10 Best Performing REITs & REIT ETFs over the last 10 Years

We used the YCharts Fund Screener to identify the best performing real estate investment trusts (REITs) and REIT exchange-traded funds across key lookback periods, including year-to-date, 1, 3, 5, and 10 years.

For insights on how other asset classes have fared during similar periods of price stability, download our latest white paper: Which Asset Classes Perform Best as Inflation is Driven Lower?

Get your copy of “Which Asset Classes Perform Best As Inflation is Driven Lower” here:What is a REIT?

A Real Estate Investment Trust, or REIT, is a company that owns, operates, and/or finances income-producing real estate. It offers individual investors income potential (in the form of dividends) from real estate without buying the properties directly.

REITs function similarly to mutual funds in how they pool and disperse capital across various investments. However, they focus exclusively on real estate assets, such as office buildings, shopping malls, apartments, and warehouses. REITs can specialize in specific types of real estate or have a broader real estate portfolio.

Established in the US by Congress in 1960 via the Cigar Excise Tax Extension, REITs must adhere to regulatory requirements set forth by the SEC, such as investing at least 75% of their total assets in real estate and generating at least 75% of their gross income from property rents or mortgage interest. This structure exempts REITs from corporate income taxes provided they distribute at least 90% of their taxable income to shareholders as dividends, underscoring their appeal as high-yield investment vehicles.

Investors seeking more diversification can access REITs through mutual funds or ETFs, which pool multiple REITs and can provide diversification across various real estate sectors.

The primary benefits of REITs include high income potential and liquidity (compared to traditional real estate investing), making them attractive to everyday investors. However, they also pose risks like interest rate sensitivity, which can influence property values and investment yields. Moreover, the obligation to distribute most of their income limits their ability to reinvest in their business and provide growth opportunities compared to other equities.

Jump to a section:

- Best Performing REITs YTD

- Best Performing REIT ETFs YTD

- Best Performing REITs over the last year

- Best Performing REIT ETFs over the last year

- Best Performing REITs over the last 3 years

- Best Performing REIT ETFs over the last 3 years

- Best Performing REITs over the last 5 years

- Best Performing REIT ETFs over the last 5 years

- Best Performing REITs over the last 10 Years

- Best Performing REIT ETFs over the last 10 years

- What was the Growth of $10,000 in the Best REITs Over the Last 10 Years?

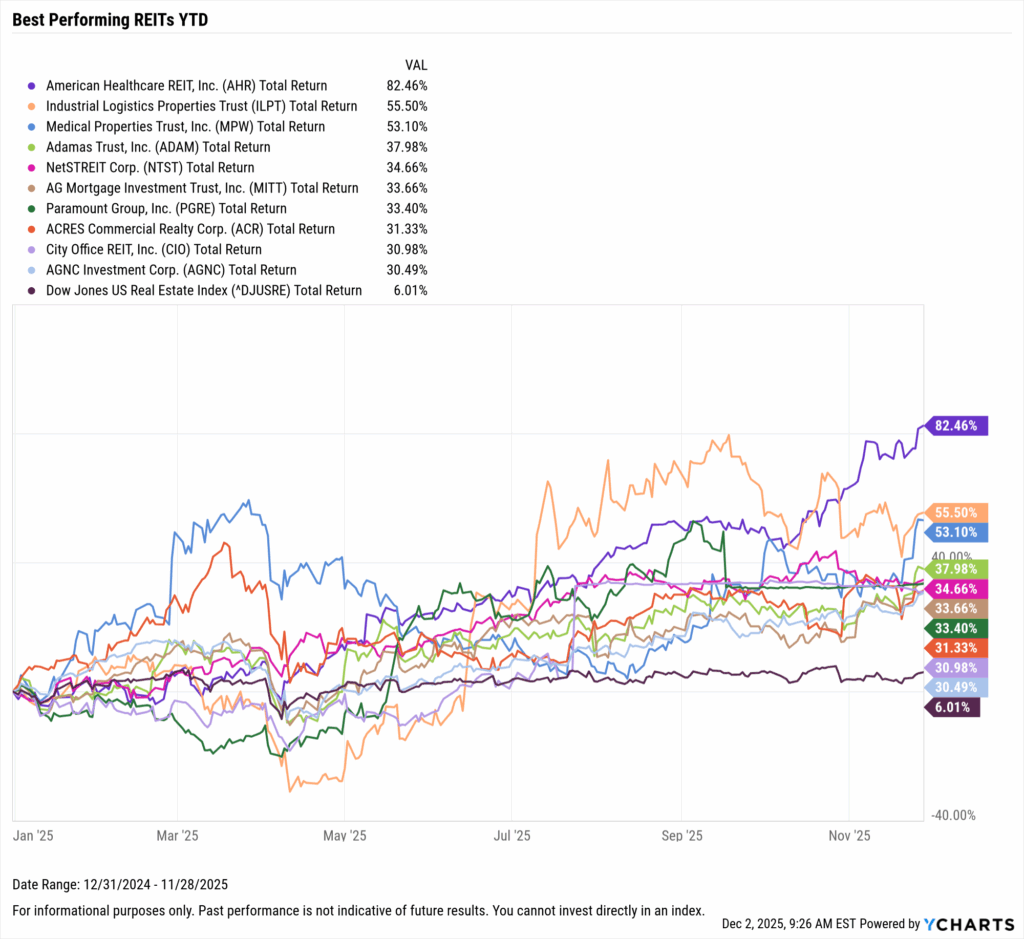

Best Performing REITs YTD

These are the top-performing REITs year-to-date in 2025, through November 30, 2025.

| Symbol | Name | Industry | Year to Date Total Returns | Dividend Yield | Market Cap ($M) |

|---|---|---|---|---|---|

| AHR | American Healthcare REIT, Inc. | Health Care REITs | 82.46% | 1.98% | $8,921.48 |

| ILPT | Industrial Logistics Properties Trust | Industrial REITs | 55.50% | 2.15% | $372.62 |

| MPW | Medical Properties Trust, Inc. | Health Care REITs | 53.10% | 5.69% | $3,380.43 |

| ADAM | Adamas Trust, Inc. | Mortgage Real Estate Investment Trusts (REITs) | 37.98% | 10.92% | $686.39 |

| NTST | NetSTREIT Corp. | Retail REITs | 34.66% | 4.75% | $1,496.59 |

| MITT | AG Mortgage Investment Trust, Inc. | Mortgage Real Estate Investment Trusts (REITs) | 33.66% | 9.71% | $264.75 |

| PGRE | Paramount Group, Inc. | Office REITs | 33.40% | 0.00% | $1,460.08 |

| ACR | ACRES Commercial Realty Corp. | Mortgage Real Estate Investment Trusts (REITs) | 31.33% | 0.00% | $153.51 |

| CIO | City Office REIT, Inc. | Office REITs | 30.98% | 5.88% | $274.47 |

| AGNC | AGNC Investment Corp. | Mortgage Real Estate Investment Trusts (REITs) | 30.49% | 13.77% | $11,220.69 |

