Unlocking Organic Growth: Why Proposal Generation Matters for Large RIAs

Organic growth has become a major driver of firm valuation for RIAs, surpassing inorganic M&A and overall AUM in importance for private equity backers and firm leadership.

Yet, many enterprises still rely on siloed workflows for statement extraction, portfolio modeling, and proposal delivery, leaving advisors and their teams stretched thin and prospects underserved.

Proposal generation software isn’t just a “nice-to-have.”

It becomes an organic growth unlock when it unites the fragmented workflows mentioned above, delivering home office consistency without constraining advisor-level execution.

However, not all proposal tools are built equally.

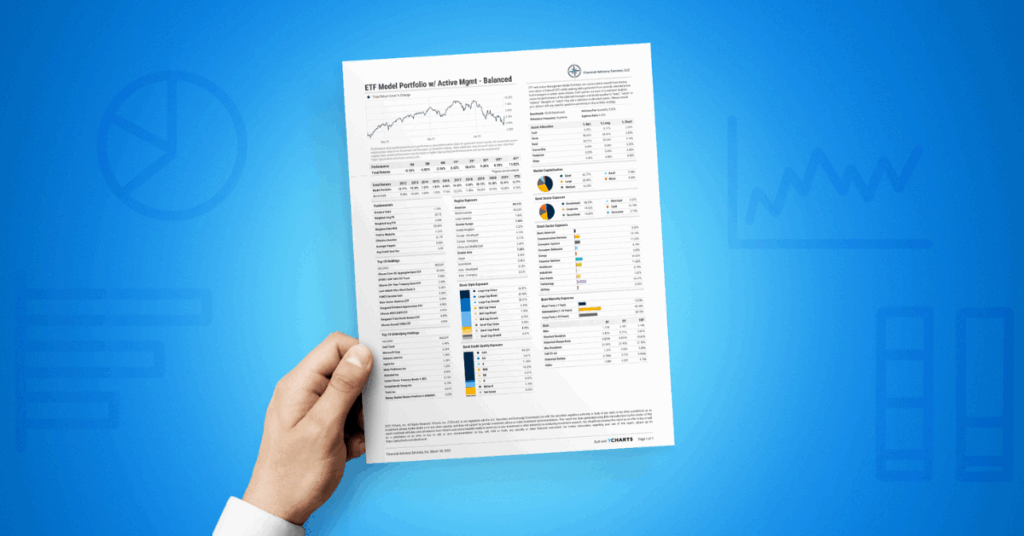

YCharts Proposals empower RIAs with modularity. Firms decide which analytics, visuals, and modules appear in proposals, creating the perfect blend of consistency, compliance, and customization.

See How Carson Group Unified 150+ Offices with a Scalable Platform

And with YCharts’ Quick Extract, Portfolios, and Proposals, you can equip offices nationwide with proposal generation software that integrates seamlessly into advisors’ existing workflows.

Interested in learning more about YCharts Proposals?The Modular Power of Proposal Generation

Field advisors using YCharts can assemble proposals from a menu of home-office-approved modules that compliantly showcase performance, risk, and tax-sensitive transition planning, while maintaining the optionality, customization, and independence advisors crave.

Meanwhile, home offices maintain oversight across all reports, ensuring compliance and gaining visibility into which proposals resonate most with prospects, fueling firm-wide growth.

Here are some of the modules available in YCharts:

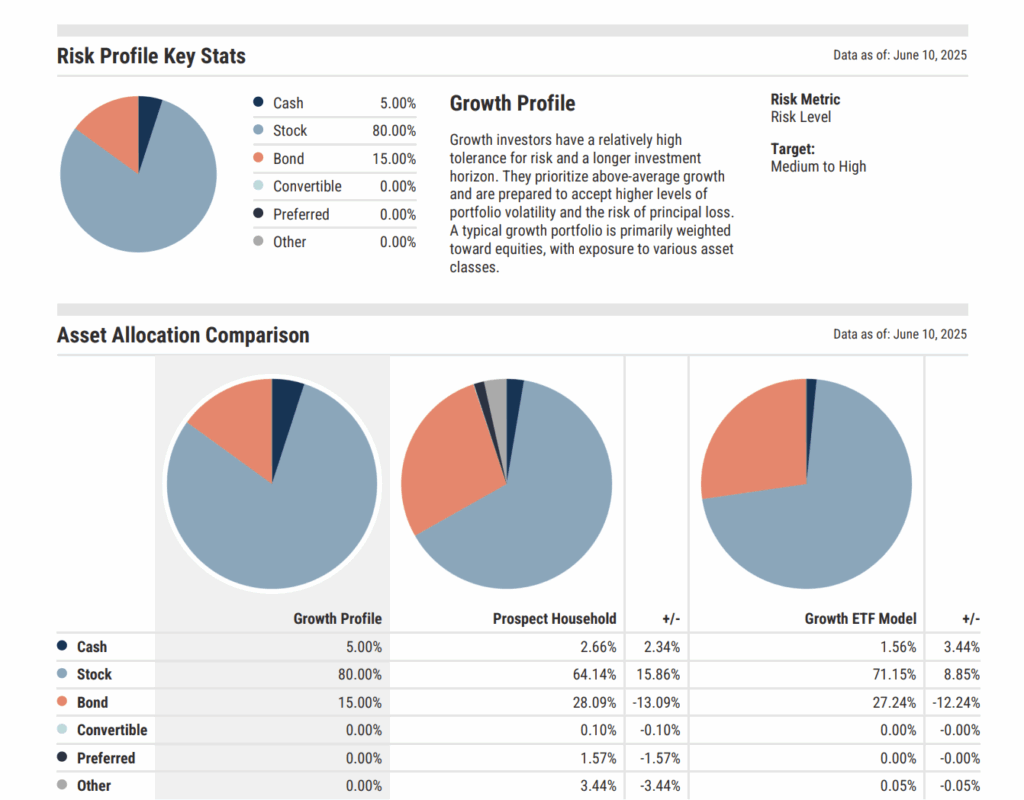

- Risk Profiles – Align client portfolios with tolerance and objectives, ensuring the proposal fits their “why” and illustrates the “how.”

View a Sample Proposal Including Risk Profiles

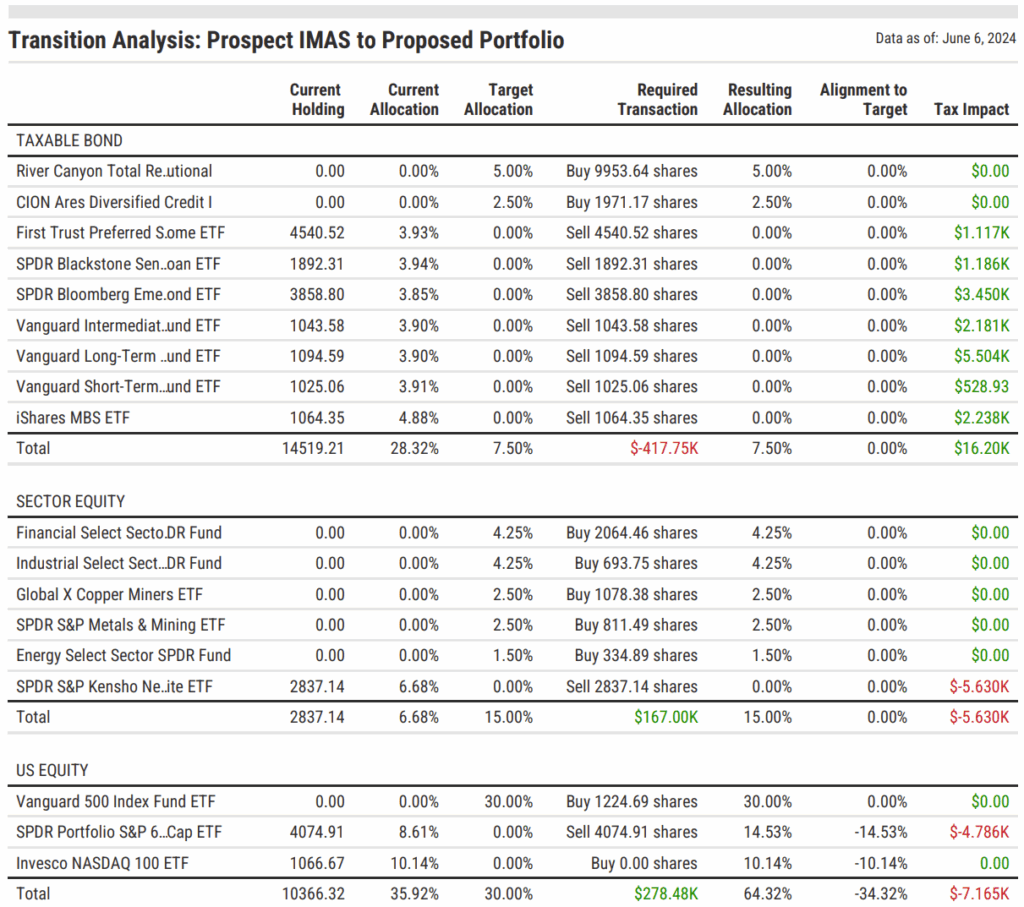

- Transition Analysis – Provide Step-by-step guidance on what to sell, buy, and rebalance—including tax implications—so prospects clearly see how their portfolio can move from a current advisor to your strategy with transparency and confidence.

View a Sample Proposal Including Transition Analysis

- Householding Views – Roll up IMAs, trusts, and retirement accounts into a single proposal so clients see their total wealth picture, not fragmented accounts.

- Modern Portfolio Theory Metrics – Deliver Sharpe ratio, alpha, beta, standard deviation, upside/downside capture, and max drawdown to tell a risk-adjusted story.

- Performance & Drawdown Analysis—Compare current and proposed allocations side-by-side, highlighting both return potential and downside risk.

3 Reasons Proposals Matter for Organic Growth and Valuation

Amid a multi-year bull market, total AUM, often lifted by market gains, has become a less meaningful measure of firm value.

Acquirers and investors today care far more about customer acquisition and wallet share growth, in other words, organic growth.

Here’s why proposals directly move the needle on organic growth, and ultimately valuation:

1. Valuation Uplift

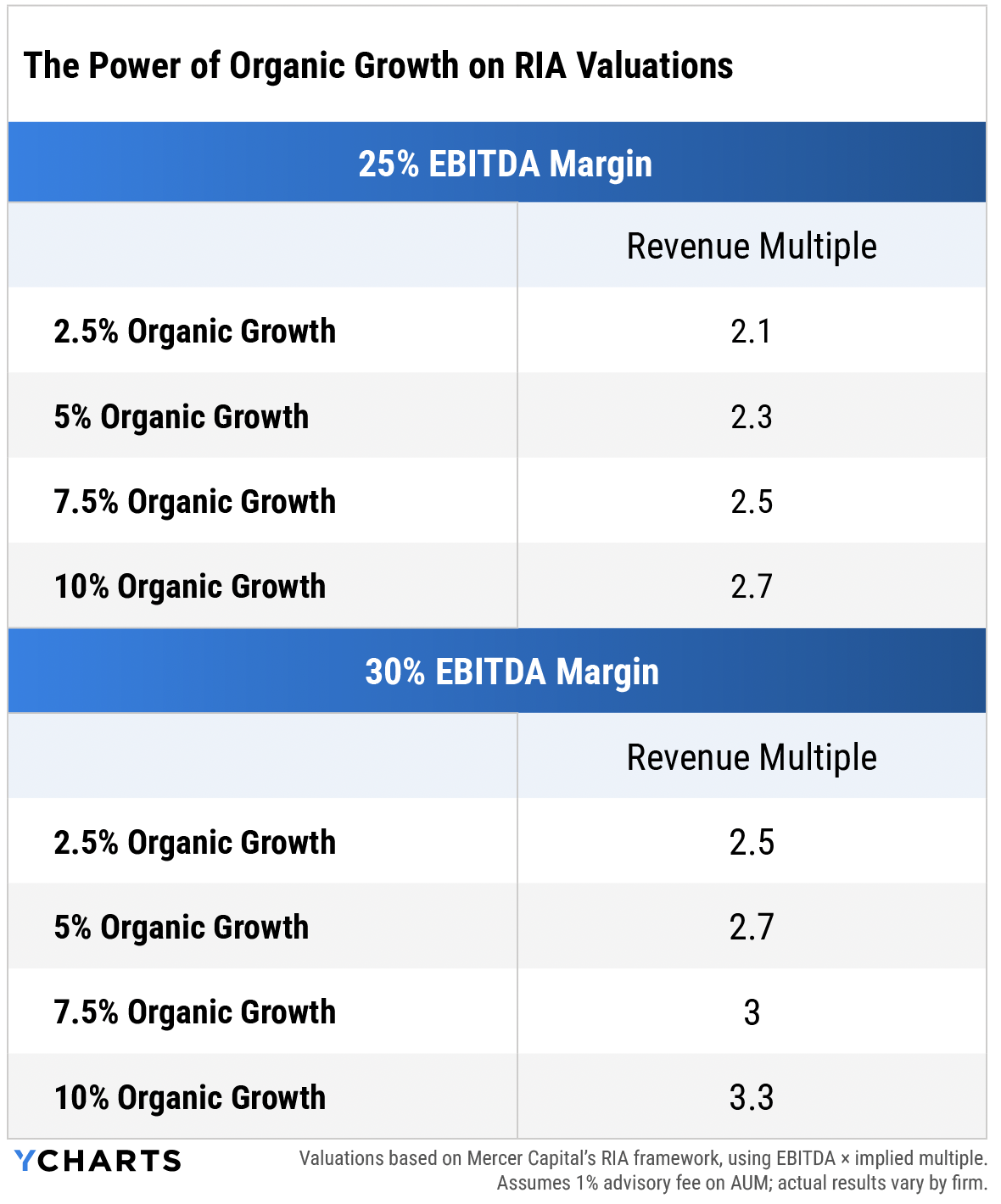

Mercer Capital, Skyview Partners, and others have shown that even modest improvements in organic growth rates can drive outsized valuation increases.

For a $2B RIA, a shift from 2.5% to 5% organic growth represents more households, increased revenue multiples, and enterprise value.

It’s one reason PE-backed RIAs are leaning harder into tech-enabled advisor productivity.

2. Operational Efficiency

Proposal generation software can turn what used to be a multi-day research bottleneck into client-ready outputs created in minutes, while staying within home-office guardrails.

