The 10 Best Performing ETFs Over the Last 10 Years

Updated as of May 22, 2025

In 2024, the ETF industry reached a new high with $1.1 trillion in net inflows, reshuffling market share leaders across various asset classes and peer groups, as detailed in our 2024 ETF market share recap.

Notably, several strategies that captured increased market share benefited significantly from robust long-term performance. Below, we explore some of the top-performing ETFs across different timeframes.

Sign up for our free monthly Fund Flow Report to stay updated on how assets are moving in and out of these strategies:

For advisors incorporating these strategies into their portfolios, YCharts offers multiple tools to enhance client communication around your decision-making process.

Start with Quick Extract to import screenshots or Excel files for a clear view of what a prospect currently holds. Use Transition Analysis to evaluate the tax impact of proposed changes. Then, with Risk Profiles and Talking Points, you can create personalized, compliance-ready proposals that help clients visualize the why, empowering you to win new business with confidence. Start a Free Trial to incorporate these tools into your workflow.

Now, let’s dive into the best-performing ETFs of the past decade. To create this list, we analyzed the entire ETF universe using the YCharts Fund Screener to find the best-performing ETFs on a 1-, 3-year, 5-year, 10-year (excluding leveraged and inverse ETFs). We also observed funds with the lowest max drawdowns during this period, as well.

Click to jump to a section:

- Best-Performing ETFs (1Y)

- Best-Performing ETFs in the Last 3 Years

- Best-Performing ETFs in the Last 5 Years

- Best-Performing ETFs in the Last 10 Years

- What Was the Growth of $10,000 Over the Last 10 Years?

