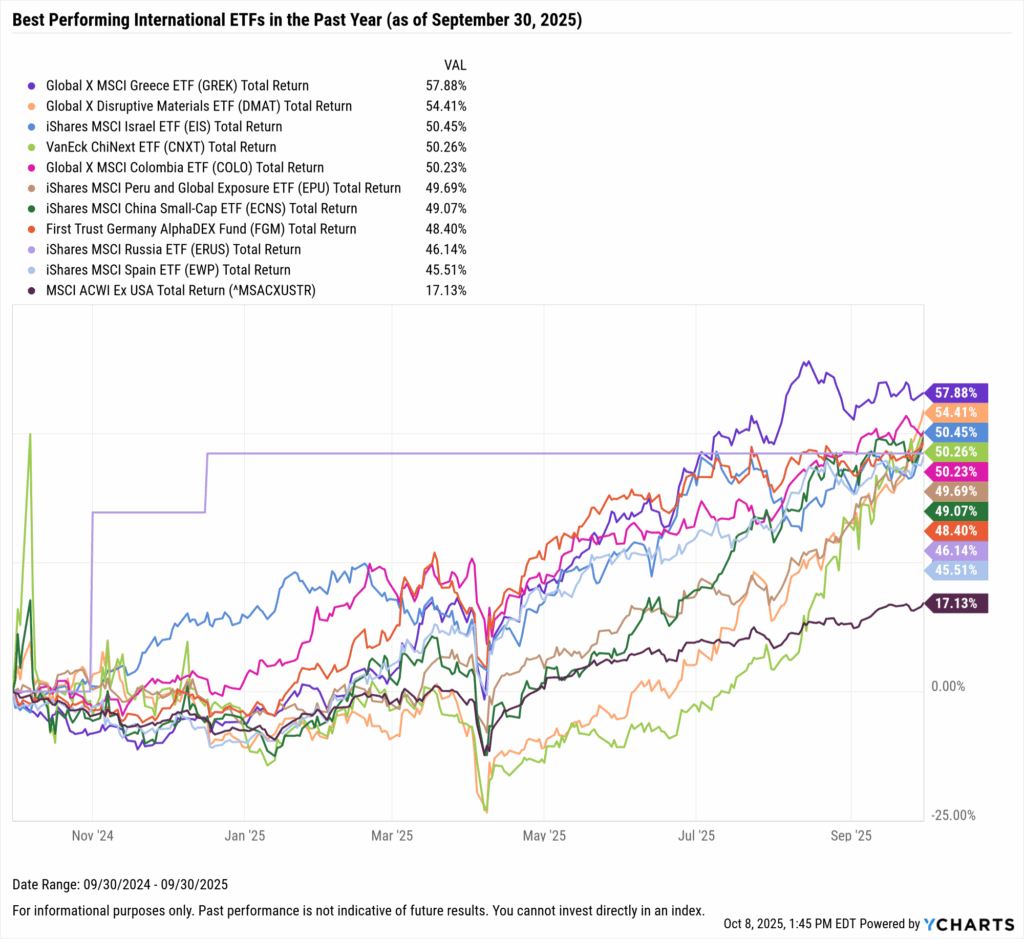

Best Performing International ETFs in the Last Year

These are the top-performing international ETFs over the past year, as of September 30, 2025.

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

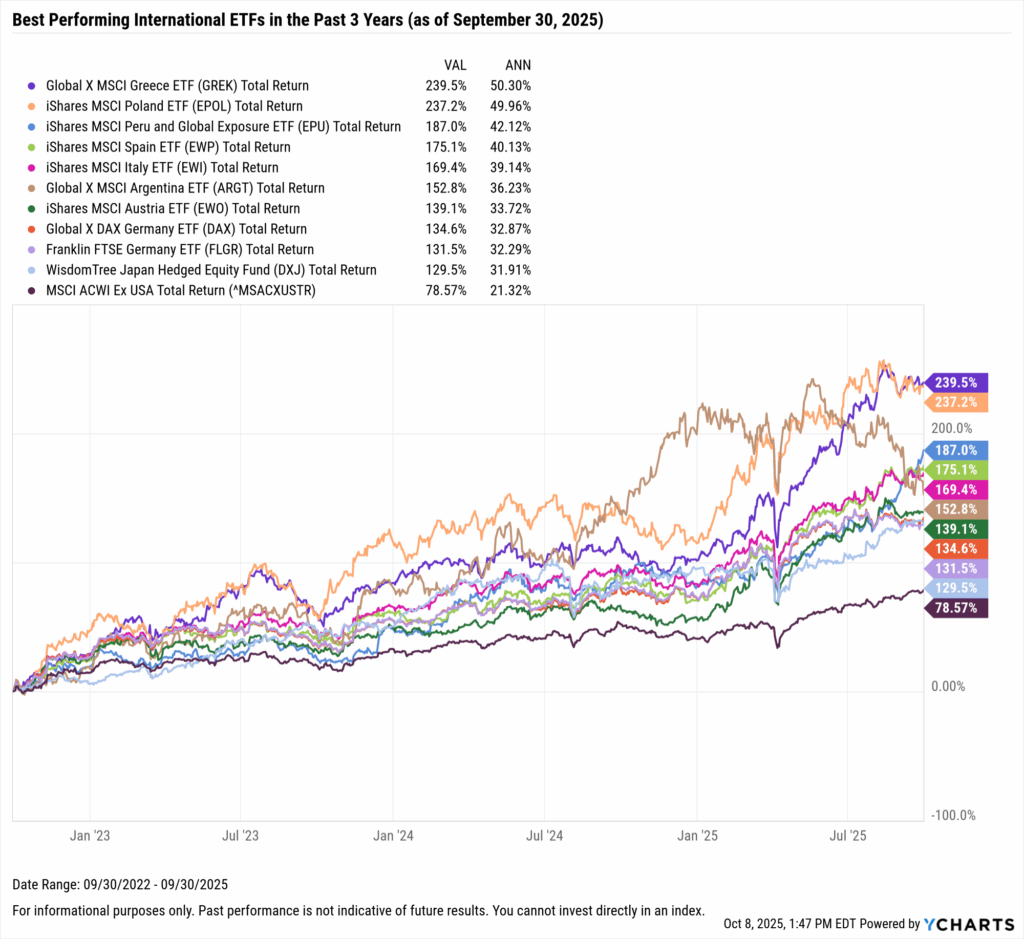

Best Performing International ETFs in the Last 3 Years

These are the top-performing international ETFs on an annualized basis between October 1st, 2022 and September 30, 2025.

