The Best Performing Dividend Stocks over the Last 25 Years

Updated as of: October 9, 2025

Dividend income composes a major part of equity investing over the long run; 35% of all stocks listed on major US exchanges pay a dividend, making for plenty of options to take advantage of periodic earnings distributions.

With more than one-third of U.S. stock market total returns since 1930 having been produced by dividends, it’s no surprise that a common investment objective is dividend income.

To help advisors make more informed decisions about which stocks to consider for client portfolios, this article contains the best-performing dividend stocks from the last year all the way back to the past decade, with data routinely updated by YCharts.

To create this list, we used the YCharts Stock Screener to find the best-performing dividend yielding stocks on the S&P High Yield Dividend Aristocrats Index over a YTD, 1-year, 3-year, 5-year, 10-year, and 25-year basis.

Table of Contents

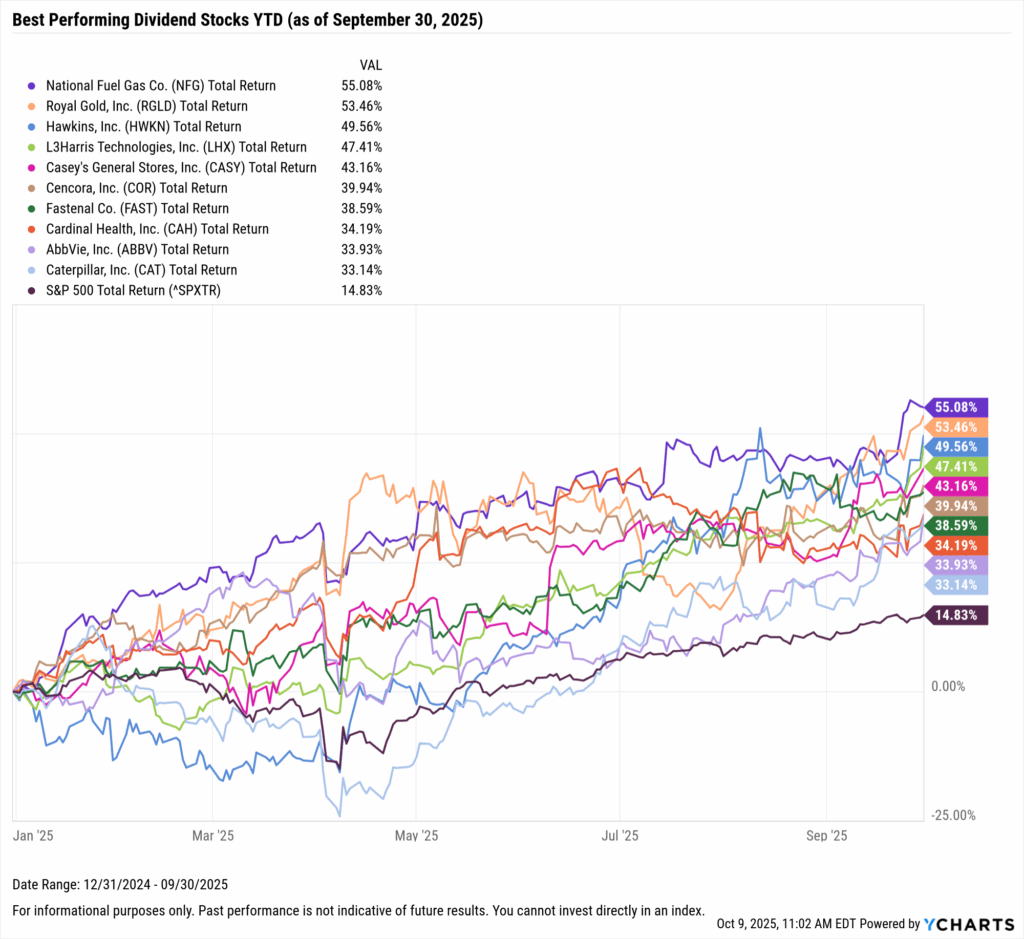

Best Performing Dividend Stocks YTD

These are the top-performing dividend stocks YTD, as of September 30, 2025.