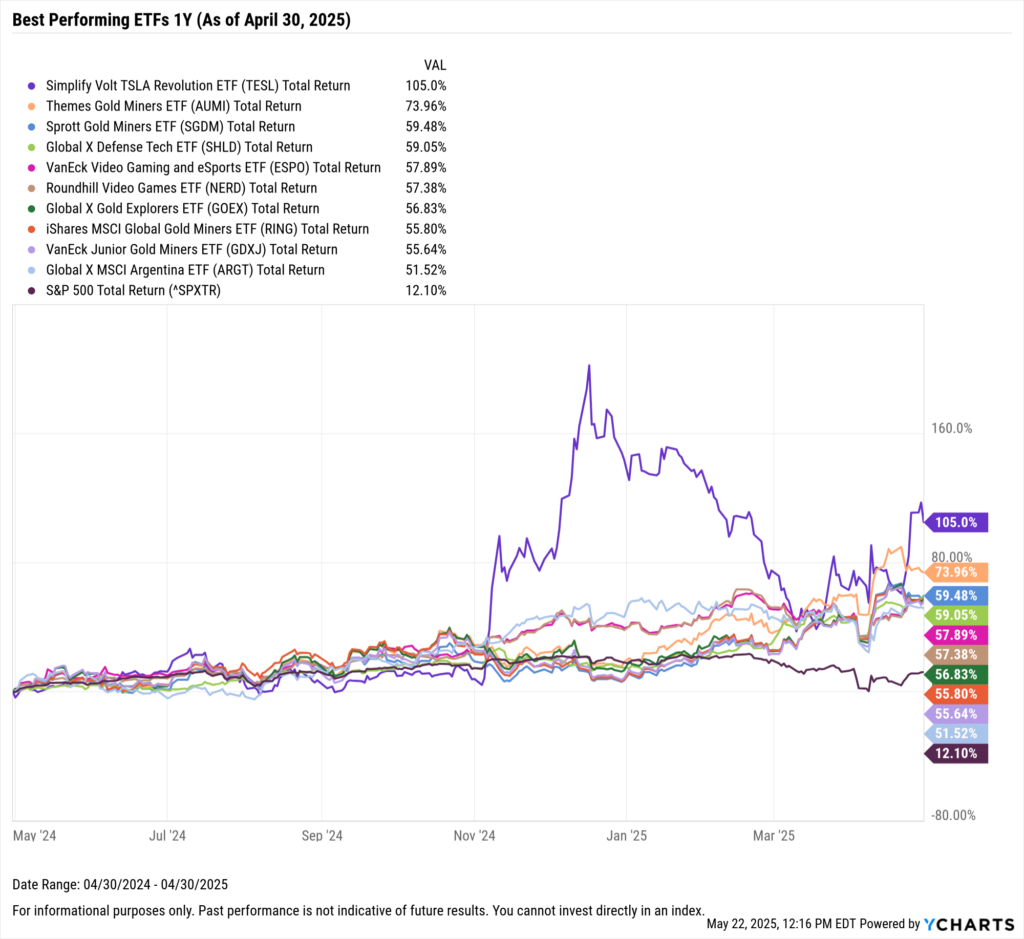

Best Performing ETFs (1Y)

These are the top-performing ETFs over the past year as of April 30, 2025.

View & Modify in Fund Screener

Download Visual | Modify in YCharts

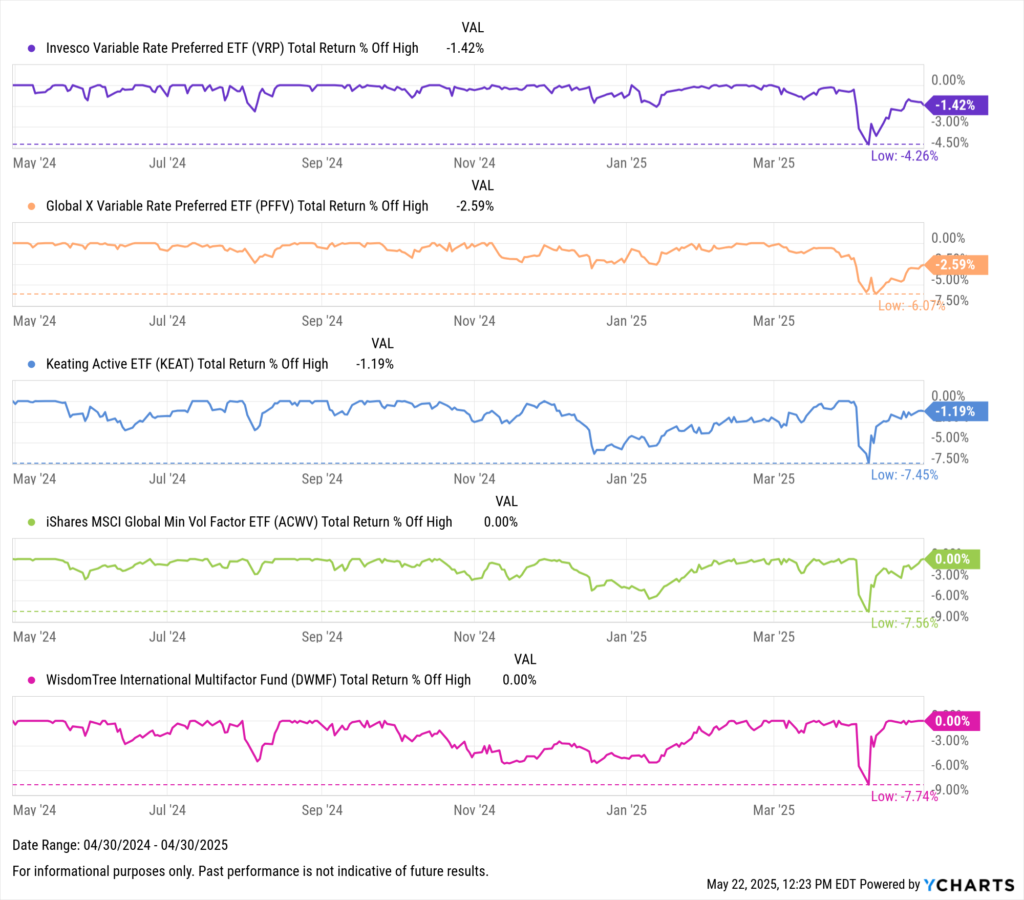

Equity ETFs with the Lowest Drawdown in the Last Year

As of April 30, 2025, these equity ETFs had the lowest drawdown over the last year. The chart below has an expanded timeframe to comprehensively depict the peak-to-trough performance of the observed funds.

