Monthly Market Wrap: December 2021

Welcome back to the Monthly Market Wrap from YCharts, where we break down the most important market trends for advisors and their clients every month. As always, feel free to download and share any visuals with clients and colleagues, or on social media.

Want the Monthly Market Wrap sent straight to your inbox? Subscribe below:

Are you based in Canada or following Canadian markets? Check out and subscribe to the Monthly Canada Market Wrap from YCharts.

And just like that, 2021 is history. Whether this is your first YCharts Monthly Market Wrap or you’ve been a reader for the past year, thanks for joining us as we recap market events for advisors and their clients. We love having you here!

Now, on to the fun stuff. How did markets do in 2021?

The S&P 500 logged a return of 28.7% in 2021, the largest of the three major US equity indices. The benchmark index also notched a new record high 70 times throughout the year, which itself is a record. The NASDAQ took second place with 22.2%, while the Dow Jones Industrial Average finished 21% higher.

2021 definitely brought more positives than negatives for stocks, as the three indices had a few minor drawdowns during the year. The S&P 500’s largest drawdown was 5.1%, the Dow’s was 6.3%, and 10.5% for the NASDAQ, the last of which narrowly qualified as correction territory.

Download Visual | Modify in YCharts

Around the world, MSCI’s International Developed Markets index rose 11.8% in 2021, while the Emerging Markets index finished 2.2% lower. In fixed income, Bloomberg’s US Corporate High Yield bond index posted a 5.3% return, while Global Aggregate bonds slipped 4.7%.

That’s a wrap on 2021. But before you eagerly—or sadly—flip that calendar, take a look at these key developments from the last month of the year:

• Off the YCharts! Who Drove Market Gains in 2021?

• Major Index Returns: Equities Finish 2021 Strong

• Sector Movement: All 11 Sectors Positive in the Last Month of 2021

• Hot Stocks of the Month: Healthcare, “Fed-proof” Names Attract

• Laggards & Losers: Technology, Cyclical Names Slide

• Economic Data: Unemployment Claims Stay Below 200K

Off the YCharts! Who Drove Market Gains in 2021?

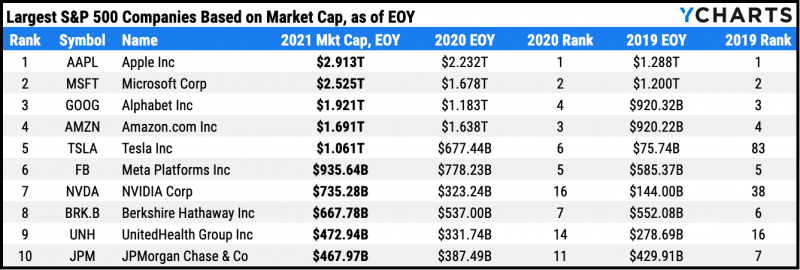

A look back at 2021 also wouldn’t be complete without identifying the biggest drivers of this year’s market returns. For the third year in a row, Apple (AAPL) and Microsoft (MSFT) are the largest two companies within the S&P 500, and added $681 billion and $847 billion of market value in 2021, respectively.