Start a Free Trial to See Full Rankings | Modify the Screen in YCharts

Download Visual | Modify in YCharts

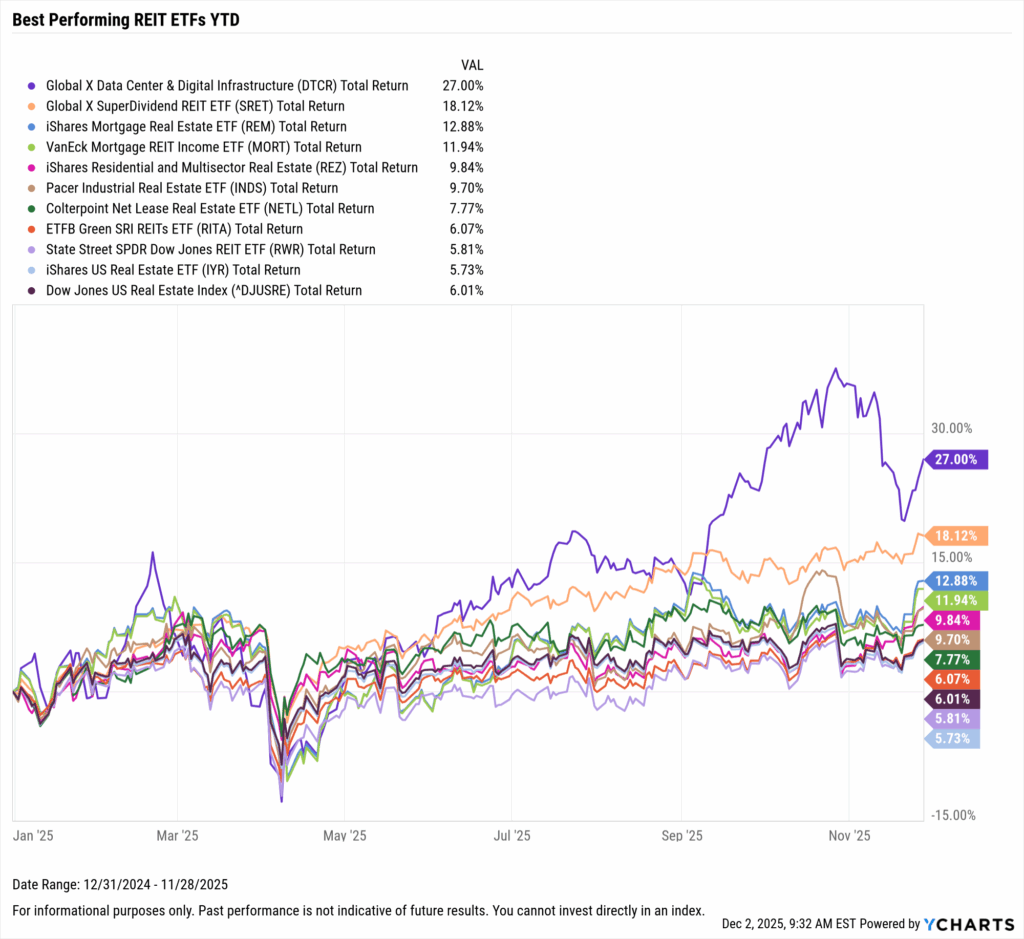

Best Performing REIT ETFs YTD

These are the top-performing REIT ETFs year-to-date in 2025, through November 30, 2025. If you’re interested in the best-performing ETFs overall over the last 10 years, check out this article.

| Symbol | Name | Year to Date Total Returns | Dividend Yield | Assets Under Management | Net Expense Ratio |

|---|---|---|---|---|---|

| DTCR | Global X Data Center & Digital Infrastructure | 27.00% | 1.31% | $624,537,327 | 0.50% |

| SRET | Global X SuperDividend REIT ETF | 18.12% | 8.01% | $207,993,358 | 0.58% |

| REM | iShares Mortgage Real Estate ETF | 12.88% | 8.69% | $650,627,466 | 0.48% |

| MORT | VanEck Mortgage REIT Income ETF | 11.94% | 12.62% | $350,329,884 | 0.42% |

| REZ | iShares Residential and Multisector Real Estate | 9.84% | 2.31% | $804,555,493 | 0.48% |

| INDS | Pacer Industrial Real Estate ETF | 9.70% | 3.27% | $118,405,651 | 0.49% |

| NETL | Colterpoint Net Lease Real Estate ETF | 7.77% | 5.01% | $40,581,934 | 0.60% |

| RITA | ETFB Green SRI REITs ETF | 6.07% | 2.97% | $7,934,025 | 0.50% |

| RWR | State Street SPDR Dow Jones REIT ETF | 5.81% | 3.90% | $1,711,217,947 | 0.25% |

| IYR | iShares US Real Estate ETF | 5.73% | 2.37% | $4,246,278,109 | 0.38% |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

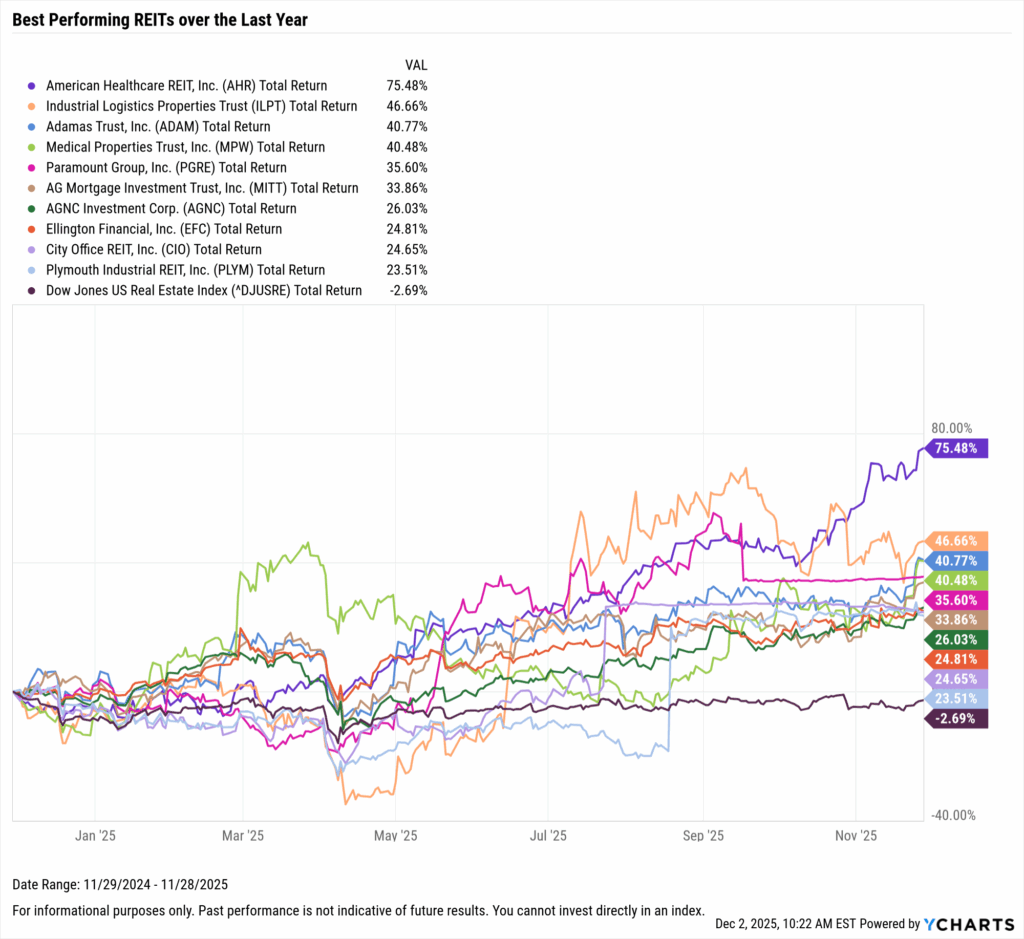

Best Performing REITs over the Last Year

These are the top-performing REITs over the last year, as of November 30, 2025.