Start a Free Trial to See Full Rankings | View & Modify in Stock Screener

Download Visual | Modify in YCharts

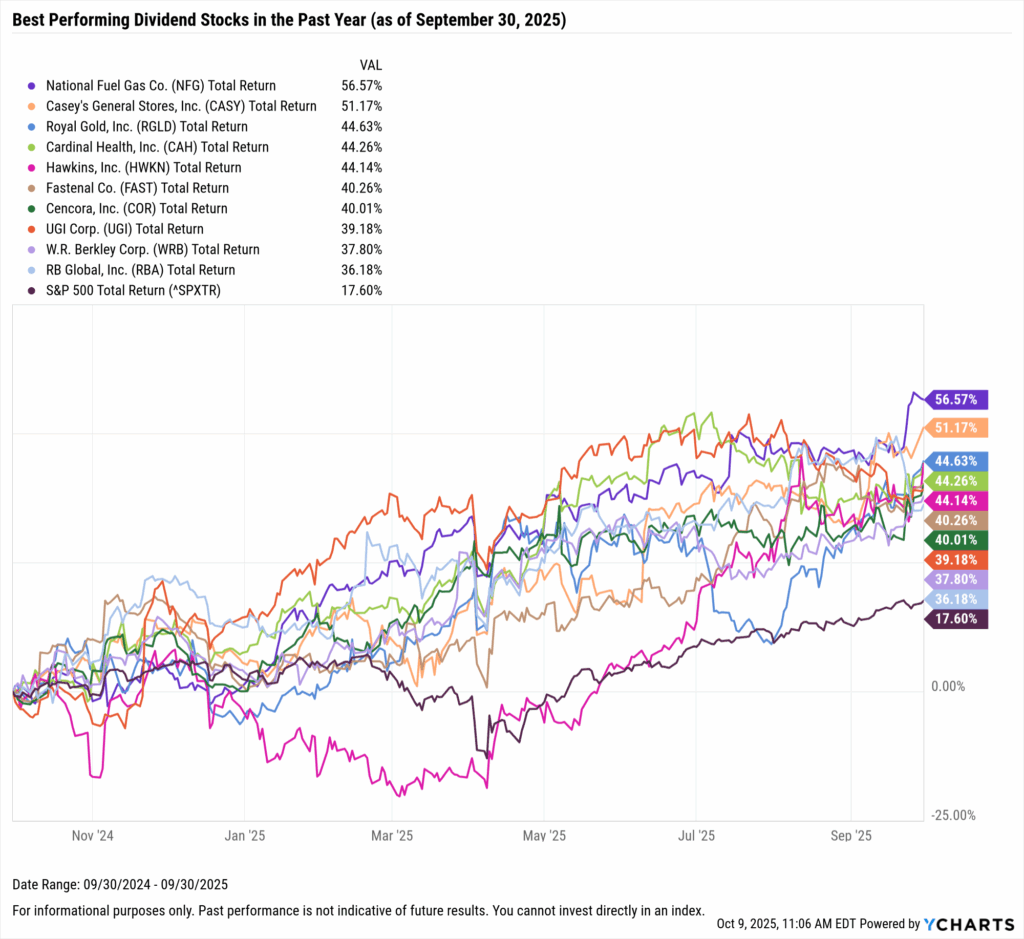

Best Performing Dividend Stocks in the Last Year

These are the top-performing dividend stocks over the past year, as of September 30, 2025.

Start a Free Trial to See Full Rankings | View & Modify in Stock Screener

Download Visual | Modify in YCharts

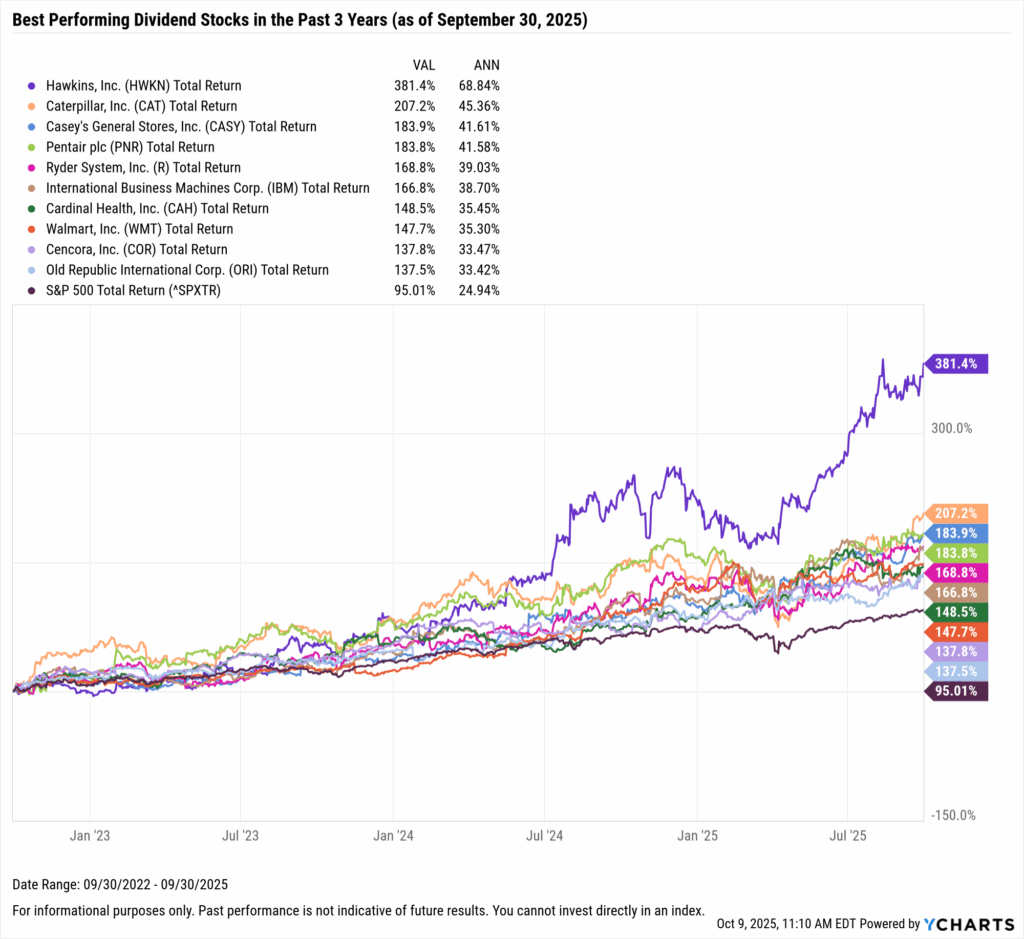

Best Performing Dividend Stocks in the Last 3 Years

These are the top-performing dividend stocks on an annualized basis between October 1st, 2022 and September 30, 2025.

