3 Ways Top Wholesalers Will Win This Summer (While Everyone Else Takes PTO)

Summer slowdown? Not for you.

While inboxes go quiet and offices empty out, top wholesalers deepen relationships, uncover opportunities, and stay front-of-mind with advisors.

They know Q3 isn’t a lull. It’s a setup to get ahead of the Q4 pipeline rush. Inspired by Kyle Geers’ playbook, here’s how to use YCharts to make your summer count:

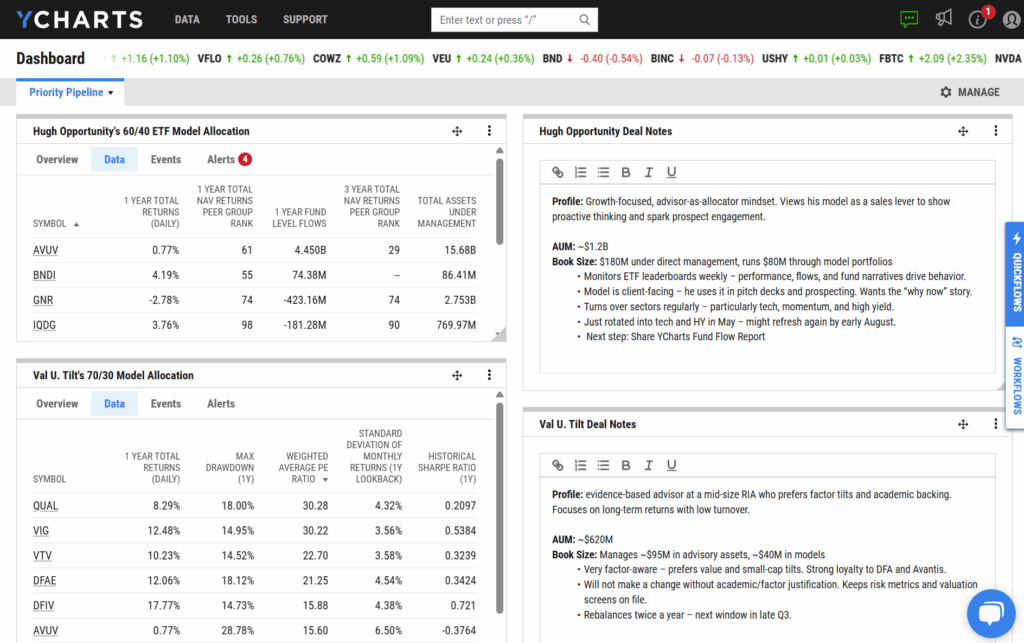

1. Watch Advisor Holdings Like They’re Your Own

If you’ve asked what’s in an advisor’s book, your next move is to track it like it’s part of yours.

That means:

- A manager change? Reach out.

- Underperformance? Reach out.

- Sudden outflows? Just ignore it… kidding. Reach out.

Each one is an opening to add value.

With tools like watchlists and real-time alerts, this becomes automatic. Build a dashboard with their core positions so you’re not guessing—you’re reacting with speed and purpose.

Advisors may be out of the office, but junior team members and support staff are still active.

If you can flag an issue or an opportunity first, you become the strategic partner who makes their lives easier.

2. Use Fund Flows to Spark Strategic Conversations

Flows don’t lie.

And they rarely go unnoticed by advisors.

Whether it’s a spike in Multi-Cap Value or renewed interest in international funds, sharing timely flow trends shows that you’re plugged in and thinking bigger than just your product.

Here’s a simple email opener to try: “I noticed a shift in flows toward [peer group]. Want to walk through what we’re seeing and whether it aligns with your client base?”

Sign up for our free monthly Fund Flow Report to stay updated on how assets are moving in and out of these strategies:

You’ve now shifted the conversation away from sales and toward strategy. That’s how you become a resource, not a pitch.

Use this outreach to engage the whole firm. Junior advisors, analysts, and internal desk members often handle research and prep, especially during the summer. Equip them with clean visuals and takeaways they can easily forward. With the right content, they become advocates.

Also, remember, you had to start somewhere, too.

Today’s junior advisor is tomorrow’s rainmaker. Help them shine now with materials that make them look sharp in meetings, and you could have an internal champion for years.