View & Modify in Fund Screener

Download Visual | Modify in YCharts

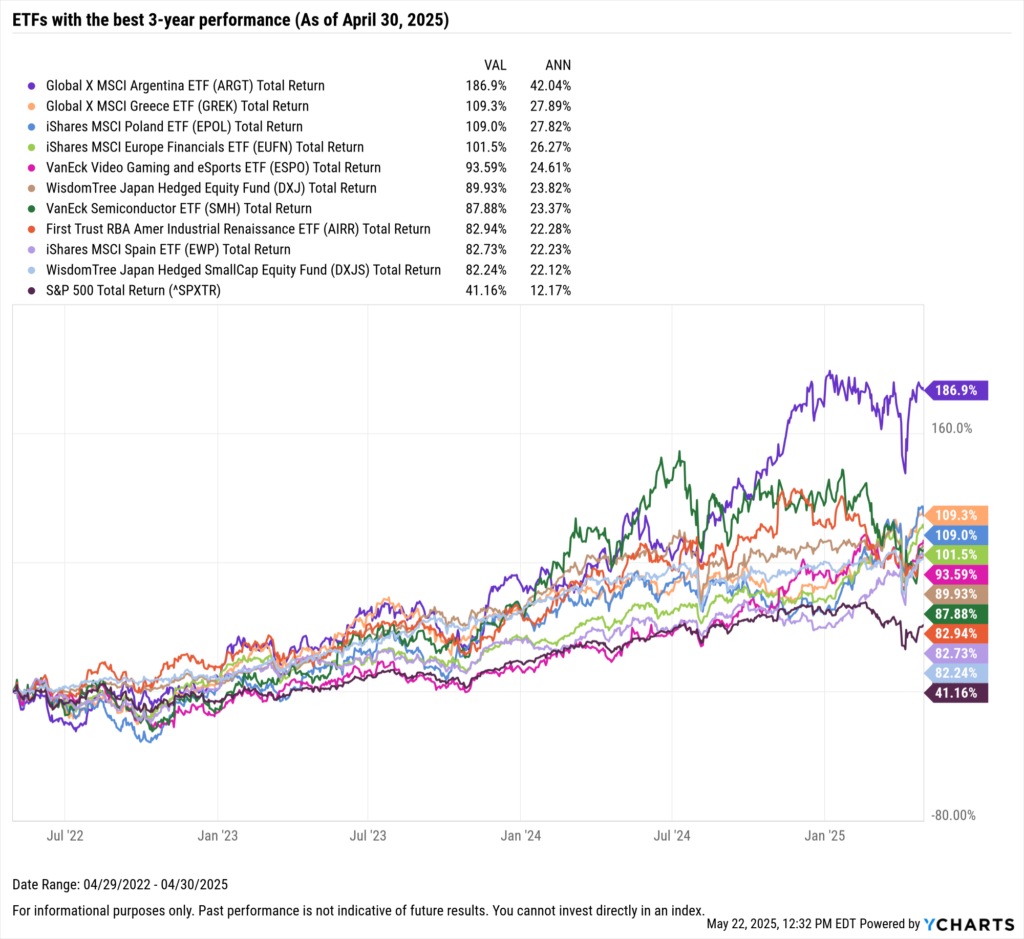

Best Performing ETFs in the Last 3 Years

These are the top-performing ETFs on an annualized basis between April 30, 2022 and April 30, 2025.

View & Modify in Fund Screener

Download Visual | Modify in YCharts

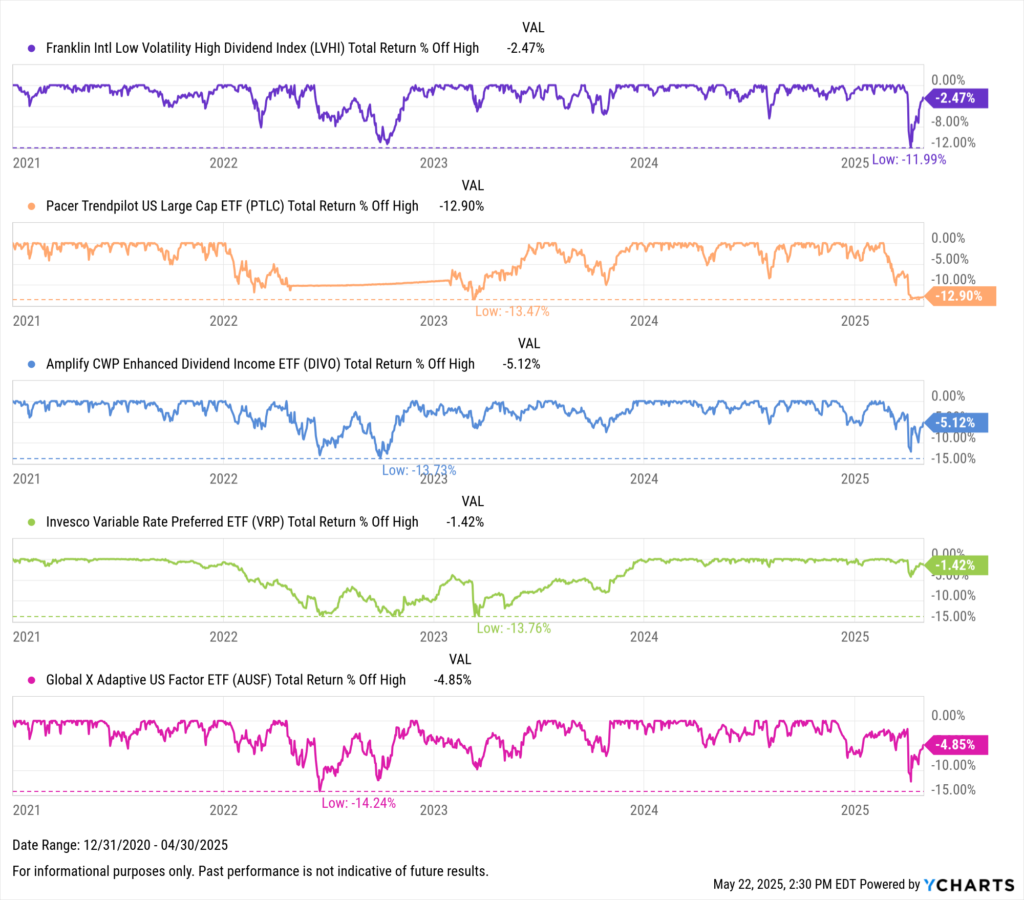

Equity ETFs with the Lowest Drawdown in the Last 3 Years

As of April 30, 2025, these equity ETFs had the lowest drawdown over the last three years. The chart below has an expanded timeframe to comprehensively depict the peak-to-trough performance of the observed funds.