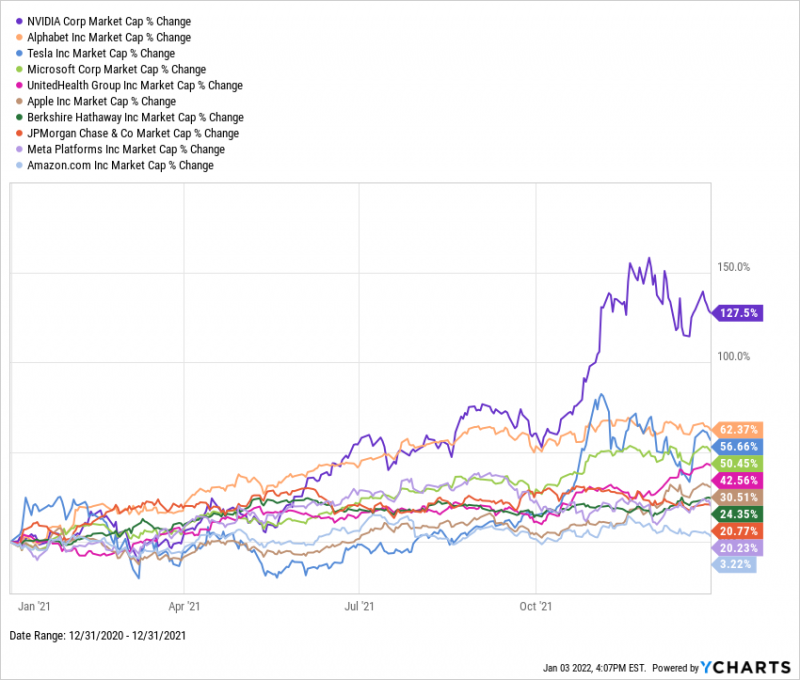

UnitedHealth Group (UNH) and JPMorgan Chase (JPM) cracked the top ten this year, as did NVIDIA (NVDA), who logged the largest market cap increase in 2021. The graphics processor designer more than doubled its market cap over the last twelve months and ran away from the pack considerably in Q4:

Download Visual | Modify in YCharts

Which stocks do you predict will be the biggest market movers in 2022?

Major Index Returns: Equities Finish 2021 Strong

Download Visual | Modify in YCharts

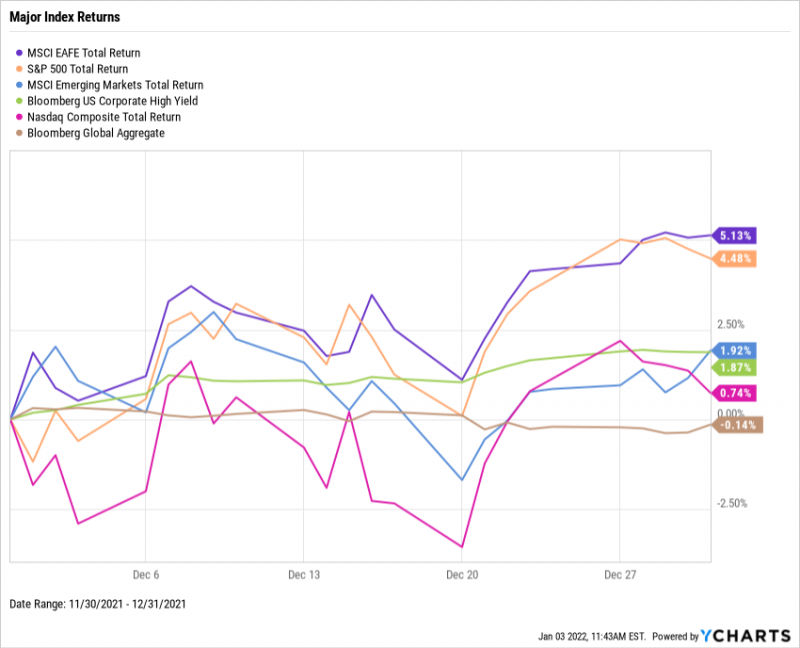

Equity indices ended 2021 on a high note. The S&P 500 rose 4.5% in December, while International Developed Markets rallied 5.1% thanks to particularly strong performances in 4 of the index’s 5 most heavily-weighted countries: Switzerland, France, the United Kingdom, and Germany. Emerging Markets tacked on 1.9%. Though the NASDAQ experienced downside pressure early in December, due mainly to the Consumer Discretionary and Technology sectors, the index still finished up 0.7%. As for fixed income, high-yield corporate bonds rebounded 1.9% after a down November, while the Global Aggregate Bond Index fell a slight 0.1%.

