Monthly Canada Market Wrap: March 2022

Welcome back to the Canadian Monthly Market Wrap from YCharts! Here, we break down the most important market trends for Canada-based advisors and their clients every month. As always, feel free to download and share any visuals with clients and colleagues, or on social media.

Looking for the US Market Wrap? Click here.

Canada Market Summary for March 2022

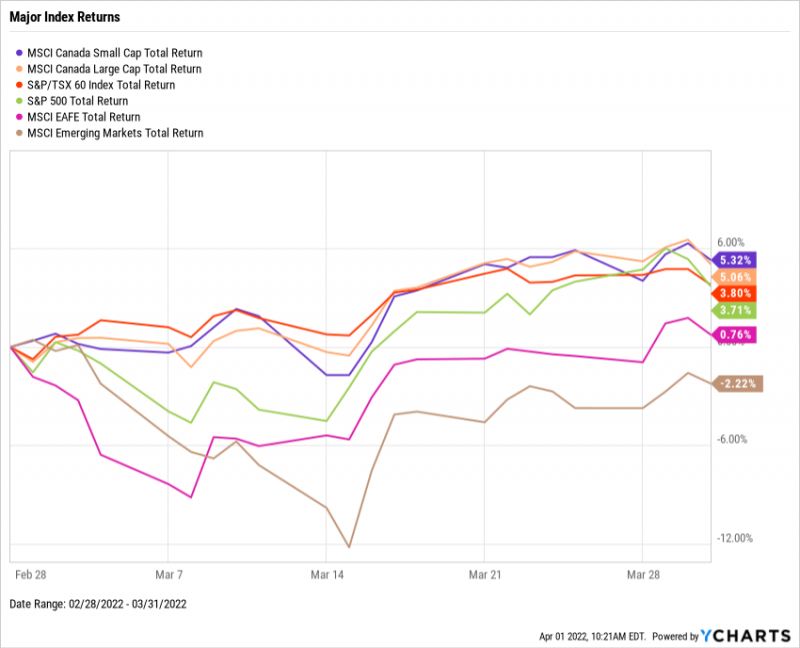

Equities made a solid rebound in March after spending the first two months of the year in the trenches. The S&P/TSX 60 index advanced 3.8% in March, while its US counterpart, the S&P 500, made a similar stride of 3.7%. Small caps were the standout among all Canadian equity styles, ending the month 5.3% higher.

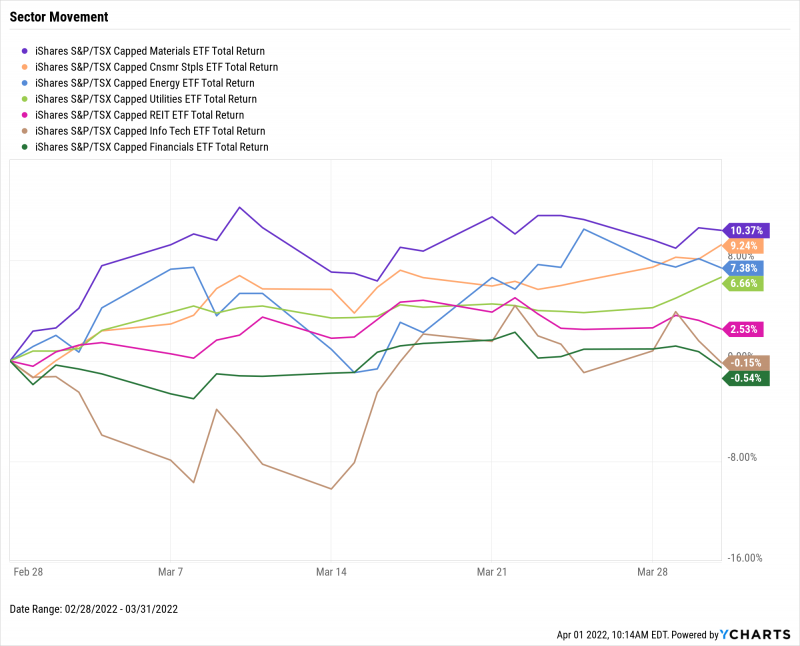

Investors continued to favour precious metal and commodity stocks in light of the ongoing Russian invasion of Ukraine, which sent the Materials and Energy sectors soaring 10.4% and 7.4% in March, respectively. Consumer staples finished the month 9.2% higher as well, signaling a further shift toward defensive names. Info Tech and Financials were the only two sectors that ended March in the red.

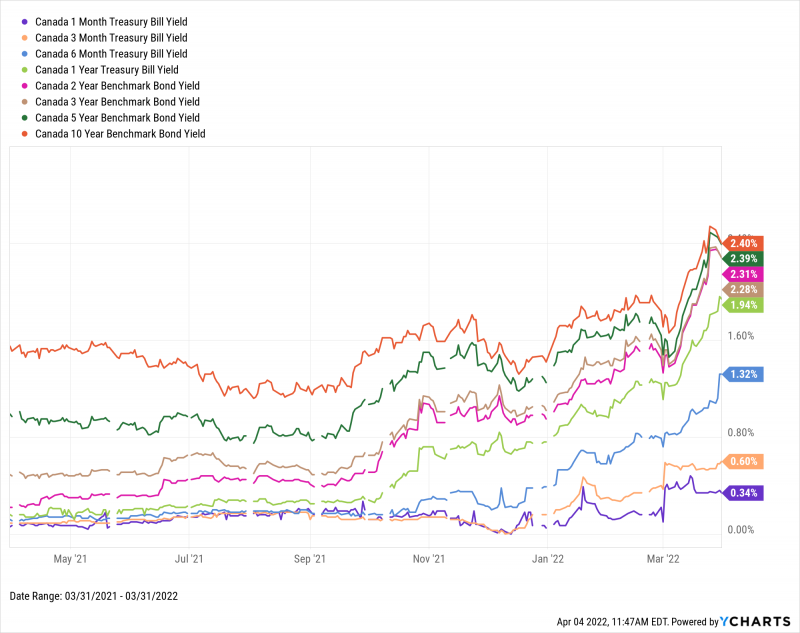

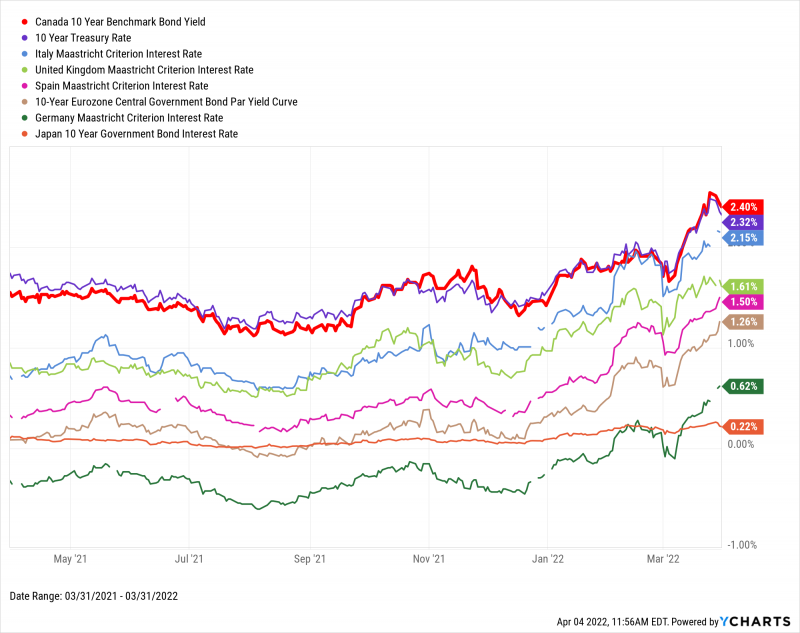

Over in fixed income, yields roared higher across the board. The Canada 2-Year Benchmark Bond rate jumped by 86 basis points in March, from 1.45% to 2.31%, the most of any Canadian fixed income instrument. Meanwhile, the longer-term Canada 10-Year yield grew by 56 bps from 1.84% to 2.40%. In global bond news, the German Bund went in and out of negative territory to end the month with a yield of 0.62%, its highest level since 2018.

Jump to Fixed Income Performance

Finally, highlights in economic data include the Canadian unemployment rate plummeting by a full percentage point to 5.5%, a level not seen in nearly three years. Canadian inflation increased for the eighth consecutive month to 5.69%, but manufacturing was strong, with the Canada Ivey PMI surging 10 full points to end February, the indicator’s latest printing, above 60.

