ETF Share Classes: Why They’ll Matter for Portfolios and Taxes

ETF share classes are coming, and they will change how advisors manage taxes for clients.

According to the SEC’s Edgar database, since the start of 2025, companies have filed or re-filed 64 exemptive applications (Form 40-APP) with the SEC seeking approval for ETF share class structures.

Nearly all begin with some version of this boilerplate: “APPLICATION PURSUANT TO SECTION 6(c) OF THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED (“ACT”), FOR AN ORDER OF EXEMPTION FROM SECTIONS 2(a)(32), 5(a)(1), 18(f)(1), 18(i), 22(d) AND 22(e)”

In plain terms, fund managers are asking the SEC for permission to offer ETF and mutual fund share classes side-by-side, a structure that could reshape how you and your clients access investment strategies.

As of September 29, 2025, the SEC approved Dimensional Fund Advisors’ application, marking the first modern approval of ETF share classes and setting a precedent that could accelerate additional approvals across the industry.

Notably, the order allows for a Mutual Fund–to–ETF Exchange Privilege, allowing investors to switch into the ETF class without triggering a taxable event.

We encourage you to explore recent insights from Cerulli and Ropes & Gray for more on the operational challenges and opportunities this creates for asset managers.

Capital Gains Driving the Rush to ETF Share Classes

One of the biggest motivators behind this wave of filings is capital gains distributions.

Mutual funds regularly leave investors with an unwelcome year-end tax bill, even if no shares were sold. That’s because the fund itself buys and sells securities to manage redemptions or adjust holdings, and those realized gains are passed along to shareholders.

ETFs, however, operate differently thanks to the in-kind creation and redemption process.

Here’s the simplified version:

- When new ETF shares are needed, large institutions called authorized participants (APs) deliver a basket of the fund’s underlying securities to the ETF provider. In return, they receive a block of ETF shares, called a creation unit.

- When redemptions happen, the process runs in reverse. APs return ETF shares to the provider, and instead of the fund selling holdings for cash, the AP receives the basket of underlying securities.

- Because this swap is done “in kind,” no taxable event is triggered inside the ETF.

In most cases, this mechanism allows ETFs to systematically push out low-cost basis securities and reduce the chance of passing on capital gains to investors.

So while mutual fund shareholders are exposed to yearly taxable distributions, ETF shareholders typically avoid them (there are exceptions, specifically with international and fixed income strategies).

This structural difference is one reason so many fund managers are racing to add ETF share classes.

This is where CapGainsValet in YCharts delivers real value. It shows you which mutual funds are most likely to deliver a tax surprise, so you can proactively guide clients toward more tax-efficient alternatives.

Reach Out to Add Cap Gains Metrics to Your AccountWhy ETF Share Classes are Happening Now

If ETFs have offered this tax advantage for years, why are we suddenly seeing a flood of applications for ETF share classes? Two reasons.

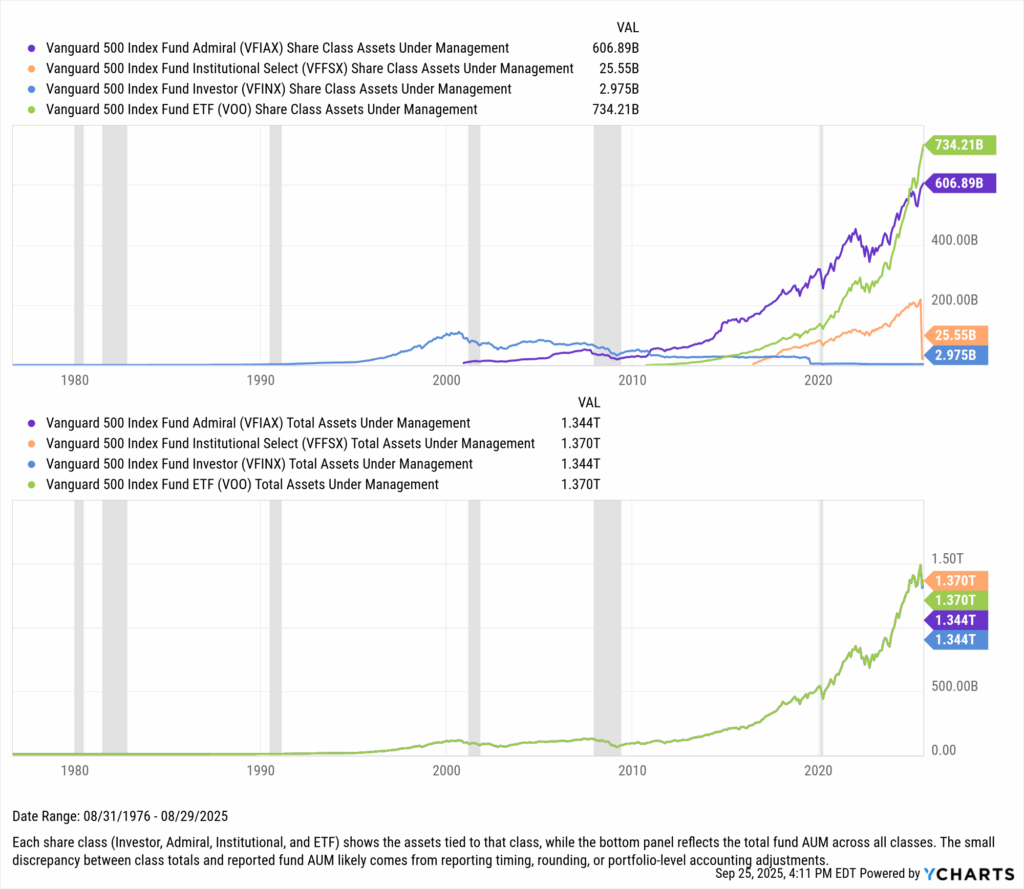

1. Vanguard’s head start is over.

Vanguard pioneered the ETF share class structure in 2001, giving investors mutual fund and ETF access to the same underlying portfolio.