Sector Movement: All 11 Sectors Positive in the Last Month of 2021

Download Visual | Modify in YCharts

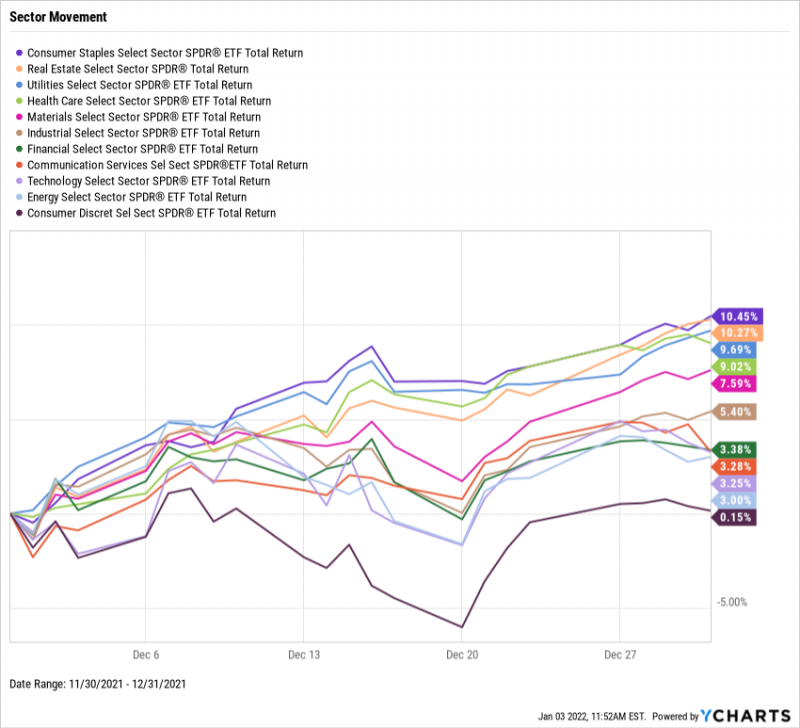

December was a fruitful month for equity sectors across the board. Two of the 11 sectors, Consumer Staples and Real Estate, finished the month with double-digit increases. Packaged goods and personal care brands, storage companies, and real estate landlords such as 5G cellular tower lessor American Tower (AMT), were outperformers of their respective sectors. Utilities and Health Care logged the next highest returns, as investors piled into these “Fed-proof” sectors following the Federal Reserve’s announcement that it would tighten rates faster than previously forecasted. Bringing up the rear in December were Energy, which rebounded 3% thanks to a bounce in oil prices, and Consumer Discretionary, overcoming a 5% drawdown to finish December just above even.

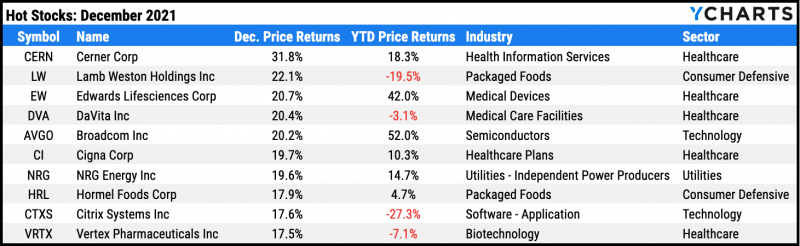

Hot Stocks of the Month: Healthcare, “Fed-proof” Names Attract

Download Visual | Modify in YCharts

December’s best performing S&P 500 stock was Cerner (CERN), vaulting 31.8% on news that the medical information systems firm would be acquired by Oracle (ORCL). Four other healthcare names made December’s “Hot Stocks” list: Edwards Lifesciences (EW), DaVita (DVA), Cigna (CI), and Vertex Pharmaceuticals (VRTX). Investors sought investments that are less sensitive to Federal Reserve rate hikes beyond healthcare, also targeting defensive names Lamb Weston Holdings (LW) and Hormel Foods (HRL) as well as utility player NRG Energy (NRG).

Technology giants Broadcom (AVGO) and Citrix Systems (CTXS) also made the cut for December’s ten best performers in the S&P 500.

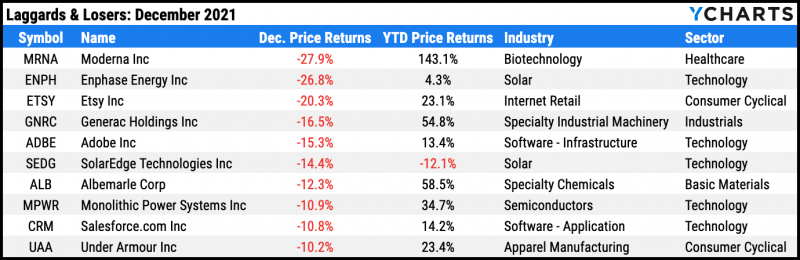

Laggards & Losers: Technology, Cyclical Names Slide

Download Visual | Modify in YCharts

Moderna (MRNA) was December’s worst-performing S&P 500 stock, plummeting nearly 28% as investors raised doubts of the company’s ability to maintain its COVID-19 vaccine-driven momentum. The vaccine manufacturer had a bleak December despite releasing studies that show the effectiveness of its booster shot against the Omicron variant. Countries such as Switzerland and South Korea also purchased millions of doses. With investors piling into defensive names in December, economically-sensitive sectors such as Technology and Consumer Discretionary saw large outflows. Technology companies Enphase Energy (ENPH), Adobe (ADBE), SolarEdge Technologies (SEDG), Monolithic Power Systems (MPWR), and Salesforce.com (CRM) took the biggest hits, while pandemic go-to’s Etsy (ETSY) and Under Armour (UAA) also suffered declines.