Equity Performance

Major Indexes

Download Visual | Modify in YCharts

Canadian Sector Movement

Download Visual | Modify in YCharts

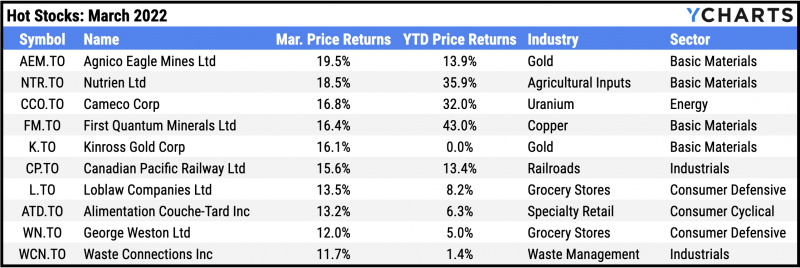

Hot Stocks: March’s Top 10 TSX 60 Performers

Agnico Eagle Mines (AEM.TO): 19.5% gain in March 2022

Nutrien (NTR.TO): 18.5%

Cameco (CCO.TO): 16.8%

First Quantum Minerals (FM.TO): 16.4%

Kinross Gold (K.TO): 16.1%

Canadian Pacific Railway (CP.TO): 15.6%

Loblaw Companies (L.TO): 13.5%

Alimentation Couch-Tard (ATD.TO): 13.2%

George Weston (WN.TO): 12.0%

Waste Connections (WCN.TO): 11.7%

Download Visual | Modify in YCharts

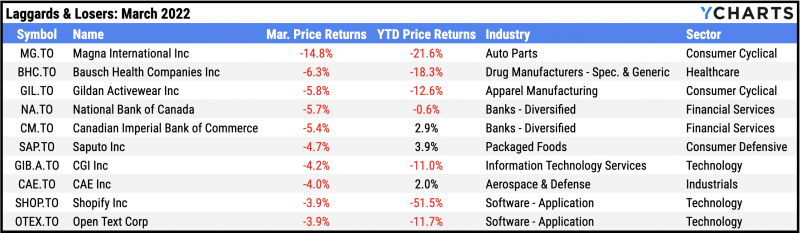

Laggards & Losers: March’s 10 Worst TSX 60 Performers

Magna International (MG.TO): -14.8% decline in March 2022

Bausch Health Companies (BHC.TO): -6.3%

Gildan Activewear (GIL.TO): -5.8%

National Bank of Canada (NA.TO): -5.7%

Canadian Imperial Bank of Commerce (CM.TO): -5.4%

Saputo (SAP.TO): -4.7%

CGI (GIB.A.TO): -4.2%

CAE (CAE.TO): -4.0%

Shopify (SHOP.TO): -3.9%

Open Text (OTEX.TO): -3.9%

Download Visual | Modify in YCharts

Fixed Income Performance

Canadian Treasury Yield Curve

Canada 1 Month Treasury Bill Yield: 0.34%

Canada 3 Month Treasury Bill Yield: 0.60%

Canada 6 Month Treasury Bill Yield: 1.32%

Canada 1 Year Treasury Bill Yield: 1.94%

Canada 2 Year Benchmark Bond Yield: 2.31%

Canada 3 Year Benchmark Bond Yield: 2.28%

Canada 5 Year Benchmark Bond Yield: 2.39%

Canada 10 Year Benchmark Bond Yield: 2.40%

Download Visual | Modify in YCharts

Global Bonds

Canada 10 Year Benchmark Bond Yield: 2.40%

10 Year Treasury Rate: 2.32%

Italy Long Term Bond Interest Rate: 2.15%

United Kingdom Long Term Bond Interest Rate: 1.61%

Spain Long Term Bond Interest Rate: 1.50%

10-Year Eurozone Central Government Bond Par Yield: 1.26%

Germany Long Term Bond Interest Rate: 0.62%

Japan 10 Year Government Bond Interest Rate: 0.22%

Download Visual | Modify in YCharts

Featured Market & Advisor News

Canada consumer confidence falls to 14-month low on inflation (BNN)

Your Complete Guide to Sector Rotation (YCharts)

Vanguard tightens grip on $6.8 trillion ETF market (InvestmentNews)

Interest Rates Are Getting Weird with Ben Carlson (YCharts)

Canadians feeling pessimistic about economy as confidence falls to lowest in a year (Financial Post)

Can You Hedge a Stock Market Crash with an ETF? (YCharts)

Economic Data

Employment

Following a half-percent increase in January, the Canadian unemployment rate dipped by a whole percentage point in February to 5.5%. The last time Canada’s unemployment rate was 5.5% or lower was May 2019. As a result, the Canada Ivey Employment index skyrocketed 11.2 points to 60.3, and Canadian Part-time Employment recorded an increase of 215,000 part-time workers in February.

Production and Sales

After just escaping contraction territory in January, the Canada Ivey PMI reading for February jumped by almost 20% to 60.6, well within expansionary range.

Housing

Canada Housing Starts bounced back from a two-month decline, logging 15,403 new starts in February. The Canada New Housing Price Index rose 1.07% month-over-month, over 4x above its monthly average change of 0.24%.

Consumers and Inflation

The Canada Consumer Price Index rose 0.62% in February, while the Canada Inflation Rate continued climbing to 5.69%. The Canada Inflation Rate currently stands at the highest level since August 1991. February’s 5.69% print also represents the eighth straight monthly increase for the inflation rate.

Gold

Despite all the events taking place in March that would typically be favorable for gold, the price per ounce in CAD was $2,444.90 per ounce at March’s end, staying about flat month over month. Nevertheless, the iShares S&P/TSX Global Gold ETF (XGD.TO) surged 11.2% in March, largely stemming from increased production among gold-producing companies within the ETF.

Oil

Oil prices went through heightened volatility in March but ended the month higher than they were in February. As of March 28th, the WTI Daily Spot Price was $107.55 USD per barrel, and Brent sat at $114.50 USD/barrel.

Cryptocurrencies

Major cryptocurrencies made solid headway in March. The price of Bitcoin was $47,063 USD as of March 31st, still 30.4% off its all-time high but about 25% higher from where it was on February 28th. Ethereum ended March at $3,384 USD, representing a similar almost 25% gain in the month. Cardano had its first winning month in several, recovering from a max drawdown of 73.4% to close March at $1.19, representing a 32.8% monthly increase.