DeepSeek’s Impact: How a $6 Million AI Model Is Reshaping the U.S. Tech Sector

Updated as of: January 28th, 2025 @ 4pm ET

Tech Sector Rebounds Amid DeepSeek Disruption

As of January 28, 2025, the technology sector is showing signs of recovery following the market disruption caused by the emergence of DeepSeek. The Chinese AI startup made headlines last week with the release of its cost-efficient AI model, DeepSeek V3, which initially sent shockwaves through the industry and triggered a massive sell-off in U.S. tech stocks.

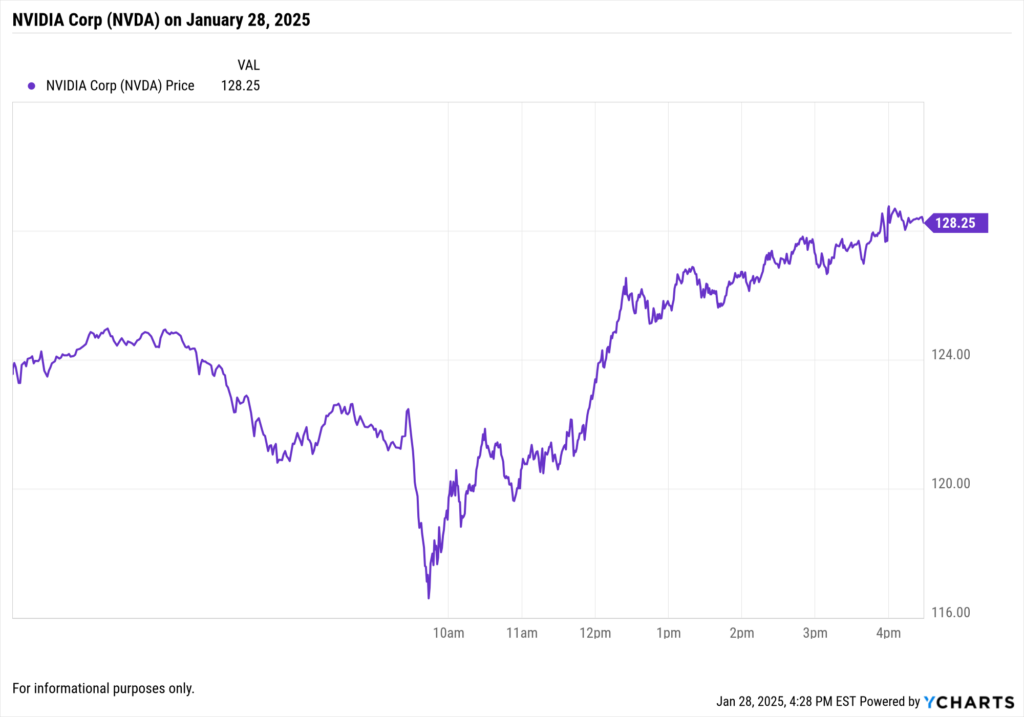

NVIDIA’s Rebound

After experiencing a record one-day loss of nearly 17% on January 27, wiping out approximately $593 billion in market capitalization, NVIDIA (NVDA) has bounced back. As of this afternoon, NVIDIA’s stock price has climbed over 6% as investors reassess the impact of DeepSeek’s announcement. Analysts suggest that while DeepSeek’s cost-effective AI model poses competitive pressure, it does not eliminate the demand for NVIDIA’s high-performance AI chips, which remain critical for advanced applications.

Broader Market Recovery

The S&P 500 Information Technology Index is up 2.7%, signaling renewed confidence in the sector. Investors are beginning to see the potential for DeepSeek’s innovation to drive efficiencies in AI development while leaving room for established players like NVIDIA, Microsoft, and Meta to retain their market leadership in cutting-edge hardware and software.

Industry Implications

DeepSeek’s AI breakthrough has sparked conversations around cost-efficiency in AI development, prompting companies and investors to rethink strategies for balancing innovation with resource allocation. While the initial announcement led to significant market volatility, analysts now view the development as a catalyst for broader advancements in the AI space.

This recovery highlights the tech sector’s resilience in adapting to disruption, with companies and investors alike recalibrating their strategies to navigate the rapidly evolving landscape.

This update contextualizes the blog’s analysis of DeepSeek’s impact, providing the latest developments and how the industry is responding to these transformative events.

Updated as of: January 27th, 2025 @ 1pm ET

Introduction: DeepSeek’s Disruption in the AI Landscape

China’s AI startup, DeepSeek, has introduced its revolutionary DeepSeek V3 model, sparking a seismic shift across the U.S. technology sector. At an estimated development cost of just $5.6 million, this model challenges the traditional high-cost AI development framework, shaking investor confidence and sending key U.S. tech stocks into turmoil.