Industrial machinery manufacturer Generac Holdings (GNRC) and Albemarle (ALB), the world’s largest lithium producer, round out December’s ten worst performers.

Featured Market & Advisor News

Analysts Are Not Raising Quarterly S&P 500 EPS Estimates for First Time Since Q2 2020 (FactSet)

The 14 Charts that Defined 2021 with Josh Brown and Friends (YCharts)

SEC denies 2 Bitcoin ETFs in latest setback to crypto industry (InvestmentNews)

The Best Performing Bond ETFs and How to Find Them (YCharts)

Fed Doubles Taper, Signals Three 2022 Hikes in Inflation Pivot (WealthManagement.com)

Bear Market Mania with Charlie Bilello (YCharts)

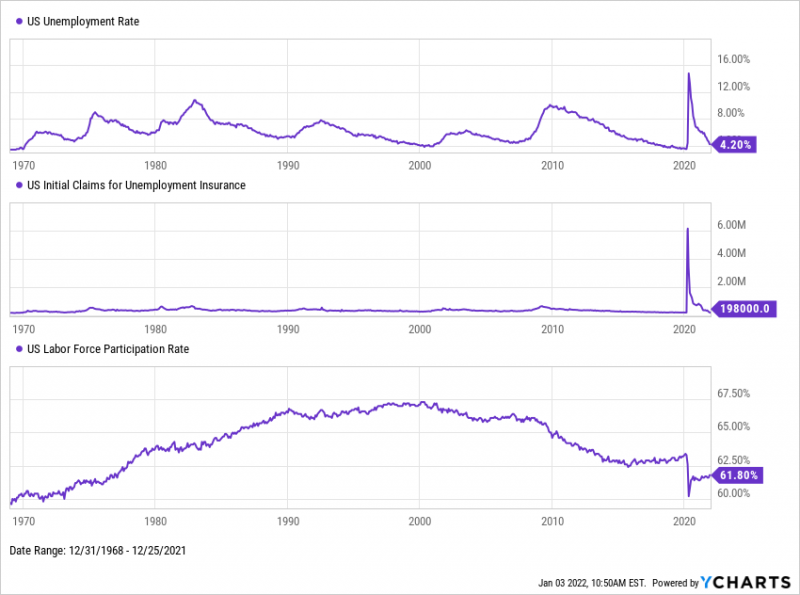

Economic Data: Unemployment Claims Stay Below 200K

Employment

November’s unemployment rate clocked in at 4.2%, falling for a fifth consecutive month and setting a new low since March 2020. An early Christmas gift came to job seekers as weekly claims for unemployment dropped below 200,000 twice in December, standing at 198,000 for the week of December 25th. The labor force participation rate of 61.8% is still 1.5 percentage points below its pre-pandemic level, but the US Job Quits Rate tapered to 2.8% from its all-time high in September of 3%.

Download Visual | Modify in YCharts

Production and Sales

US Retail and Food Services Sales rose just a quarter of a percent in November, and December’s US ISM Manufacturing PMI reading checked in at 58.7, a decline of 2.4 points. Though anything above 50 indicates expansion in the manufacturing sector, it’s the weakest reading for all of 2021.

Housing

The US housing market saw significant activity in November. Following an October in which US New Single Family Houses Sold declined 8.4% MoM, that figure rebounded in November to a 12.4% increase. At the same time, Existing Home Months’ Supply fell to 2.1, its lowest reading since March 2021. The strong housing activity caused the US house price index to rise 1.1%.

Consumers

Consumer activity remained elevated in November, as consumer spending (PCE) increased another 0.6% MoM. Prices outpaced spending on a month-over-month basis for the second straight month, with the US Consumer Price Index jumping 0.8%.

Have a great January and 2022! 📈

If you haven’t yet, subscribe to the YCharts Monthly Market Wrap here: