Analyzing the Latest Trends in the US Producer Price Index (PPI)

The US Producer Price Index (PPI) is a pivotal economic measure, reflecting the average change over time in the selling prices received by domestic producers. It is a key indicator of inflation at the production level and offers valuable insights into the economic condition. It influences everything from policy decisions to business strategies and investment plans, making it essential for financial advisors and investors to stay updated.

Visit the US Bureau of Labor Statistics PPI page for more detailed information.

Latest Data Release

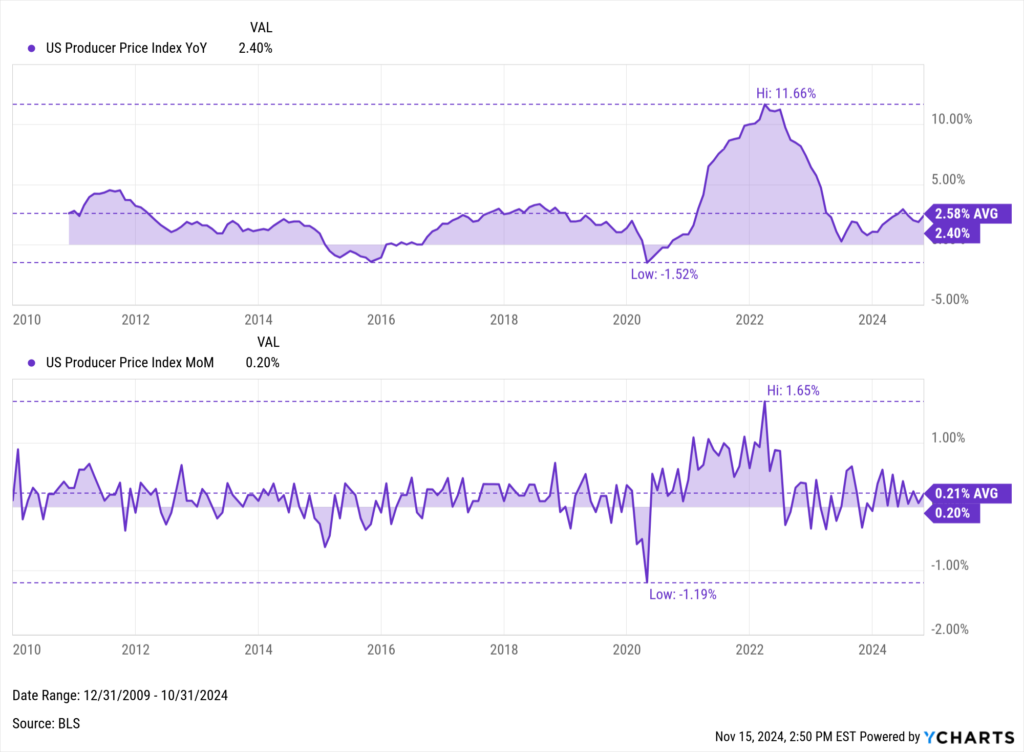

As of the latest update on November 14th, 2024, the PPI shows a 0.2% increase from the previous month and a 2.4% year-over-year increase. These trends are crucial for understanding sector-specific impacts and potential shifts in the broader economy. The chart below shows the trend of PPI over time.

Download Visual | Modify in YCharts

Analysis and Insights

The Year-over-Year data for the US PPI throughout the early months of 2024 illustrates a nuanced trend in producer prices, reflecting broader economic recovery and the lingering effects of global supply chain adjustments post-pandemic. The PPI decrease from its 2024 peak of 2.72% in June to 2.4% by November suggests easing inflationary pressures. Falling prices across key commodities and improvements in supply chains have contributed to this decline, offering relief to businesses managing production costs. As demand stabilizes and raw material shortages begin to resolve, the outlook for price stability appears more optimistic, though vigilance remains necessary given potential global economic shifts.

Both YoY and MoM data collectively offer a comprehensive view of the economic pressures shaping the production landscape, essential for informed strategic planning and immediate market responsiveness.

Using YCharts, financial advisors can deeply analyze PPI data to guide investment decisions and economic forecasts. Here’s how to leverage our platform:

- Log on to ycharts.com.

- From anywhere on the platform, search “US Producer Price Index MoM” or “US Producer Price Index YoY”.