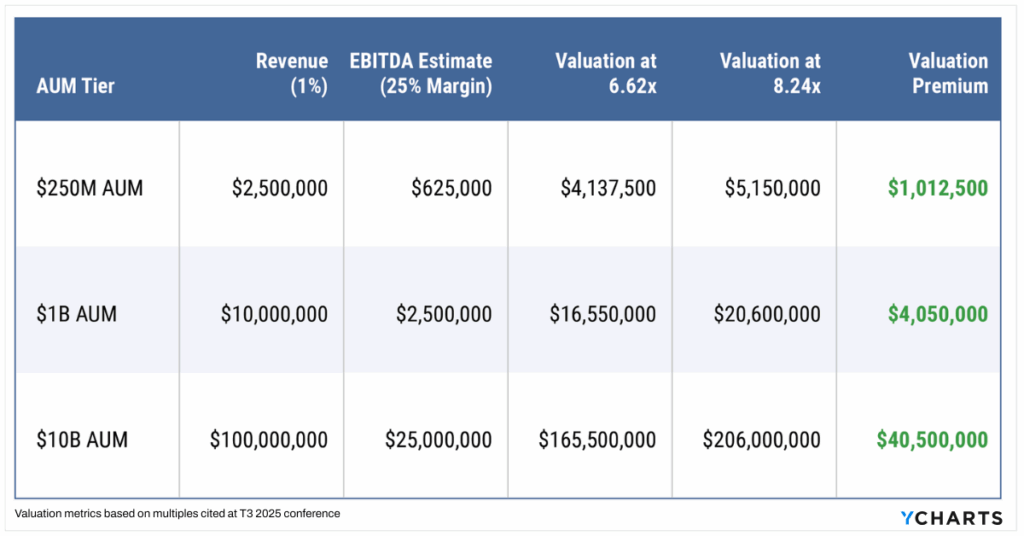

This speed and scalability help advisors close more business, and tech like this also signals operational readiness that commands valuation premiums, as Craig Iskowitz from Ezra Group reported from the T3 Conference in March 2025.

3. Client Trust

The third and final reason may be the most important because it concerns your clients.

They want personalized, goal-aligned advice presented clearly and confidently. Inconsistent proposals—or worse, noncompliant ones—undermine trust.

Centralized templates ensure every proposal is polished, compliant, and on brand, reinforcing relationships and retention.

See How Alan Doubled His Business Using YCharts Proposals

The Strategic Advantage of Adopting YCharts for Proposal Generation

Proposal tools that sit outside advisor workflows often go unused. As the 2025 Kitces Report notes, standalone proposal tools have struggled with adoption, despite being rated a 7.8/10 in importance by advisors.

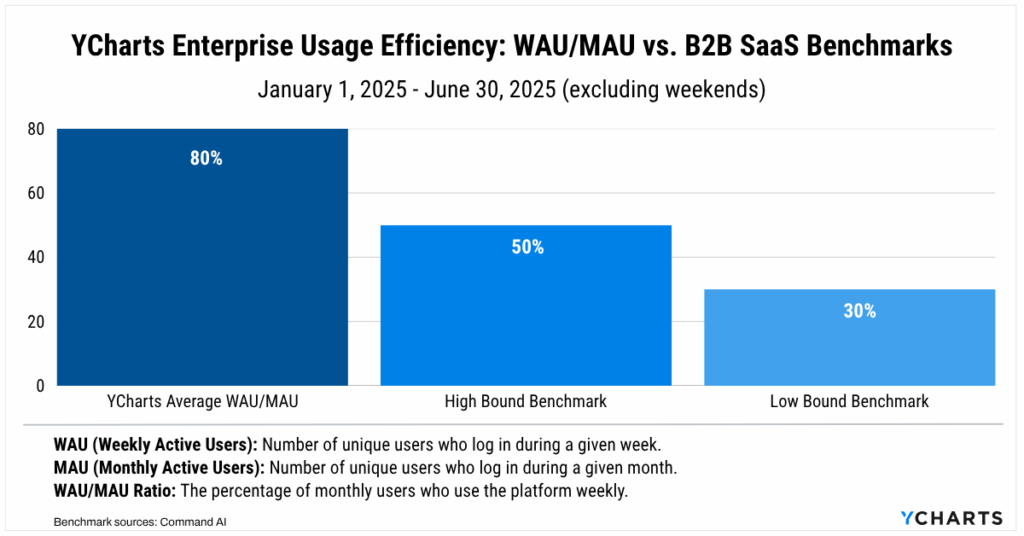

YCharts is different. It’s embedded into research, intake, and client conversation workflows, driving adoption far exceeding that of other B2B tech.

With YCharts proposal generation, leadership can:

- Embed Proposal generation seamlessly into advisor workflows – Unlike one-off tools that often go unused (as Kitces research points out), YCharts integrates directly into advisor research, client intake, and other day-to-day workflows.

