Are Wholesalers Giving Advisors What They Really Want?

The role of the modern-day wholesaler has drastically evolved over the last few years. In the past, externals would rattle off facts about their best funds, drop off a fact sheet, then hit the golf course with advisors.

Today, advisors are expecting more. Their time is as valuable as ever and previous tactics aren’t cutting it anymore. Advisors are looking for an expert who’s knowledgeable about not only their own firm’s products but also those of the competition. They ask how strategies fit with the market environment, what the firm’s top researchers are saying, and what economic data is being followed.

To better understand the evolving dynamic between advisors and wholesalers, YCharts surveyed both groups to identify: How can wholesalers make the biggest impact on an advisor’s day-to-day? How have these relationships changed since 2020? And what can wholesalers do to create even more value for the advisors they work with?

Download the free White Paper What Do Advisors Look For In Their Wholesalers? to see our full findings:

Advisor Expectations vs. Reality

The modern wholesaler wears many hats. Acting as an industry consultant, a product vendor, and, in some cases, an active partner developing the right strategy, it can be difficult to pinpoint the wholesaler’s primary value-add. Is there alignment or misperception between advisors and wholesalers?

Download: What Do Advisors Look For In Their Wholesalers?

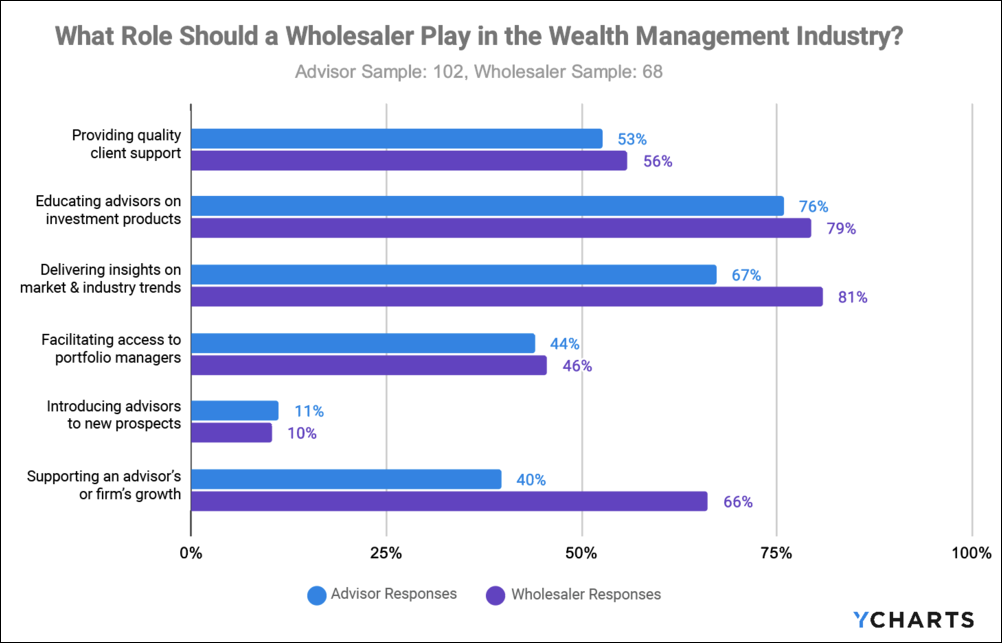

Both parties largely agreed on how wholesalers contribute to advisors’ goals. The top three for advisors:

– Educating advisors on investment products (76% of advisors surveyed)

– Delivering insights on market & industry trends (67%)

– Providing quality client support (53%)

Based on this data, advisors expect their wholesaler partners to keep them informed on prevailing market conditions and how different investment products can help while being a support resource along the way.

Of note, “Supporting an advisor’s or firm’s growth” showed the biggest diversion amongst advisors and wholesalers surveyed. While surely not unimportant to advisors, it appears there are bigger priorities from that side of the table.

Do Wholesalers Live Up to Expectations?

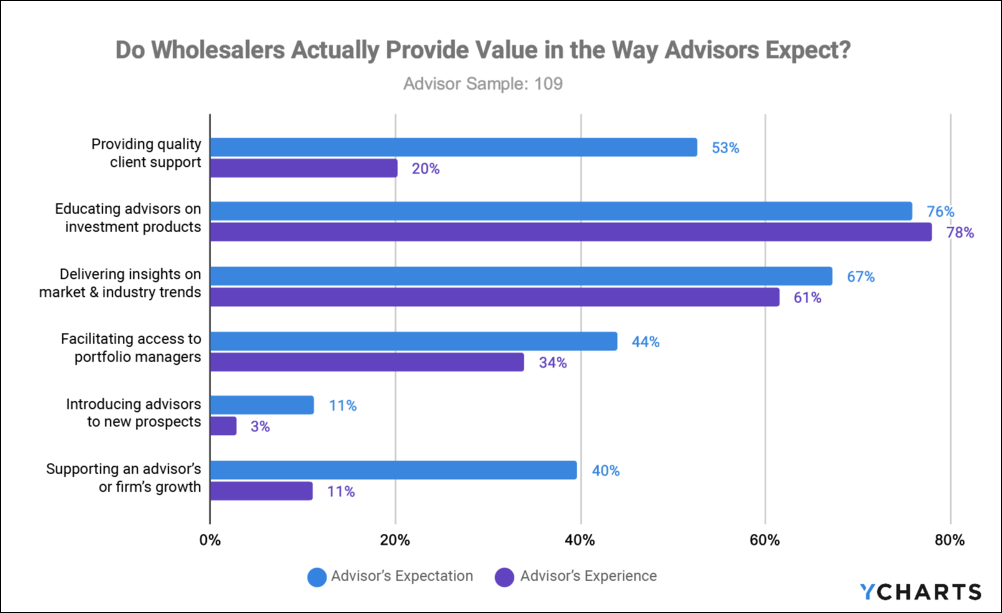

Starting with the good news, wholesalers were given high marks for two of advisors’ top wishlist items: 1) being educated on investment products and 2) learning about the latest market and industry trends. Here, at least, expectations and reality have aligned.

Download: What Do Advisors Look For In Their Wholesalers?

Now the less good news. Advisors do NOT believe wholesalers are meeting expectations in two areas: 1) providing quality client support and 2) supporting an advisor and their firm’s growth.

Perhaps this is a reflection of advisors’ ever-evolving expectations, or maybe wholesaler offerings are just missing the mark. Either way, this should serve as a reality check to all wholesalers. Whether it’s spending a little more time to better understand an advisor’s specific needs, or sending them a check-in email with market insights, it appears wholesalers have some ground to make up.

Download the free White Paper What Do Advisors Look For In Their Wholesalers? to see our full findings:

Connect with YCharts

To learn more, schedule time to meet with an asset management specialist, call us at (773) 231-5986, or email hello@ycharts.com.

Want to add YCharts to your technology stack? Sign up for a 7-Day Free Trial to see YCharts for yourself.

Disclaimer

©2022 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer, or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

New on YCharts: Multi-Comparison Reports for Funds & PortfoliosRead More →