For two decades, competitors couldn’t replicate the design because of Vanguard’s patent, and even Vanguard limited it to passive strategies.

2. Tax efficiency is no longer optional.

After years of market gains, many mutual funds carry significant embedded appreciation. At the same time, income has returned as a central part of portfolios, and global diversification has increased turnover and complexity.

That means more sources of taxable gains and larger year-end capital gains distributions for investors. In an environment where clients are increasingly fee- and tax-sensitive, firms that can deliver similar strategies in a more efficient ETF wrapper will hold an advantage.

How Share Classes Work Today, and What ETF Share Classes Could Mean

Mutual funds already come in multiple share classes. And each class invests in the same underlying portfolio, but costs and access vary.

- Institutional shares usually offer the lowest fees but require high minimums.

- Advisor shares often carry higher fees tied to distribution or service agreements.

- Retirement shares (R-shares) are structured for use in employer plans.

An ETF share class would extend this structure.

Instead of creating an entirely new fund, asset managers could bolt on an ETF share class to an existing mutual fund, giving investors another way to access the same strategy.

For investors and advisors, the implications are significant:

- Tax efficiency: ETF share classes could reduce year-end capital gains distributions thanks to the in-kind creation/redemption process.

- Liquidity and transparency: ETF share classes would trade intraday, unlike mutual funds priced once per day.

- Accessibility: Popular mutual fund strategies, especially in active management, could become available in a lower-cost ETF wrapper.

ETF share classes matter most for actively managed funds, which tend to have higher turnover, which can lead to the largest taxable distributions.

Wrapping those strategies in ETF share classes could help advisors deliver the same investment ideas to clients with far better after-tax results.

Use CapGainsValet to:

- Identify at-risk accounts before record dates.

- Quantify the expected distribution and after-tax drag.

- Prioritize transitions to lower-tax wrappers where appropriate.

Who’s Applying for Exemptive Relief: Big Names in the Mix

Since the patent expired, leading firms across passive and active have filed 40-APP requests. Examples include BlackRock, Fidelity, T. Rowe Price, Franklin Templeton, and Dimensional Fund Advisors, which have all submitted applications to launch ETF share classes.

Why ETF Share Classes Matter for Advisors

ETF share classes would represent a structural shift that could reshape fund lineups, advisor workflows, and client outcomes.

The appeal is clear for investors: access to familiar strategies with greater tax efficiency, liquidity, and transparency.

For asset managers, it’s a way to modernize their products without rebuilding them from scratch.

For advisors, this is where YCharts becomes essential.

With ETF share classes on the horizon, now is the time to show value. Use CapGainsValet to identify accounts at risk of large year-end distributions, explain how structure impacts after-tax returns, and position portfolios for the future of fund investing.

Reach Out to Add Cap Gains Metrics to Your AccountAdvisor Playbook: 3 steps before year-end

- Screen: Run Cap Gains Valet for your book to spot funds likely to distribute.

- Quantify: Estimate after-tax drag and show clients the delta vs an ETF class.

- Transition plan: Define timing, trading approach, and client messaging. Talk to YCharts.

Bonus: What the 1940 Act Has to Do With ETF Share Classes

Most of the filings for ETF share classes fall under the Investment Company Act of 1940 (the “1940 Act”), which still governs how mutual funds, ETFs, and other investment companies operate today.

Because the “40 Act” was written long before ETFs existed, asset managers need exemptions from certain sections so that ETFs (and ETF share classes) can function in practice.

Here are the main sections you’ll see cited in applications (see Cornell’s Legal Information Institute for more):

- Section 6(c): The “escape hatch.” It lets the SEC grant exemptions from any part of the Act if it’s in the public interest and protects investors. Every ETF share class application leans on this section as its legal foundation.

- Section 2(a)(32) & 5(a)(1): These define what a “redeemable security” and an “open-end fund” are. Without relief, ETF shares technically wouldn’t qualify, since they trade on an exchange instead of being redeemed directly with the fund.

- Section 22(d) and Rule 22c-1: These require mutual funds to sell shares at the exact NAV once per day. ETFs need an exemption here so their shares can trade intraday like stocks.

- Section 22(e): This requires funds to pay redemptions within seven days. ETFs need flexibility here because in-kind redemptions don’t always follow the same timelines.

- Sections 17(a)(1), 17(a)(2), and 17(b): These deal with “affiliated transactions.” Since authorized participants interact directly with ETFs, exemptions are needed to avoid technical violations.

In summary, the “40 Act” sets rules meant for classic mutual funds. To make ETF share classes feasible, asset managers ask the SEC to adjust or exempt parts of that statute, so that ETF and mutual fund classes can coexist under one strategy.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Get the Cap Gains Valet dataset added to your YCharts account:

Reach Out to Add Cap Gains Metrics to Your Account2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Sign up for a copy of our Fund Flows Report: to keep tabs on flows into ETFs and Mutual Funds:

Sign up for our free monthly Fund Flow Report:Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Year-End Tax Planning That Turns Success Into Client ReadinessRead More →