View & Modify in Fund Screener

Download Visual | Modify in YCharts

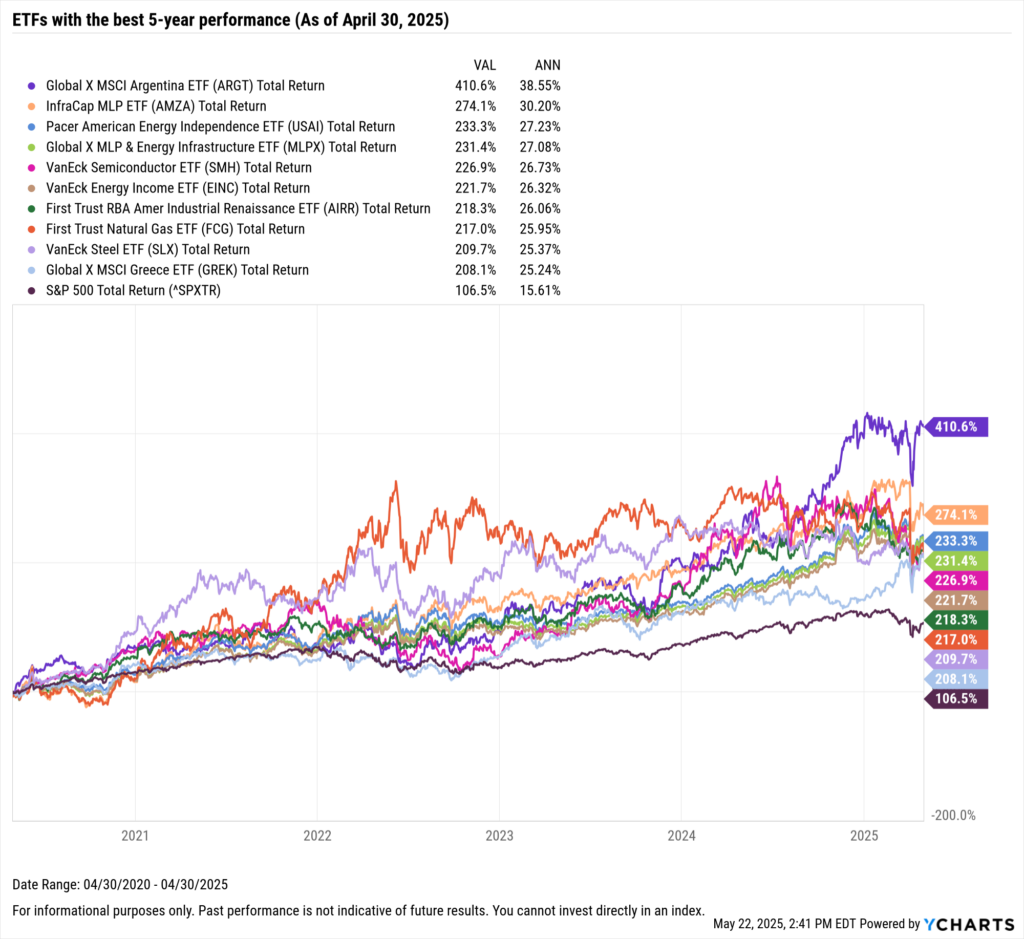

Best Performing ETFs in the Last 5 Years

These are the top-performing ETFs on an annualized basis between April 30, 2020 and April 30, 2025.