| Symbol | Name | Industry | 1 Year Total Returns | Dividend Yield | Market Cap $M) |

|---|---|---|---|---|---|

| AHR | American Healthcare REIT, Inc. | Health Care REITs | 75.48% | 1.98% | $8,921.48 |

| ILPT | Industrial Logistics Properties Trust | Industrial REITs | 46.66% | 2.15% | $372.62 |

| ADAM | Adamas Trust, Inc. | Mortgage Real Estate Investment Trusts (REITs) | 40.77% | 10.92% | $686.39 |

| MPW | Medical Properties Trust, Inc. | Health Care REITs | 40.48% | 5.69% | $3,380.43 |

| PGRE | Paramount Group, Inc. | Office REITs | 35.60% | 0.00% | $1,460.08 |

| MITT | AG Mortgage Investment Trust, Inc. | Mortgage Real Estate Investment Trusts (REITs) | 33.86% | 9.71% | $264.75 |

| AGNC | AGNC Investment Corp. | Mortgage Real Estate Investment Trusts (REITs) | 26.03% | 13.77% | $11,220.69 |

| EFC | Ellington Financial, Inc. | Mortgage Real Estate Investment Trusts (REITs) | 24.81% | 11.58% | $1,445.55 |

| CIO | City Office REIT, Inc. | Office REITs | 24.65% | 5.88% | $274.47 |

| PLYM | Plymouth Industrial REIT, Inc. | Industrial REITs | 23.51% | 4.37% | $978.79 |

Start a Free Trial to See Full Rankings | Modify the Screen in YCharts

Download Visual | Modify in YCharts

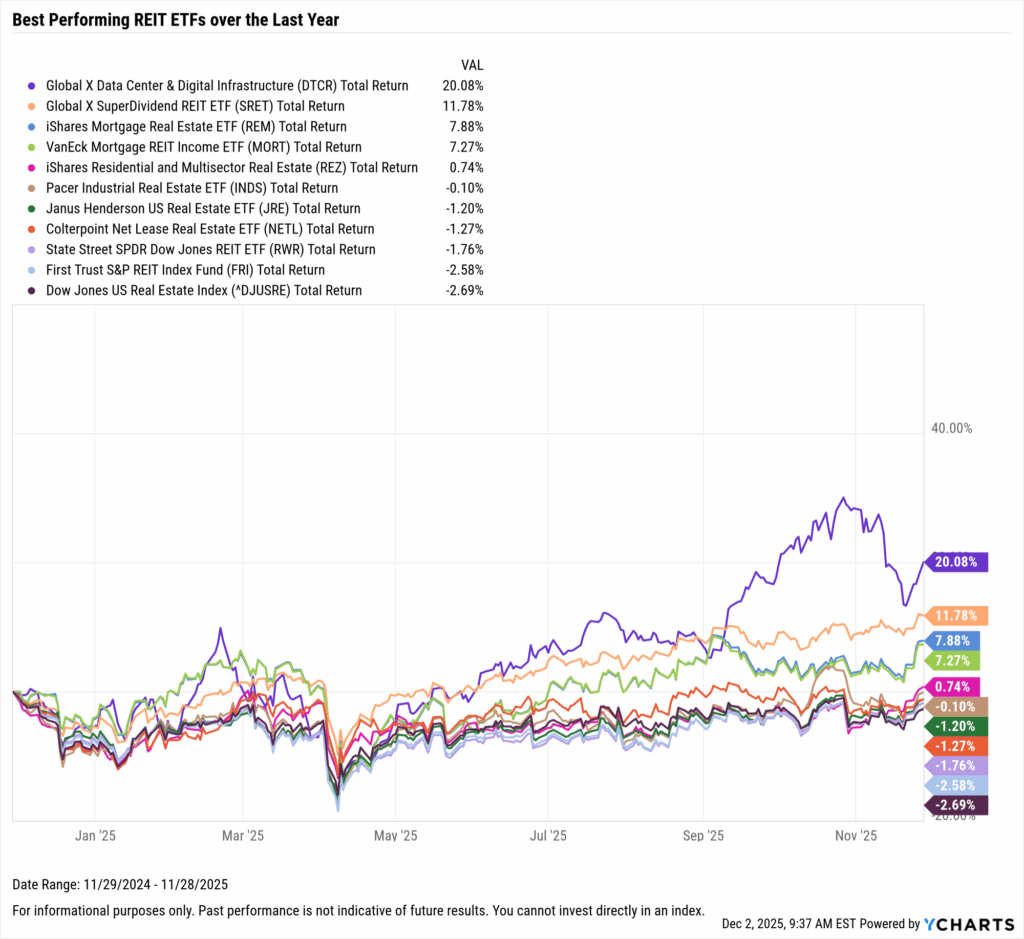

Best Performing REIT ETFs over the Last Year

These are the top-performing REIT ETFs over the last year, as of November 30, 2025.

| Symbol | Name | 1 Year Total Returns | Dividend Yield | Assets Under Management | Net Expense Ratio |

|---|---|---|---|---|---|

| DTCR | Global X Data Center & Digital Infrastructure | 20.08% | 1.31% | $624,537,327 | 0.50% |

| SRET | Global X SuperDividend REIT ETF | 11.78% | 8.01% | $207,993,358 | 0.58% |

| REM | iShares Mortgage Real Estate ETF | 7.88% | 8.69% | $650,627,466 | 0.48% |

| MORT | VanEck Mortgage REIT Income ETF | 7.27% | 12.62% | $350,329,884 | 0.42% |

| REZ | iShares Residential and Multisector Real Estate | 0.74% | 2.31% | $804,555,493 | 0.48% |

| INDS | Pacer Industrial Real Estate ETF | -0.10% | 3.27% | $118,405,651 | 0.49% |

| JRE | Janus Henderson US Real Estate ETF | -1.20% | 2.24% | $3,701,053 | 0.65% |

| NETL | Colterpoint Net Lease Real Estate ETF | -1.27% | 5.01% | $40,581,934 | 0.60% |

| RWR | State Street SPDR Dow Jones REIT ETF | -1.76% | 3.90% | $1,711,217,947 | 0.25% |

| FRI | First Trust S&P REIT Index Fund | -2.58% | 3.27% | $149,887,280 | 0.49% |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

