The Best Bond ETFs: A Complete Guide

Many of us first encountered fixed income not through bond ETFs, but rather the physical savings bonds that were gifted to us as kids (thank you, Aunt Judy).

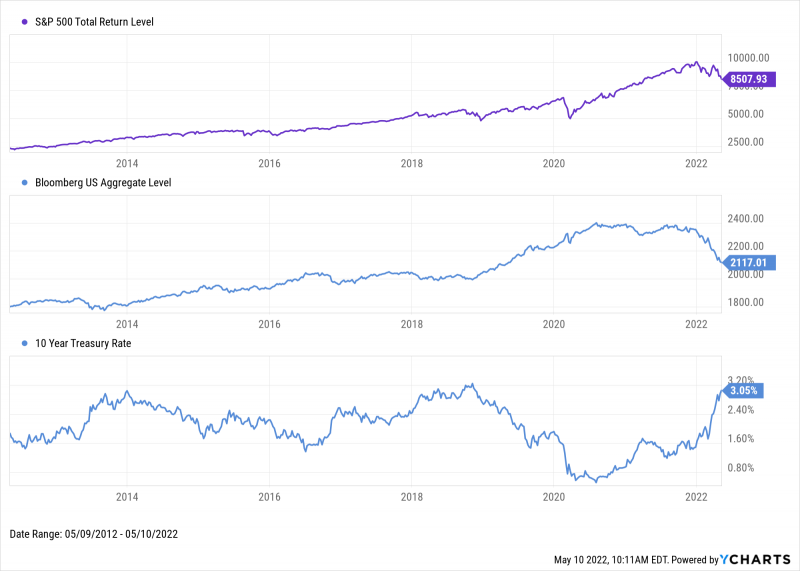

Although bond ETFs and savings bonds are a bit different, advisors know fixed income’s consistent payments and low correlation to stocks are vital to a well-balanced investment portfolio. So, what’s the best way to invest in bonds on behalf of your clients? Will a hassle-free bond ETF do the trick?

With major equity indices in correction or bear market territory, and interest rates on the rise, it may be worthwhile to take a closer look at the best bond ETFs for your portfolio.

Download Visual | Modify in YCharts

Table of Contents

The Best Performing Bond ETFs by Category

Differences Between Bonds, Bond ETFs & Bond Mutual Funds

Important Metrics for Evaluating Bond Funds

Using YCharts to Find the Best Bond ETFs

The Best Performing Bond ETFs by Category

These are current lists of the best-performing bond ETFs in key categories, identified using the YCharts Fund Screener.

Intermediate Term Core & Intermediate Term Core-Plus Bond ETFs

The Screener identified the best bond ETFs in each category as those that rank in the top 75% among their category peers for 30-Day SEC Yield, Yield to Maturity, Distribution Yield, and Expense Ratio. (The best Inflation-Protected bond ETFs were defined as ones that rank in the top 90% for each metric.)

Then, an objective Scoring Model was added to actually rank the results from best to worst using an equal-weighted score that considers all of the aforementioned metrics.

Intermediate Term Core & Intermediate Term Core-Plus Bond ETFs

These are the best performing Intermediate Core & Intermediate Core-Plus bond ETFs as of May 10th, 2022:

Vanguard Intermediate Term Bond ETF (BIV)

Vanguard Total Bond Market ETF (BND)

iShares Yield Optimized Bond ETF (BYLD)

iShares CMBS ETF (CMBS)

iShares Edge US Fixed Income Balanced Risk ETF (FIBR)

iShares Core 5-10 Year USD Bond ETF (IMTB)

iShares Core Total USD Bond Market ETF (IUSB)

Nuveen Enhanced Yield US Aggregate Bond ETF (NUAG)

Nuveen ESG US Aggregate Bond ETF (NUBD)

SPDR® Portfolio Aggregate Bond ETF (SPAB)

Short-Term Bond ETFs

These are the best performing Short-Term bond ETFs as of May 10th, 2022:

iShares 1-5 Year Investment Grade Corporate Bond ETF (IGSB)

iShares Core 1-5 Year USD Bond ETF (ISTB)

iShares 0-5 Year Investment Grade Corporate Bond ETF (SLQD)

iShares ESG 1-5 Year USD Corporate Bond ETF (SUSB)

Vanguard Short-Term Corporate Bond ETF (VCSH)

Corporate Bond ETFs

These are the best performing Corporate bond ETFs of May 10th, 2022:

Goldman Sachs Access Investment Grade Corporate Bond ETF (GIGB)

iShares Edge Investment Grade Enhanced Bond ETF (IGEB)

iShares 5-10 Year Investment Grade Corporate Bond ETF (IGIB)

iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

SPDR® Portfolio Corporate Bond ETF (SPBO)

iShares ESG USD Corporate Bond ETF (SUSC)

Vanguard Intermediate-Term Corporate Bond ETF (VCIT)

High Yield Bond ETFs

These are the best performing High Yield “Junk” bond ETFs as of May 10th, 2022:

Franklin Liberty High Yield Corporate Bond ETF (FLHY)

Goldman Sachs Access High Yield Corporate Bond ETF (GHYB)

iShares Edge High Yield Defensive Bond ETF (HYDB)

iShares iBonds 2025 Term High Yield and Income ETF (IBHE)

iShares iBonds 2026 Term High Yield and Income ETF (IBHF)

VanEck International High Yield Bond ETF (IHY)

SPDR® Bloomberg High Yield Bond ETF (JNK)

Nuveen ESG High Yield Corporate Bond ETF (NUHY)

iShares 0-5 Year High Yield Corporate Bond ETF (SHYG)

SPDR® Portfolio High Yield Bond ETF (SPHY)

iShares Broad USD High Yield Corporate Bond ETF (USHY)

Principal Active High Yield ETF (YLD)

Ultrashort Bond ETFs

These are the best performing Ultrashort bond ETFs as of May 10th, 2022:

VanEck Investment Grade Floating Rate ETF (FLTR)

Goldman Sachs Access Ultra Short Bond ETF (GSST)

iShares Interest Rate Hedged Long-Term Corporate Bond ETF (IGBH)

SPDR® SSgA Ultra Short Term Bond ETF (ULST)

Principal Ultra-Short Active Income ETF (USI)

Janus Henderson Short Duration Inc ETF (VNLA)

Inflation-Protected Bond ETFs

These are the best performing Inflation-Protected bond ETFs as of May 10th, 2022:

Goldman Sachs Access Inflation Protected USD Bond ETF (GTIP)

SPDR® Portfolio TIPS ETF (SPIP)

iShares TIPS Bond ETF (TIP)

Jump to ‘Using YCharts to Find the Best Bond ETFs’

Types of Bond ETFs

The spectrum of bond ETFs does not leave much to the imagination — there are innumerable ways to manage your fixed-income exposure through ETFs.

One route is to invest in the broad universe of bonds all at once. Choosing Total Bond products like the Vanguard Total Bond Market ETF (BND) accomplishes the goal of broad bond exposure.

Government Bond ETFs

When you think of government bonds, U.S. Treasuries tend to come to mind. Treasuries are considered “risk-free” as investors prescribe no default risk to the U.S. government. For this reason, Treasury ETFs tend to have lower yields than other products — less risk, less reward, but with the expectation of more stability.

One option for exposure to relatively lower-interest rate risk treasuries is the Vanguard Short-Term Bond ETF (BSV), which typically boasts an effective duration under 3, and allocates over 70% of its holdings into government bonds.

Download Visual | Modify in YCharts

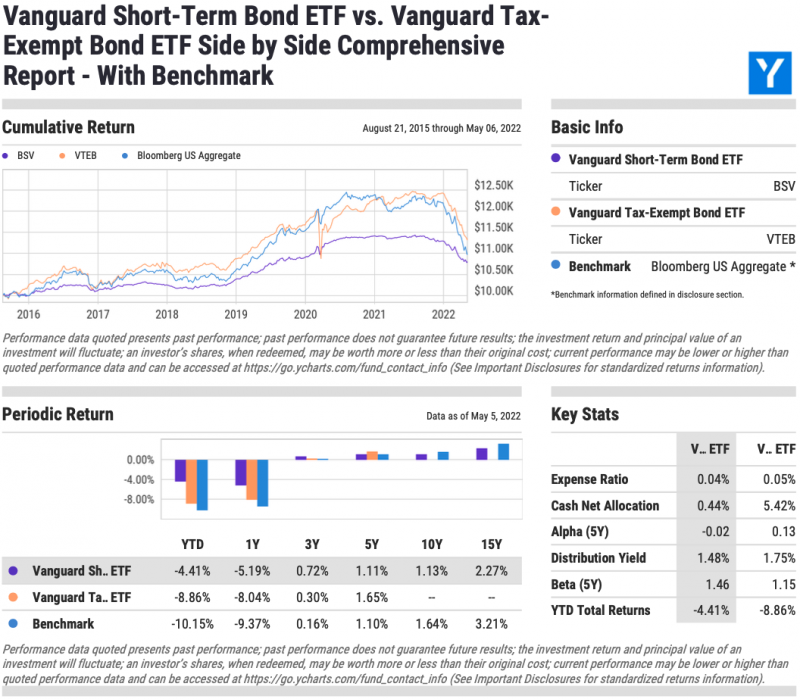

An integral word in any savvy advisor’s vocabulary is “munis.” Municipal bonds represent debt issued by a state, county, or municipality. Most importantly, munis are “tax-exempt” from federal and most state or local taxes. For tax-sensitive clients, the Vanguard Tax-Exempt Bond ETF (VTEB) may be worth a look.

Municipal Bond ETFs

An integral word of any savvy advisor’s vocabulary is “munis”, formally known as municipal bonds. Municipal bonds represent debt issued by a state, county, or municipality. Most importantly, munis are “tax-exempt” from federal and most state or local taxes. For tax-sensitive clients, the Vanguard Tax-Exempt Bond ETF (VTEB) may be worth a look.

Corporate Bond ETFs

Investment-grade bonds are the cream of the crop when it comes to corporate debt.

“Investment-grade” encapsulates all bonds with a credit rating of “BBB” or above, with “AAA” and “AA” signifying the highest credit qualities. A higher credit quality means a lower chance of default, but also a lower yield. An investment grade bond ETF like the Vanguard Long-Term Corporate Bond ETF (VCLT) pays out significantly more income than the 10 Year Treasury does while maintaining a relatively high credit quality.

High Yield Bond ETFs

When it comes to income, high yield bond ETFs offer the most. The appropriately-tickered SPDR® Bloomberg Barclays High Yield Bond ETF (JNK) is quite attractive in low rate environments. But there’s no such thing as a free lunch; high yield (or “junk”) bonds are debt instruments with below-investment grade ratings (anything BBB- or below), meaning the chance of the issuer defaulting is relatively high. Investing in junk bonds is high risk, but they can provide a valuable income stream for your clients in a well-balanced portfolio.

Differences Between Bonds, Bond ETFs & Bond Mutual Funds

Investing in individual bonds within a client’s portfolio can be difficult — they’re typically sold over-the-counter (OTC), so they’re not as easy to trade. Bond ETFs, however, allow you to invest in hundreds or thousands of underlying bonds at once. Plus, casting a wide net in terms of bond exposure only helps in diversifying away from stocks. To top it off, bond ETF holders receive payments monthly (as opposed to semi-annual coupons), which often can be automatically reinvested at no extra cost.

So why not invest in a bond mutual fund? Mutual funds typically report their holdings monthly, or semi-annually. To boot, they typically have a holding period of at least 90 days, and can only be traded once a day after the markets close.

While bond ETFs provide many advantages, they’re not perfect. Like all fixed income products, investing in bond ETFs exposes your or your client to interest rate risk, inflation risk, and credit risk.

However, bond funds are also subject to their lack of maturity — unlike Aunt Judy’s savings bond you received years ago, there is no guarantee that the principal invested in a bond fund will be repaid in full. That being said, some firms have begun to offer ETFs with fixed maturity dates. Lastly, bond ETFs are passively managed; while actively managed funds are more expensive to own, hurting clients’ returns.

Jump to ‘Using YCharts to Find the Best Bond ETFs’

Important Metrics for Evaluating Bond Funds

Yield, which is arguably the most important metric for any fixed-income product, gets a bit tricky to nail down when evaluating bond funds. Three common yield figures you’ll see for every bond fund are the 30-Day SEC Yield, the Yield to Maturity (YTM), and the Distribution Yield.

30-Day SEC Yield: also referred to as “standardized yield”, it uses the fund’s last 30 days of interest to approximate the rate an investor may receive in the coming 12 months, after deducting expenses. Aptly named, it was developed by the SEC to allow for fairer comparisons of bond funds.

Yield to Maturity (YTM): the weighted average yield of all underlying bonds in the ETF, assuming they are held to maturity. However, YTM does not factor in the fund’s expenses, and ETFs do not typically hold bonds to maturity.

Distribution Yield: the ratio of all distributions paid by the fund in the past 12 months (i.e. income, capital gains, etc.) divided by the current value-per-share of the fund. The distribution yield can fluctuate wildly if the size of a bond ETF’s distributions spikes up or down between payments.

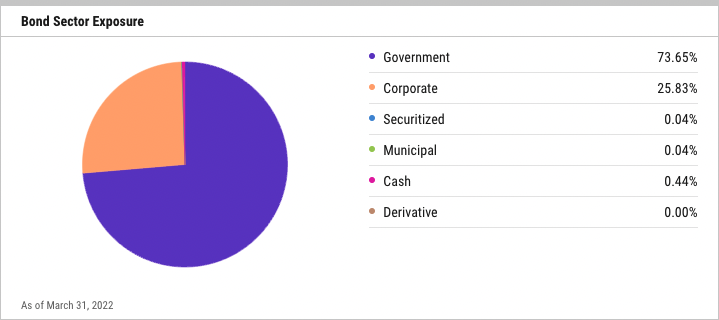

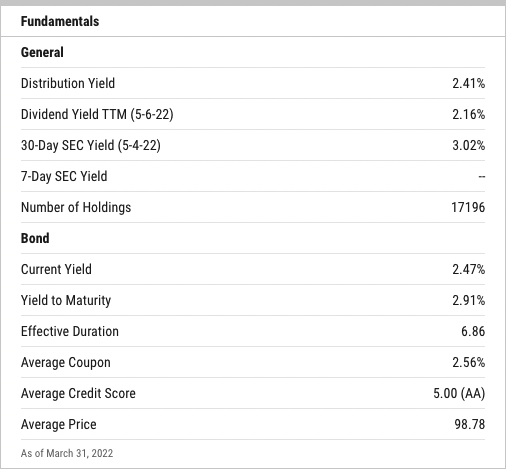

Below are some fundamental metrics for the Vanguard Total Bond Market ETF (BND). As you can see, the different yield metrics can vary significantly; you can use multiple yield metrics to evaluate bond funds, but it is important to understand their differences.

Download Visual | Modify in YCharts

A couple of other key metrics to consider:

Average Credit Score: the weighted average credit rating of all underlying bonds in the fund. The closer to “AAA”, the better. Credit ratings below BBB- mean the average bond is below investment grade (also known as “junk” or “high yield”). With an average credit score of “A”, the Vanguard Total Bond Market ETF (BND) is considered high quality.

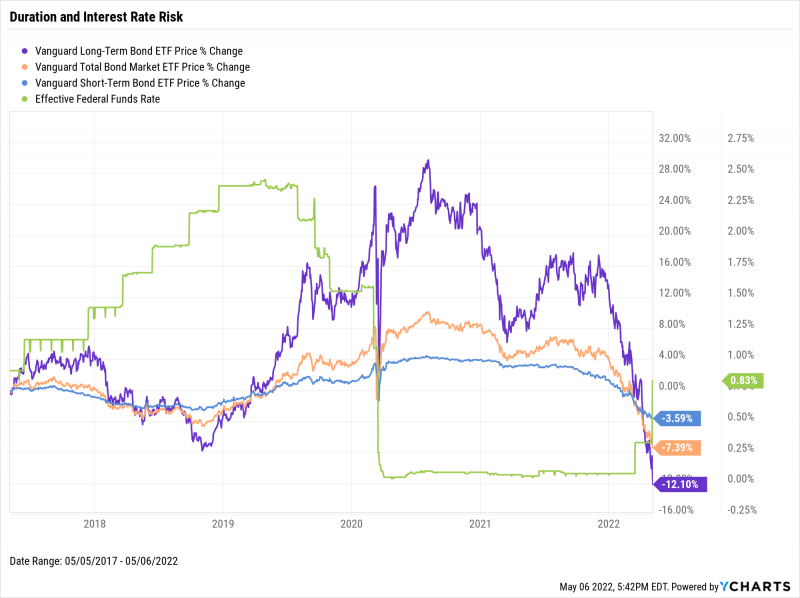

Effective Duration: represents the weighted average duration of the bond ETF. Duration is the expected change in a bond’s price in response to a change in its yield and is largely affected by the underlying bonds’ maturity lengths — the longer the maturity, the higher the duration. The chart below illustrates this interaction; as interest rates fall, bond ETF prices rise. The longer maturity (and therefore duration) ETFs like the Vanguard Long-Term Bond ETF (BLV) show a greater price increase, while the shorter maturity Vanguard Short-Term Bond ETF (BSV) only appreciated marginally.

Download Visual | Modify in YCharts

Using YCharts to find the Best Bond ETFs

YCharts tools enhance your bond ETF research, allowing you to make the most informed decisions for your clients’ portfolios. Below are a few impactful ways that YCharts helps you find the best bond ETFs.

Screen for Bond ETFs

With hundreds of bond ETFs out there, the Fund Screener helps you apply custom criteria and find the needle in the haystack for your clients. As a starting point, spark your research with pre-built fixed income ETF screens, such as the Tax-Preferred Municipal Bond ETFs, ESG-Friendly Bond ETFs, or Fixed Income ETFs with the Most Inflows templates.

The custom-built Top Performing Bond ETFs screen below finds bond ETFs with above-average 30-Day SEC Yields, high returns over the past few years, and relatively low expense ratios.

Bond ETF Comparison Reports

YCharts Comparison PDF Reports help you compare ETFs, portfolios, and other securities clearly and concisely. Most importantly, you can tailor the data and visuals included in your report to guide your clients and prospects towards their investment goals. For that extra touch, customize PDF reports with your firm’s logo and colors. (YCharts Professional clients, customize your PDF Reports here)

The YCharts Side-by-Side Comprehensive Report evaluates the performance, key metrics, and holdings of two bond ETFs, such as the aforementioned Vanguard Short-Term Bond ETF (BSV) and Vanguard Tax-Exempt Bond ETF (VTEB). See an example below.

Download Visual | Learn more about Custom PDF Reports

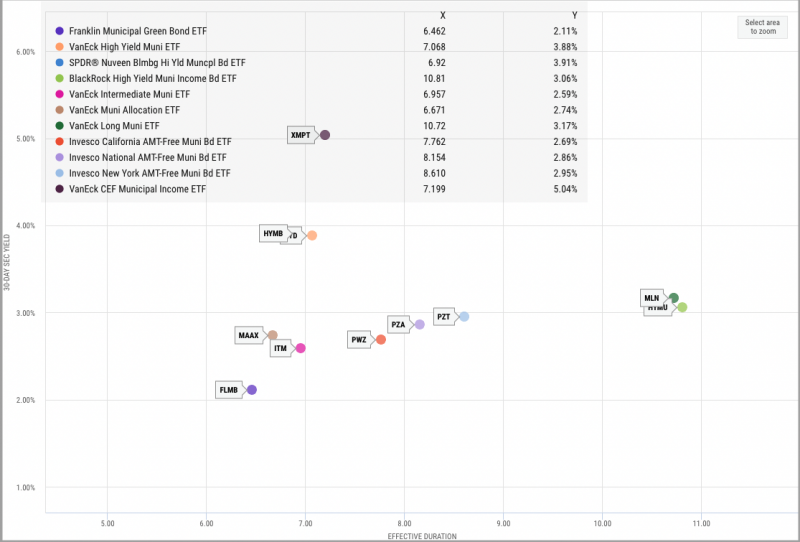

Analyze Yield Using Scatter Plot

YCharts’ Scatter Plot enables you to plot any of YCharts’ 4,000+ calculated metrics for any combination of securities and allows you to visually analyze them head-to-head.

An important dynamic for any fixed-income fund is the relationship between its yield and duration. Current or prospective fundholders will want to know the income a fund can provide, but also that fund’s sensitivity to rate changes, as given by effective duration. Plotting fixed-income funds to determine which offer higher yields and lower risk of a price drop is revealing. Below, the Scatter Plot shows several Municipal Bond ETFs with “Effective Duration” along the X-axis and “30-Day SEC Yield” along the Y-Axis. For investors, the most attractive ETFs of the group have a lower effective duration and higher 30-Day SEC yield.

Download Visual | Modify in YCharts

Evaluate Bond ETFs On-the-Go with Quickflows

While due diligence is important, no one wants to spend all day researching, analyzing, and comparing bond ETFs. Making comprehensive research faster and easier, YCharts Quickflows enable in-depth analysis in just a few clicks and free up time to spend with your clients.

There’s a swath of bond ETFs that track the same bond index or have similar strategies. The Find Similar ETF Quickflow is perfect for comparing expense ratios and returns across fund families, so you can find the best bond ETFs for your clients. Click here to see the Quickflow in action, finding bond funds similar to the Vanguard Intermediate-Term Corporate Bond ETF (VCIT).

Use the Credit Quality Exposure Quickflow to break down the credit exposures of up to 12 bond ETFs at once. Click here to see how this Quickflow compares some of the previously mentioned bond ETFs, or take a quick glance below.

Connect with YCharts

To get in touch, contact YCharts via email at hello@ycharts.com or by phone at (866) 965-7552

Interested in adding YCharts to your technology stack? Sign up for a 7-Day Free Trial.

Disclaimer

©2022 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Twitter, Floating Rate Bonds, Fed Rate Hikes | What's Trending on YCharts?Read More →