View & Modify in Fund Screener

Download Visual | Modify in YCharts

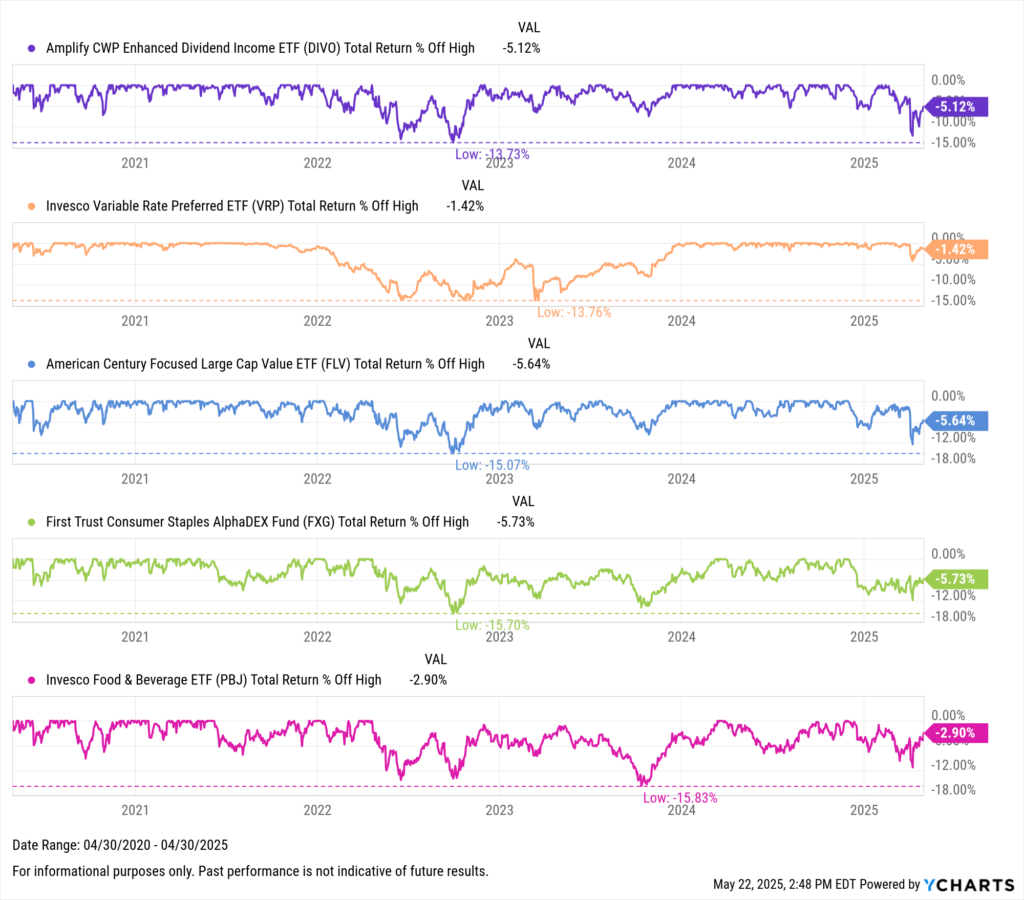

Equity ETFs with the Lowest Drawdown in the Last 5 Years

As of April 30, 2025, these equity ETFs had the lowest drawdown over the last five years. The chart below has an expanded timeframe to comprehensively depict the peak-to-trough performance of the observed funds.