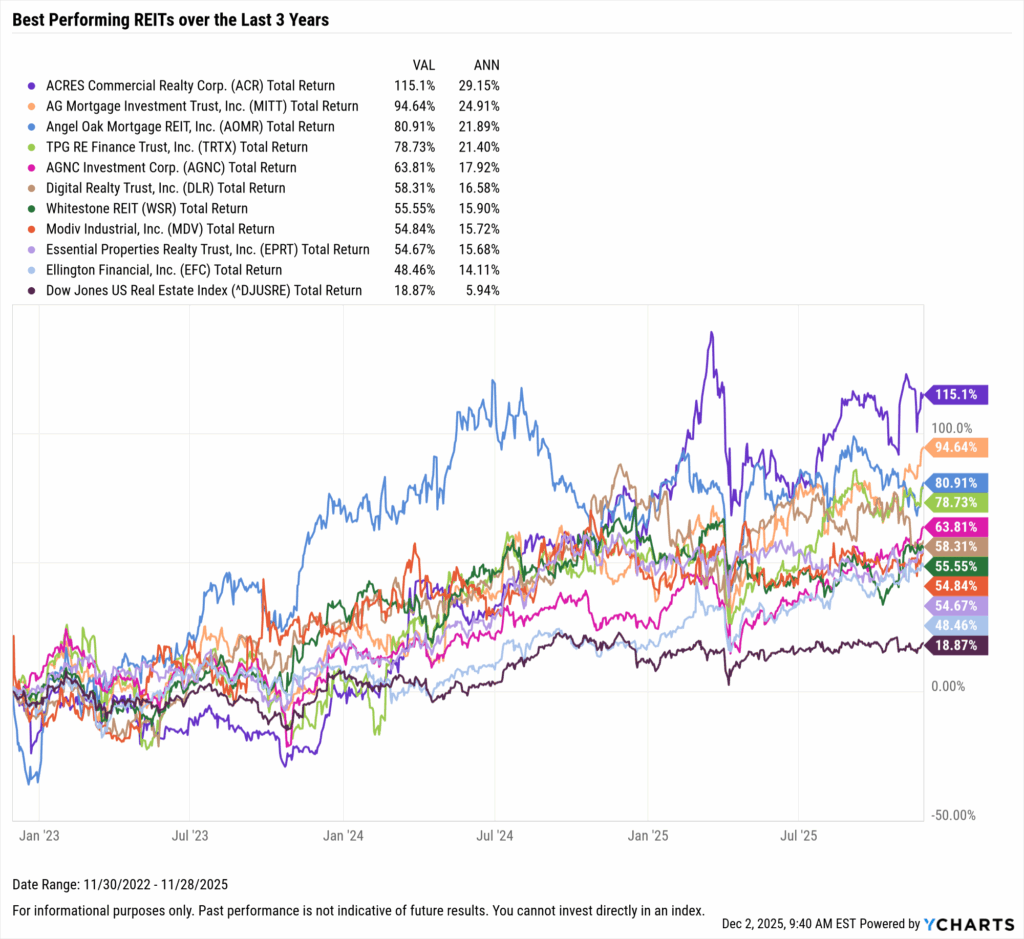

Best Performing REITs over the Last 3 Years

These are the top-performing REITs on an annualized basis between December 1, 2022, and November 30, 2025.

| Symbol | Name | Industry | 3 Year Total Returns | Annualized 3 Year Total Returns | Dividend Yield | Market Cap ($M) |

|---|---|---|---|---|---|---|

| ACR | ACRES Commercial Realty Corp. | Mortgage Real Estate Investment Trusts (REITs) | 115.11% | 29.09% | 0.00% | $153.51 |

| MITT | AG Mortgage Investment Trust, Inc. | Mortgage Real Estate Investment Trusts (REITs) | 94.64% | 24.86% | 9.71% | $264.75 |

| AOMR | Angel Oak Mortgage REIT, Inc. | Mortgage Real Estate Investment Trusts (REITs) | 80.91% | 21.85% | 14.40% | $221.49 |

| TRTX | TPG RE Finance Trust, Inc. | Mortgage Real Estate Investment Trusts (REITs) | 78.73% | 21.36% | 10.55% | $712.18 |

| AGNC | AGNC Investment Corp. | Mortgage Real Estate Investment Trusts (REITs) | 63.81% | 17.88% | 13.77% | $11,220.69 |

| DLR | Digital Realty Trust, Inc. | Specialized REITs | 58.31% | 16.55% | 3.12% | $53,720.22 |

| WSR | Whitestone REIT | Retail REITs | 55.55% | 15.87% | 4.12% | $668.36 |

| MDV | Modiv Industrial, Inc. | Diversified REITs | 54.84% | 15.69% | 8.02% | $149.71 |

| EPRT | Essential Properties Realty Trust, Inc. | Diversified REITs | 54.67% | 15.65% | 3.78% | $6,241.55 |

| EFC | Ellington Financial, Inc. | Mortgage Real Estate Investment Trusts (REITs) | 48.46% | 14.08% | 11.58% | $1,445.55 |

Start a Free Trial to See Full Rankings | Modify the Screen in YCharts

Download Visual | Modify in YCharts

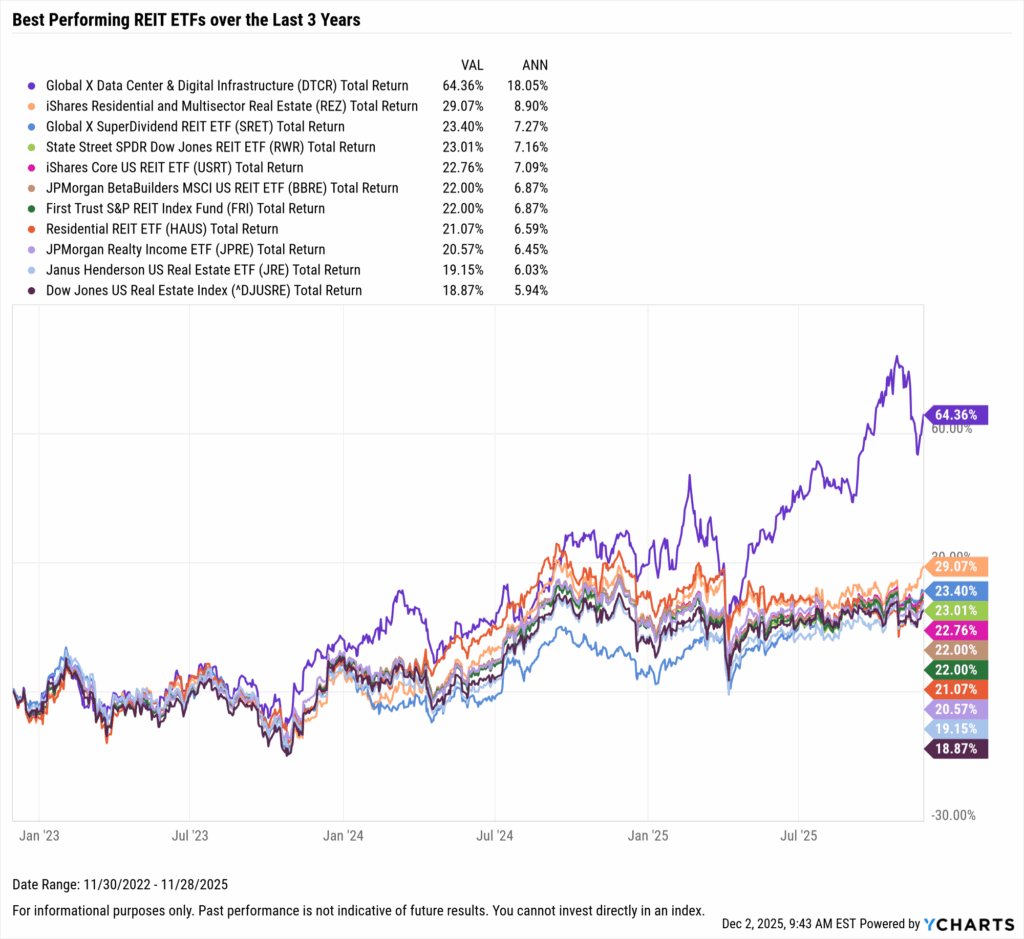

Best Performing REIT ETFs over the Last 3 Years

These are the top-performing REIT ETFs on an annualized basis between December 1, 2022, and November 30, 2025.