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

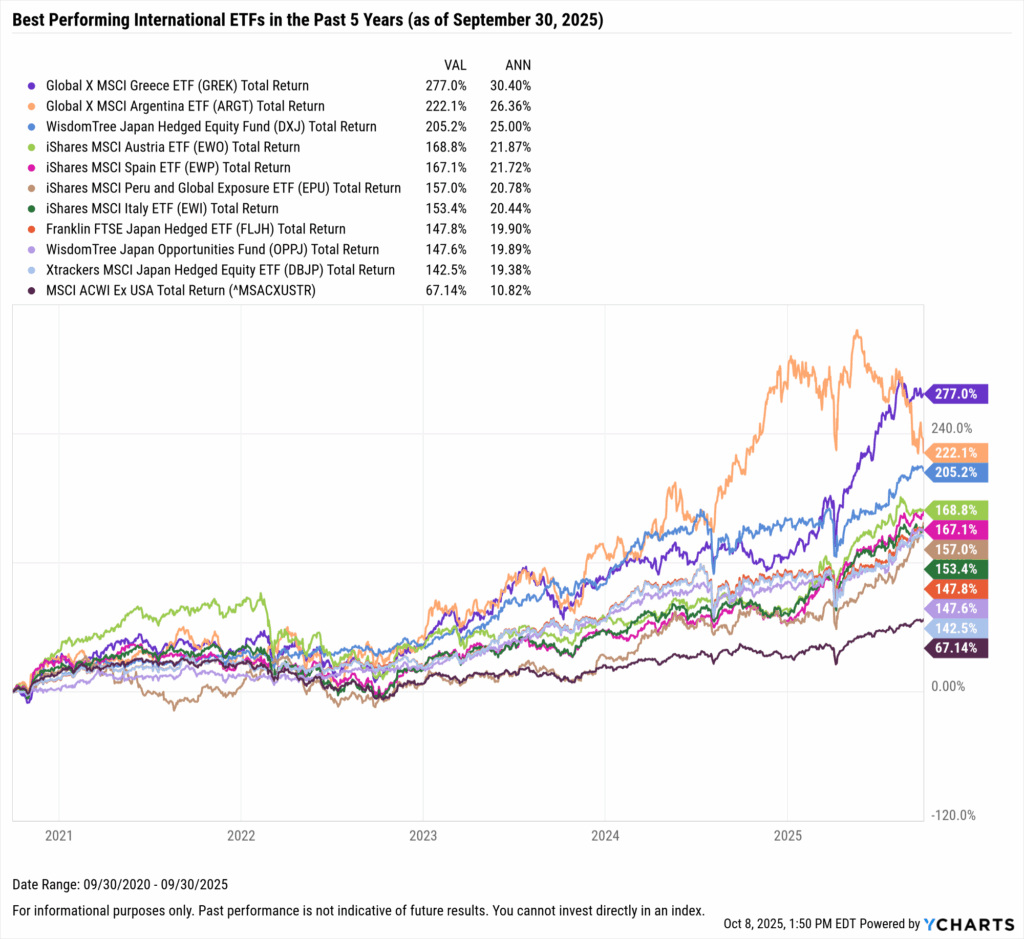

Best Performing International ETFs in the Last 5 Years

These are the top-performing international ETFs on an annualized basis between October 1, 2020 and September 30, 2025.