The impact is profound: companies like NVIDIA, Microsoft, and Meta have collectively lost hundreds of billions in market capitalization. This blog analyzes the implications of DeepSeek V3 and explores how it’s reshaping AI innovation, investor sentiment, and broader market dynamics.

The Cost Efficiency of DeepSeek V3

What sets DeepSeek V3 apart is its remarkable cost efficiency. Developed for under $6 million, it rivals—and in some cases outperforms—leading models like OpenAI’s GPT series, which typically require hundreds of millions in development costs.

Why It Matters:

- Valuation Shock: The revelation has forced investors to reassess the economics of AI innovation, contributing to sharp declines in tech stock prices.

Competitive Pressure: DeepSeek’s low-cost model increases pressure on established players to justify high valuations and innovate more efficiently.

By demonstrating that groundbreaking AI models can be built on leaner budgets, DeepSeek has introduced a new paradigm—one that could permanently alter the landscape of AI development.

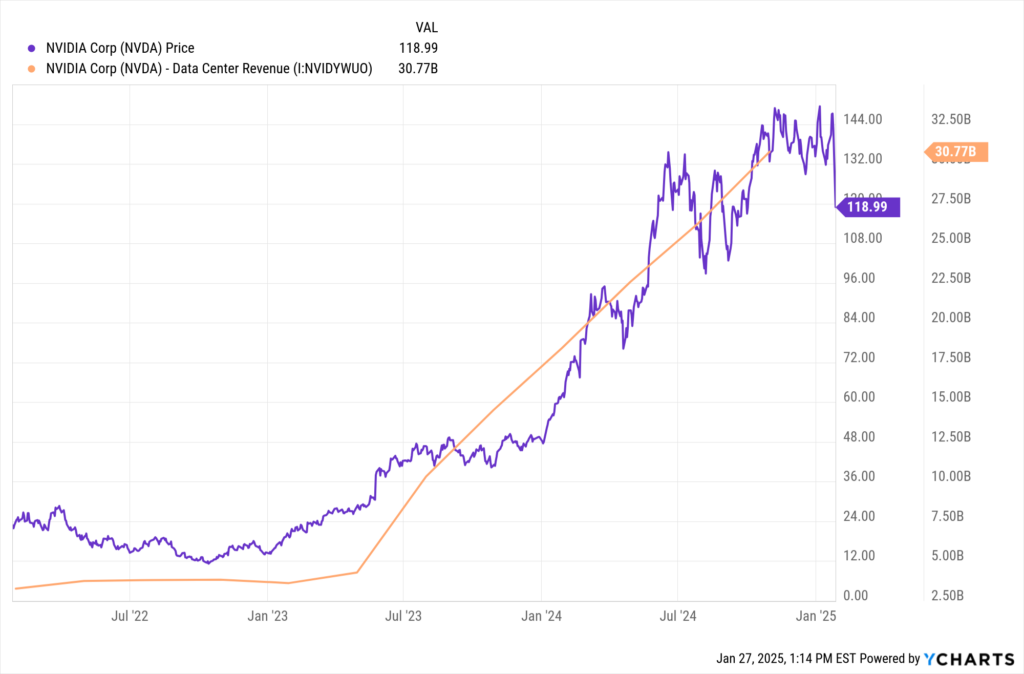

NVIDIA’s Data Center Revenue: A Key Performance Driver at Risk

NVIDIA has long been the cornerstone of the AI hardware revolution, with data center revenue driving much of its growth. The chart below highlights the correlation between NVIDIA’s stock price and its rising data center revenue:

Key Highlights:

- Revenue Milestone: NVIDIA’s data center revenue hit $30.77 billion in its most recent reporting period, a testament to its dominance in AI chip production.

Stock Surge: The stock price reflects the market’s confidence in NVIDIA’s ability to lead the AI wave.

Why This Matters:

DeepSeek’s V3 model, which is less computationally intensive, threatens to erode the demand for high-performance AI chips. This disruption could fundamentally weaken a critical revenue driver for NVIDIA, with far-reaching consequences for the semiconductor sector.

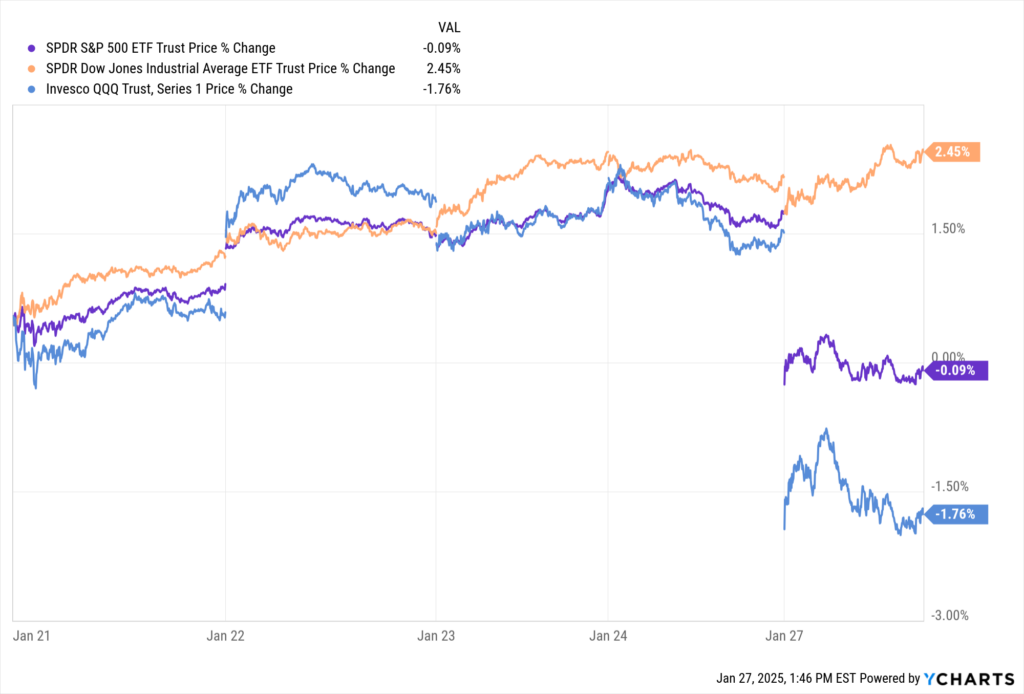

DeepSeek’s Ripple Effect: Intraday Market Performance

DeepSeek’s emergence has sent shockwaves across U.S. markets, particularly impacting technology-heavy indices. The chart below illustrates the intraday percentage price changes for major ETFs:

Insights from the Chart:

- QQQ Decline: The tech-heavy Invesco QQQ Trust (QQQ) saw a significant drop of -1.76%, reflecting the vulnerability of AI-driven stocks.

- DIA Resilience: The SPDR Dow Jones Industrial Average ETF Trust (DIA), with less tech exposure, posted a 2.45% gain, showcasing its diversification advantage.

S&P 500 Stability: The SPDR S&P 500 ETF Trust (SPY) remained relatively flat at -0.09%, balancing losses in tech with gains in other sectors.

Market Implications:

Investors heavily allocated to tech-focused ETFs like QQQ may need to reassess their portfolios. Diversified indices such as DIA and SPY demonstrated resilience, highlighting the value of balanced allocations during market volatility.