| Symbol | Name | 3 Year Total Returns | Annualized 3 Year Total Returns | Dividend Yield | Assets Under Management | Net Expense Ratio |

|---|---|---|---|---|---|---|

| DTCR | Global X Data Center & Digital Infrastructure | 64.36% | 18.01% | 1.31% | $624,537,327 | 0.50% |

| REZ | iShares Residential and Multisector Real Estate | 29.07% | 8.88% | 2.31% | $804,555,493 | 0.48% |

| SRET | Global X SuperDividend REIT ETF | 23.40% | 7.26% | 8.01% | $207,993,358 | 0.58% |

| RWR | State Street SPDR Dow Jones REIT ETF | 23.01% | 7.15% | 3.90% | $1,711,217,947 | 0.25% |

| USRT | iShares Core US REIT ETF | 22.76% | 7.07% | 2.67% | $3,298,402,245 | 0.08% |

| BBRE | JPMorgan BetaBuilders MSCI US REIT ETF | 22.00% | 6.85% | 3.06% | $985,760,413 | 0.11% |

| FRI | First Trust S&P REIT Index Fund | 22.00% | 6.85% | 3.27% | $149,887,280 | 0.49% |

| HAUS | Residential REIT ETF | 21.07% | 6.58% | 3.22% | $8,911,633 | 0.60% |

| JPRE | JPMorgan Realty Income ETF | 20.57% | 6.43% | 2.37% | $481,851,985 | 0.50% |

| JRE | Janus Henderson US Real Estate ETF | 19.15% | 6.01% | 2.24% | $3,701,053 | 0.65% |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

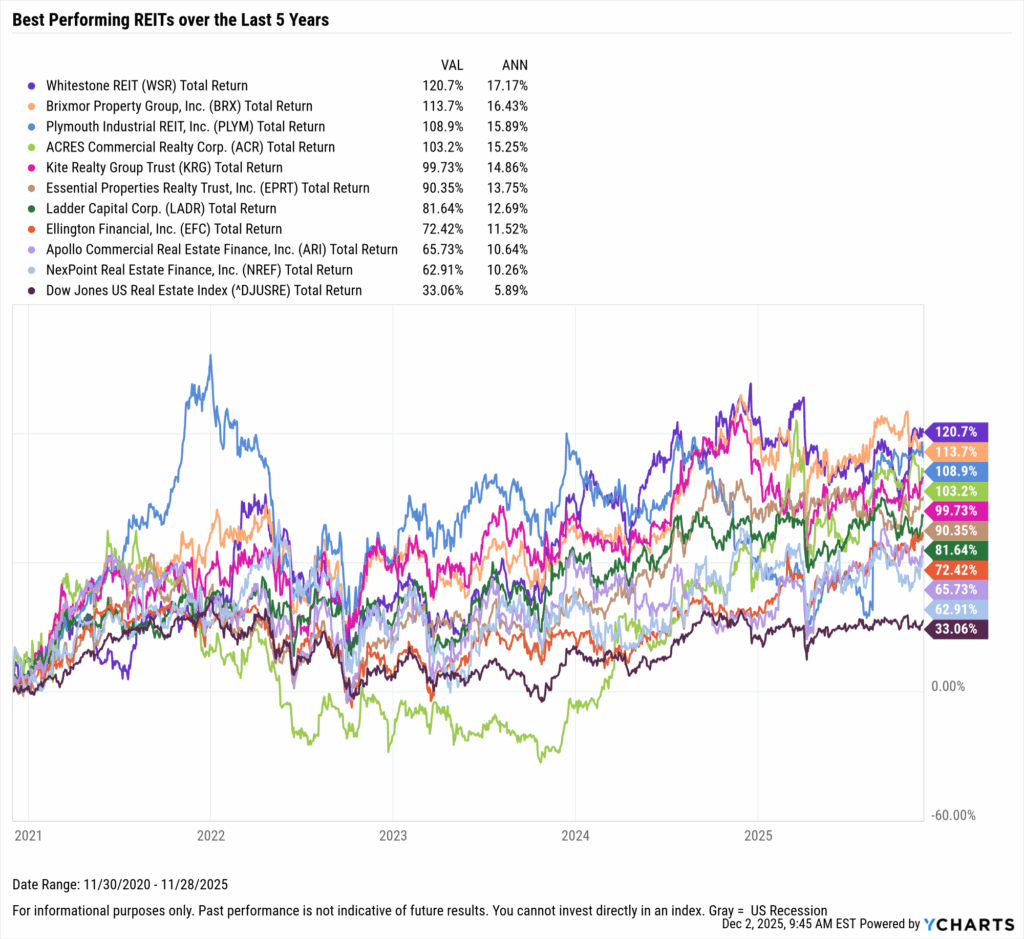

Best Performing REITs over the Last 5 Years

These are the top-performing REITs on an annualized basis between December 1, 2020, and November 30, 2025.

| Symbol | Name | Industry | 5 Year Total Returns | Annualized 5 Year Total Returns | Dividend Yield | Market Cap ($M) |

|---|---|---|---|---|---|---|

| WSR | Whitestone REIT | Retail REITs | 120.69% | 17.15% | 4.12% | $668.36 |

| BRX | Brixmor Property Group, Inc. | Retail REITs | 113.74% | 16.41% | 4.44% | $7,924.93 |

| PLYM | Plymouth Industrial REIT, Inc. | Industrial REITs | 108.90% | 15.87% | 4.37% | $978.79 |

| ACR | ACRES Commercial Realty Corp. | Mortgage Real Estate Investment Trusts (REITs) | 103.16% | 15.23% | 0.00% | $153.51 |

| KRG | Kite Realty Group Trust | Retail REITs | 99.73% | 14.84% | 4.71% | $4,966.65 |

| EPRT | Essential Properties Realty Trust, Inc. | Diversified REITs | 90.35% | 13.74% | 3.78% | $6,241.55 |

| LADR | Ladder Capital Corp. | Mortgage Real Estate Investment Trusts (REITs) | 81.65% | 12.68% | 8.42% | $1,391.62 |

| EFC | Ellington Financial, Inc. | Mortgage Real Estate Investment Trusts (REITs) | 72.42% | 11.51% | 11.58% | $1,445.55 |

| ARI | Apollo Commercial Real Estate Finance, Inc. | Mortgage Real Estate Investment Trusts (REITs) | 65.73% | 10.63% | 9.90% | $1,403.33 |

| NREF | NexPoint Real Estate Finance, Inc. | Mortgage Real Estate Investment Trusts (REITs) | 62.91% | 10.25% | 13.85% | $255.90 |