Start a Free Trial to See Full Rankings | View & Modify in Stock Screener

Download Visual | Modify in YCharts

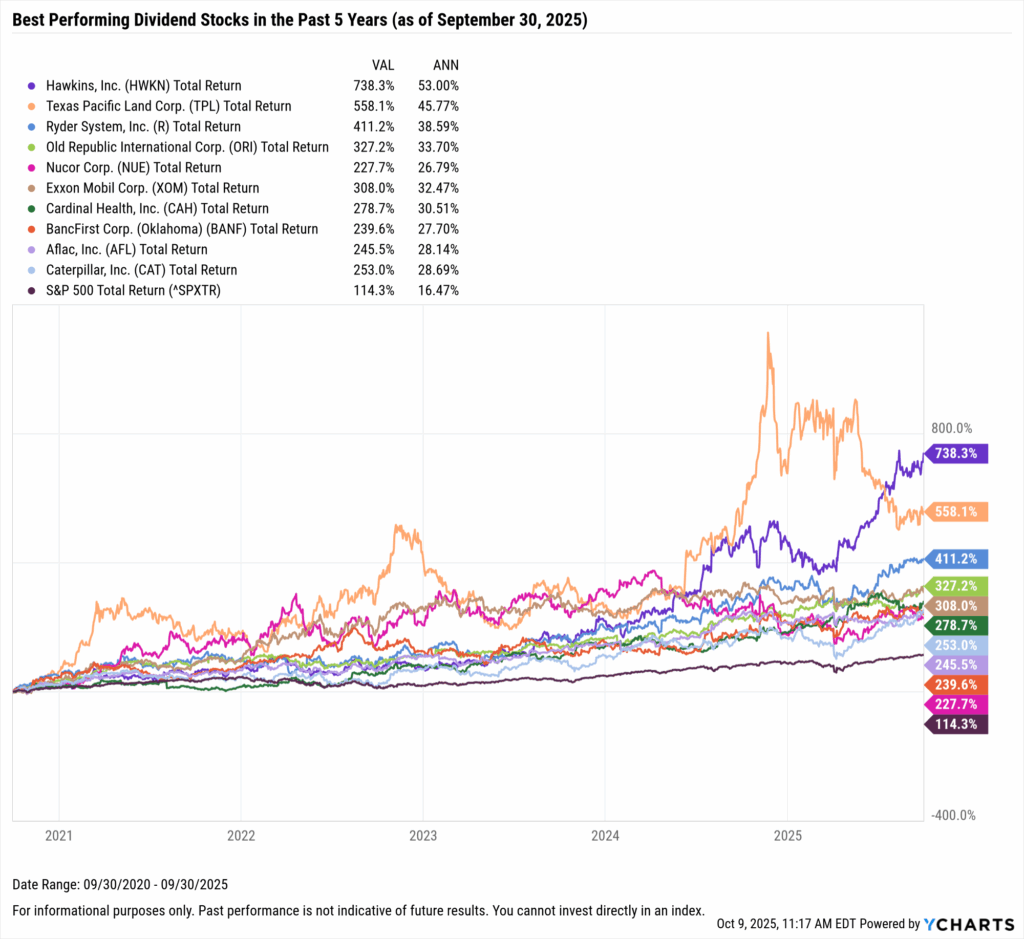

Best Performing Dividend Stocks in the Last 5 Years

These are the top-performing dividend stocks on an annualized basis between October 1, 2020 and September 30, 2025.