- Facilitate an integrated tech stack – Advisors can instantly generate proposals that tie into existing CRM, planning, and reporting systems, such as eMoney, Schwab, Orion, Redtail, Black Diamond, Addepar, and others, to minimize friction and accelerate sales cycles.

- Push firm-approved models and disclosures – Home offices maintain control over the models and compliance disclosures embedded in every proposal, ensuring consistency and regulatory alignment across hundreds of advisors and offices.

- Track proposal creation and adoption – Leadership gains visibility into which advisors are creating proposals, how often they’re used, and which versions close business

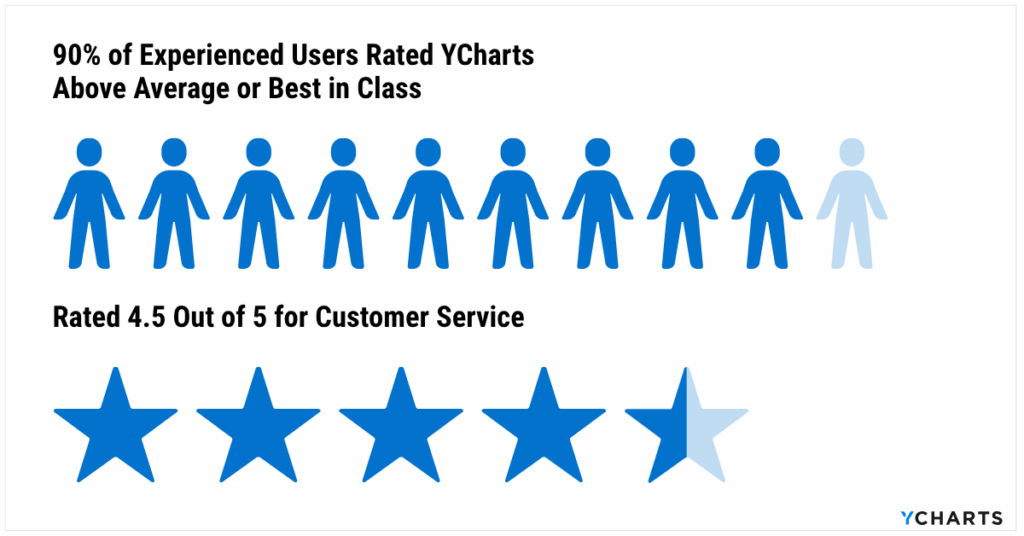

- Partner with our dedicated success team – YCharts doesn’t just provide software; our success team ensures advisors are trained, supported, and actually using the tools. The result: a consistent, best-in-class client experience, whether your advisors are meeting in New York, Chicago, or San Diego.

The Growth Unlock for Multi-Office RIAs

Proposal generation software is a growth unlock that scales with your enterprise.

Advisors need proposals because organic growth is now a key driver of RIA valuation, and predictable, scalable processes directly influence the multiples that acquirers and private equity backers are willing to pay.

The challenge is finding a solution advisors will actually use.

Too often, proposal tools, like many other enterprise tech solutions, become more shelfware than software. YCharts helps enterprises avoid this buyer’s remorse by embedding directly into advisor workflows.

For firms that want to grow household by household, maintain consistency across offices, and demonstrate scalable processes that enhance valuation, YCharts is the clear choice for proposal generation. You can empower your offices with proposal generation that scales by setting your team up with a free trial.

Whenever you’re ready, here’s how YCharts can help you:

1. Curious how YCharts Proposals fit into your practice?

Our team is happy to show you how YCharts Proposals facilitate organic growth.2. Interested in how other advisors are growing with YCharts?

Read Alan Cohen’s success story to see how proposals helped double his business.

3. Ready to try YCharts for yourself?

Start a no-risk 7-day free trial.

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Financial Plan vs. Investment Plan: Why Illustrating the “How” is the Key to Organic GrowthRead More →