Start a Free Trial to See Full Rankings | Modify the Screen in YCharts

Download Visual | Modify in YCharts

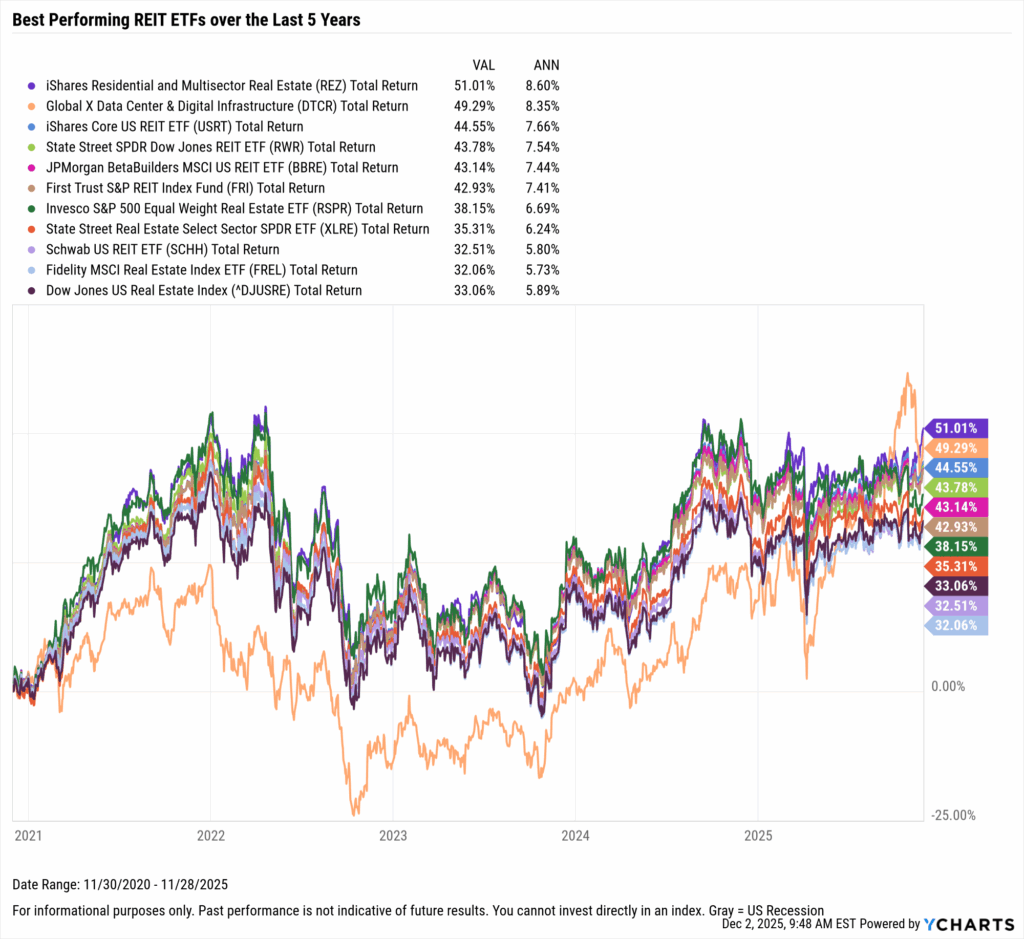

Best Performing REIT ETFs Over the Last 5 Years

These are the top-performing REIT ETFs on an annualized basis between December 1, 2020, and November 30, 2025.

| Symbol | Name | 5 Year Total Returns | Annualized 5 Year Total Returns | Dividend Yield | Assets Under Management | Net Expense Ratio |

|---|---|---|---|---|---|---|

| REZ | iShares Residential and Multisector Real Estate | 51.01% | 8.59% | 2.31% | 0.48% | $804,555,493 |

| DTCR | Global X Data Center & Digital Infrastructure | 49.29% | 8.34% | 1.31% | 0.50% | $624,537,327 |

| USRT | iShares Core US REIT ETF | 44.55% | 7.65% | 2.67% | 0.08% | $3,298,402,245 |

| RWR | State Street SPDR Dow Jones REIT ETF | 43.78% | 7.53% | 3.90% | 0.25% | $1,711,217,947 |

| BBRE | JPMorgan BetaBuilders MSCI US REIT ETF | 43.14% | 7.44% | 3.06% | 0.11% | $985,760,413 |

| FRI | First Trust S&P REIT Index Fund | 42.93% | 7.41% | 3.27% | 0.49% | $149,887,280 |

| RSPR | Invesco S&P 500 Equal Weight Real Estate ETF | 38.15% | 6.68% | 2.68% | 0.40% | $108,318,482 |

| XLRE | State Street Real Estate Select Sector SPDR ETF | 35.31% | 6.23% | 3.38% | 0.08% | $7,571,924,617 |

| SCHH | Schwab US REIT ETF | 32.51% | 5.79% | 3.07% | 0.07% | $8,385,183,413 |

| FREL | Fidelity MSCI Real Estate Index ETF | 32.06% | 5.72% | 3.55% | 0.08% | $1,088,733,176 |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

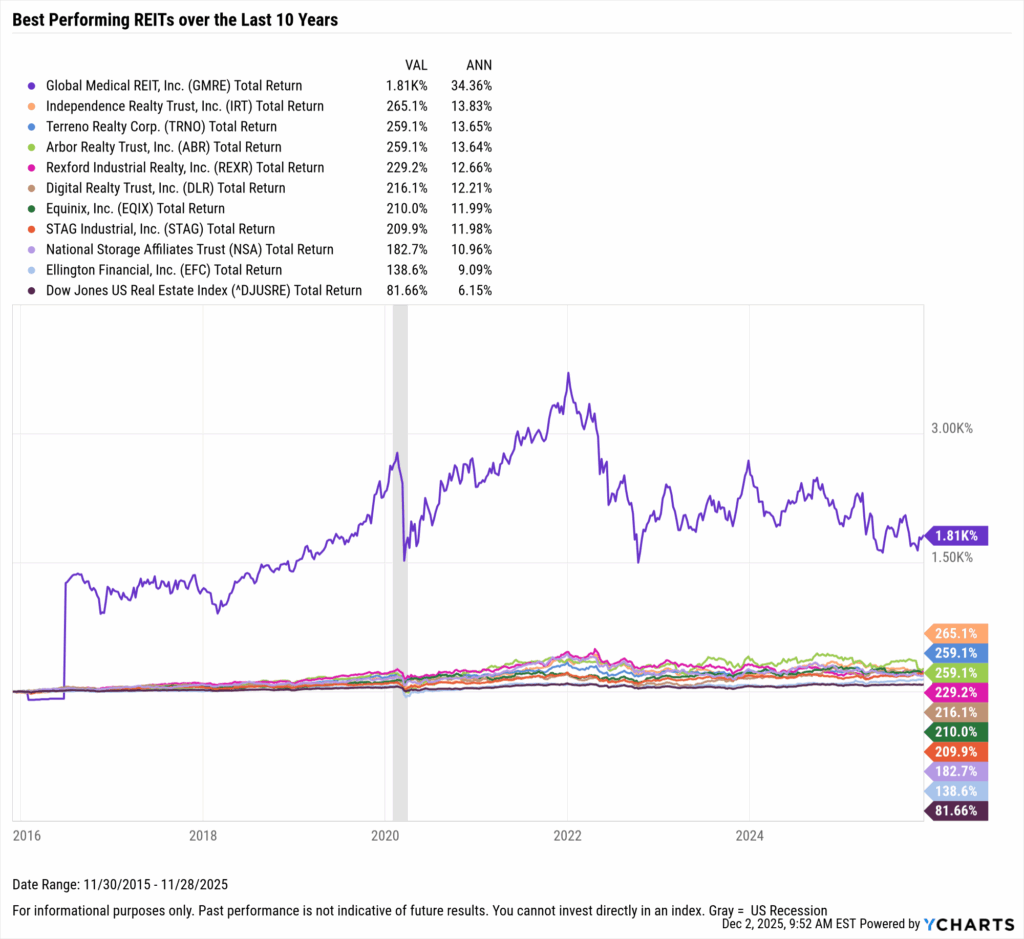

Best Performing REITs over the Last 10 Years

These are the top-performing REITs on an annualized basis between December 1, 2015, and November 30, 2025.

