Bitcoin Value Hits Record High Amid Regulatory Optimism

Introduction

Bitcoin’s value has reached a record high of roughly $115,000 in mid-2025, more than double its level from a year ago. This surge comes amid rising optimism for clearer crypto regulations, as U.S. lawmakers prepare to debate bills that could finally provide the industry with a long-sought regulatory framework.

The YCharts blog Bitcoin for Financial Advisors: Price Trends, Portfolio Strategy, and Client Communication in 2025 highlighted how advisors have been tracking Bitcoin’s volatile journey. Now, as Bitcoin breaks new ground, advisors face fresh questions about portfolio strategy and client communication in light of this milestone.

Table of Contents

Bitcoin Value Hits Record High: Why Now?

Major U.S. crypto legislation is on the horizon, a “Crypto Week” in Congress will debate bills to clarify digital asset rules. The prospect of regulatory clarity has emboldened investors, attracting capital that was previously sidelined by uncertainty back into crypto markets.

Institutional inflows are also lifting Bitcoin. Newly launched spot Bitcoin ETFs have seen strong and sustained investments, helping drive prices higher. Bitcoin is now up 26% year-to-date and about 41% in the last three months, reflecting powerful momentum heading into this regulatory inflection point.

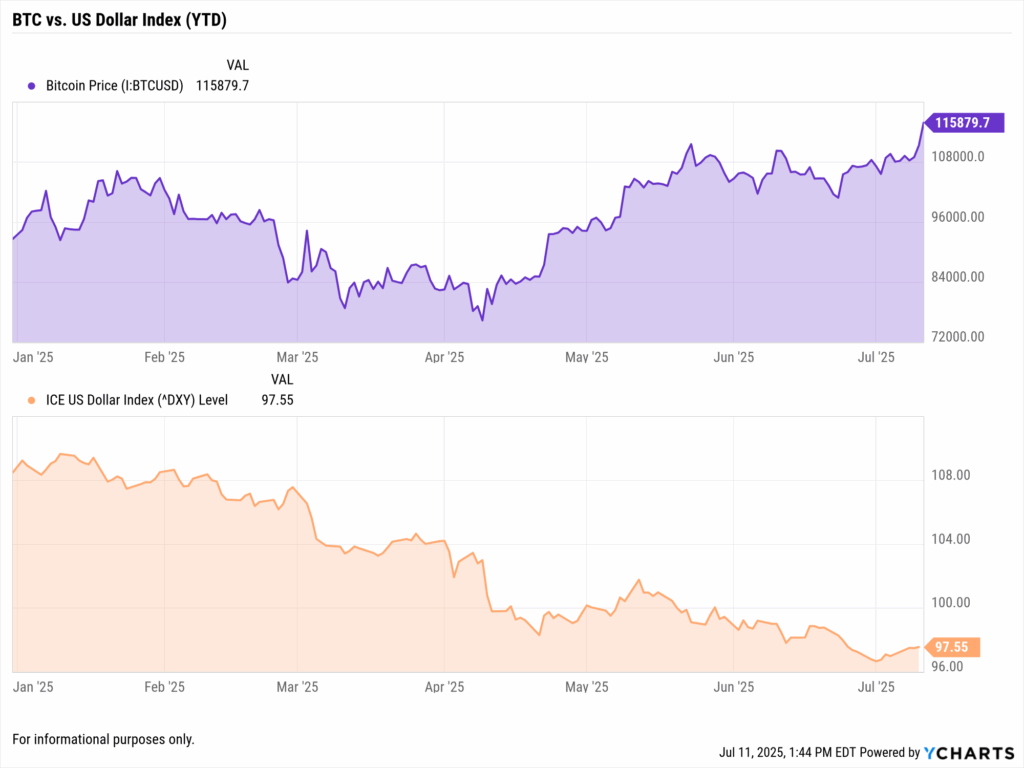

Interestingly, this rally has occurred even as interest rates remain elevated. In the past, rising yields often coincided with crypto downturns, but not this time. Bitcoin has lately acted like a risk asset that can climb alongside economic optimism. This shift shows why advisors must continually update assumptions and not rely on outdated correlations.

Crucially, the narrative around Bitcoin has shifted. Where once fear of a crackdown loomed, there is now growing confidence that policymakers will integrate crypto into the financial system rather than ban it outright. Even the mere possibility of friendlier regulation has been enough to send Bitcoin’s value higher on optimism.

However, not everyone is swept up in the euphoria. Some analysts warn that hype may be running ahead of fundamentals. They point out that even with a supportive backdrop, Bitcoin remains highly volatile and could see a sharp pullback if sentiment sours.

Q: Should clients invest when Bitcoin’s value is at a record high?

A: It’s natural for clients to wonder about buying after such a run-up. Remind them that Bitcoin’s rally comes with elevated volatility. Chasing an asset at its peak is risky. It’s wiser to stick to the long-term plan, perhaps adding a little at a time instead of a FOMO-driven leap.

Portfolio Implications of Bitcoin’s Rally

Bitcoin’s new high has immediate effects on client portfolios. For those who already held Bitcoin or crypto funds, that slice of the portfolio may now be much larger thanks to recent gains. Advisors should consider rebalancing, trimming back some Bitcoin exposure, to lock in profits and keep the portfolio’s risk in line with targets.

For clients who had a 5% allocation to Bitcoin, for example, the doubling of Bitcoin’s value could mean their exposure is now 10% or more. Rebalancing by selling a portion can capture gains and prevent an unintended overweight in a single volatile asset.

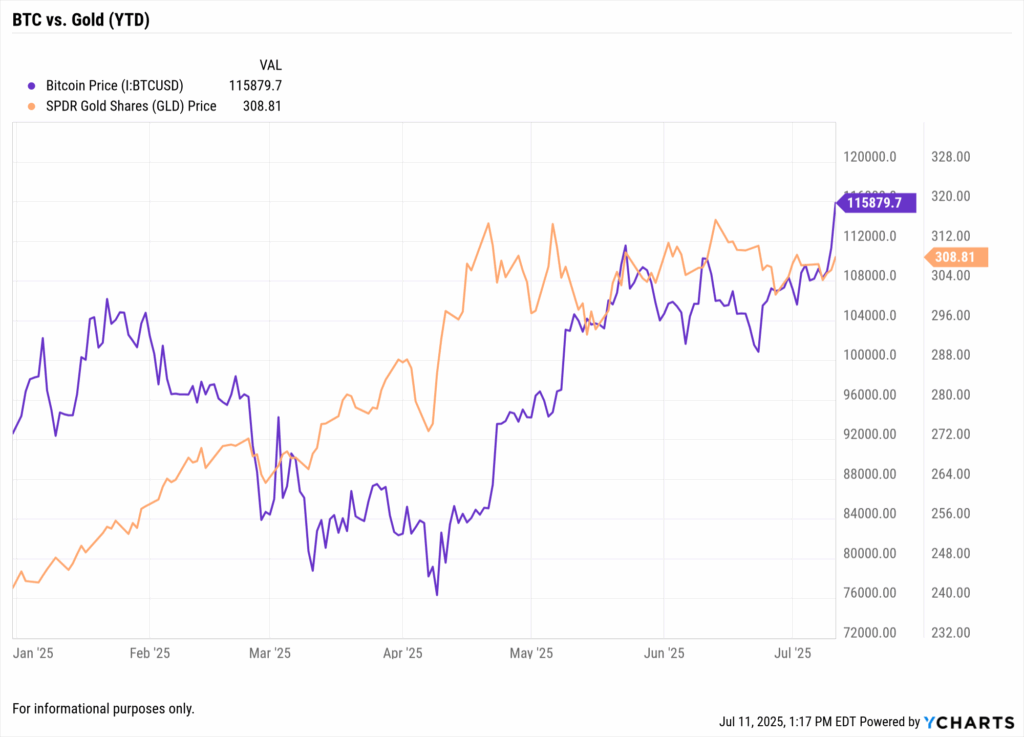

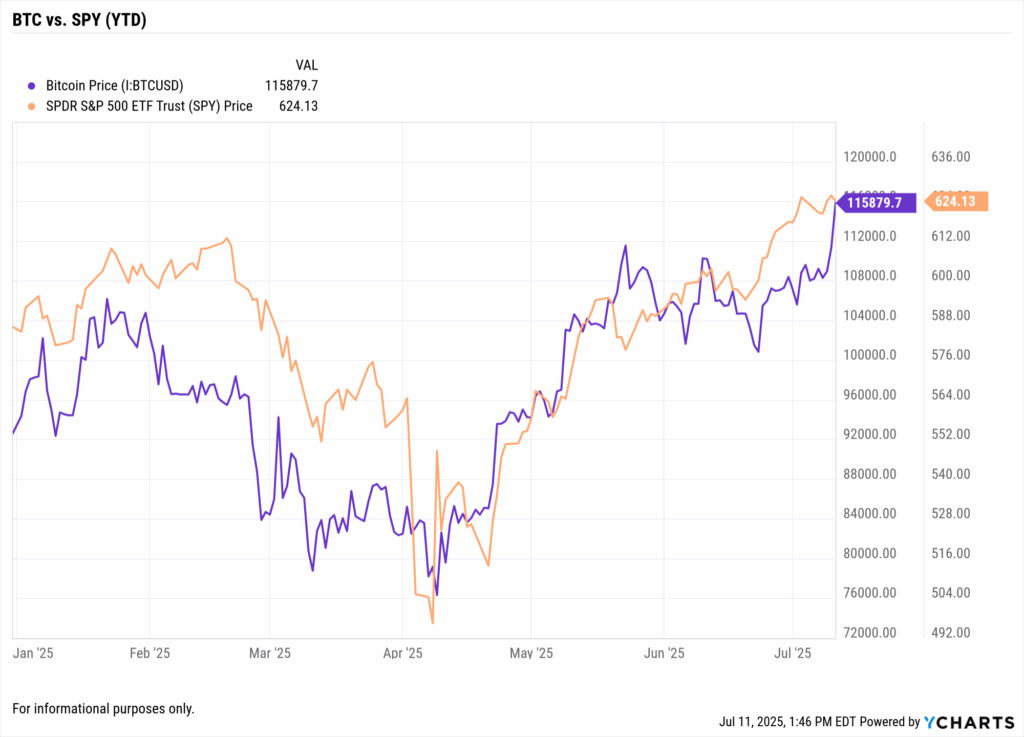

On the other hand, advisors may be re-evaluating whether Bitcoin deserves a place in portfolios that previously had no crypto exposure. The choice must be driven by analysis, not fear of missing out. Bitcoin has historically behaved more like a high-beta tech stock than a “digital gold” safe haven.

It tends to amplify broader market moves rather than offset them, which means it’s a growth asset and not a reliable hedge. As such, any crypto position should be kept modest. For example, advisors might limit Bitcoin to 1-5% of an aggressive portfolio, making sure clients understand even a small slice can swing widely.

Q: Should we rebalance our portfolios after Bitcoin’s rally?

A: If Bitcoin now makes up more of a portfolio than intended, it’s prudent to rebalance. Trimming the position locks in some gains and keeps the client’s risk in check. You can use YCharts’ Proposal Tool to illustrate how rebalancing would affect portfolio performance and volatility before implementing changes.

Communicating Bitcoin’s Risks and Rewards to Clients

Nearly all advisors have been fielding client inquiries about crypto, 96% received a question about crypto from clients in the past year. With Bitcoin’s value grabbing headlines, clients may be excited or anxious. This is a prime opportunity for advisors to provide perspective and education.

Start by acknowledging Bitcoin’s achievement, but also remind clients that every surge can be followed by steep drops. Bitcoin has experienced multiple boom-and-bust cycles. For instance, after past all-time highs, it sometimes lost more than half its value in subsequent corrections. Setting this historical context is key to managing expectations.

Visual aids can help make the risks clear. Using YCharts, advisors might chart Bitcoin’s long-term price trend alongside the S&P 500 or gold. This comparison vividly shows that while Bitcoin’s growth has been explosive, its ride has been far more volatile. Seeing the frequency and magnitude of past drawdowns on a chart can help clients grasp the risk involved.

Advisors should emphasize that having a plan and sticking to it beats reacting emotionally. Focusing on long-term objectives and referencing hard data keeps the conversation grounded. Using YCharts’ scenario analysis tool, an advisor can show how a portfolio with a small Bitcoin allocation might have performed in the past, a concrete way to add perspective to the discussion.

Q: How can I explain Bitcoin’s volatility to concerned clients?

A: Use a visual approach. For example, chart Bitcoin’s value against a stock index or gold over the years using YCharts. The comparison makes it clear that Bitcoin’s ups and downs are much more dramatic. By reviewing how often and how quickly Bitcoin has dropped in the past, clients gain perspective that big swings are part of the ride.

Regulatory Outlook: What’s Next for Advisors and Bitcoin

The regulatory landscape for Bitcoin is evolving to further legitimize crypto assets. Congress’s mid-2025 debate of major crypto bills marks a dramatic shift from the uncertainty of prior years. This clarity is spurring broader participation; about 22% of financial advisors now allocate to crypto, double last year’s share.

Notably, the political winds have shifted as well, 56% of advisors said they are more likely to invest in crypto in 2025 as a result of the U.S. election outcome. A more crypto-friendly administration has clearly emboldened both lawmakers and market participants.

Once advisors invest in crypto, they tend to stick with it: 99% of advisors who’ve added exposure plan to maintain or increase it in 2025. Notably, regulatory uncertainty as an obstacle is easing, about 50% cite it now, down from over 60% in earlier surveys.

That said, access remains a hurdle for many, only about 35% of advisors say they are able to directly buy crypto in client accounts today. This figure should rise as more platforms support crypto and as traditional custodians warm up to digital assets.

In 2024, the introduction of U.S. spot Bitcoin ETFs made crypto far more accessible. Bitcoin’s price leapt to new highs after the first ETF approvals, and roughly $58 billion flowed into these funds within months. With ETFs now available, advisors can gain Bitcoin exposure through traditional investment accounts and workflows.

Looking ahead, even more crypto-focused funds and tools will emerge in the coming years, and advisors will need to compare their options carefully, considering fees, liquidity, and custody, when deciding how best to invest in Bitcoin for each client’s needs.

Fortunately, new resources can help. For instance, YCharts’ Fund Screener lets advisors filter for Bitcoin or crypto funds and evaluate their performance and risk metrics over time. Staying informed and leveraging such tools will be key as crypto integrates into mainstream finance.

Finally, advisors should remain vigilant. Optimism is high, but regulations can evolve in unexpected ways. Compliance requirements or market rules might change as oversight increases. By staying flexible and educated, advisors can adapt their strategies to continue serving clients’ best interests in this fast-changing crypto environment.

Q: Should we wait for clearer regulations before investing more in Bitcoin?

A: Waiting for perfect clarity could mean missing out. If a client wants a small Bitcoin allocation, it may make sense to start now in a measured way. Some regulatory clarity is already here – for example, Bitcoin ETFs offer a regulated avenue. Just ensure the investment fits the client’s goals, and be ready to adjust as rules evolve.

Conclusion

For financial advisors, Bitcoin’s latest milestone is both an opportunity and a test. With sound strategy, clear communication, and the right tools at hand, advisors can help clients navigate the excitement around crypto while keeping their long-term goals on track.

By helping clients appreciate both the potential and the pitfalls, advisors can ensure that excitement doesn’t turn into panic when volatility strikes. The coming year could bring further milestones, perhaps approval of an Ethereum ETF or new regulatory guidance on crypto custody, and advisors who stay alert can turn these changes into strategic advantages for their clients.

Whenever you’re ready, here’s how YCharts can help you:

1. Looking to Move On From Your Investment Research and Analytics Platform?

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Sign up for a copy of our Fund Flows Report and Visual Deck to stay on top of ETF trends:

Sign up to recieve a copy of our monthly Fund Flows Report:Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure.

Next Article

Bitcoin for Financial Advisors: Price Trends, Portfolio Strategy, and Client Communication in 2025Read More →