Start a Free Trial to See Full Rankings | View & Modify in Stock Screener

Download Visual | Modify in YCharts

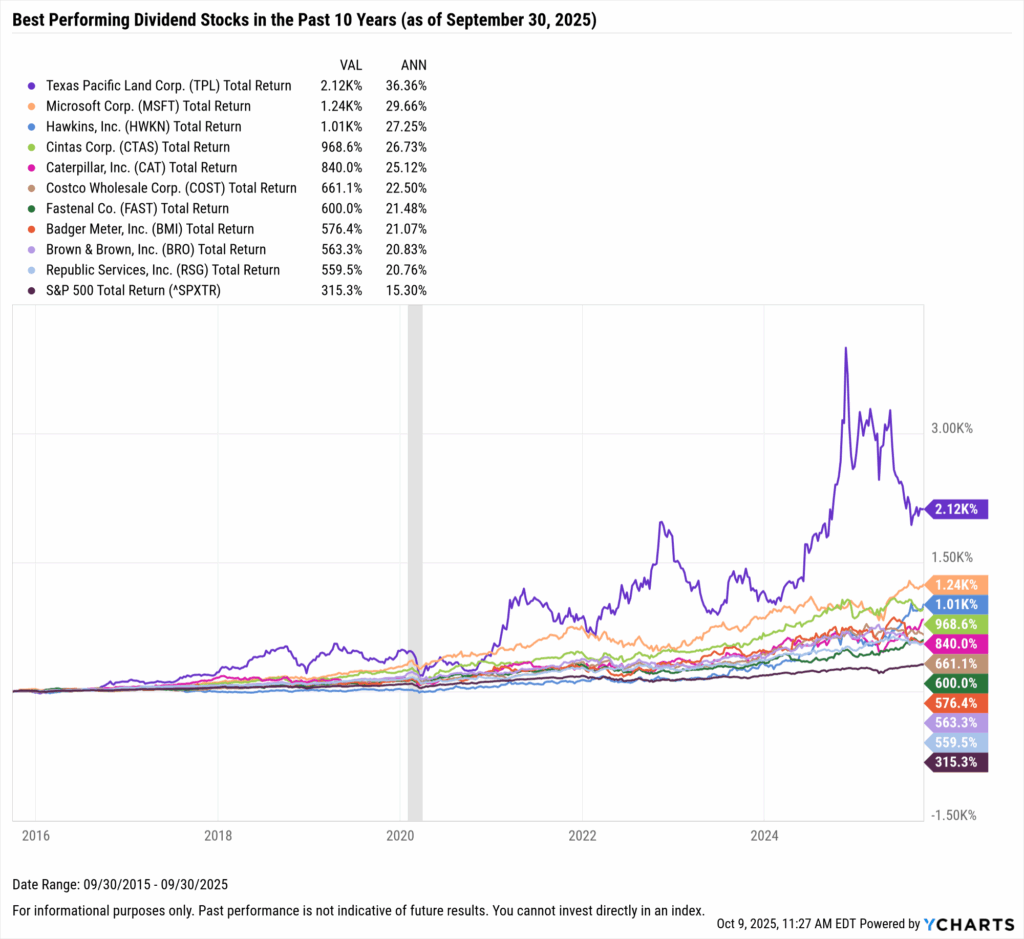

Best Performing Dividend Stocks in the Last 10 Years

These are the top-performing dividend stocks on an annualized basis between October 1, 2015 and September 30, 2025.

Start a Free Trial to See Full Rankings | View & Modify in Stock Screener

Download Visual | Modify in YCharts

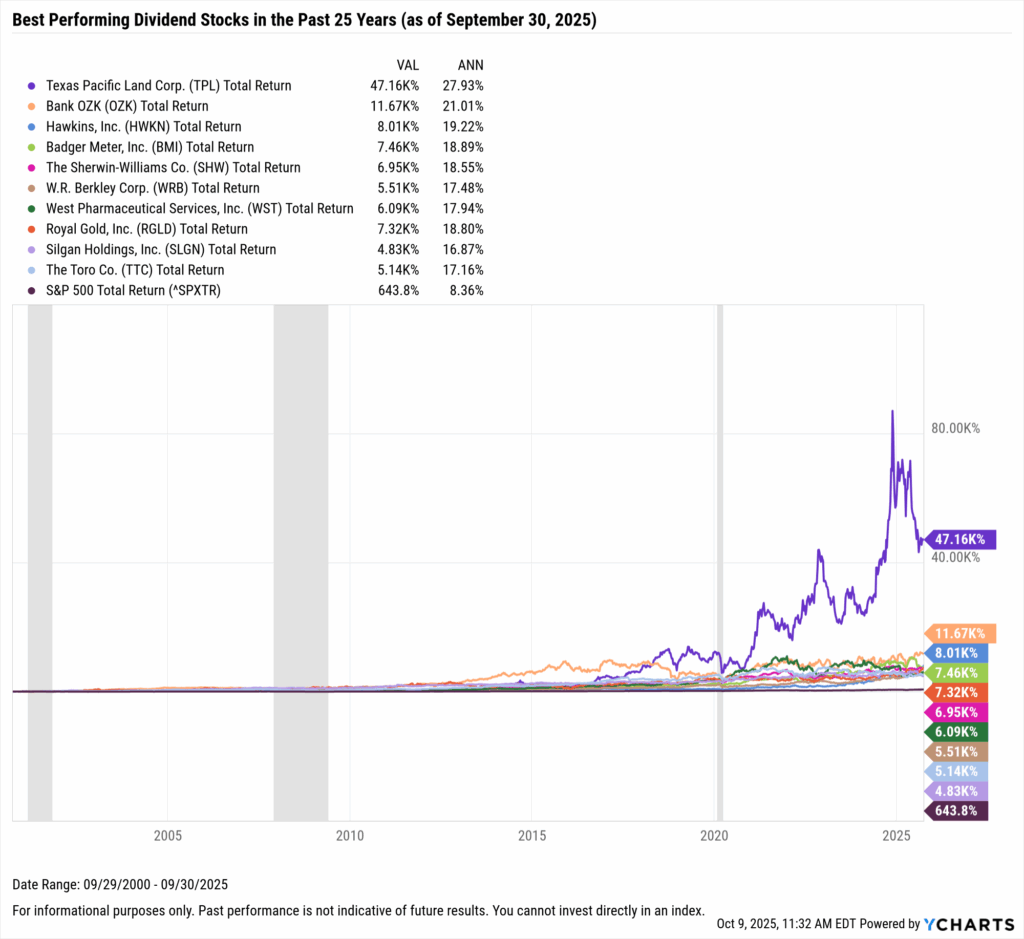

Best Performing Dividend Stocks in the Last 25 Years

These are the top-performing dividend stocks on an annualized basis between October 1, 2000 and September 30, 2025.