| Symbol | Name | Industry | 10 Year Total Returns | Annualized 10 Year Total Returns | Dividend Yield | Market Cap ($M) |

|---|---|---|---|---|---|---|

| GMRE | Global Medical REIT, Inc. | Health Care REITs | 1814.19% | 34.34% | 10.97% | $440.03 |

| IRT | Independence Realty Trust, Inc. | Residential REITs | 265.12% | 13.83% | 3.87% | $4,081.66 |

| TRNO | Terreno Realty Corp. | Industrial REITs | 259.11% | 13.64% | 3.17% | $6,463.84 |

| ABR | Arbor Realty Trust, Inc. | Mortgage Real Estate Investment Trusts (REITs) | 259.08% | 13.64% | 15.10% | $1,724.21 |

| REXR | Rexford Industrial Realty, Inc. | Industrial REITs | 229.18% | 12.65% | 4.12% | $9,652.32 |

| DLR | Digital Realty Trust, Inc. | Specialized REITs | 216.12% | 12.20% | 3.12% | $53,720.22 |

| EQIX | Equinix, Inc. | Specialized REITs | 210.00% | 11.98% | 2.56% | $71,997.90 |

| STAG | STAG Industrial, Inc. | Industrial REITs | 209.94% | 11.98% | 3.80% | $7,315.00 |

| NSA | National Storage Affiliates Trust | Specialized REITs | 182.69% | 10.95% | 7.74% | $2,265.73 |

| EFC | Ellington Financial, Inc. | Mortgage Real Estate Investment Trusts (REITs) | 138.62% | 9.09% | 11.58% | $1,445.55 |

Start a Free Trial to See Full Rankings | Modify the Screen in YCharts

Download Visual | Modify in YCharts

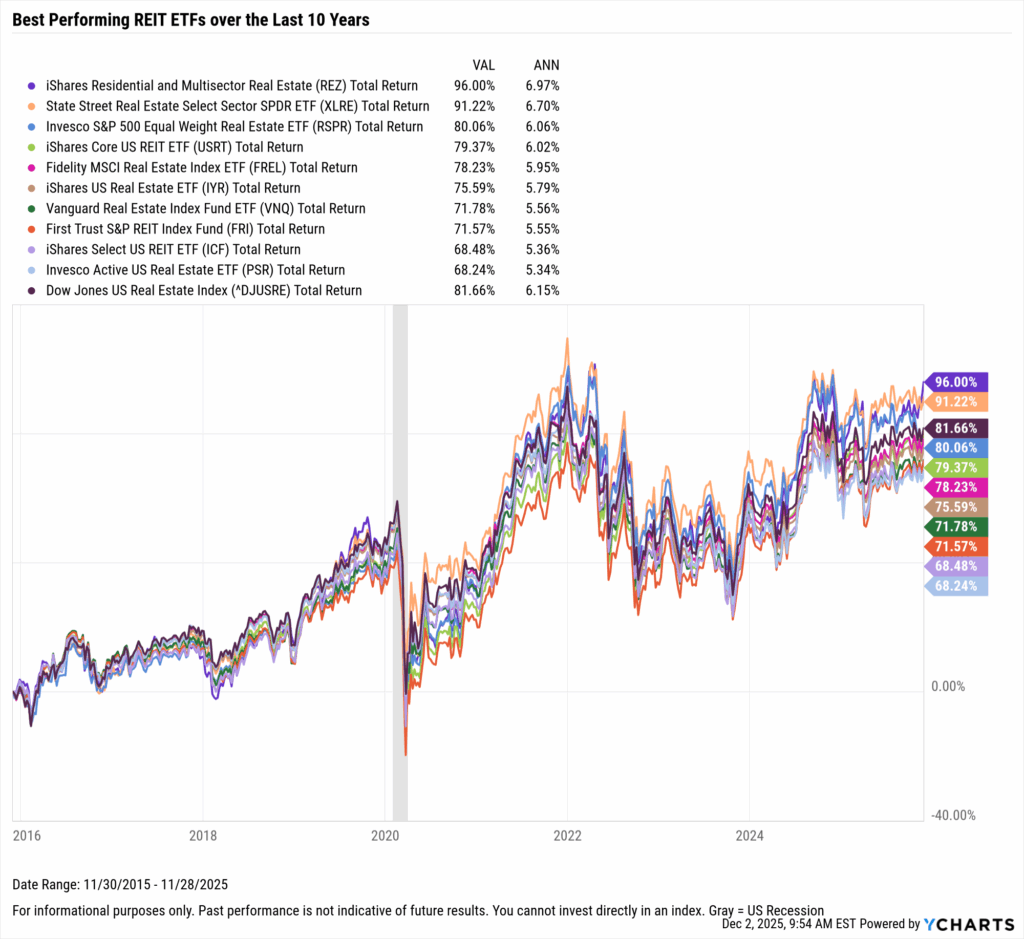

Best Performing REIT ETFs over the Last 10 Years

These are the top-performing REIT ETFs on an annualized basis between December 1, 2015, and November 30, 2025.

| Symbol | Name | 10 Year Total Returns | Annualized 10 Year Total Returns | Dividend Yield | Assets Under Management | Net Expense Ratio |

|---|---|---|---|---|---|---|

| REZ | iShares Residential and Multisector Real Estate | 96.00% | 6.96% | 2.31% | $804,555,493 | 0.48% |

| XLRE | State Street Real Estate Select Sector SPDR ETF | 91.22% | 6.70% | 3.38% | $7,571,924,617 | 0.08% |

| RSPR | Invesco S&P 500 Equal Weight Real Estate ETF | 80.06% | 6.06% | 2.68% | $108,318,482 | 0.40% |

| USRT | iShares Core US REIT ETF | 79.37% | 6.02% | 2.67% | $3,298,402,245 | 0.08% |

| FREL | Fidelity MSCI Real Estate Index ETF | 78.23% | 5.95% | 3.55% | $1,088,733,176 | 0.08% |

| IYR | iShares US Real Estate ETF | 75.59% | 5.79% | 2.37% | $4,246,278,109 | 0.38% |

| VNQ | Vanguard Real Estate Index Fund ETF | 71.78% | 5.56% | 3.91% | $34,364,825,156 | 0.13% |

| FRI | First Trust S&P REIT Index Fund | 71.57% | 5.55% | 3.27% | $149,887,280 | 0.49% |

| ICF | iShares Select US REIT ETF | 68.48% | 5.35% | 2.52% | $1,892,957,040 | 0.32% |

| PSR | Invesco Active US Real Estate ETF | 68.24% | 5.34% | 2.63% | $51,459,294 | 0.55% |