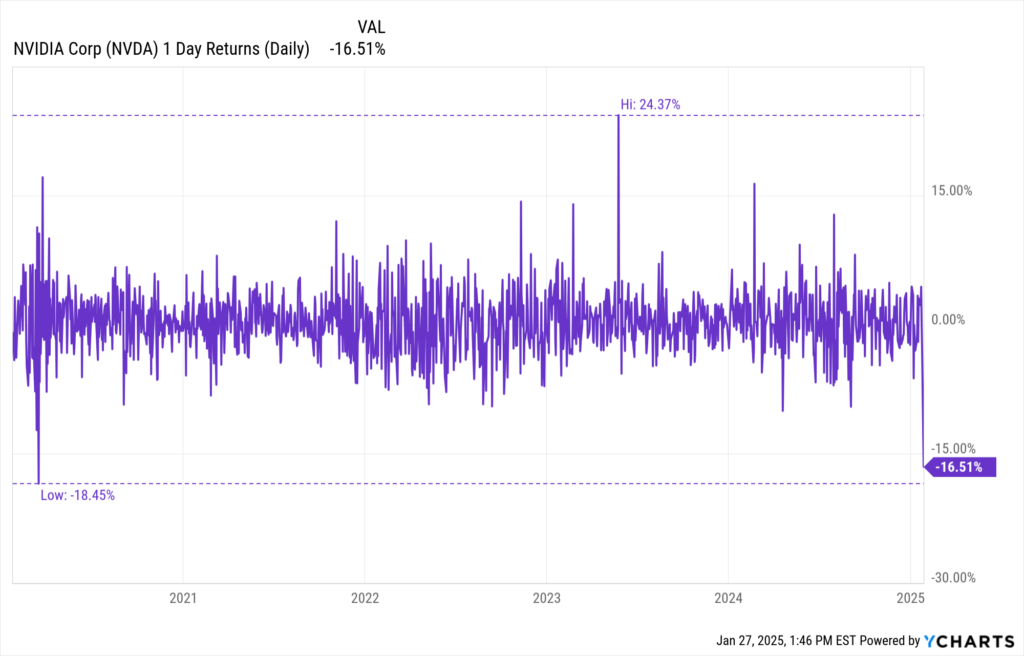

NVIDIA’s Historical Down Day: The Role of DeepSeek

NVIDIA’s -16.51% single-day drop on DeepSeek’s announcement marks its second-worst performance since the COVID-19 crash.

Chart Insights:

- Comparison to COVID-19: This drop mirrors volatility levels last seen during the 2020 crash, underlining DeepSeek’s disruptive impact.

Market Fear: DeepSeek’s low-cost model has amplified concerns over NVIDIA’s ability to sustain its dominance in AI hardware.

Context for Investors:

NVIDIA’s reliance on AI-driven revenue makes it particularly susceptible to disruptions like DeepSeek. Investors should monitor how this shift in the AI landscape impacts broader semiconductor valuations and consider diversification to mitigate risk.

Market Implications: A $1 Trillion Sell-Off

The broader U.S. market has reportedly shed over $1 trillion in value, with tech giants bearing the brunt. This sell-off underscores the market’s sensitivity to disruptive innovations and highlights the need for strategic adjustments.

Key Takeaways for Investors:

- Valuation Pressure: Tech-heavy portfolios may face prolonged headwinds as the market recalibrates.

- Diversification Needs: Balancing exposure across sectors can help mitigate risk during periods of volatility.

Opportunities in Disruption: Funds investing in cost-efficient innovators may offer long-term growth potential.

Top Public Funds to Watch Amidst DeepSeek’s Disruption

DeepSeek’s disruption is reshaping investment strategies. Here are five funds worth watching:

- ERShares Crossover ETF (XOVR): Offers diversified exposure to entrepreneurial innovation.

- ARK Innovation ETF (ARKK): Focused on disruptive tech across AI, biotech, and robotics.

- VanEck Semiconductor ETF (SMH): Targets the AI hardware supply chain.

- Vanguard Information Technology ETF (VGT): Provides balanced exposure to leading U.S. tech firms.

Global X Artificial Intelligence & Technology ETF (AIQ): Invests in AI-driven enterprise analytics.

How YCharts Can Help Investors Navigate AI Market Volatility

Amid DeepSeek’s market-shaking developments, financial professionals need data-driven insights and customizable tools to guide their strategies. YCharts empowers users to:

- Screen and Compare Funds: Analyze ETFs like ARKK, VGT, and XOVR for performance and risk.

- Conduct Scenario Analysis: Model the impact of AI disruptions on portfolios.

Enhance Client Communication: Create branded visuals and reports to explain market trends and portfolio adjustments.

YCharts provides the actionable intelligence advisors need to manage volatility and capitalize on opportunities.

Conclusion: What DeepSeek’s Disruption Means for Investors

DeepSeek’s $5.6 million investment has not only redefined the economics of AI development but also reshaped the U.S. tech landscape. This unprecedented disruption highlights the importance of agility and informed decision-making in today’s markets.

For advisors and investors, leveraging tools like YCharts can make the difference in navigating these volatile times, ensuring portfolios are positioned to weather risks and seize opportunities in the evolving AI economy.

Whenever you’re ready, there are 3 ways YCharts can help you:

1. Looking to better communicate the importance of economic events to clients?

Send us an email at hello@ycharts.com or call (866) 965-7552. You’ll be directly in touch with one of our Chicago-based team members.

2. Want to test out YCharts for free?

Start a no-risk 7-Day Free Trial.

3. Download a copy of the Quarterly Economic Update slide deck:

Download the Economic Summary Deck:Disclaimer

©2025 YCharts, Inc. All Rights Reserved. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker-dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations. This report has been generated through application of the analytical tools and data provided through ycharts.com and is intended solely to assist you or your investment or other adviser(s) in conducting investment research. You should not construe this report as an offer to buy or sell, as a solicitation of an offer to buy or sell, or as a recommendation to buy, sell, hold or trade, any security or other financial instrument. For further information regarding your use of this report, please go to: ycharts.com/about/disclosure

Next Article

YCharts Dashboard: Elevate Your Financial Analysis and Client CommunicationRead More →