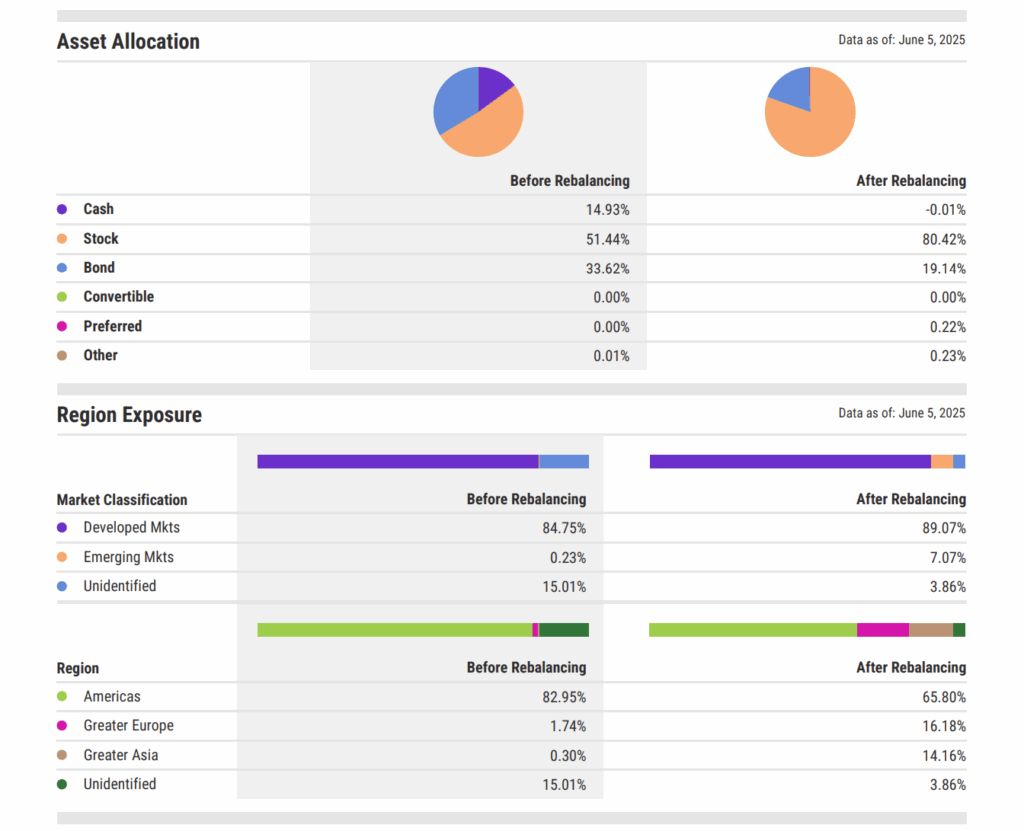

3. Lead the Portfolio Review Before Someone Else Does

Summer is prime time for rebalancing, as books might be:

- Underweight international exposure

- Light on small/mid caps

- Heavy in cash or short-duration instruments

This is your moment to provide a consultative edge. Use tools like Portfolios and Report Builder to identify allocation gaps, run side-by-side comparisons, and build visual cases for repositioning.

Activity like this works because you’re helping advisors answer tough client questions with data and clarity. And if the lead decision-maker is OOO? Equip junior team members with educational visuals on your strategy, or to begin building their books, like the Monthly Market Wrap or The Top 10 Visuals Deck.

Tools like Nested Sharing enable you to share saved assets (like dashboards or models) across YCharts (which over 10,000 FAs use) directly with advisors to make it easy to keep momentum moving.

When you make it easier for an advisor’s support team to communicate your strategy, you win twice—once now, and again when that junior team member becomes the primary contact in the future.

The Truth: Summer’s Only Slow If You Let It Be

The best wholesalers know this season isn’t about waiting. It’s about planting seeds that earn a “let’s revisit this after Labor Day.”

- Stay present while others go silent.

- Use data to open conversations, not close them.

- Be the one who makes your contact’s life easier, whether they’re a partner, a gatekeeper, or a future rainmaker.

Come September, advisors won’t remember who sent the best product PDF.

They’ll remember who helped them think clearly, act strategically, and prepare for the second half of the year.

Whenever you’re ready, here’s how YCharts can help you:

1. Book time with our asset management specialists

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Sign up for a copy of our Fund Flows Report and Visual Deck to stay on top of fund trends:

Sign up to recieve a copy of our monthly Fund Flows Report:Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Next Article

May Jobs Report Surpasses Labor Market Expectations: Implications for Fed Policy and Market StrategyRead More →