View & Modify in Fund Screener

Download Visual | Modify in YCharts

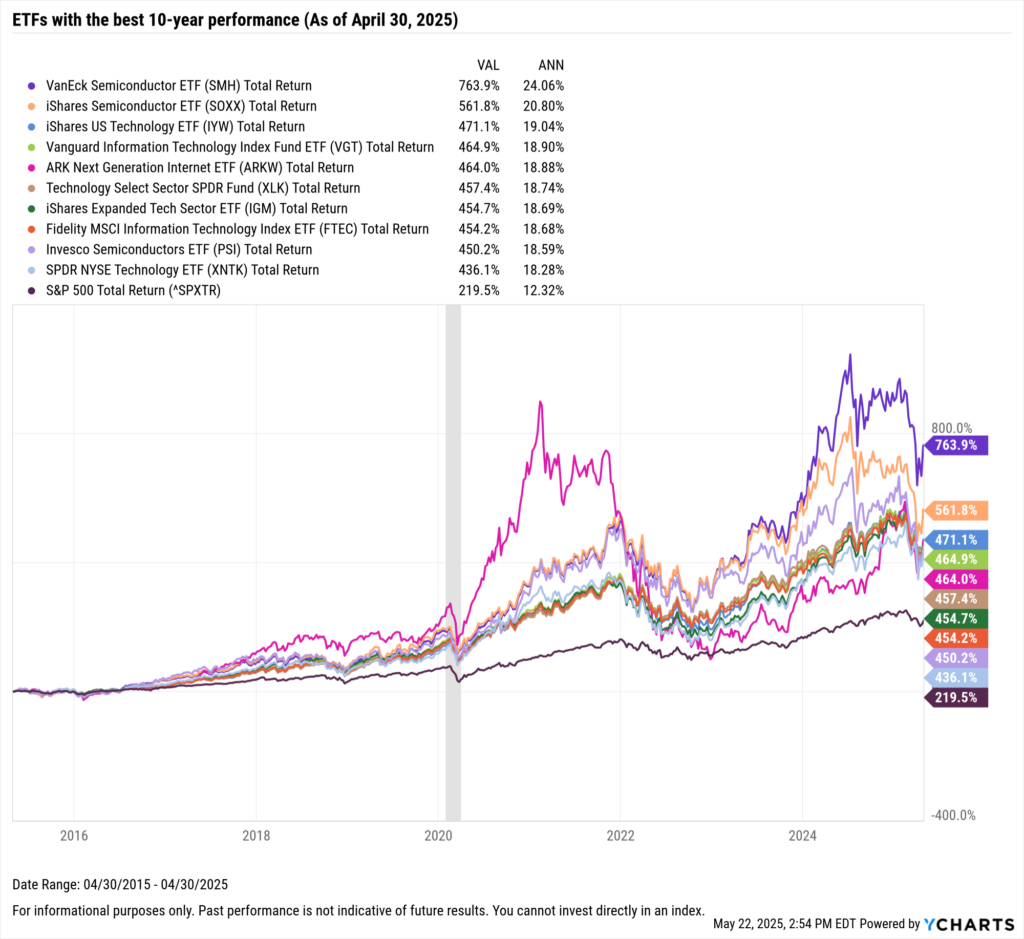

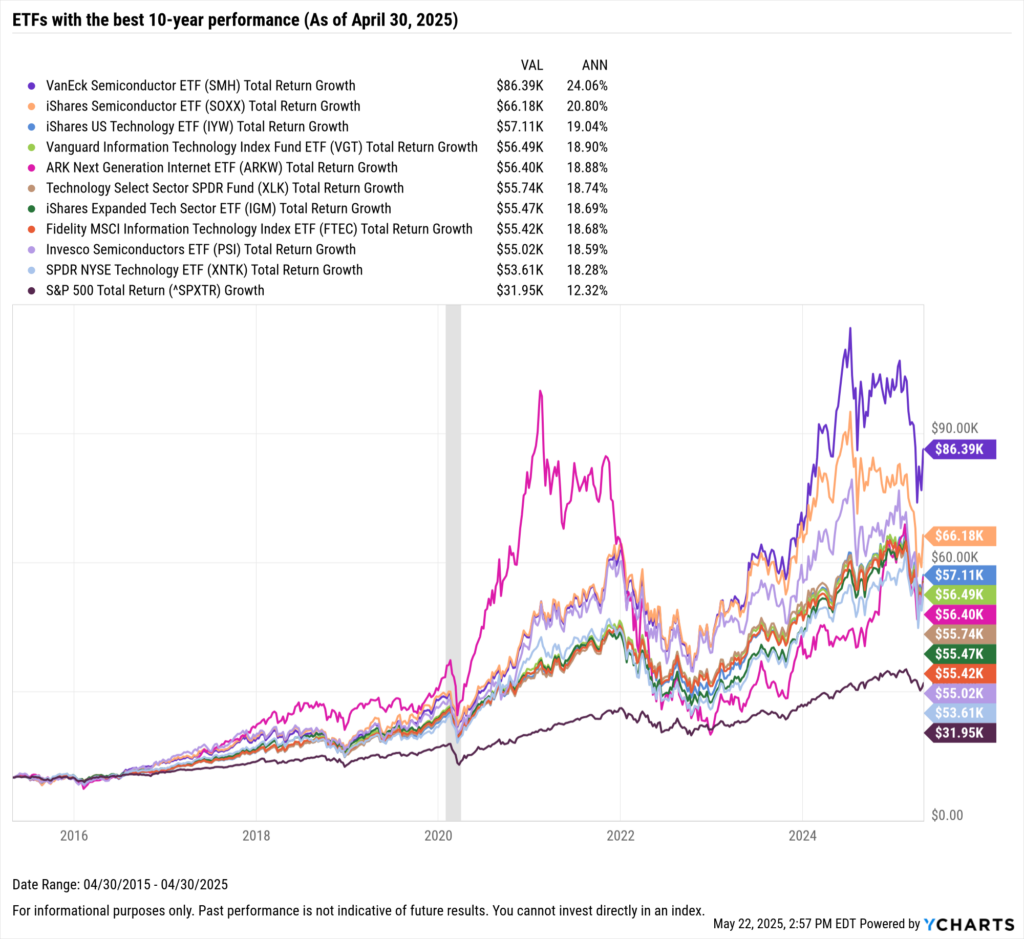

Best Performing ETFs in the Last 10 Years

These are the top-performing ETFs on an annualized basis between April 30, 2015 and April 30, 2025.