Start a Free Trial to See Full Rankings | View & Modify in Fund Screener

Download Visual | Modify in YCharts

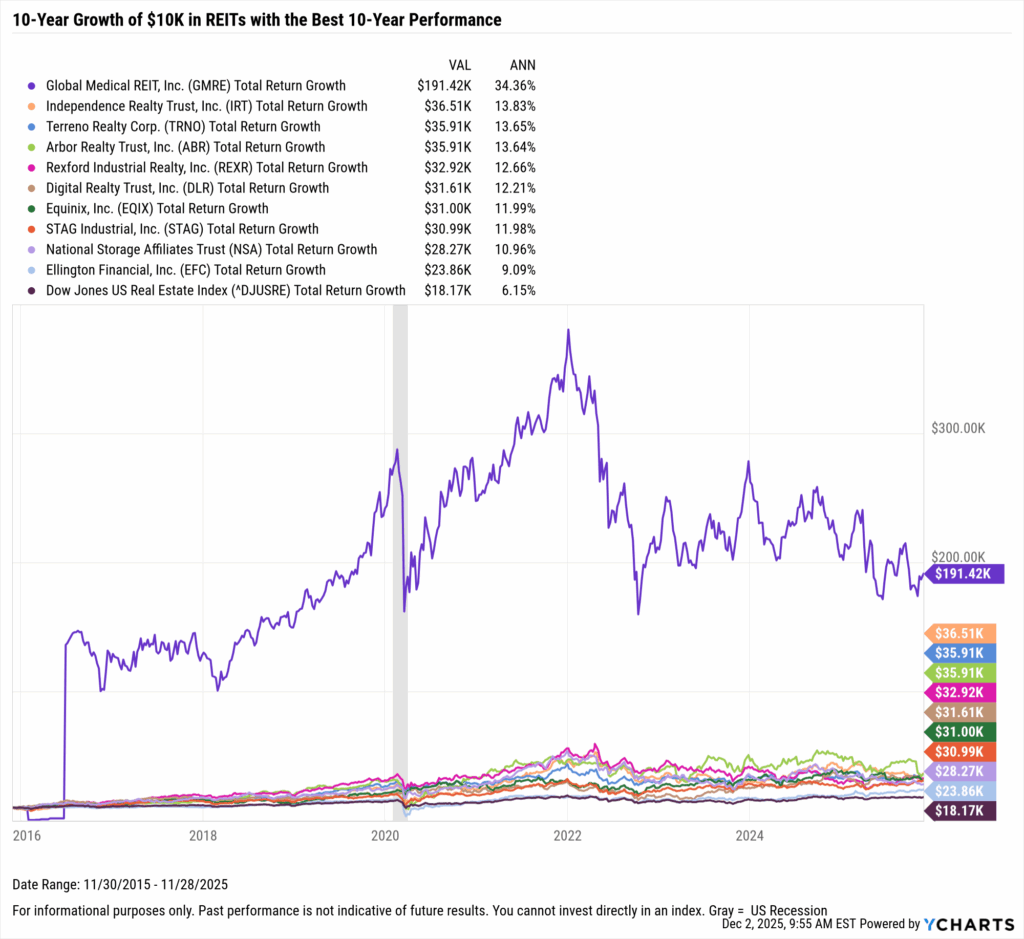

What was the Growth of $10,000 in the Best REITs Over the Last 10 Years?

If you invested $10,000 10 years ago into any of the ten best-performing REITs over the last 10 years, your balance today would be no less than $24K.

The best-performing REIT in the last 10 years was Global Medical REIT (GMRE). A $10,000 investment into GMRE 10 years ago would be worth over $191,000 today. Right behind it was Independence Realty Trust (IRT); investing $10,000 into IRT back in 2015 would’ve turned into over $36K.

Download Visual | Modify in YCharts

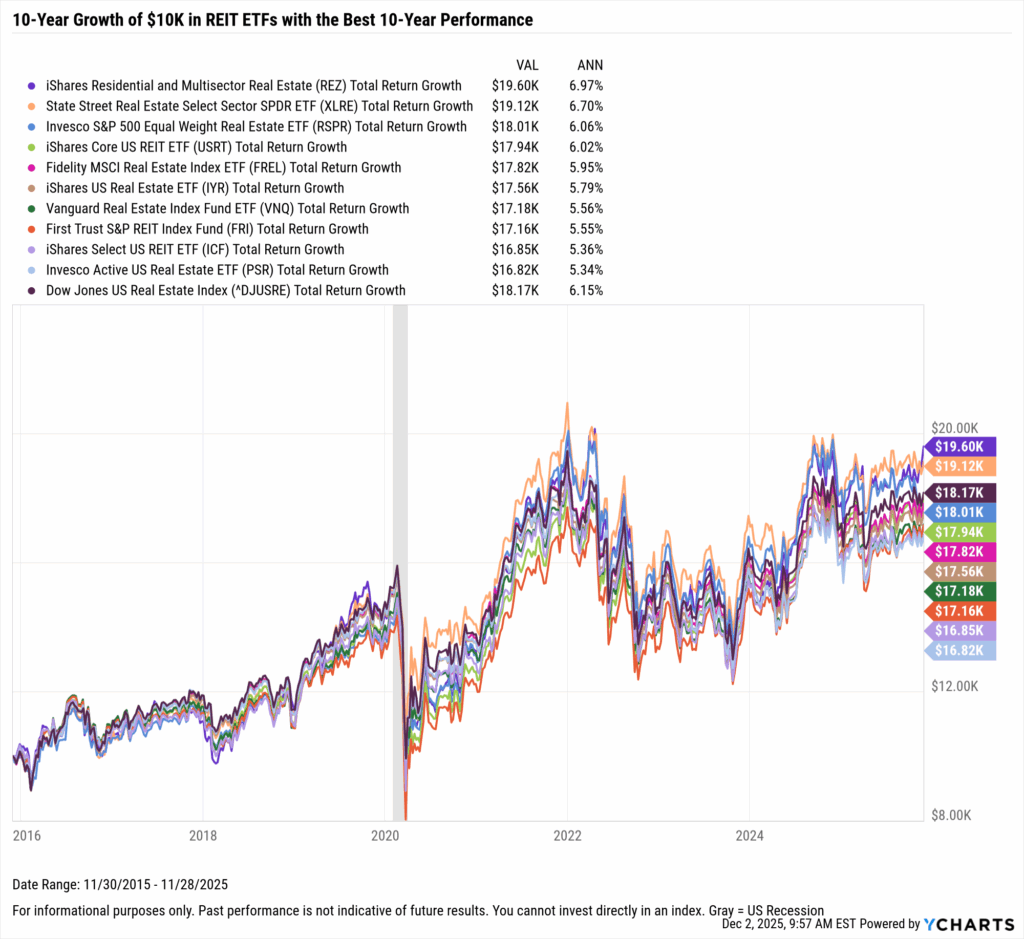

On the other hand, if you invested $10,000 10 years ago into any of the ten best-performing REIT ETFs over the last 10 years, your balance today would be at least $16.8K, while diversifying across a broader pool of underlying investments than with a typical REIT.

The best-performing REIT ETF in the last 10 years was the iShares Residential & Multisector Real Estate ETF (REZ). A $10,000 investment in REZ 10 years ago would be worth nearly $20K today. The second best-performing REIT ETF was the Real Estate Select Sector SPDR Fund (XLRE); investing $10,000 in XLRE back in 2015 would also have turned into a little over $19K.

However, REZ and XLRE were the only two REIT ETFs that outperformed the Dow Jones US Real Estate Index over the last 10 years.

Download Visual | Modify in YCharts

Whenever you’re ready, there are 3 ways YCharts can help you:

Interested in doing further REIT or REIT ETF research with YCharts?

Email us at hello@ycharts.com or call (866) 965-7552. You’ll get a response from one of our Chicago-based team members.

Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Sign up to receive a copy of our latest research, “Which Asset Classes Perform Best As Inflation is Driven Lower.”

Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

Best Performing Mutual Funds of the Last 10 Years: A Financial Advisor’s PerspectiveRead More →