- Navigate using the toolbar to access historical data or visualize trends in an interactive chart.

- Once on the indicator page, users can toggle the navigation bar to browse historical data monthly or view data in an interactive chart.

Check our YCharts analysis tools page for further guidance.

Related Financial Indicators

Understanding the PPI in conjunction with other financial indicators like the Consumer Price Index (CPI) and the Effective Federal Funds Rate provides a fuller picture of economic conditions. YCharts’ Producer Price Index report contains several additional related indicators to the PPI, including:

- US Core Producer Price Index

- US Core Producer Price Index YoY

- US Core Producer Price Index MoM

- US Producer Price Index: Goods MoM

- US Producer Price Index: Inputs to Stage 1 Services Producers, Transportation and Warehousing of Goods

- US Producer Price Index: All Commodities

Several other granular data points are also included in the monthly PPI report.

Implications for Businesses and Investors

Business Strategies: An increase in PPI often signals rising production costs, prompting businesses to reevaluate their pricing strategies and cost management practices. For instance, manufacturing companies might look into automating certain processes to mitigate labor costs or seek alternative suppliers to maintain profit margins. Conversely, decreasing PPI could allow businesses to reduce prices competitively or increase margins without altering retail prices.

Sectoral Impact of PPI: Different sectors react distinctly to changes in the PPI. The construction and manufacturing industries, for example, are particularly sensitive to changes in the prices of raw materials. An increase in PPI might squeeze margins in these sectors, whereas service-oriented sectors might be less affected directly but could experience indirect impacts through cost changes in inputs.

Investment Decisions: Investors use PPI as a leading indicator to predict inflation trends and assess the economic environment’s health. Rising PPI may signal forthcoming inflation, prompting investors to adjust portfolios towards sectors that traditionally hedge against inflation, such as real estate and commodities. On the other hand, a stable or declining PPI might encourage investments in bonds and other fixed-income securities, perceived as safer during periods of low inflation.

Understanding these dynamics can help businesses and investors navigate through economic cycles more effectively, using PPI as a critical guide for strategic planning and investment decision-making.

For real-life impacts and strategic recommendations, visit our YCharts case studies page.

YCharts Feature Highlights

YCharts offers advanced features for tracking and analyzing PPI data:

Fundamental Charts

Build Fundamental Charts to visualize the PPI over time, enhancing analysis with custom annotations. Additional economic indicators, securities, funds, and indices can be added for an enhanced visual comparison. Emphasize critical junctures with interactive or static annotations like Min, Max, and Average lines. Additionally, you can make aesthetic additions such as your firm’s custom colors or logo.

Timeseries Analysis

Import historical PPI data for detailed backtesting and analysis across various periods. Data can be exported into CSV format for analysis in YCharts’ Excel Add-in or as a standalone file.

Dashboard

Monitor the PPI alongside other crucial economic indicators with YCharts’ personalized Dashboard, where users can easily track the information that matters most to them. If you’re short on time, choose from YCharts’ ready-made templates, such as the “US Economy” template, which showcases data on Employment, Consumerism, Housing, and other major US indicators.

Economic Indicator Calendar

Gain a comprehensive overview of recent and upcoming economic data releases worldwide with YCharts’ Economic Indicator Calendar. Seamlessly integrate any specific indicator’s release schedule into your personal or professional calendar for streamlined planning and timely updates.

Alerts

Users can also set Custom Alerts for the PPI (or other economic indicators), triggered by criteria they define (e.g., % Change from Previous >= 1%). These alerts can be configured for any other security, watchlist, saved model portfolio, index, or indicator, ensuring users stay informed about significant fluctuations.

For tutorials on these features, check our YCharts tutorial page.

Conclusion

This month’s PPI report provides crucial insights into producer price trends and broader economic indicators. It’s essential to regularly check these updates and use tools like YCharts for detailed and actionable analyses. YCharts equips you with a robust suite of tools, including an extensive library of economic indicators, advanced charting software, and comprehensive analysis capabilities.

To fully leverage these resources and tailor them to your specific needs, schedule a personalized information session or start a free trial.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking to better communicate the importance of economic events to clients?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Download a copy of the Quarterly Economic Update slide deck:

Disclaimer

©2024 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation

Next Article

Analyzing the Latest CPI Report: Insights and Implications for Businesses and InvestorsRead More →