View & Modify in Fund Screener

Download Visual | Modify in YCharts

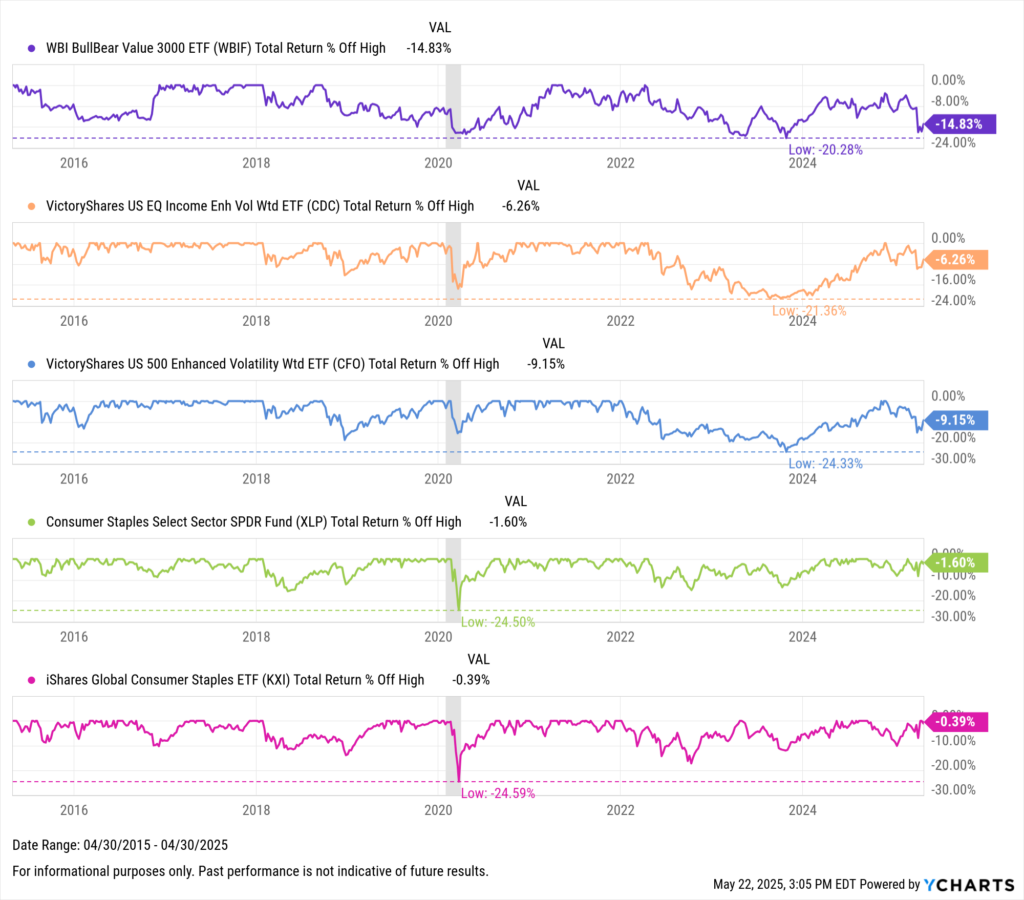

Equity ETFs with the Lowest Drawdown in the Last 10 Years

As of April 30, 2025, these equity ETFs had the lowest drawdown over the last ten years. The chart below has an expanded timeframe to comprehensively depict the peak-to-trough performance of the observed funds.

View & Modify in Fund Screener

Download Visual | Modify in YCharts

What Was the Growth of $10,000 Over the Last 10 Years?

If you invested $10,000 10 years ago into any of the ten best-performing ETFs over the last 10 years, your balance today would be no less than $50K.

The best-performing ETF in the last 10 years was VanEck Semiconductor ETF (SMH). A $10,000 investment into SMH 10 years ago would be worth over $85K today. Right behind it was the iShares Semiconductor ETF (SOXX); investing $10,000 into SOXX back in 2014 would’ve turned into over $65K.

Download Visual | Modify in YCharts

Whenever you’re ready, here’s how YCharts can help you:

1. Looking to Move On From Your Investment Research and Analytics Platform?

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Sign up for a copy of our Fund Flows Report and Visual Deck to stay on top of ETF trends:

Sign up to recieve a copy of our monthly Fund Flows Report:Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Next Article

Best Performing Mutual Funds of the Last 10 Years: A Financial Advisor’s PerspectiveRead More →