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

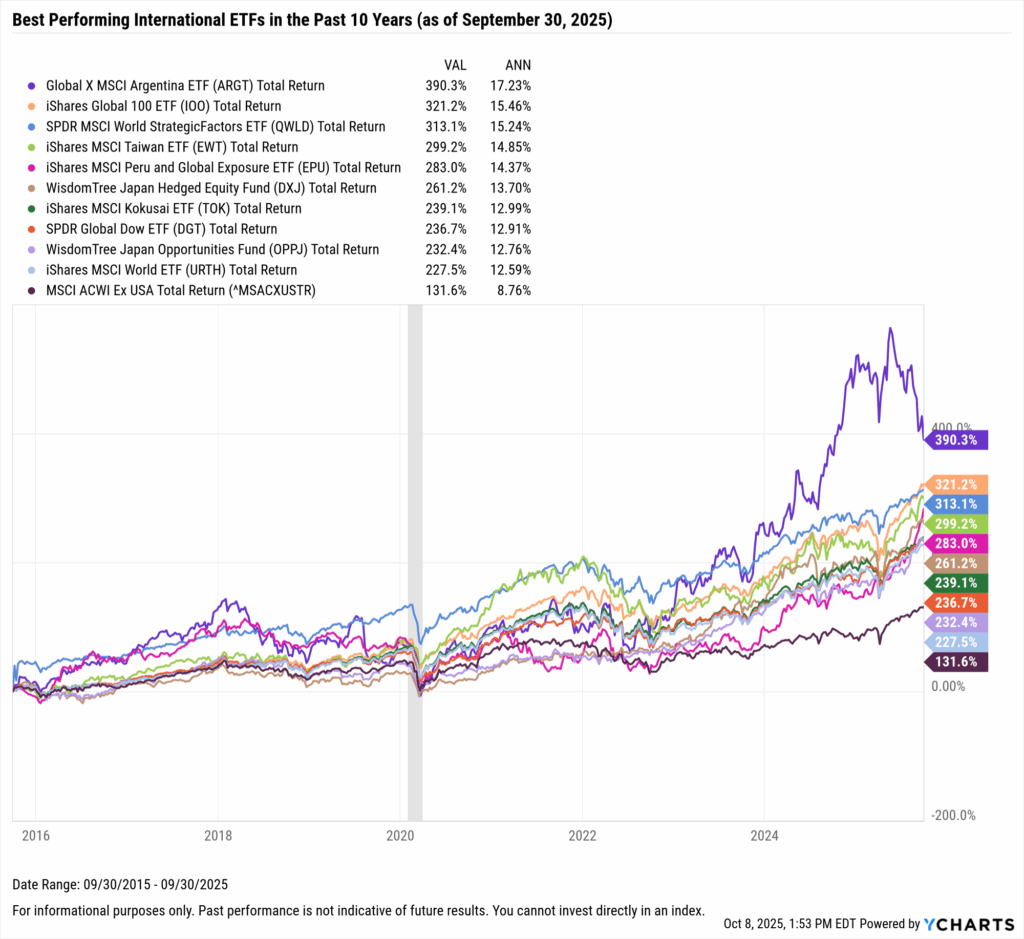

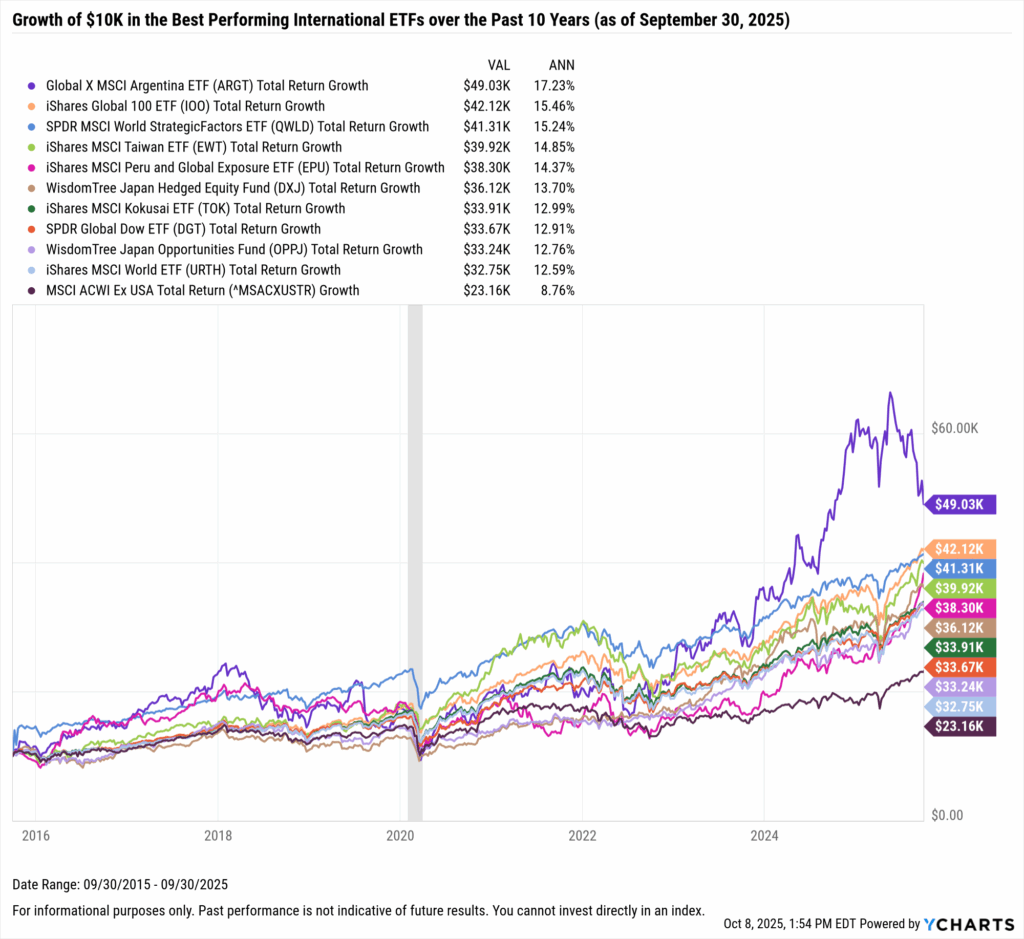

Best Performing International ETFs in the Last 10 Years

These are the top-performing ETFs on an annualized basis between October 1, 2015 and September 30, 2025.

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

What Was the Growth of $10,000 in the Top International ETFs Over the Last 10 Years?

The best-performing international ETF in the last 10 years was the Global X MSCI Argentina ETF (ARGT). A $10,000 investment into this Argentina-focused ETF 10 years ago would be worth $49K today on a total return basis.

Right behind ARGY was the iShares Global 100 ETF (IOO); investing $10,000 into IOO back in 2015 would’ve turned into $42,120 with dividend reinvestment. Despite its international focus, IOO has moved mostly in tandem with the S&P 500 over that time period due to a nearly 50% holdings overlap between IOO and SPY.

Download Visual | Modify in YCharts

Whenever you’re ready, here’s how YCharts can help you:

1. Interested in doing further ETF research with YCharts?

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Sign up for a copy of our Fund Flows Report and Visual Deck to stay on top of mutual fund trends:

Sign up to recieve a copy of our monthly Fund Flows Report:Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Next Article

The Best Performing Bond Mutual Funds over the Last 10 YearsRead More →