Start a Free Trial to See Full Rankings | View & Modify in Stock Screener

Download Visual | Modify in YCharts

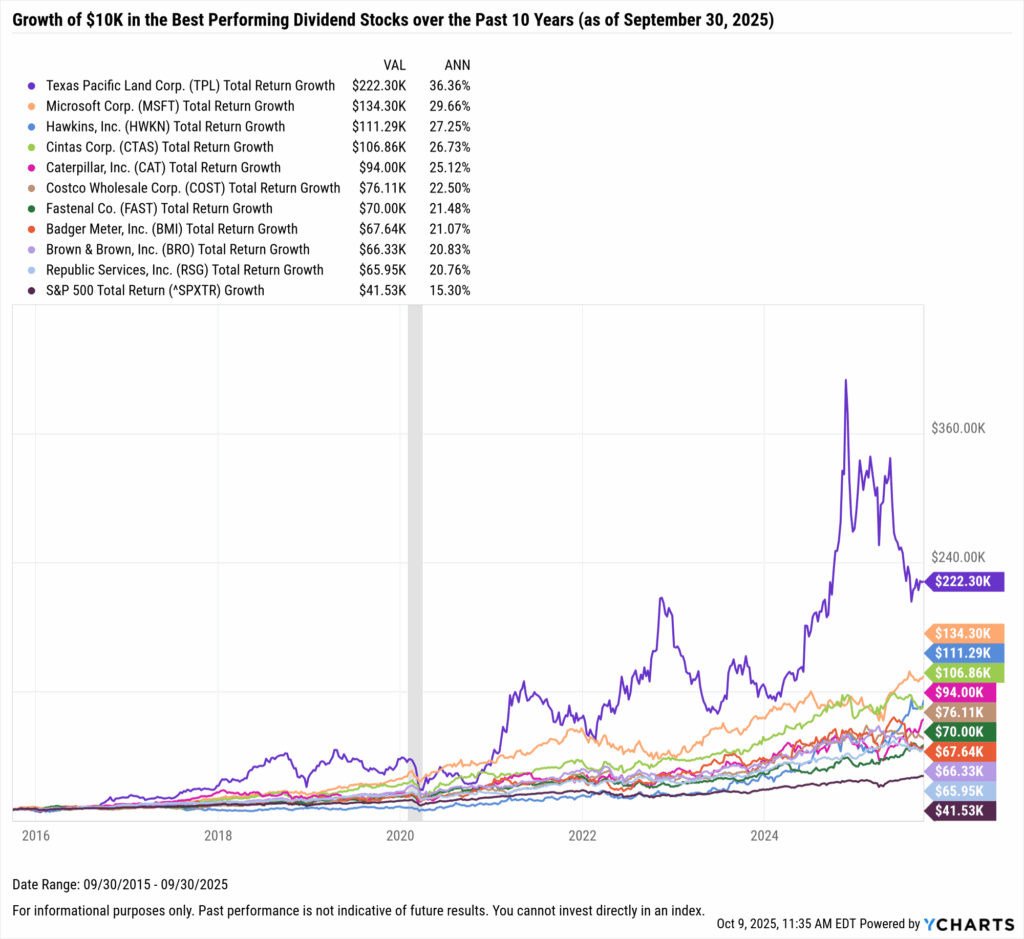

What Was the Growth of $10,000 in the Top Dividend Stocks Over the Last 10 Years?

If you invested $10,000 ten years ago into any of the ten best-performing dividend stocks over the last 10 years, your total return would be no less than $66K.

The best-performing dividend stock in the last 10 years was Texas Pacific Land Corp (TPL). A $10,000 investment into TPL 10 years ago would be worth $222,300 today on a total return basis. Right behind TPL was Microsoft Corp (MSFT); investing $10,000 into MSFT back in 2015 would’ve turned into $134,300 with dividend reinvestment.

The four best-performing stocks on the S&P High Yield Dividend Aristocrat index each achieved over $100,000 in value on a $10K investment ten years ago, with dividends reinvested.

Download Visual | Modify in YCharts

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking for a best-in-class data & visualization tool?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Download a copy of The Top 10 Visuals for Client and Prospect Meetings slide deck:

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Next Article

The Best Performing International ETFs over the Last 10 YearsRead More →